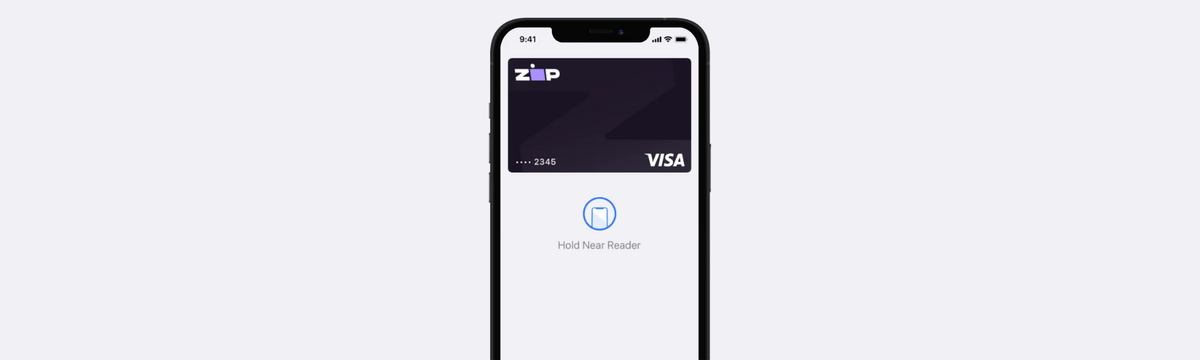

Zip in Talks With Apple for U.S. Buy-Now-Pay-Later Integration

Hey FinTech Fanatic!

BNPL firm Zip is exploring a partnership with Apple, aiming to integrate its installment payment services in the U.S., according to CEO Cynthia Scott.

While no current collaboration exists, discussions are ongoing. Zip also plans to partner with major U.S. merchants this quarter.

Recently, Zip enabled U.S. merchants using Stripe to offer its services and is pursuing further partnerships.

Apple, which launched its own BNPL service in 2022, halted new loans this year but may collaborate with other providers.

Zip is also looking to embed its product at the point-of-sale with more major retailers. Pointing to Best Buy as one of Zip’s key merchant partners, Scott said she expected to announce what she called significant U.S. merchants during its September quarter.

BNPL services are growing in popularity, particularly among young, digital consumers, with spending on BNPL reaching $17 billion during the holiday season, a 14% increase from the previous year.

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

INSIGHTS

💡 Disrupting the traditional payday. Instant payments are an opportunity for companies to meet overwhelming worker demand. Research has found that 60% of Americans believe that all companies should offer workers immediate access to their earned wages, and nearly 80% of Americans target job opportunities for companies that offer instant payments. Companies that don’t comply will get left behind.

Gabriel Grisham, Senior Vice President at Payout Orchestration platform PayQuicker, explains: Learn more

FINTECH NEWS

🇸🇪 Sweden's Klarna says AI chatbots help shrink headcount. Klarna is an early adopter of generative machine learning in marketing and customer service and says the tech is already doing the work of 700 employees. CEO Siemiatkowski said that Klarna’s workforce has already dropped from 5,000 to 3,800, and that it could see that number shrinking to 2,000 in the next few years due to AI.

🇬🇧 Freetrade chose Sharegain to launch securities lending to retail clients in the UK. Freetrade launched its securities lending program with no upfront costs and no additional headcount. Sharegain’s technology solution enables clients to launch programs that comply with the relevant regulatory requirements, including CASS and SFTR.

🇺🇸 Galileo enhances B2B expense management offering with Mastercard Smart Data. Galileo FinTech clients using Mastercard Smart Data can streamline business operations by automatically integrating detailed purchase info into their ERP or expense management systems.

🇺🇸 Visa launches Money Movement Advisory Practice in North America. Visa's Money Movement Advisory Practice addresses the growing demand for seamless payments and mobile experiences, focusing on facilitating fund transfers across multiple platforms and channels.

🇺🇸 Liberis and Sezzle partner to provide funding to small businesses across the United States. Embedded finance platform, Liberis, is partnering with Sezzle, a Buy Now, Pay Later platform, to promote Sezzle Capital, offering small to medium-sized businesses in the United States funding without giving up equity.

🇺🇸 CPI joins forces with Rippleshot to enhance fraud protection. With the addition of Rippleshot, CPI customers can more effectively prevent fraudulent events before they occur and reduce the frustrations that epitomize the fraud management experience.

🇺🇸 Rellevate announces partnership with Mastercard to advance digital payments capabilities in the U.S. public sector. Together, the companies will work with local, city and state governments to create ways for their constituents to access and manage their money faster and more efficiently.

🇦🇪 Beyon Money Business, part of the Beyon Group, is now live, offering digital financial solutions tailored to both SMEs and Corporates, delivering a seamless experience for business customers, providing expense management through prepaid cards, profitable solutions to invest company liquidity with Flexi Invest, and B2B instant payments.

PAYMENTS NEWS

🇺🇸 Aeropay targets pay-by-bank evolution in the US. The Chicago FinTech has moved from servicing small merchants to handling cannabis payments, and now it’s catering to gaming clients. Read the complete article

🇲🇽 ACI Worldwide and Mexipay extend partnership to boost instant payments adoption in Mexico. Mexipay will utilize ACI’s Digital Central Infrastructure solution, part of the award-winning ACI Enterprise Payments Platform, to address the need for enhanced real-time payment services.

🇸🇪 Adyen announced a global partnership with Swedish home furnishing business IKEA. The new partnership with Adyen will allow IKEA to connect the dots between in-store and digital sales channels and offer better payment and loyalty experiences for customers.

🇺🇸 Aghanim, a mobile gaming FinTech company, announced a strategic partnership with Adyen, which will give the Aghanim direct-to-consumer enablement platform for mobile game developers and publishers access to high value payment processing capabilities all over the world.

🇺🇬 Flutterwave expands African footprint with Ugandan payments licence. Leveraging its advanced technology and deep understanding of African markets, Flutterwave offers a comprehensive suite of payment solutions tailored to the country's unique needs.

🇬🇧 Teya introduces Tap to Pay. The product, Teya Tap, allows business owners to accept payments directly with their Android phones, removing dependencies on physical card machines. It can be a cost-effective alternative to traditional card machines for business owners who trade on the go.

🇬🇧 BR-DGE partners with Vibe to fast-track travel payments. Through a single integration with BR-DGE, Vibe’s merchants will gain enhanced global payments connectivity, stronger platform resilience and stability, more capabilities to drive acceptance optimisation, and an expedited time-to-market.

🇺🇸 PayJunction expands payment capabilities with Text to Pay. The new feature lets businesses easily integrate Text to Pay into their invoicing workflows, allowing them to accept payments via SMS. This helps businesses better meet customer expectations while improving collection rates, contributing to overall revenue growth.

OPEN BANKING NEWS

🇳🇿 NZ FinTech in process of launching first bank designed for Open Banking and AI. FinTech company Debut is preparing to become the first locally-owned bank specifically designed for an open banking environment and powered by artificial intelligence (AI).

🇺🇸 Sensedia’s new FinTech API Accelerator Platform unlocks emerging FinTechs’ business agility and ecosystem potential. The Sensedia FinTech Accelerator allows FinTechs to navigate regulatory challenges and avoid third-party strategies that push the compliance burden onto them.

REGTECH NEWS

🇬🇧 Sumsub becomes first verification provider to achieve new Global Digital Identity Certification. This groundbreaking initiative was created by AVID Certification Services Ltd, the UK’s leading provider of Digital Identity Certification. Read on

DIGITAL BANKING NEWS

🇪🇬 Advapay announces exclusive partnership with ICT Misr to deliver Core Banking Solutions in Egypt and Libya. Under this exclusive partnership, ICT Misr will provide comprehensive core banking solutions, including implementation, integration services, and ongoing support to Advapay’s customers in these regions.

BLOCKCHAIN/CRYPTO NEWS

🇦🇪 Aquanow, a global crypto infrastructure provider trusted by 300+ clients, is announcing a strategic partnership with Zodia Custody, a leading institution-first digital asset custodian backed by Standard Chartered, SBI Holdings, Northern Trust, and National Australia Bank. The partnership will see Zodia Custody provide its enterprise custody solutions, which are trusted by globally recognised financial institutions, for Aquanow’s expansion across UAE and the wider Gulf Cooperation Council (GCC) region region.

DONEDEAL FUNDING NEWS

🇺🇸 Linker Finance secures $3.7M seed round from industry leading investors to reimagine digital banking solutions for community banks. With the new funding, Linker Finance is strategically planning to invest in product development, strategic team growth, and business development initiatives.

🇮🇳 Finarkein Analytics raises $4.75M in pre-series A round led by Nexus Venture Partners. The new funds raised will be used for new product development, and expansion in Indian financial services markets. Continue reading

🇧🇷 TepMed, a Brazilian FinTech specializing in financial solutions for healthcare clinics and hospitals, raised $3.6M from SRM Ventures. The firm will use the funds to provide additional capital for financing and reimbursement and grow its client base.

🇮🇳 Keshav Reddy, founder of Equal, an identity verification startup, has invested an undisclosed amount for a strategic stake in Hyderabad-based account aggregator platform One Money. Read more

🇯🇵 Tokyo-based climate finance firm Creattura secures $2.4m in Series A round. The funding will be used to accelerate Creattura’s development of carbon projects and its IT capabilities, both within Japan and internationally.

🇺🇸 Fast-growing immigrant-focused neobank Comun has secured $21.5M in new funding just months after its last raise. The company plans to use its new capital to expand locations and create new products. For instance, Comun recently hired former Nubank and Capital One employees to help it build out a credit product.

M&A

🇺🇸 Private equity firms Summit Partners and Vista Equity Partners are exploring a potential sale of Trintech that could value the financial software provider at about $2 billion, including debt, according to people familiar with the matter. Find out more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()