Where Will Revolut Choose to List?

Hey FinTech Fanatic!

In a revealing episode of the 20VC podcast hosted by Harry Stebbings, Revolut CEO Nikolay Storonsky addressed the much-debated question of where Revolut might choose to list.

His key observation perfectly encapsulates the challenge: "The problem with the UK – if you think about the UK versus the US – is the US is much more liquid [and] trading in the US is free. If you look at trading in the UK, you always pay a stamp duty tax which is 0.5pc. I just don't understand how the product which is being provided by the UK can compete with the product provided by the US."

The CEO's analysis aligns remarkably with what our community predicted in one of my recent polls, where the majority voted for a US listing as the most likely destination for the FinTech giant.

This perspective gains particular significance considering our recent community poll results, which showed strong consensus around a US listing. The discussion provides valuable context for understanding why major FinTech companies increasingly look toward US markets for their public debuts, despite their European roots.

Watch the podcast here:

Do these insights change your perspective on FinTech listings, or did you anticipate this direction? Share your thoughts in the comments!

Read more global FinTech industry updates below 👇 and I'll be back tomorrow!

Cheers,

P.S. Follow Harry Stebbings and 20VC for more insightful conversations with tech leaders.

FEATURED NEWS

🇬🇧 Revolut boss says listing on London stock market is ‘not rational’. Stamp duty on shares means Britain ‘can’t compete’ with US, he warns: “The problem with the UK – if you think about the UK versus the US – is the US is much more liquid [and] trading in the US is free. Explore now – Click here to learn more

#FINTECHREPORT

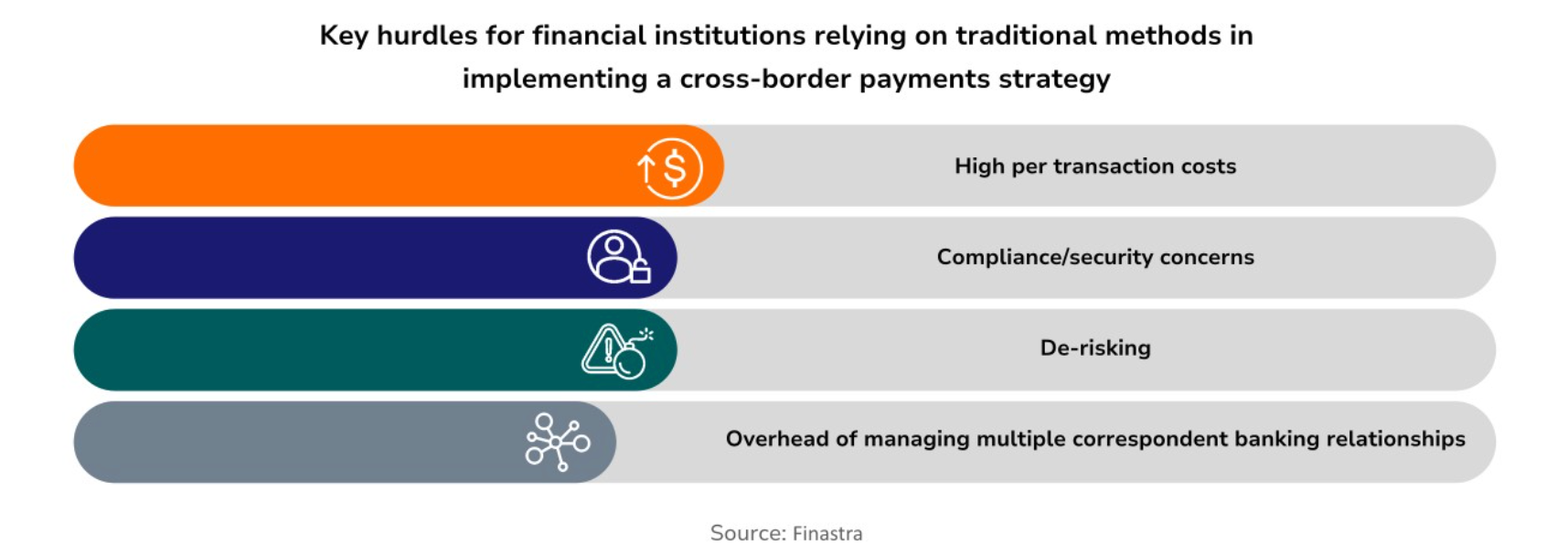

📊 Take a look at “Unlocking instant cross border payments in APAC” report. Global cross-border ecommerce is expected to reach 𝗨𝗦$𝟯.𝟰 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 in 2028, with Asia Pacific emerging as the largest market by accounting for over 40% of global sales. Read the full report

INSIGHTS

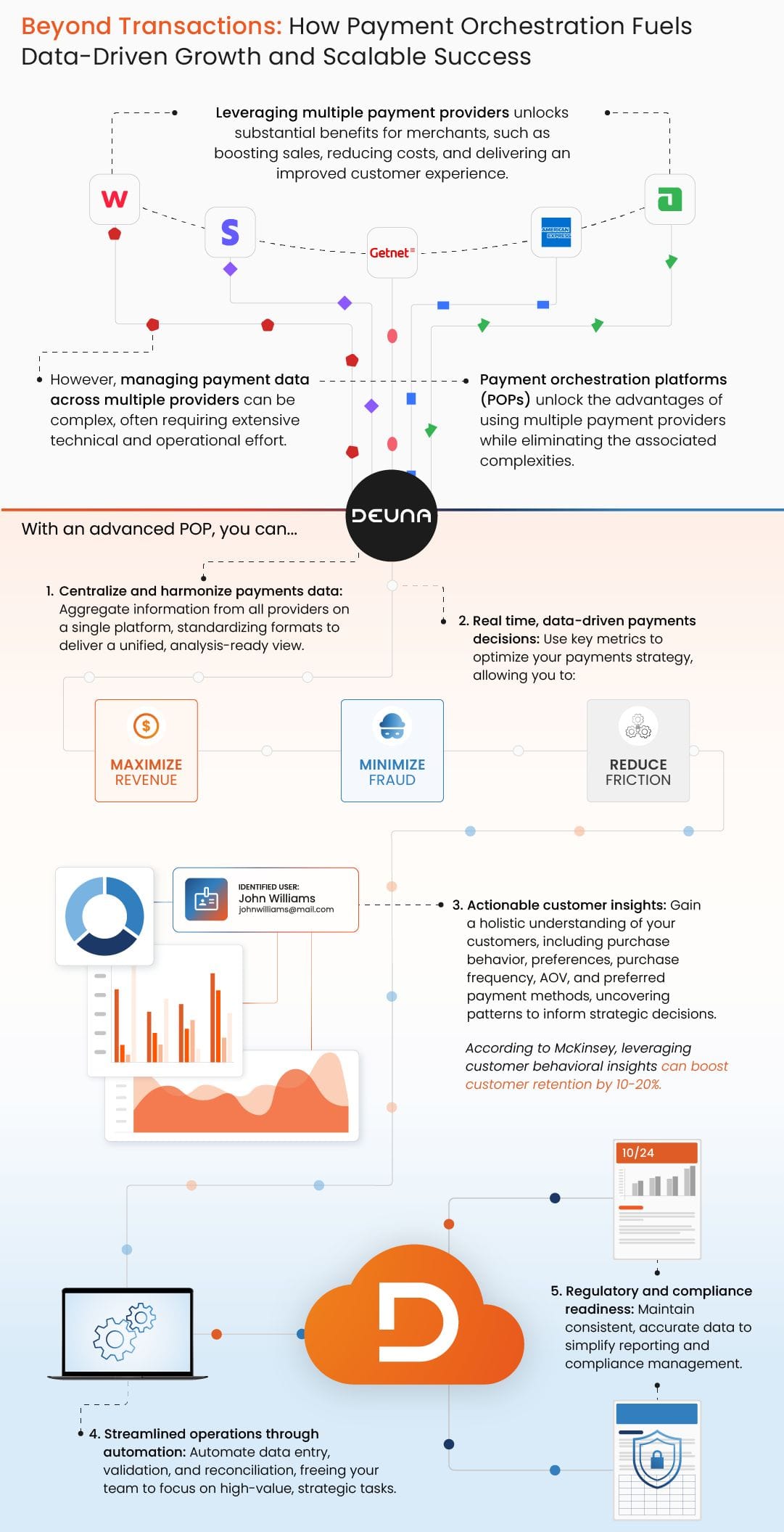

💳 5 ways advanced Payment Orchestration Platforms drive growth & efficiency.

Let's dive in:

FINTECH NEWS

🇸🇬 DBS and the IMDA partner to launch the Spark GenAI programme, designed to raise awareness and encourage the adoption of generative artificial intelligence (gen AI) solutions amongst Singapore’s small and medium-sized enterprises (SMEs). Read more

🇳🇵 Fonepay introduces Nepal’s first virtual credit card with support of Compass Plus Technologies. The service is designed to provide a secure, flexible, and cost-effective digital credit solution for Nepal’s financial institutions (FIs), offering a strong local alternative to those offered by international card networks.

PAYMENTS NEWS

🇨🇴 Yuno brings smart routing to payments process. Yuno announced the launch of Smart Routing, a revolutionary payment solution leveraging proprietary data and intelligent algorithms, reinforcing its leadership in payment orchestration and commitment to empowering merchants with seamless, intelligent tech.

🇧🇷 Rerserva achieves the perfect balance of efficiency and control with Yuno. The partnership between Reserva and Yuno has delivered exceptional results in a short period. Within three months of launching Yuno’s solutions on the Reserva website, the company achieved a four-percentage-point increase in its purchase conversion rate. Get the full story here

🇬🇧 Ecommpay streamlines payouts where beneficiary details unknown with new Payouts via Hosted Payment Page. The new Payouts via Payment Page solution offers an efficient way to process payouts to payment cards, as well as deposits to Apple Pay and Google Pay. This advanced solution is an industry first and game-changer for businesses where senders don’t have the beneficiary's details.

🇱🇹 myTU issues business Visa debit card, built to simplify expense management for businesses of all sizes across the EEA. Raman Korneu, CEO said: “We created this new offering to help businesses streamline expenses and scale efficiently.”

🇺🇸 More record-breaking Black Friday Cyber Monday weekend stats: Total sales by Shopify merchants reached $𝟭𝟭.𝟱𝗕 𝗯𝗶𝗹𝗹𝗶𝗼𝗻, up 24% from the $9.3 billion in 2023 🤯 People around the world showed up to support Shopify merchants and their favourite brands. More here

🇺🇸 Corpay expands corporate payments business with acquisition of GPS Capital Markets. “The transaction is a result of last year’s strategic review to simplify the company and focus on our core business,” Corpay said in a press release. Find out more

OPEN BANKING NEWS

🇪🇪 tell.money partners with Enfuce to deliver PSD2-compliant open banking services for their customers. This collaboration marks a significant milestone in the open banking landscape, enabling Enfuce to deliver seamless, PSD2-compliant services that meet the diverse needs of their customer base with agility and efficiency.

REGTECH NEWS

🇺🇸 Nasdaq study shows firms turning to AI and data scientists to enhance regulatory compliance. Nasdaq, Inc. unveiled its ninth Annual Global Compliance Survey, highlighting key trends and challenges in financial services compliance and surveillance, featuring insights from 94 compliance professionals.

🇧🇷 FinTechs implicated in laundering operations tied to Brazil's largest criminal organization. Police say the PCC, a global drug-trafficker, is accused of running billion-dollar digital platform scams. Investigators say the organization’s brass is now setting its sights on Brazil’s financial sector and digital marketplaces, including cryptocurrency and online sports-betting platforms as well as its booming FinTech industry.

DIGITAL BANKING NEWS

🇺🇸 Telcoin targets first US regulated digital asset bank with Nebraska hearing. Telcoin’s application for a Digital Asset Depository Charter has already cleared a significant hurdle. In September 2024, the Nebraska Department of Banking and Finance confirmed the application’s completeness.

🇫🇷 La Banque Postale launches 'impact' bank card in collaboration with WWF France. The bank's impact card - made from recycled PVC - is available on the Visa Classic and Visa Premier ranges at current rates. An additional €5 annual fee for the card will be donated in full to WWF France.

🇦🇪 Backbase and Seven join forces to drive digital banking innovation in MEA. Through this partnership with Seven, Backbase aims to further extend its reach and impact in the region, leveraging local knowledge and technical expertise to deploy next-generation banking solutions.

🇮🇩 Deutsche Bank launches merchant solutions in Asia Pacific, empowering eCommerce growth. The solutions provide the bank’s clients with a global payment acceptance platform and access to a diverse range of local payment methods in Australia, India, Indonesia and South Korea.

🇬🇧 Third Financial launches customisable mobile app. It provides centralized access to all investments with real-time valuations, detailed analysis, digital document delivery, advanced security features, and full customization options. Read on

🇬🇧 Chetwood Bank partners with Sandstone Technology to accelerate the launch of a new digital savings platform. This collaboration between Chetwood Bank and Sandstone Technology delivers a fully integrated savings solution, meeting urgent market demand and compliance requirements in record time.

🇳🇱 Plumery enhances mobile banking applications with UI/UX Factory. The software has been pre-integrated in Plumery’s existing digital banking services, and aims to reduce time-to-market for banking app development while maintaining control over design and functionality.

🇺🇸 US digital banking platform Milli Bank closes down. The banking platform, a division of First National Bank of Omaha (FNBO), closed on 15 November 2024. A spokesperson said the move allows the company to redirect resources to strengthen other business areas and better serve customers.

🇺🇸 Banks hit credit card users with higher rates in response to regulation that may never arrive. Banks that issue credit cards used by millions of consumers raised interest rates and introduced new fees over the past year in response to an impending regulation that most experts now believe will never take effect.

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Brazil considers banning stablecoin withdrawals to self-custodial wallets. Transfers of stablecoins between residents would be restricted in cases in which Brazilian law allows payments in foreign currencies, CryptoSlate reported Nov. 29, citing the central bank’s public consultation notice on its regulatory proposal.

HTX launches flexible Crypto Loans and offers a prize pool of 2.7 billion in tokens. The launch is accompanied by additional incentives, including a prize pool of 2.7 billion HTX tokens, aimed at addressing the growing demand for flexible financial solutions.

🇸🇬 dtcpay announces shift to stablecoin-only payment services by 2025. This move will see the phasing out of support for Bitcoin (BTC) and Ethereum (ETH) by the end of the year, while maintaining support for all other stablecoin and fiat currency services.

🇬🇧 eToro expands crypto staking programme with addition of NEAR Protocol and Polygon. Users can earn rewards by holding these assets. Opening a NEAR or POL position automatically opts users into staking, with monthly emails detailing rewards earned and their calculation.

🇺🇸 BitGo debuts platform for retail cryptocurrency customers. The company said its platform offers the security that comes from safeguarding billions in cryptocurrency assets for institutions, along with access to “secure, regulated custody” via cold and self-storage, trading, staking, lending and wallet services.

PARTNERSHIPS

🇨🇭 Avaloq and Quadient partner to elevate client communications for financial services. The partnership aims to enhance customer communications management (CCM) for the financial services industry, with Avaloq selecting Quadient Inspire as its standard CCM solution, seamlessly integrating it into the Avaloq platform.

DONEDEAL FUNDING NEWS

🇬🇧 London’s Synthera raises €1.7M to transform financial market analysis with GenAI. The company will use the funds to accelerate product development, expand its team of engineers and data scientists, and collaborate with financial institutions to pilot its technology.

🇭🇰 KPay, a financial management platform for SMEs, raises $55M Series A. The funds will support product development, accelerate go-to-market efforts, enhance customer experience, expand into new Asian markets, and pursue growth through mergers and acquisitions, according to the company’s CFO.

🇺🇸 Lumin Digital secures $160 million in growth funding. The firm plans to leverage the funding to accelerate its strategic growth initiatives, focusing on innovation and driving greater value for financial institutions, their members, and shareholders.

M&A

🇯🇵 Japan’s SBI Holdings Inc. is set to become the majority owner of FinTech Solaris SE after making the largest contribution in the German FinTech's ongoing fundraising, according to a source. Solaris aims to raise €100–€150 million to secure funding until it expects to reach profitability in about two years, the person said.

MOVERS & SHAKERS

🇮🇪 Revolut snaps up mortgage pioneer from rival Avant Money. The company has hired Stephen McCormick, one of the architects of Avant’s successful commercial strategy in Ireland, to build out its mortgage team and develop its product set across Europe in 2025, The Sunday Times has learnt.

🇦🇺 Zip Co's pioneering FinTech leader Larry Diamond to step down. Co-Founder Larry Diamond has agreed with the Board that he will step down as a director of Zip and as US Chairman to establish a Family Office and Foundation for his philanthropic endeavours.

🇺🇸 Pipe appoints new executive leaders to drive scale and expand embedded financial solutions for small businesses. Pipe announced the appointments of Claurelle Rakipovic as Chief Product Officer (CPO), Nate Wiger as Chief Technology Officer (CTO), Amy Loh as Chief Marketing Officer (CMO), and Jon Lear as Global Head of Growth to lead Pipe’s next phase of technology innovation and growth.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()