Wise Implements AML Remediation Plan in Europe

Hey FinTech Fanatic!

Wise has been tackling a formal remediation plan from European regulators after a 2022 review by the Belgian National Bank flagged anti-money laundering (AML) issues. According to the Financial Times, the review found Wise lacked proof of address for hundreds of thousands of customers.

The company responded swiftly, collaborating with regulators to implement their recommendations. Wise contacted affected customers within weeks, requesting proof of address and freezing accounts that failed to comply.

While the Belgian National Bank declined to comment, Wise emphasized its proactive approach, stating, "We worked closely with our regulator and fully implemented their recommendations."

Founded in 2011 and listed on the London Stock Exchange in 2021, Wise aims to make international money transfers simpler and fairer.

Catch you tomorrow with more updates!

Cheers,

FEATURED NEWS

🇬🇧 Bulgarians plead guilty to involvement in Jan Marsalek spy ring. The pleas from Orlin Roussev, 46, and Biser Dzhambazov, 43, were reported last Thursday for the first time at the start of a trial at the Old Bailey involving three other alleged accomplices.

#FINTECHREPORT

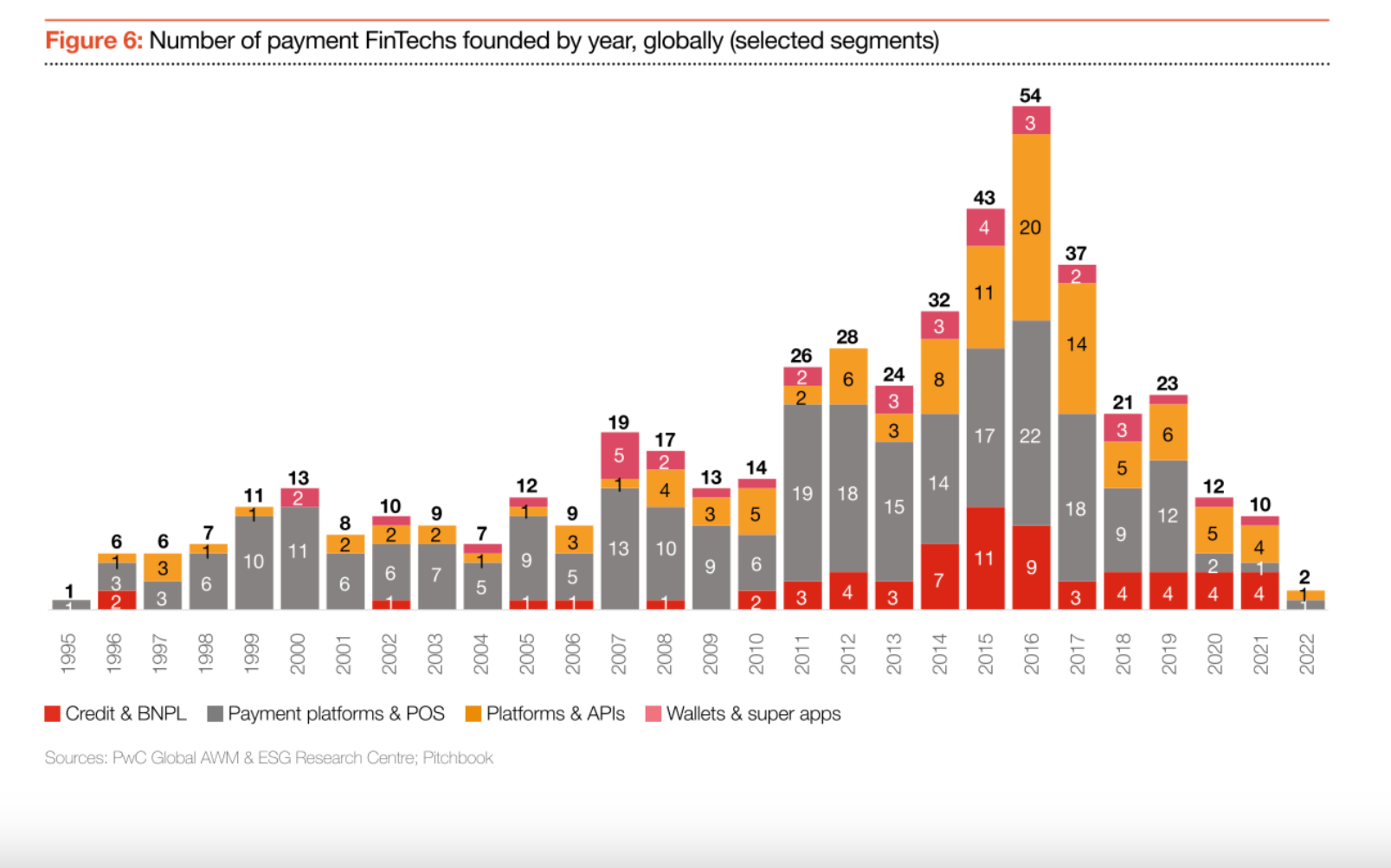

📊 Check out the Open Finance report 'Genesis of a Revolution' by PwC

INSIGHTS

🇬🇧 Revolut Legal has quietly been working on an AI copilot with Google Gemini. This will be the future for in-house legal teams in global (multi-regulated) financial services orgs. In Q4, Revolut's MVP for commercial contracts is live & early testing shows an absolute accuracy difference of only 6.75% against our commercial lawyers.

FINTECH NEWS

🇪🇺 Digital ID wallets bolstered as EU commission adopts technical standards. The European Digital Identity Framework regulations establish uniform standards and procedures for wallet functionalities, including data formats for cross-border use of digital documents and measures.

🇬🇧 KPMG UK joins FinTech Scotland for accelerated tech adoption and growth. The collaboration aims to enhance the FinTech ecosystem in Scotland, which includes over 250 SMEs and various financial institutions, promoting financial inclusion and strengthening local FinTech businesses.

🇸🇬 Eddid Financial receives In-Principle Approval for Singapore Capital Markets Services license. Once officially approved, the license will offer a wide array of services, such as dealing in capital markets products, product financing, and custodial services, marking a significant step into the local market.

🇸🇬 Fingular surpasses operational breakeven in record time, gains 5 million customers globally. The company has quickly expanded its footprint, launching fully online lending services and entering underserved markets like Malaysia, Bangladesh, and Qatar.

PAYMENTS NEWS

🇬🇧 Klarna Payments and Klarna Pay Now Standalone are now available on Checkout.com’s network. Click here to watch video

🇷🇴 Paysera Romania launches online payment processing solution combining card processing and open banking payments. By combining bank card processing with payment initiation services, the company offers merchants maximum flexibility and provides customers with a fast and secure payment experience.

🇧🇪 Wise was forced into a formal remediation plan by European regulators over its anti-money laundering controls, the Financial Times reported on Friday, citing five people familiar with the matter. Wise created a remediation plan, approved by the regulator, to contact all customers within weeks for proof of address, the report said.

🇬🇧 Dopple accelerates growth with 50% month-on-month surge as major retailers switch to the multi-lender platform. Built on Managing Director, Kurt Shinner’s, extensive Point-of-Sale (PoS) BNPL experience, Dopple was born from five years of direct merchant feedback around the pleasures and pain points of retail finance.

🇦🇪 MyFatoorah enhances payment experience for 75,000+ merchants across Middle East by partnering with Mastercard Gateway. The integration enables merchants to offer fast, secure transactions and convenient payment options to customers. Read on

🇫🇷 Worldline says payments services 'back to normal' after major disruption in Italy. Worldline's payment services faced disruptions during the busy Black Friday season, prompting concern from Italian business group Fipe-Confcommercio. The issues began Thursday, affecting Italy and other markets.

🇳🇴 ECB and Norges Bank have signed an agreement for Norway to join TIPS, in order to add the Norwegian krone (NOK) to Eurosystem’s instant payment service. The NOK will join TIPS enabling instant, 24/7 settlement in central bank money. It will be the fourth currency which joins in April 2025.

🇺🇸 Delaware North selects Nuvei to power payments for online gaming. This partnership enhances the player experience at the checkout, streamlining both the deposit and payout processes for Betly customers across their online casino and sports betting profiles.

OPEN BANKING NEWS

🇳🇿 New Zealand advances Open Banking with second implementation milestone. New Zealand's four largest banks – ANZ, ASB, BNZ, and Westpac NZ – have met the Payments NZ API Centre's Account Information API standard, enabling expanded Open Banking services by 30 November 2024.

DIGITAL BANKING NEWS

🇨🇦 Tencent’s Neo investment comes as national security scrutiny of FinTechs ramps up. Chinese tech giant Tencent’s reported lead investment in Neo Financial’s recent funding round comes as Canadian regulators are tightening oversight of foreign ownership of FinTechs, raising questions about the Calgary startup’s future.

🇨🇳 HSBC pulling back from China credit card business after struggling to expand. The Asia-focused bank has stopped issuing new cards and is working towards winding down the service offered to a large part of China onshore customers, three sources with direct knowledge of the matter said.

🇺🇸 Synapse partner banks hit with lawsuit over fund mismanagement. Synapse's four partner banks—American Bank, AMG National Trust, Lineage Bank, and Evolve Bank & Trust—along with Evolve Bancorp, face a class action lawsuit in Colorado over alleged mishandling of customer funds following the FinTech's collapse.

🇸🇬 Maybank and ESGpedia team up to simplify sustainability reporting for SMEs. Maybank Singapore's myimpact SME programme now includes a feature powered by ESGpedia, enabling SMEs to calculate carbon emissions, report key ESG metrics, and enhance access to sustainable financing and opportunities.

🇦🇺 Revolut has moved over to their own BSB’s in Australia, moving away from the banking system offered by ANZ. This move means Revolut owns their own bank account number and is registered on the Aussie Banking system. It also allows customers in Australia to sign up for direct debits from their accounts.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 ID Crypt Global, ADEX, and cheqd Partner to Bring Trust and Reputation to DeFi. This collaboration is designed to tackle two critical challenges facing the cryptocurrency and DeFi markets: user trust and identity verification. Continue reading

🇧🇪 OKX launches exchange and wallet services in Belgium. The rollout includes support for over 200 cryptocurrencies, with more than 60 crypto-euro trading pairs. Belgian users can access services such as spot trading, currency conversion, and earning tools through the OKX app and website.

🇩🇪 The German Government selects Secupay and Episode Six Technology to deliver government disbursements. By integrating E6’s enterprise-grade card technology and Visa Ready for Government Disbursements, Secupay will securely disburse government aid to 1 million people over four years, supporting poverty alleviation and financial inclusion.

🇺🇸 Facebook’s Diem stablecoin payment chain killed through captive banks and intimidation, says former exec. David Marcus, former head of Facebook’s Libra stablecoin project, later rebranded to Diem, has revealed new details about the initiative’s collapse. He alleged that political interference — not regulatory noncompliance — was its undoing.

Stablecoin issuer Tether has ceased minting EUR₮, will discontinue support for Token. According to a blog post by the company, they have decided to halt its Euro stablecoin. They noted that when evaluating whether to release a product, they carefully assess the “economic and market conditions” that could affect the token’s performance.

PARTNERSHIPS

🇦🇪 Magnati partners with Aafaq Islamic Finance to support SMEs with embedded financial solutions. The partnership aims to simplify the loan application process, reduce complexity, and enhance access to Islamic financial services. Magnati’s embedded platform accelerates loan processing for SME merchants.

DONEDEAL FUNDING NEWS

🇩🇪 Klarna founder-backed Predium cements €13M to decarbonise real estate with AI. The fresh capital will enable Predium to strengthen its position as a prominent real estate intelligence platform for sustainable and economic management while exploring new markets.

🇬🇧 Revolut will let former staff sell stock in secondary sale. The company has informed former staff that those who had been with Revolut for at least 24 months and held $100,000 or more in vested shares can sell up to 5% of their portfolio, according to a memo seen by Bloomberg News.

M&A

🇬🇧 Coventry Building Society to take over Co-op Bank in January. The FCA and the Bank of England's Prudential Regulation Authority have approved the £780m takeover, set to complete on 1 January 2025, making Co-op Bank a subsidiary of Coventry while both retain their banking licenses.

🇮🇩 Indonesian P2P lender Amartha enters leasing market with Bosowa acquisition. This acquisition reflects Amartha’s dual focus on expanding its market presence and enhancing its ability to deliver customer-focused financial solutions. Read the full piece

🇯🇵 Japan's MUFG to spend over $660 million to buy robo-adviser WealthNavi. MUFG will launch a tender offer on Monday for 1,950 yen apiece, or an 84% premium over WealthNavi's closing share price on Thursday. The stock surged 28% on Friday by the daily limit to 1,358 yen after the Nikkei business daily reported the deal ahead of the announcement.

MOVERS & SHAKERS

🇸🇬 Revolut expands S’pore workforce, products as it caters to businesses. Revolut is expanding its Singapore workforce and product offerings as it shifts focus to serve the corporate sector. It has plans to increase headcount by 60% by 2025. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()