Wise Expands to Mexico, Targeting $60B Remittance Market

Hey FinTech Fanatic!

Wise has officially landed in Mexico! The London-based cross-border payments firm is enabling users to send money from Mexico to over 40 currencies across 160 countries. The expansion targets one of the world's largest remittance markets, where the dollar-to-peso transfer corridor has doubled in volume over two years, becoming Wise's third-largest transmission route for US customers.

Harsh Sinha, Wise's CTO, stated: "Importantly, this takes us one step closer in solving the problems of opaque, slow, and expensive international money movement." The company aims to address inefficiencies in Mexico's remittance system, where hidden fees can reach up to 10.4% of transfer costs.

The company plans to offer faster and more transparent cross-border payments while maintaining compliance with local regulations as it expands its Americas operations.

Read more global FinTech industry updates below 👇 and I’ll be back on Monday!

Cheers,

Navigate Europe’s evolving FinTech landscape. Get the latest insights delivered weekly—subscribe today.

INSIGHTS

📊 𝐒𝐞𝐚𝐦𝐥𝐞𝐬𝐬, 𝐒𝐦𝐚𝐫𝐭, 𝐚𝐧𝐝 𝐒𝐜𝐚𝐥𝐚𝐛𝐥𝐞: 𝐓𝐡𝐞 𝐍𝐞𝐰 𝐄𝐫𝐚 𝐨𝐟 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

FINTECH NEWS

Nasdaq's fourth-quarter profit rides on lower-than-expected FinTech performance. Its revenue rose nearly 9.8% in Q4. However, the $438 million revenue from financial technology unit marginally missed analysts' estimates of $441.2 million, per data compiled by LSEG.

🇬🇧 Chrysalis stock jumps on Klarna and Starling upgrades. Shares rose over six percent following significant valuation upgrades of its private equity holdings. Starling Bank rose 10% thanks to share price increases in comparable companies and Klarna’s value also rose just over 10%.

🇮🇳 PB FinTech reports a rise in Q3 profit on insurance boost. The company's consolidated net profit rose 88% from a year earlier to 715.4 million rupees ($8.26 million). It also continues to benefit from increasing demand in the insurance policy aggregator sector.

🇺🇸 Mastercard earnings beats estimates as firm broadens offerings. Adjusted net income of $3.5 billion, or $3.82 a share, in the fourth quarter beat analysts’ estimates of $3.69 a share. Global purchase volume grew to $2.11 trillion, matching forecasts.

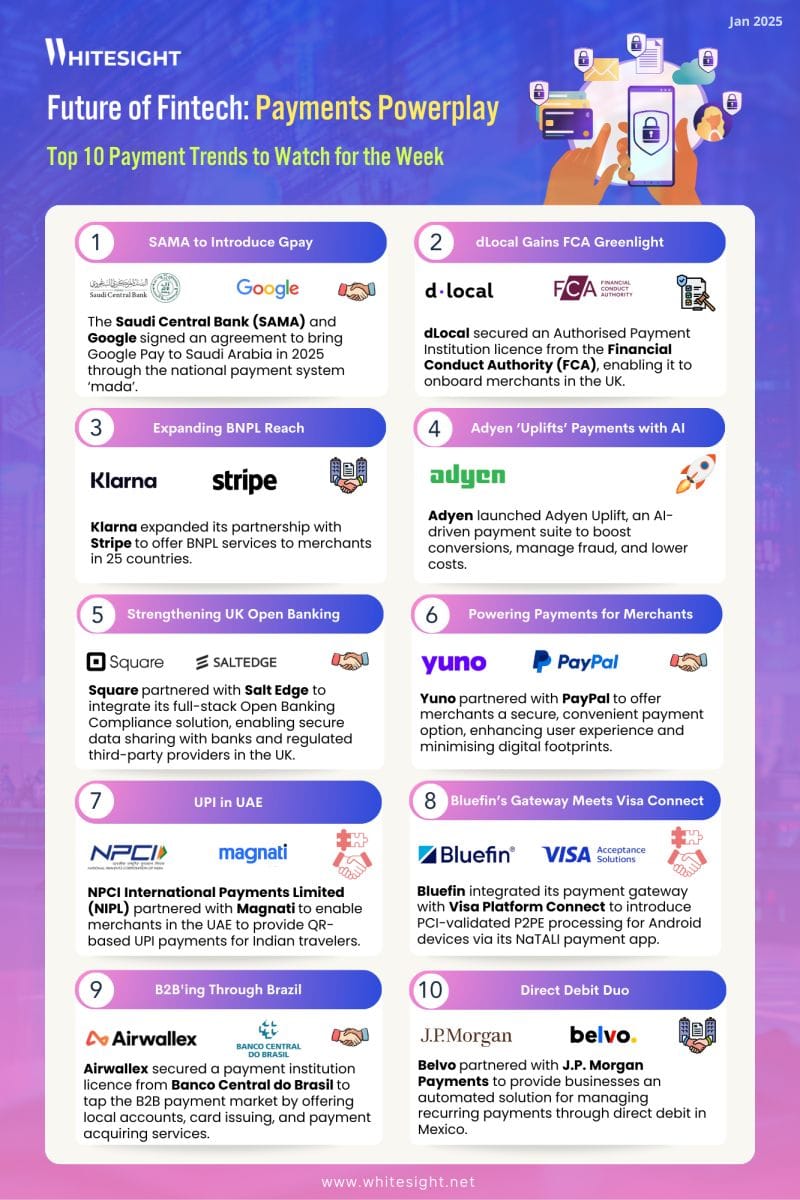

PAYMENTS NEWS

🇬🇧 GetYourGuide partners with Checkout. com. This partnership underscores Checkout.com’s commitment to helping digital-first businesses to thrive. By leveraging Checkout.com’s modular payments infrastructure, GetYourGuide gains access to: high performance payments across borders, localized payment options, and data-driven insights.

🇩🇪 Payone: BaFin cracks down hard. A recent audit by Germany’s financial regulator, BaFin, uncovered significant shortcomings in PAYONE’s anti-money laundering (AML) measures and IT processes. The institution has not fully complied with the Payment Services Supervision Act requirements, according to a special audit from 2022.

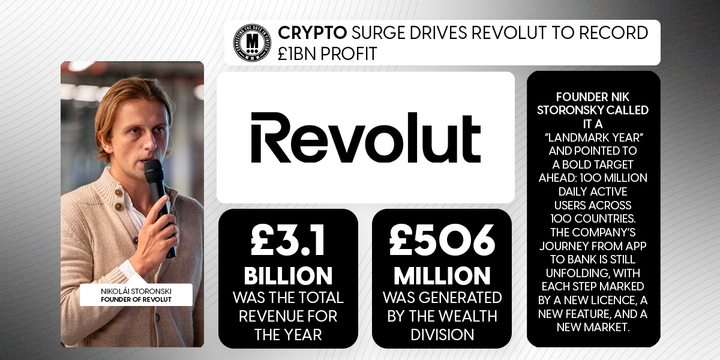

🇬🇧 Travel Ledger integrates Revolut. This integration brings Revolut Business accounts, enabling travel businesses to use Revolut’s extensive banking services to automatically settle B2B payments with partners directly through the Travel Ledger platform.

🇺🇸 JetBlue and Barclays launch premier credit card packed. Customers can apply for the JetBlue Premier Card and take advantage of a limited-time offer: 70,000 TrueBlue points and 5 tiles toward Mosaic qualification after spending $5,000 in the first three months.

🇺🇸 Citi Flex Pay is now available on Apple Pay. Users can make Apple Pay purchases over USD 75 using Citi Flex Pay. The default payback period is three months, with longer payback durations available with a monthly fee. Flex Pay can be used when making purchases on websites or in apps.

🇲🇽 Wise launches in Mexico. The company seeks to capture a slice of the country’s vast remittance market. Users will be able to send money from Mexico to more than 40 currencies and 160 countries, including transferring Mexican pesos to US dollars, it said in a statement.

OPEN BANKING NEWS

🇸🇪 Qred streamlines credit decisions with open banking tech from Enable Banking. This collaboration enables real-time financial data analysis, helping Qred streamline credit decisions, enhance customer experiences, and expand its offerings to meet the unique needs of entrepreneurs.

REGTECH NEWS

🌍 Crypto.com secures MiCA Licence. Approval by Malta Financial Services Authority (MFSA) allows Crypto.com to offer services across the European Economic Area (EEA) under a unified regulatory framework enhancing transparency and regulatory compliance within the sector.

DIGITAL BANKING NEWS

🇪🇸 Banco Sabadell offers customers real-time card payment geolocation. The bank is using transaction enrichment technology from Snowdrop Solutions to enable its customers to accurately visualise the locations of their card transactions on a map, along with the merchant name and logo for clearer understanding.

🇩🇪 Deutsche Bank shares drop after quarterly profit falls. Net profit attributable to shareholders hit 106 million euros ($110.4 million) in the Q4, compared with the 282.39 million euros forecast in an LSEG poll of analysts. The result marked a significant fall from the 1.461 billion euros achieved in the third quarter.

🇸🇪 UBS and Microsoft unite: co-creating the future of banking with Azure AI. UBS selected Microsoft Azure AI solutions to power “Smart Assistants” that streamline content access and provide real-time information to Client Advisors, boosting efficiency and client engagement.

🇪🇸 BBVA expects to reach 20,000 tech employees in 2025. The profiles most in-demand in the Engineering area continue to be software developers and data engineers, followed by security, infrastructure and architecture specialists. Continue reading

🇩🇰 Danske Bank first in Nordics to adopt BlackRock's Aladdin platform. With this collaboration, the bank aims to increase proactivity and engagement for its investment customers via a more scalable approach to its already existing strong investment competencies.

🇸🇦 Saudi Telecom’s digital bank STC set to launch full operations. It will enable customers to open a bank account and manage their money solely online, or pay their bills, receive salaries and move funds, among others, via non-traditional channels.

🇬🇧 Doo Clearing partnered with Aurum Solution. The integration will enable the broker to comply efficiently with the Financial Conduct Authority’s Client Asset Sourcebook (CASS) regulations. Aurum offers reconciliation software that automates companies’ day-to-day processes.

🇦🇺 National Australia Bank scam warnings help Australians abandon suspect payments. NAB pings customers with an alert if a payment appears out of character for them or raises scam concerns. The notices are designed to encourage recipients to stop and check before they send money.

🇨🇭 BIS issues AI guidance for central banks. The guidance covers a wide range of AI use cases in central banking, such as data analysis, research, economic forecasting, payments, supervision, and banknote production. It also identifies key risks such as data security concerns, AI model errors, and reputational challenges.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Kraken debuts instant crypto payments offering Kraken Pay. The feature allows users to choose the crypto or fiat currency in their accounts that they want to send and transmit that payment instantly. Payments are sent via a paylink and the recipient clicks on the link to accept payment.

🇸🇻 El Salvador passes change to Bitcoin law and Sparking Bond Gain. El Salvador’s dollar bonds rose the most in emerging markets after lawmakers approved changes to the nation’s Bitcoin law that were needed to secure an International Monetary Fund loan.

PARTNERSHIPS

🇺🇸 Visa to use ServiceNow dispute management tools. The company will use the solution to power its Visa Dispute Management Service (VDMS) and Visa DPS Dispute Analysis and Support (DAS). The ServiceNow platform includes artificial intelligence (AI) capabilities that help solve dispute issues.

🇺🇸 Clip Money and Green Dot partner to launch Business Cash Deposit Service. Green Dot, in collaboration with its retail partners, will enable Clip Money’s over-the-counter cash deposit service at more than 4,000 locations across the U.S. to facilitate easier deposits for businesses.

DONEDEAL FUNDING NEWS

🇫🇷 Swan adds another $44 million to its Series B. Swan helps other companies offer financial products at scale. The company can generate virtual and physical cards that work with Apple and Google Pay. Cards can be configured by Swan’s corporate clients with spending limits, authorized merchants, and more.

🇸🇦 Forus secures $60 million debt facility from Fasanara. This funding will enable Forus to scale towards becoming one of the largest non-bank providers of debt financing to SMEs. Forus’ mission is aligned with Saudi Vision 2030, which aims to increase SMEs’ contribution to the Kingdom’s GDP from 20% to 35%.

🇬🇧 Sokin secures $15m funding from BlackRock. The funding will enable Sokin to further grow its market share, develop new products which enhance its proposition and significantly scale its team including new offices in London, New York, Toronto and Dubai.

🇳🇬 QED seeds $9.9M in Cedar Money. With this funding, the platform plans to scale its payment infrastructure and tackle the inefficiencies in international payments. Continue reading

🇺🇸 Clear Decisions secures pre-seed investment led by SFC Capital. This milestone marks the beginning of Clear Decisions’ journey to redefine the data centre landscape in line with its mission to empower organisations through intelligent data solutions.

🇺🇸 Wealth-tech OneVest raises $20m in Series B financing. OneVest CEO said: “With this new funding, we are poised to achieve our goal of becoming the leading wealth management platform in North America.” Read more

🇺🇸 Swoop eyes US expansion with fresh funds. The global business funding and savings platform announced a significant strategic investment from Sandbox Industries, the venture capital and consulting firm that specialises in the insurance sector, as well as healthcare and sustainability.

MOVERS AND SHAKERS

🇦🇺 ASX appoints Dirk McLiesh as Chief Risk Officer. Mr McLiesh is an accomplished listed-company executive with more than 25 years’ experience in risk management leadership positions within the financial services industry in Australia and New Zealand.

🇬🇧 Lloyds Banking Group appoints Magdalena Lis as Head of Responsible Artificial Intelligence. She will focus on leveraging next-generation technology to enhance Lloyds Banking Group's products and services while implementing necessary safeguards and controls. She brings over 15 years of experience in AI.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()