Visa Revamps B2B2X: Unifying Money Movement Brands Under Visa Direct

Hey FinTech Fanatic!

Visa is uniting its entire Money Movement suite under the 𝗩𝗶𝘀𝗮 𝗗𝗶𝗿𝗲𝗰𝘁 brand, consolidating all solutions into one comprehensive portfolio for the first time.

Visa has quickly become a key player in B2B2X cross-border payments through its Visa Direct brand, enabling domestic and international payments for banks, money transfer services, and other providers.

In recent years, Visa Direct has experienced substantial growth, with transaction volumes increasing by 27% in 2023, reaching 7.5 billion, while endpoints expanded by over 1.5 billion, surpassing 8.5 billion.

Yet, Visa Direct is just one part of Visa's broader Money Movement solutions. The company also facilitates B2B cross-border payments through Visa B2B Connect and has acquired other B2B2X-focused brands like Currencycloud and YellowPepper in recent years.

Now, Visa is evolving its offering by consolidating these four brands—Visa Direct, Visa B2B Connect, Currencycloud, and YellowPepper—under a unified, rebranded 𝗩𝗶𝘀𝗮 𝗗𝗶𝗿𝗲𝗰𝘁.

"Visa is committed to streamlining cross-border payments, and this transformation is a step toward simplifying access for businesses, FinTechs, and financial institutions globally," said Chris Newkirk, President of Commercial and Money Movement Solutions at Visa.

I highly recommend reading this interview article by Daniel Webber and I'll be in your inbox on Monday.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

FEATURED NEWS

🇺🇸 Stripe in talks to acquire Bridge, a stablecoin payment platform founded by Coinbase alumnus Sean Yu. Sources familiar with the matter indicate that discussions are in advanced stages, though no agreement has been finalized. Both parties might still withdraw from the negotiations.

FINTECH NEWS

🇦🇺 15 startups selected for Startupbootcamp’s 2024 Sustainable FinTech Accelerator Programme. These startups are addressing financial challenges and, along with Startupbootcamp’s network of investors, mentors, and corporate partners, are influencing the future of finance. Click here to view the list

🇺🇸 Robinhood unveiled its new desktop trading platform, 𝗥𝗼𝗯𝗶𝗻𝗵𝗼𝗼𝗱 𝗟𝗲𝗴𝗲𝗻𝗱, at its HOOD Summit 2024. The app, which became synonymous with mom-and-pop investors in 2021, is now seeking to mature into a full-fledged financial services provider and compete with established brokerages that serve institutional investors.

🇸🇬 Finastra and LPBank modernize treasury management operations in record time. This collaboration supports LPBank’s digital transformation and market competitiveness, helping it meet rising demands for managing treasury, liquidity products, and enhancing risk management.

🇬🇧 FCA launches AI Lab to help firms with implementation. In a speech at an FCA Innovation 10th anniversary event, Jessica Rusu, Chief Data, Information and Intelligence Officer, announced the new initiative that will also align with the government’s efforts to promote safe and responsible AI development.

PAYMENTS NEWS

🇺🇸 Master Cross-Border Payouts: Top Strategies for Global Success, by Payquicker. Cross-border payouts are essential for the global economy, allowing businesses to transfer funds efficiently. As international markets expand, seamless cross-border payouts are crucial for competitiveness. Explore the full article for further insights

🇪🇬 Thunes expands its Direct Global Network into Egypt. This expansion brings mobile wallet and bank account payment capabilities to Thunes’ Pay solutions, enhancing the company’s cross-border payment services in one of the Middle East and North Africa’s most dynamic markets.

🇺🇸 Klarna is now officially a part of Apple Pay. This new integration makes the world of flexible payment options even more accessible as consumers can make purchases using Klarna directly on an iPhone or iPad, in app and online with Apple Pay.

🇫🇷 Worldline launches “Bank Transfer by Worldline”, a new account-to-account payment method in 14 European countries by the end of 2024. The solution enables retailers to accept payments, enhancing existing options and handling scenarios like invoices and high-value transactions that traditional methods often miss.

🇺🇸 Visa is transforming its B2B2X offering 𝗩𝗶𝘀𝗮 𝗗𝗶𝗿𝗲𝗰𝘁, bringing its full suite of Money Movement brands into a single portfolio for the first time. This updated Visa Direct will enable organisations including businesses, financial institutions, governments and FinTechs to access a broad range of capabilities.

🇬🇧 MuchBetter to offer free payment rings to UK consumers. The wearable payments company is offering free contactless ceramic payment rings to everyone in the UK. The ring requires no battery, bank affiliation, or phone to operate.

🇯🇵 Wise becomes first foreign firm to gain direct access to Japan's payment clearing network. Wise said access to the "Zengin" system will allow it to bypass intermediary banks that process and settle funds in Japan, lowering fees and processing times.

🇺🇸 Zelle says money transfers jumped 27% in first half of year, with payments totaling almost $500 billion. Consumers and businesses conducted 1.7 billion transactions across 143 million accounts during the first six months of 2024, according to a statement Thursday.

🇸🇴 Premier Bank, Mastercard, and Tappy Technologies launch tokenization-passive payment wearables, revolutionizing the future of payments. This makes Premier Bank the first Somali bank in Africa to offer this solution, enabling secure, contactless transactions through advanced wearable technology.

DIGITAL BANKING NEWS

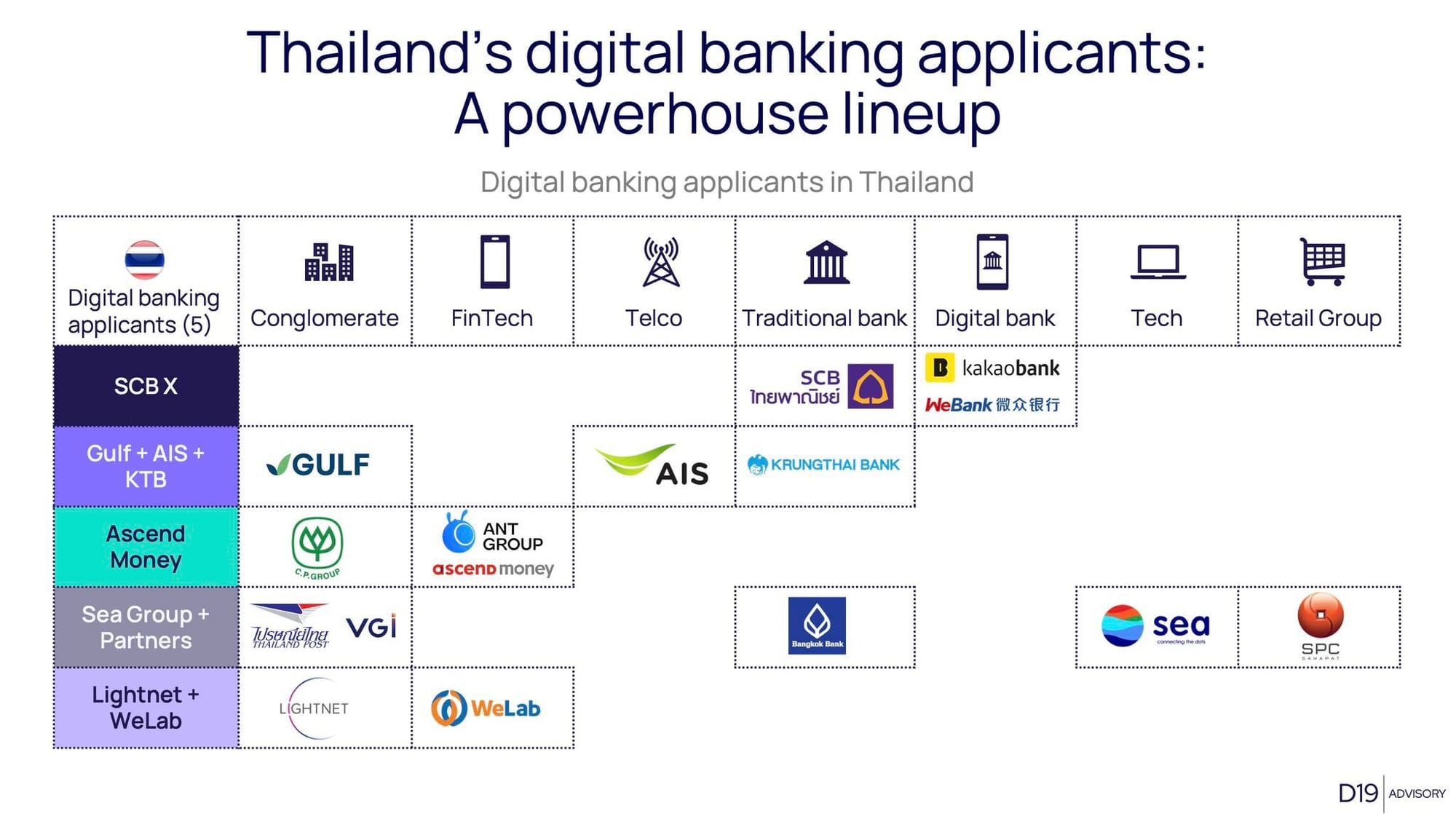

🇹🇭 Thailand’s digital banking applicants👇

A powerhouse lineup:

🇭🇺 Hungarian branch of Revolut opening postponed, MNB worried. Hungary’s National Bank (NBH) stated that Revolut’s Hungarian clients “deserve a domestic bank.” While urging the launch of a local Revolut branch, the NBH noted that such a branch wouldn’t be covered by the National Deposit Insurance Fund (OBA).

🇺🇸 SoFi Technologies will adopt Galileo’s Cyberbank Core to power a range of payment services to commercial clients, including debit, prepaid, ACH and wire transactions, and associated banking services. Cyberbank Core became an integral part of Galileo’s offering after SoFi’s acquisition of Technisys in 2022.

🇮🇳 India’s central bank orders Sachin Bansal’s Navi to halt loans. The RBI cited firms for violations in pricing, income assessment, and asset classification, following months of warnings on responsible lending. While they can still service existing customers, they must implement corrective measures to resume new lending.

🇬🇧 More than 50 former Monzo employees petition board to be included in share sale. A group of 58 former employees at the UK neobank signed a letter to its board, requesting inclusion in the secondary transaction. Many signatories, among the company's earliest staff, claim their contributions were vital in its initial growth.

🇧🇩 Global neobank Fingular among first to expand into Bangladesh aiming for a historic breakthrough in financial inclusion, eyes digital bank license. It is preparing to rapidly launch an innovative digital lending business in the country through a strategic partnership with a local licensed Non-Banking Financial Institution.

BLOCKCHAIN/CRYPTO NEWS

🇹🇭 Siam Commercial Bank launches stablecoin-based cross-border payments. The bank recently launched Thailand's first cross-border payments solution using stablecoins—digital assets pegged to gold or the dollar—in a bid to strengthen the country's regional leadership in banking and financial innovation.

🇬🇧 BVNK, Circle partner to expand $USDC utility for global business payments, simplifying payouts. Under the partnership, BVNK will integrate Circle's USDC deeply into its payments offering, enabling businesses to leverage the popular stablecoin's speed and stability across various payment use cases.

PARTNERSHIPS

🇺🇸 Treasury Prime expands compliance tools with Greenlite partnership. This allows banks within Treasury Prime’s network to improve their anti-money laundering (AML) and risk management efforts by automating repetitive tasks. Continue reading

🇺🇸 Visa and Analytic Partners collaborate on AI-Powered Data Analytics. This collaboration brings together Visa’s merchant relationships and consumer spend insights and Analytic Partners’ commercial decisioning platform, the companies said in a press release.

DONEDEAL FUNDING NEWS

🇳🇬 African crypto startup Yellow Card raises $33 million in new funding. With the funds, the company aims to grow its customer base and expand into Ethiopia, Egypt, and Morocco, where new legislation may further open the market to digital currencies.

🇸🇬 Euroclear invests in Marketnode, a Singapore DLT fund platform. Marketnode provides a tokenization solution, Gateway, and a DLT-based fund administration platform, Fundnode, which Euroclear sees as a way to enhance its Euroclear FundsPlace solution in the Asia-Pacific region.

M&A

🇺🇸 American Express completes acquisition of Tock. The acquisition strengthens American Express’ offerings in dining, travel, and entertainment, expanding its digital tools for restaurants and merchants to enhance customer service. Read on

MOVERS & SHAKERS

🇸🇬 Yuno announced the appointment of SheueChee Beh as Head of Partnerships for the APAC region, signaling the company's strategic expansion in the APAC digital payment sector, which accounts for over 50% of the global market share. Beh previously served as APAC Payments Director at Uber.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()