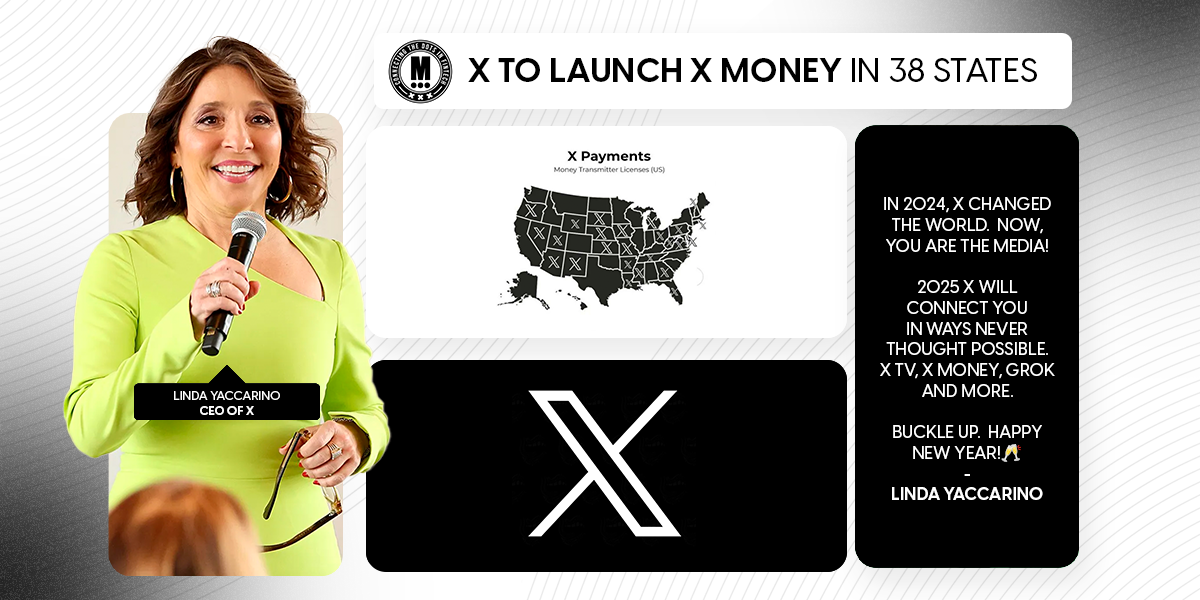

X to Launch X Money in 38 States

Hey FinTech Fanatic!

X (formerly known as Twitter) has announced its upcoming launch of X Money, with plans to roll out in 38 U.S. states where it holds payment transmitter licenses. Linda Yaccarino, X CEO, revealed that X Money will be part of several new platform features launching in the coming months.

The platform's payment service aims to offer peer-to-peer transfers and e-commerce integration. However, X's expansion faces regulatory hurdles, notably withdrawing its New York license application after concerns were raised about its ties to Saudi investors. Backend code analysis suggests X will proceed with a regional rollout in approved states.

This initiative marks X's entry into digital payments under Elon Musk's leadership, who previously co-founded PayPal. The company currently holds payment transmitter licenses in 38 U.S. states, suggesting a phased launch approach.

You can read more FinTech industry updates below👇, and I'll be back in your inbox tomorrow!

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

INSIGHTS

🇮🇳 FinTech Ecosystem Map India

Which company is missing in this overview? 👇

FINTECH NEWS

🇺🇸 Startup TurmaFinTech launches to help US community banks fight technological lag. The startup offers a customer data platform to manage, analyse and monetise their customer data. It aims to provide community banks with the tools they need to navigate the low-rate landscape, digitalise, and compete with more technologically advanced financial institutions.

🇪🇺 European FinTech’s next IPO candidates. Sifted compiled a list of European scaleups founded between 2005 and 2020, valued as unicorns, and raising $100m+ (via Dealroom). They verified public intent and sought comments to finalize the list. Click here to view it

PAYMENTS NEWS

🇺🇸 X Plans to launch ‘X Money’. The announcement was made by CEO Linda Yaccarino. X Money is expected to function as a versatile payment platform, potentially offering services such as peer-to-peer transfers, e-commerce integration, and even cryptocurrency transactions. Read More

🇫🇮 Tietoevry banking secures EPC registration for payment services. Tietoevry in partnership with Movitz Payments, will manage Verification of Payee solutions across Europe, providing client banks with a new service saving time and money while reducing fraud.

🇮🇳 Briskpe launches cross-border payments. By combining A2A transfers with card- and wallet-based collections, BRISKPE offers MSMEs unparalleled flexibility to cater to diverse client preferences, broaden market reach, and accelerate growth. With this integration, businesses can tap into a global network of users and unlock new opportunities.

🇧🇷 Paysafe expands into Brazil with new payment license. This license allows Paysafe to expand its partnerships with iGaming operators in Brazil and offer eCommerce payment solutions to merchants across various industries. Also, Paysafe strengthens its presence in the Latin American iGaming market, including Argentina, Colombia, Mexico, and Peru.

🇪🇺 Bank-backed EPI processes first e-commerce transactions, paving the way for a full-scale roll out later this year. This setup entailed the smooth integration of the EPI's Wero wallet into the online platform of the merchant and its acquiring partner, VR Payments, as well as in the online banking app of the end-customers.

🇨🇭 CPMI boosts ISO 20022 for cross-border payments. The steps aim to clarify the medium-term governance and maintenance of these requirements during the global transition to the ISO 20022 messaging standard. The CPMI's actions also encourage industry-led efforts to develop guidelines for cross-border fast payments.

🇬🇧 Sticpay expands to over 100 countries. Its global network reaches more than 1 million consumers worldwide, spread across over 160 countries. Also, it is widely used by businesses and merchants that sell their services globally, with more than 5,000 businesses connected on the STICPAY e-wallet platform.

🇪🇺 Europe to scale A2A payments with new regulation. January 9th, 2025 is the implementation deadline for all banks in the eurozone to receive instant payments. This is arguably one of the most significant deadlines for European payments innovation since PSD2 came into force seven years ago. Continue reading

OPEN BANKING NEWS

🇬🇧 CFIT secures industry partners to lead next coalition. The coalition will build on CFIT’s Open Finance coalition and SME Finance Taskforce by developing the technology, policy, and regulatory solutions to help the UK’s 5.6 million small businesses raise external finance “more readily, successfully, and efficiently”.

🇬🇧 Money Squirrel launches open banking-powered cash flow management app. The offering links to business current accounts, and sweeps cash into interest-bearing savings accounts for automatically calculated VAT, budgeting, and tax purposes. Continue reading

REGTECH NEWS

🇳🇱 Hidden Road secures MiCAR license. Currently, Hidden Road is one of only four companies to secure a MiCAR license from the AFM, which allows it to offer digital assets services to counterparties based in all EEA countries. The firm's new MiCAR license stands in addition to its DNB Crypto Services Provider registration.

🇺🇸 PSD3’s global reach brings new compliance challenges. In terms of consumer-related details, the proposals indicate that PSPs with online account features must create permission “dashboards” that enable users to consent to having their information shared with third parties, and where users can monitor who they’ve allowed that access. Read More

DIGITAL BANKING NEWS

🇬🇧 Shawbrook targets £2bn value in potential sale or IPO. The new plans for an IPO offer a small glint of positivity to the London Stock Exchange, which last year suffered its biggest net outflow of companies since the global financial crisis. A total of 88 businesses delisted or transferred their primary listings from the LSE last year.

🇺🇸 JPMorgan quits Net-Zero Banking Alliance, the latest U.S. lender to the sector's biggest climate coalition amid rising U.S. political pressure. JPMorgan gave no clear reason for leaving the initiative, yet it comes after months of pressure from some Republican politicians who said membership of such coalitions could breach anti-trust rules.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Ripple and Chainlink partner for RLUSD stablecoin. By adopting the Chainlink standard for verifiable data on the Ethereum blockchain, Ripple is enhancing the utility of RLUSD across the onchain economy. RLUSD is an enterprise-grade, USD-denominated stablecoin created with trust, utility, and compliance at its core.

🇹🇷 Garanti BBVA’s to provide crypto trading services. Bit2Me will be used as the bank’s trading execution center. The partnership between BBVA and the crypto exchange is a strong signal of more things are brewing on the horizon, according to Bit2Me’s chief sales officer. Read More

🇺🇸 CFTC leader in bitcoin oversight steps down. Chairman Rostin Behnam will resign on Jan. 20 and leave the agency on Feb. 7. During his tenure, Behnam advocated for making the CFTC the primary regulator for Bitcoin and crypto exchanges. Click for more information

PARTNERSHIPS

🇪🇺 Checkout.com and Noqodi collaborate to revolutionize payment services in the UAE. The integration will streamline the payment process, reduce friction, and boost overall operational efficiency for merchants across various sectors. The partnership represents a significant step towards advancing digital payments in the UAE, supporting economic growth, and fostering a more seamless online payment experience.

DONEDEAL FUNDING NEWS

🇬🇧 Tide to raise £50m via share sale. The offering may involve the issuance of new shares, as well as an opportunity for existing investors to reduce or offload part of their stakes. With operations in the UK, Germany and India, Tide provides business banking services to over one million SME customers.

M&A

🇪🇺 Backpack acquires FTX EU. The acquisition was approved by the FTX bankruptcy court and the Cyprus Securities and Exchange Commission (CySEC), paving the way for Backpack to expand its footprint in the European Union. The company said in an announcement that will offer a suite of crypto derivative services across the EU, including perpetual futures.

🇬🇧 ClearScore acquires Aro Finance, Argos and Asda Partner. "This acquisition allows us to continue our growth by expanding into two complementary areas as a credit broker, namely embedded finance and secured second charge lending," Justin Basini, ClearScore's chief executive, said.

🇺🇸 Eltropy acquires Lexop for collections tech. The acquisition will add Lexop’s collections technology to Eltropy’s artificial intelligence-powered unified conversations platform. Also the combination of these tools will offer community financial institutions a better way to handle loan repayment and collections, according to the release.

🌎 Scotiabank transfers operations in Colombia, Costa Rica, and Panama to Davivienda. The transaction is expected to streamline Scotiabank's focus on the North American corridor and Latin America. This deal includes a mutual referral agreement, allowing Scotiabank to continue supporting its clients through Davivienda's network.

🇺🇸 Employer.com offers to buy shuttered startup Level. Employer.com has proposed paying roughly $30 million in cash and stock for Level according to The Information. The talks, which are ongoing, come just days after Level said it was shutting down because a different acquisition fell through. Read on

MOVERS AND SHAKERS

🇺🇸 Wise expands leadership for EMEA. Wise announced the appointment of Lauren Langbridge as CD for North America, and Manuel Sandhofer as its new GM for Europe, Middle East and Brazil. They will oversee and scale Wise Platform’s strategic partnerships, growth, and commercial strategy across the regions, as demand for its solutions rapidly grows.

🇺🇸 Masttro appoints Jay McNamara as CEO. McNamara is a proven leader with a track record of driving strategic growth, operational excellence, and innovation. McNamara is a proven leader with a track record of driving strategic growth, operational excellence, and innovation.

🇬🇧 Curve appoints Lord Stanley Fink as Chair of Board. Lord Fink’s leadership will guide Curve through its next phase of strategic scaling. This appointment underscores Curve’s commitment to leadership in the evolving digital wallet market.

🇬🇧 Finastra names Chris Walters as new CEO. “Chris brings a wealth of experience from senior executive leadership positions, driving innovation and scaling technology companies,” Finastra said in a news release. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()