Wise Investigates Customer Data Exposure Linked to Evolve Bank Hack

Hey FinTech Fanatic!

Wise, a FinTech company, revealed that some customer data may have been compromised in the recent Evolve Bank and Trust data breach. Wise collaborated with Evolve from 2020 to 2023 to provide USD account details.

Following Evolve's breach, Wise announced that personal information, including names, addresses, birth dates, contact details, and Social Security numbers, might be affected. Non-U.S. customers’ identity document numbers could also be involved.

Wise is currently investigating and plans to notify affected customers directly. The company emphasized that its own systems remain secure.

The breach at Evolve, caused by a LockBit ransomware attack, has also affected partners like Affirm, EarnIn, Marqeta, Melio, and Mercury. Evolve is actively addressing the incident and promises further updates.

If you want to know all about this cyber attack, I highly recommend following Jason Mikula for the latest news updates.

Cheers,

Join my Telegram channel for instant access to a daily updates and exclusive breaking news from the FinTech industry. Connect with fellow FinTech Fanatics and stay ahead with the latest trends and insights.

FINTECH NEWS

🇬🇧 Wirecard’s former CFO claims limited dealings with business after 2017. Burkhard Ley says he had only a minor role after he retired, in his first public remarks since the group collapsed 4 years ago. Read on

🇬🇧 The UK's Football Club Millwall signs multi-year deal with FinTech startup MyGuava. The FinTech company will become a new front-of-shirt sponsor starting from the 2024/25 season. The long-term deal includes, among others, exclusive Millwall-designed payment cards.

🇨🇳 Chinese FinTech giant Ant Group spins off database firm OceanBase, giving Alibaba affiliates a stake. A shareholder restructuring for OceanBase, which develops the database tech behind Alipay, gives 35 companies a stake, paving the way to a possible public listing.

🇬🇧 AIM-listed FinTech Equals Group has notched a jump in revenue for the first half of 2024, helped by “strong growth” in its solutions platform, as it readies for a possible takeover offer. The firm, which offers business-to-business payment solutions, reported revenue of £60m over the six months to 30 June 2024.

PAYMENTS NEWS

🇺🇸 New York BNPL bill is dead, for now. Hopes for passing a 2024 buy now, pay later bill in New York state to regulate the nascent industry expired with the end of the legislative session last month. But next year could be a different story.

🇨🇴 Pronus launches "Pronus Payments" to provide Instant Payment Technology in Colombia. This launch is thanks to the partnership between the investment bank Pronus and the Brazilian payment developer C&M, which helped build the Pix system.

🇳🇱 Mollie connects Riverty for postpay. Mollie teamed up with Riverty, offering a 30 day invoicing solution in The Netherlands, Belgium, Austria and Germany. Continue reading

🇨🇦 Helcim launches Integrated Payments for Developers and Platforms. The program allows third-party developers, software platforms and integration partners to participate in the revenue generated by the transactions that flow through those integrations.

🇨🇴 Clinng arrives in Colombia. Leveraging the booming payment industry in the region, Eduardo Luna (CEO) and Franco Zurita (CCO), founders of Monnet Payments Solutions—a Peruvian payment gateway celebrating its 4th anniversary—announce the launch of their new brand, CLINNG.

🇦🇪 UPI QR payment acceptance comes to UAE. Network International, the leading enabler of digital commerce across the Middle East and Africa (MEA) region, in partnership with NPCI International Payments Ltd., has enabled the acceptance of QR code-based UPI payments across Network’s POS terminals in the UAE.

OPEN BANKING NEWS

🇬🇧 Lenovo launches Trustly’s Open Banking at checkout in the UK and Europe. The service will provide customers with an alternative payment method that is less vulnerable to fraud, compared to other forms of payment such as credit or debit cards.

🇨🇴 The Open Finance Institute was officially launched, marking the first institute dedicated to the training of professionals in open finance in Ibero-America. Founded and led by Ángel Sierra, the institute gathered over 30 open finance experts from the Colombian financial system.

DIGITAL BANKING NEWS

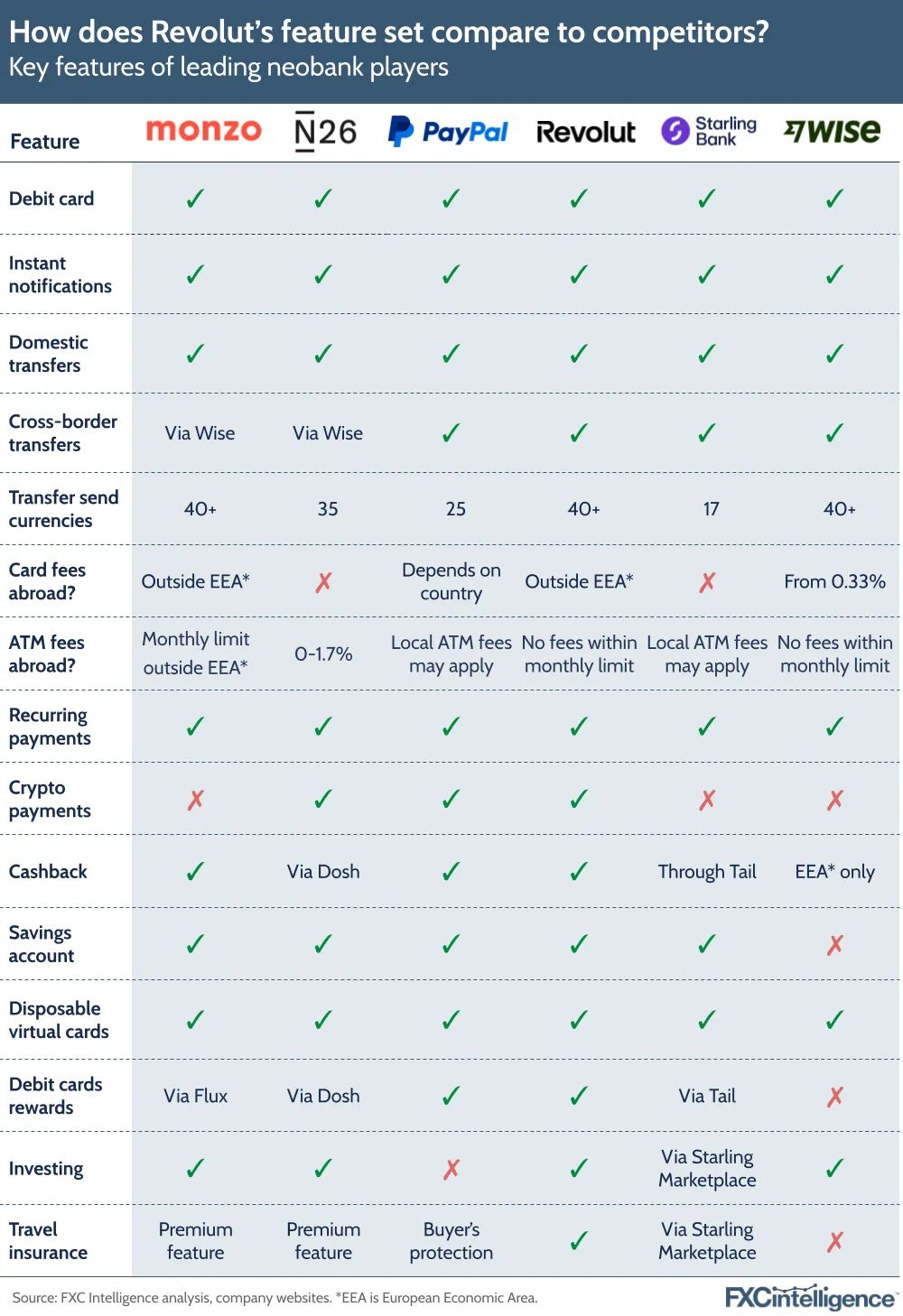

Here is how these features compare to competitors:

🇮🇪 Revolut could enter the Irish mortgage market as early as next year. The company has confirmed it is “actively working tirelessly” towards building a mortgage offering for its Irish customers. Click here for more info

🇪🇸 FINOM launches local IBAN for business accounts in Spain. This launch complements FINOM’s existing offerings of banking services, competitive FX rates, and robust account payables and receivables capabilities.

🇳🇱 Plumery and Fimple forge challenger bank technology pact. This end-to-end, customer-first, digital banking partnership is set to empower banks and other financial institutions by providing them with a robust, scalable foundation for modernising their digital presence.

🇬🇧 Wise says some customers affected by Evolve Bank data breach. In a statement published on its official website, Wise wrote that the company worked with Evolve from 2020 until 2023 “to provide USD account details.” And given that Evolve was breached recently, “some Wise customers’ personal information may have been involved.”

🇵🇭 Tonik and Gupshup collaborate on generative AI chatbot for digital banking innovation. The innovative solution aims to provide Tonik's customers with instant and accurate answers to frequently asked questions, revolutionizing the way they interact with their bank.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Crypto bank Silvergate pays $63m to settle US regulatory charges about its AML programme and the losses sustained during the collapse of FTX. The bank will pay a $43 million penalty to the Federal Reserve System and another $20 million to the California Department of Financial Protection and Innovation.

DONEDEAL FUNDING NEWS

🇹🇭 MUFG and the Finnoventure Private Equity Trust I fund have invested $195M in Thailand-based FinTech unicorn "super app" Ascend Money. With 30 million active users in Thailand, Ascend Money serves a broad customer base through strategic partnerships with corporations, businesses, and merchants in both online and offline landscapes.

🇲🇽 Mexican FinTech Colors raises $1.2M and partners with VISA and Círculo de Crédito to offer Financial services to the LGTBIQ+ community. Colors offers a personalized Credit Builder in its app, incentivizing timely payments with rewards and connecting the community with offers and services tailored to their needs.

🇲🇽 Stori plans to invest 7 billion pesos (approx $381 million) over the next two years to expand its financial services in Mexico, particularly targeting underserved municipalities, said co-founder Marlene Garayzar. “This capital will be used to improve our financial products, increase their accessibility, and support local economies,” she said.

M&A

🇰🇪 Kenyan identity management startup, Peleza has merged with YC-backed Prembly to form the Prembly Group. Both companies declined to provide the specific financial details of the transaction. Over the last 18 months, Peleza has been using Prembly’s infrastructure.

🇳🇱 ABN AMRO completes acquisition of BUX, BUX becomes a subsidiary. The acquisition was subject to regulatory approvals. These have been obtained and the transaction has now been finalised. More on that here

MOVERS & SHAKERS

🇬🇧 Stephen Bowe joins Paymentology as Chief Product Officer. Stephen will expand Paymentology’s next-generation payments infrastructure, focusing on seamless API integrations to simplify complex payment solutions.

🇬🇧 ING appoints Anjila Thomas as Head of Sectors in the UK. In this newly created role, Anjila will be responsible for overseeing all UK commercial activities at ING in Energy, Infrastructure, Real Estate, Financial Institutions, Shipping and Sustainable Finance. Transaction services and Corporate Sector Coverage will also report to her.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()