Worldline CEO Transition Amidst Slow Trading

Hey FinTech Fanatic,

Worldline is shaking things up as CEO Gilles Grapinet steps down on September 30. The board will now search for a new CEO to craft a fresh strategic plan. Grapinet's departure follows a summer of sluggish trading and specific performance issues, which Worldline plans to address in its Q3 results on October 30.

This profit warning marks Worldline's third this year, driving shares to a record low—down 92% from July 2021 highs. While the hunt for a new CEO is underway, Marc-Henri Desportes, the deputy CEO and head of merchant services, will serve as interim CEO.

Worldline remains committed to its Power24 plan, aiming to boost client focus, innovation, and growth. Wilfried Verstraete, board chairman, praised Desportes for building a strong European presence and key partnerships.

Grapinet expressed confidence in Desportes to navigate current challenges and ensure a bright future for Worldline. In February, Worldline announced an 8% workforce reduction to cut costs and fuel future growth.

Cheers,

PODCAST

🎙 Moving beyond payments to solve the evolving needs of SMBs with PayPal’s Michelle Gill. In this episode, Michelle Gill, EVP and General Manager, Small Business and Financial Services Group of PayPal, delves into the strategies that have positioned PayPal at the forefront of supporting small businesses. Tune in now!

FINTECH NEWS

🇬🇧 Global FinTech Rapyd introduces initiatives focused on boosting revenue growth. The company is expanding its Rapyd Payment Partner Programme to drive revenue growth and collaboration among Referral Partners, consultants, ISOs, PayFacs, and ISVs in key industries.

🇵🇭 Asia’s 1st AI-powered SME lending marketplace launches in the Philippines. Kredit Hero is democratizing access to capital and addressing the inefficiencies of traditional loan applications. The firm is transforming the business financing landscape by offering a streamlined, accessible, and innovative solution.

🇬🇧 Moneyhub research shows cash savings fell by 24.5% over last year. This coincides with an individual’s capacity to save without making any changes to their overall spending behaviour, falling by 5.5% over the same period. Link here

🇰🇼 Motery announced the launch of its app, designed to revolutionize car financing using cutting-edge FinTech solutions. The Motery app empowers users to navigate the complexities of car financing, test drives, and reservations, all in one user-friendly platform.

PAYMENTS NEWS

🇫🇷 Worldline CEO exits, shares plunge as payments firm issues another profit warning. The French payments group said last Friday that long-time CEO Gilles Grapinet would leave the company as it issued its third profit warning within a year, sending its shares to a record low.

🇨🇦 Chimoney and The Interledger Foundation to power cross-border payments between more than 130 countries. The companies will eliminate up to 12% in international payment fees while enabling individuals to convert between traditional and emerging payment options.

🇺🇸 JP Morgan Payments has announced new and enhanced product integrations connecting to the Oracle ecosystem, making it easier for clients to streamline their payments across treasury, trade and commerce. Keep reading

🇺🇸 U.S. Faster Payments Council publishes operational considerations for receiving instant payments guideline. This guideline offers essential insights and best practices for financial institutions to improve their readiness for real-time payments like RTP® and FedNow®, with contributions from industry experts.

🇬🇧 UK’s Pay Later FinTech Kriya Solution now supported on Stripe. Starting this month, Stripe users can offer flexible payment terms “to their business buyers through Kriya.” Continue reading

🇿🇲 Lupiya partners with Network International to launch their card product. The solution introduces an e-commerce enabled debit card with 3D Secure and tokenization, enhancing Lupiya’s value proposition by expanding from simplified lending to also include digital payments for its existing and new customers.

🇺🇸 Citi has launched its BNPL offering, Citi Flex Pay, on its travel booking platform, Citi Travel. The combination of these offerings allows Citi cardmembers to book a getaway and pay for it, without having to pay fees or interest for 12 months. Read more

🇧🇷 Brazil’s Pix could take over from cards earlier than expected. Global payments technology company EBANX predicts that Pix will account for 44% of all value transacted in online purchases in Brazil next year, more so than debit and credit cards which are expected to have a 41% share.

🇺🇸 Bolt has quietly settled its lawsuit with Fanatics amid ongoing boardroom drama. Online sports apparel retailer Fanatics has agreed to settle and drop a lawsuit that it filed against troubled one-click payments provider Bolt in March, according to court documents obtained by TechCrunch.

🇨🇳 Beijing metro enables "Tap-and-Go" fare payment for foreign MasterCard and Visa card holders. Beijing becomes the first city on the Chinese mainland supporting contactless fare payments in rail transit for foreign MasterCard and Visa card holders. More here

DIGITAL BANKING NEWS

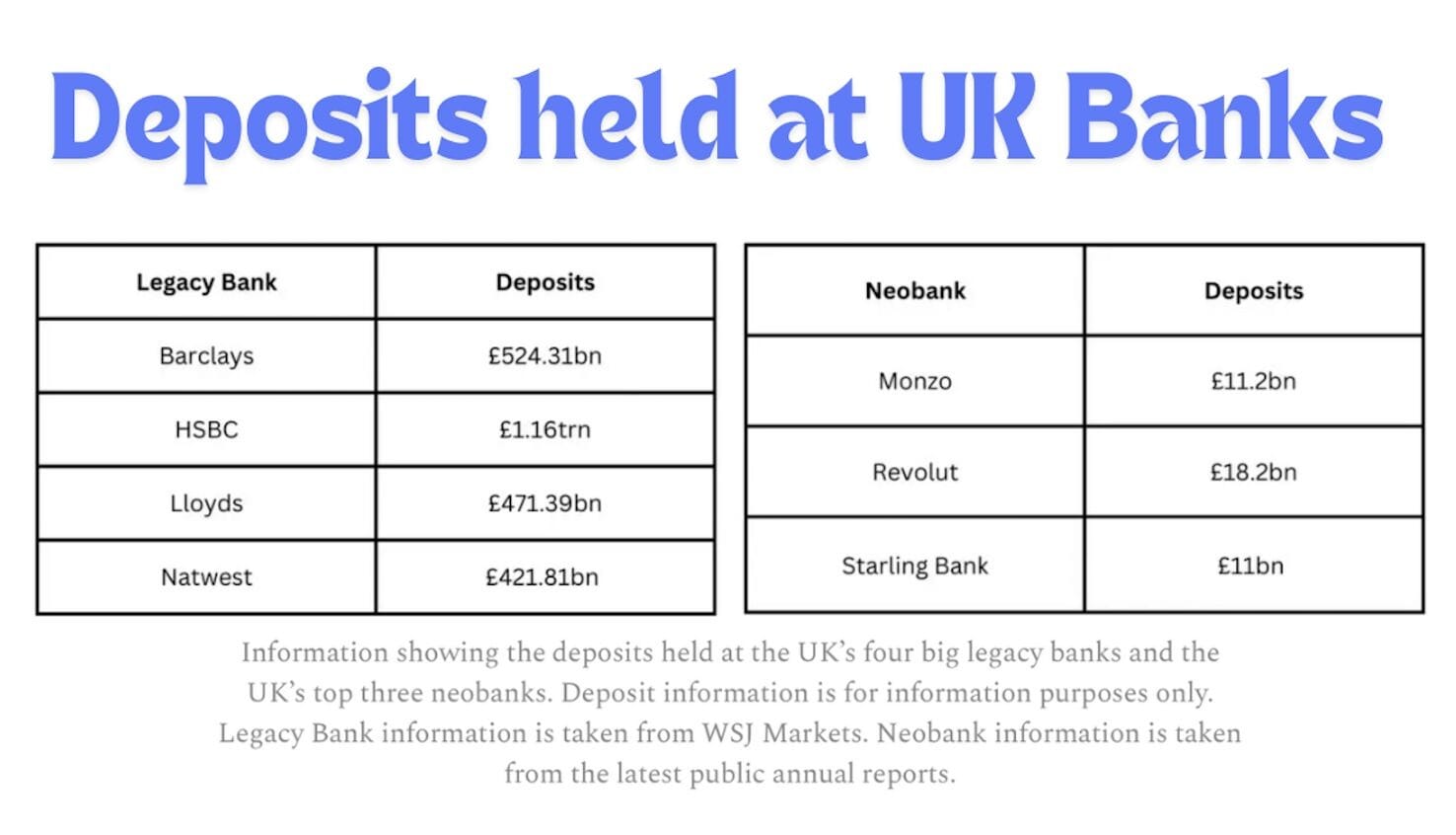

🏦 Neobanks have struggled to capture deposits. Most bank deposits in the UK still sit outside the three big neobanks, with the big four legacy banks capturing the lion’s share.

🇦🇪 Revolut eyes expansion in the Middle East with license applications, and takes on new investment from Abu Dhabi sovereign investor Mubadala. The neobank has submitted applications to the Central Bank of the United Arab Emirates to become an electronic-money institution and offer remittances in the country.

🇮🇪 Bunq is hiring in Ireland as part of global workforce expansion. The neobank said 17 of the new roles will be based in Ireland but added that many positions will let staff work from anywhere in the world, with more flexibility the longer they are with the company.

🇺🇸 Nearly 300 bank branches under the Lloyds Banking Group will close their doors to customers, the group has confirmed. Lloyds, Halifax and Bank of Scotland will close at least 292 of their branches in 2024 and 2025.

🇺🇸 Wells Fargo agrees to take ‘comprehensive corrective actions’ on AML in agreement with U.S. OCC. The agreement requires the bank to take comprehensive corrective actions to enhance its Bank Secrecy Act/anti-money laundering and U.S. sanctions compliance programs.

🇺🇸 Affinity Plus has entered into a multi-year agreement with Lumin Digital as part of its strategy to adopt “a fresh approach to digital banking. The credit union will introduce new features including customised spending insights, financial guidance, tailored savings goals, and fraud protection.

🇺🇸 Why Y Combinator companies are flocking to banking and HR startup Every. This new startup, distinguishes itself by offering a comprehensive suite that includes free incorporation documents and business bank accounts, alongside its core modules.

🇺🇸 The Bank of London readied wind-down plans. This summer, The Bank of London prepared a solvent wind-down plan in case it couldn't raise enough funds to bolster its capital buffers. However, the bank successfully raised £42 million in August from Mangrove Capital Partners, making the backup plan unnecessary.

🇬🇧 Barclays struggling to sell stake in UK payments business, sources say. Barclays is finding it difficult to sell a stake in its British merchant payments business due to diverging views on its valuation, complicating the bank's plans to revamp the unit, according to people familiar with the matter.

➡️ How Mercado Libre is democratizing access to commerce. As the Goldman Sachs tech conference comes to a close in San Francisco, Ed Ludlow and Caroline Hyde take a look at how FinTech is revolutionizing the financial sector. They are joined by Martín de los Santos, CFO of Mercado Libre, one of the main players in global e-commerce, on "Bloomberg Technology." Discover more

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Northern Trust has launched an institutional carbon credit ecosystem on its Northern Trust Matrix Zenith digital assets platform. The Northern Trust Carbon Ecosystem will enable carbon credit transactions from issuance to retirement. Find out more

🇦🇺 MoonPay lands AUSTRAC registration for Aussie crypto services. This may allow the company to establish local payment processing relationships across the country. As a result, Australian users of MoonPay could have access to alternative payment methods, including Osko and PayID.

🇺🇸 MicroStrategy continues bitcoin buying spree, lifting holdings to $9.45 bln. Analysts have said MicroStrategy's purchase of bitcoin to protect the value of its reserve assets has helped strengthen the appeal of the firm's stock, which tends to move in tandem with the digital asset.

DONEDEAL FUNDING NEWS

🇩🇪 Lendorse secures €10M for ‘Study Now, Pay Later’ student financing model. The capital will enable the company to provide access to higher education in Europe for over 1,000 talented students from developing and emerging countries. Read on

🇺🇸 Ninth Wave secures growth funding to expand leading Open Finance platform. This financing will enable the company to further expand its commercial team and make additional scale investments in the industry’s leading Open Finance connectivity platform for the foreseeable future.

🇬🇧 Novatus nabs $40M to help financial institutions quell their regtech nightmares. The company has offices in London and Sydney, and plans to use some of the funding to invest in technology and some to expand in North America, the founders said.

🇺🇸 Illuma Labs raises $9 million for bank voice verification. The company, which makes voice authentication technology for banking contact centers, announced its series A funding round in a news release, saying it would help banks address threats like fraud, deep fakes and voice cloning.

M&A

🇺🇸 Kort Payments announces acquisition of Barnet Technologies. The acquisition of Barnet aligns with KORT's aggressive growth strategy and commitment to providing innovative solutions to businesses across North America. Learn more

🇦🇪 Dubai-listed Mashreq Bank has agreed to sell a 65% stake ($𝟯𝟴𝟱𝗺𝗹𝗻) in NeoPay, the brand name for its subsidiary IDFAA Payments Services, to Arcapita and Turkish FinTech firm Dgpays. The bank said that it was entering into a long-term shareholder arrangement with the purchasers for the future growth of the business.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()