Zoho Dives into FinTech with New Payment Gateway Launch

Hey, FinTech Fanatic!

Zoho is making waves in the payments sector with the launch of Zoho Payments, a unified solution designed to help businesses seamlessly accept online payments.

Zoho Payments offers secure transactions using cards, UPI, and over 35 net banking options. It aims to streamline checkout, reduce cart abandonment, and prevent revenue loss. The platform also features fraud management, transaction insights, refunds, and easy dispute resolution—saving businesses time and money.

Registered with NPCI Bharat BillPay, Zoho Payments can handle B2B payments and onboard users onto the BBPS network. Its integration with Zoho Books ensures smooth invoice and transaction sharing with partners.

With support for various payment methods like RTGS, IMPS, UPI, and NEFT, Zoho Payments automates data updates and reconciliation, reducing manual work. Bulk payment options further simplify the process for businesses.

Zoho’s FinTech debut is definitely one to watch. Stay tuned for more updates!

Cheers,

POST OF THE DAY

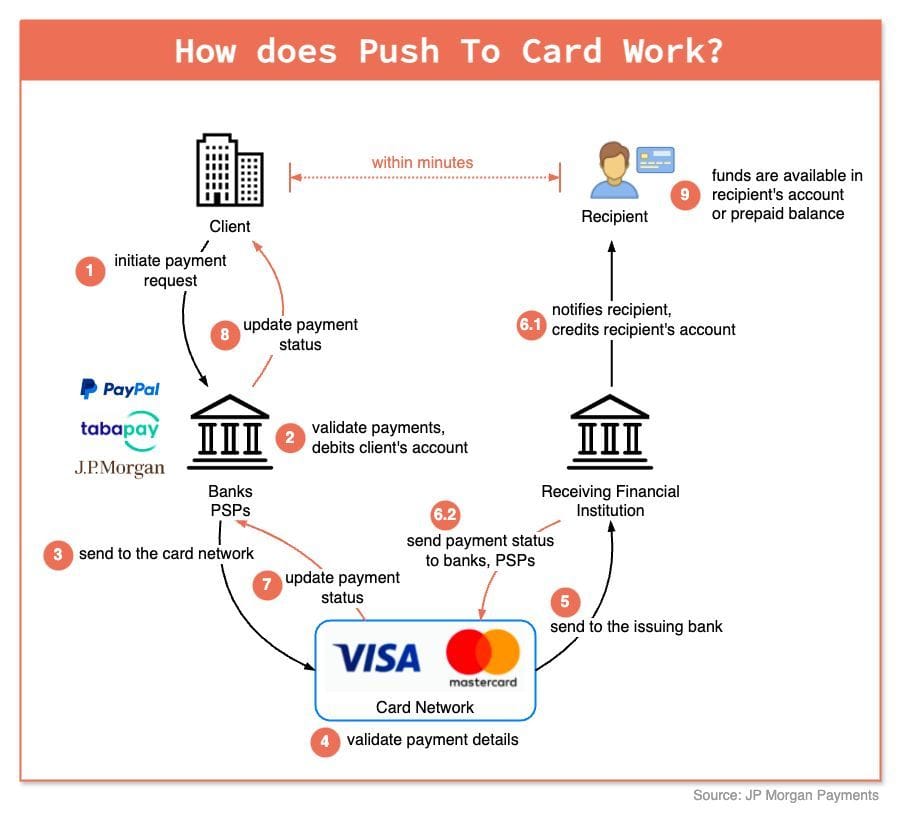

💳 How does Push To Card Work? How is it different from regular payments?

FINTECH NEWS

🇸🇪 Klarna's CEO Sebastian Siemiatkowski said that the company is shutting down its software as a service provider (SaaS) Salesforce and within a few weeks will shut down Workday.

Siemiatkowski added that with the help of AI, the company is able to standardize and create a more lightweight tech stack to operate more effectively with higher quality.

"We are shutting down a lot of our SaaS providers, as we are able to consolidate," he said on a conference call.

🇳🇬 Spleet replaced CEO in early 2024 over claims of ‘misappropriating’ $1.5 million. Co-founder and CEO Adetola Adesanmi was removed in March 2024 after an audit revealed alleged financial mismanagement and the misappropriation of $1.5 million, according to anonymous sources.

🇦🇪 Aurem announces licensing by UAE’s Financial Services Regulatory Authority, marking a significant milestone in the company’s mission to connect the world for a better financial future. Access full article

🇺🇸 Unit introduces Business Continuity Tool, a suite of white-labeled digital banking experiences designed to help banks enhance their business continuity procedures and reduce operational disruption in the event of the failure of a third-party program partner—without being dependent on the partner.

🇺🇸 Nasdaq unit reaches $22M settlement with CFTC over supervision failures for allegedly misleading the public, regulators, and its own compliance staff about the details of a trader incentive program. Read on

🇨🇳 UP FinTech reports $87M revenue and $106B trading volume in Q2. Non-GAAP net income for the quarter was $5.2 million. The total trading volume reached $105.9 billion, a substantial rise from the same period last year.

🇺🇸 Redfin is already trying to defend against a new flat-fee real estate startup. On August 29, TechCrunch reported that Landian, a new startup, offers homebuyers a flat-fee service for touring and making offers on homes, bypassing commissions. Redfin, while skeptical of the flat-fee model, called Landian “a brother in arms” in the effort to provide consumers a better deal.

🇹🇷 Mastercard Lighthouse invites Turkish FinTech startups to the global stage. The program enables start-ups to connect with business partners and investors via Mastercard’s global network, while accelerating their growth through intensive training with Mastercard and industry experts.

🇺🇸 Invoiv.com launches to revolutionize cash flow management for Small and Medium Businesses. The platform offers comprehensive accounts payable (AP) and accounts receivable (AR) solutions, along with online invoice generation tools embedded with payment links, ensuring businesses get paid faster than ever before.

PAYMENTS NEWS

🇮🇳 Zoho forays into FinTech, rolls out Payment Gateway. According to media reports, the payment solution, Zoho Payments, gives end users a seamless checkout process, significantly lowering the cart abandonment rate and preventing revenue leakage.

🇱🇹 Nium grows presence in Lithuania with local team and office expansion. The cross-border payments leader has moved to a new, larger, state-of-the-art office in Vilnius as it continues to hire more local talent and strengthen its operational risk and compliance teams.

🇿🇦 India’s UPI changing FinTech landscape globally – South Africa enables UPI QR. At Global FinTech Fest 2024 in Mumbai, Indian and South African counterparts signed a landmark agreement to enable UPI QR code acceptance in South Africa, revolutionizing digital payments.

🇺🇸 Narmi goes live with the FedNow® Service in receive mode with Grasshopper. Through FedNow, Grasshopper is positioned to provide its on-core FinTech clients with the option to receive payments in real-time, offering enhanced cash flow management, immediate access to funds, and improved operational efficiency.

🇯🇵 JCB and BINDO launch world's first metal JCB card. In addition to its premium metallic feel and look, the Wonder x JCB Metal Corporate Card has various innovative and bespoke features, including: Fast Virtual Card Issuance, Beneficial Services, and other benefits.

🇺🇸 FinTech Affirm outpacing industry rivals, including Klarna, CEO Max Levchin said. Affirm had a "killer quarter" as the industry gets more competitive. Levchin joined Ed Ludlow and Caroline Hyde on "Bloomberg Technology," to discuss Affirm's latest earnings report. Watch here

🇬🇧 Payments regulator probes banks over APP fraud. The Payments Systems Regulator has hit firms with a letter to check whether they are ready for new rules that could force them to pay millions in compensation to fraud victims, Financial News has learned.

🇧🇷 PayPal joins group investing $15M in Brazilian startup. PayPal’s venture arm and other investors are injecting $15 million in Ume, a Brazilian payment services provider that caters to small and mid-sized merchants, according to a press release.

🇮🇳 PayU unveils push provisioning platform to enable seamless card tokenisation between banks & merchants. The new platform allows customers to tokenize their credit and debit cards for multiple merchants directly through their bank's portal, eliminating the need to save card details with each merchant.

REGTECH NEWS

🇬🇧 Milan-based Cleafy has officially launched its UK entity, marking a significant milestone in its global mission to combat digital banking fraud. Renowned for its AI-driven innovation and detection of critical banking threats, Cleafy has secured billions of transactions for over 100M accounts at leading financial institutions worldwide.

DIGITAL BANKING NEWS

🇬🇧 Crown Agents Bank teams up with Visa on FX and ‘last mile’ payments in emerging markets. Crown Agents Bank (CAB) and Visa announced a collaboration to enable fast, efficient and reliable payments and FX, especially across the ‘last mile’ – a term for the final and most complex stage in the payment process.

🇬🇧 NatWest banking app down as customers locked out. Users of NatWest and Royal Bank of Scotland banking apps were facing issues to access their accounts and transferring money. A message on the NatWest app stated “some kind of error has occurred” and “cannot establish a connection”.

🇪🇸 Digital banking services provider CaixaBank to expand mobile office services to enable financial inclusion in 800+ municipalities, “amounting to a 27% increase compared to the number of towns reached by the financial institution’s mobile offices service in the first six months of 2023.”

🇺🇸 Goldman, Nomura tap Meta Llama AI models. In the 18 months since launch, the mostly free open source Llama models have seen nearly 350 million downloads and been taken up several major firms, including in financial services.

🇺🇸 Goldman to lay off a few hundred employees in annual talent review, source says. Last year, the exercise reportedly resulted in 1% to 5% of Goldman employees losing their jobs. Over the years, the cuts done under Goldman's strategic resource assessment have fluctuated based on market conditions and its financial outlook.

🇬🇧 Allica Bank enters bridging market with Tuscan acquisition. Allica, which has been steadily expanding its commercial finance offering for its established business customers, will be able to leverage Tuscan’s existing bridging expertise and broker network.

BLOCKCHAIN/CRYPTO NEWS

Binance hiring 1,000 as compliance spending tops $200M. Chief Executive Officer Richard Teng, outlined the employment goals for the world’s largest crypto trading platform. The planned hiring spree also encompasses customer service roles, according to Teng.

🇬🇧 Wirex launches decentralized payment method, Wirex Pay. This blockchain-based payment method allows users to make transactions using cryptocurrencies at more than 80 million merchants in more than 200 countries, the company said in an Aug. 28 press release.

🇰🇷 South Korean tech giant Naver launches crypto wallet in partnership with Chiliz. With its new crypto wallet, Naver Pay Wallet, the company is offering a non-custodial wallet, meaning users directly control their private keys and digital assets.

🇳🇬 Nigeria approves Quidax, Busha as crypto platforms.The two exchanges were approved under the Commission's Accelerated Regulatory Incubation Programme (ARIP). Read the complete article

🇺🇸 NCR Atleos rolls out Bitcoin cashouts at ATMs in the US. The ATM firm plans to start the rollout in 30 states. It will only be available at ATMs that are ‘ReadyCode’ connected, where ReadyCode is a special API.

🇸🇬 Crypto.com bolsters transaction capabilities with Standard Chartered. Crypto.com’s launch of its global retail services seeks to accelerate the transferring of funds on the platform from more than 90 countries, improving on the efficiency and utility of the crypto-to-fiat, or fiat-to-crypto transaction process.

PARTNERSHIPS

🇮🇳 EbixCash & iPiD team to secure cross-border remittances for Indian students. This collaboration enables students and their families to verify names and bank account details of educational institutions and recipients in key destinations worldwide before making international payments from India.

🇧🇷 Ant International collaborates with Brazilian partners to drive financial jnclusion with innovative credit tech solutions. This collaboration aims to enhance the credit management capability and infrastructure efficiency for Dock’s clients, which include financial institutions, retailers, FinTech start-ups, etc.

DONEDEAL FUNDING NEWS

🇺🇸 Coinbase and Square vets aim to level up stablecoins with Bridge and $58 million in funding. Bridge already has high-profile customers including Elon Musk’s SpaceX, which uses Bridge to collect payments in different jurisdictions in different currencies and move them through stablecoins into its global treasury.

🇬🇧 FNZ announces executive leadership transition and $1B of investment from existing institutional shareholders. FNZ has grown to a global company with over $1.4bn in annual revenue, employing 6,000 people over more than 30 countries, digitizing savings and investment for over 24m consumers with over $1.6tn.

🇮🇱 Gems launchpad secures $198 Million in less than one year. Following its launchpad success, Gems aims to launch a dedicated cryptocurrency exchange, further enhancing its ecosystem.

MOVERS & SHAKERS

🇺🇸 Shopify welcomes new CTO Mikhail Parakhin. As CTO, Mikhail will oversee engineering and data organizations and push Shopify to the cutting edge, not just in ML and AI, but in everything they’re building to make commerce better for everyone.

🇺🇸 Affirm shuffles leadership, promoting CFO to COO. Affirm’s CFO Michael Linford will become the company’s new Chief Operating Officer, the BNPL provider announced last week. Taking his place as CFO will be Rob O’Hare, who currently serves as the San Francisco-based company’s senior vice president of finance.

🇮🇪 SumUp Limited appoints CEO, CFO, and new board members at its Dublin office. Niall Mac an tSionnaigh is now CEO of SumUp Limited, while Alastair Nolan has been appointed Head of Finance. Claire Gillanders takes on the role of Head of Compliance, and Jessica Cotta is the new Chief Risk Officer. Gareth Walsh moves to a non-executive director position, and Siona Meghen joins as an independent non-executive director.

🇫🇷 Arnaud Bouyer to join Barclays from GBL. Taking overall responsibility for the French investment banking business, Bouyer will work with Francois Baroin, chairman of Barclays in France and global chairman of investment banking, and Raoul Salomon, France CEO, as the firm continues to expand its business in the region.

🇬🇧 DNA Payments brings on new CFO, former Trust Payments Finance Director. The company has appointed Preete Janda as new Chief Financial Officer. The firm, an independent payment provider in the UK and EU, made this decision to strengthen its finance and leadership teams.

🇬🇧 UK’s Tandem Bank hires former JP Morgan exec Adi Kadle as director of engineering. Kadle says he plans to “help lead our journey in transforming our omni-channel strategy, including our app and website”. Read the full piece

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()