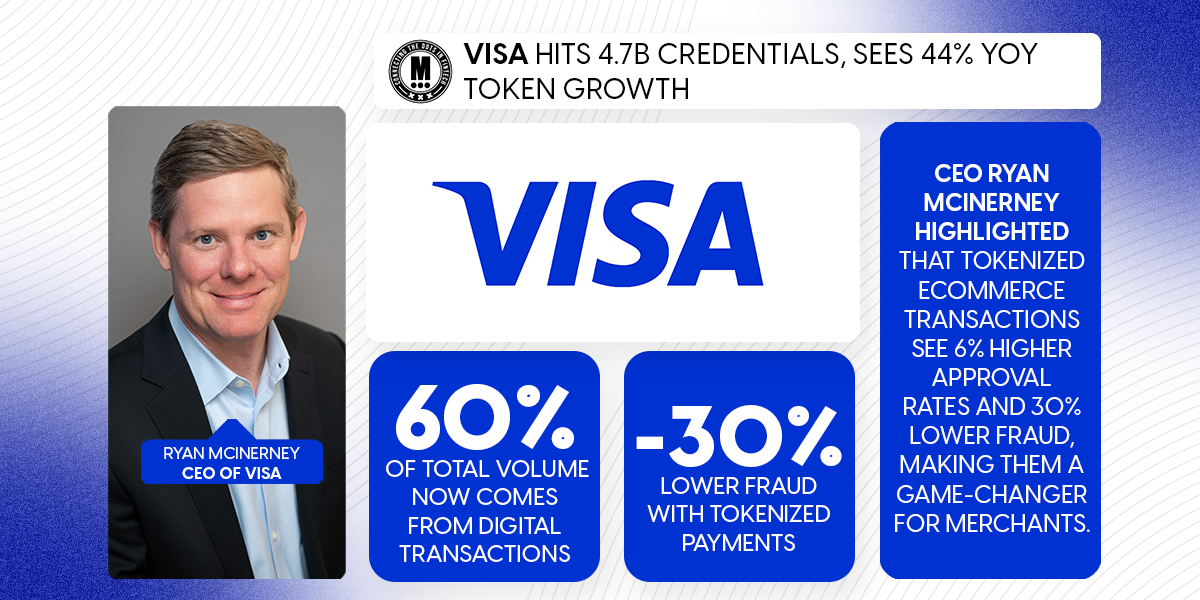

Visa Hits 4.7B Credentials, Sees 44% YOY Token Growth

Hey FinTech Fanatic!

Visa’s latest earnings are in, and the payments giant is riding the digital wave! Payment volumes hit $4 trillion, up 9% YOY, with U.S. debit up 8%, credit up 7%, and cross-border up 11%. Digital transactions now drive over 60% of total volume.

Massive Growth in Tokens & Credentials

Visa has issued 4.7 billion credentials (+7% YOY) and 12.6 billion tokens, a 44% surge. CEO Ryan McInerney highlighted that tokenized eCommerce transactions see 6% higher approval rates and 30% lower fraud, making them a game-changer for merchants.

Tap-to-Pay and Visa Direct Surge

Tap-to-pay now powers 74% of all face-to-face Visa transactions, with double-digit growth in Japan and Argentina. In the U.S., adoption climbed 13 points to 57%. Meanwhile, Visa Direct hit 10B transactions, with 3B in Q1 alone (+34% YOY). McInerney also spotlighted X Money, enabling 600M X users to move funds instantly via Visa Direct.

What’s Next?

Visa is pushing hard into account-to-account (A2A) payments, aiming to launch its Visa A2A solution in 2025 for bill payments. The company is also betting big on value-added services, with recent acquisitions like Pismo and FeatureSpace fueling future growth.

Stay tuned for more updates below 👇. Talk soon!

Cheers,

The most important FinTech event in the Nordics is back for its 7th edition, bringing together 1,500+ attendees, 100 senior speakers, 25+ partners, and 600+ companies under one roof. Join us at Stockholm FinTech Week 2025, happening February 11–12 in Stockholm! 🌍✨

FEATURED NEWS

🇺🇸 Trump administration fires Consumer Bureau Chief. Rohit Chopra was fired prematurely, ending a five-year term scheduled for late 2026. He used that time to impose a $2 million fine on a money transmitter and release reports on auto lending costs, specialty credit reporting companies and rent payment data.

#FINTECHREPORT

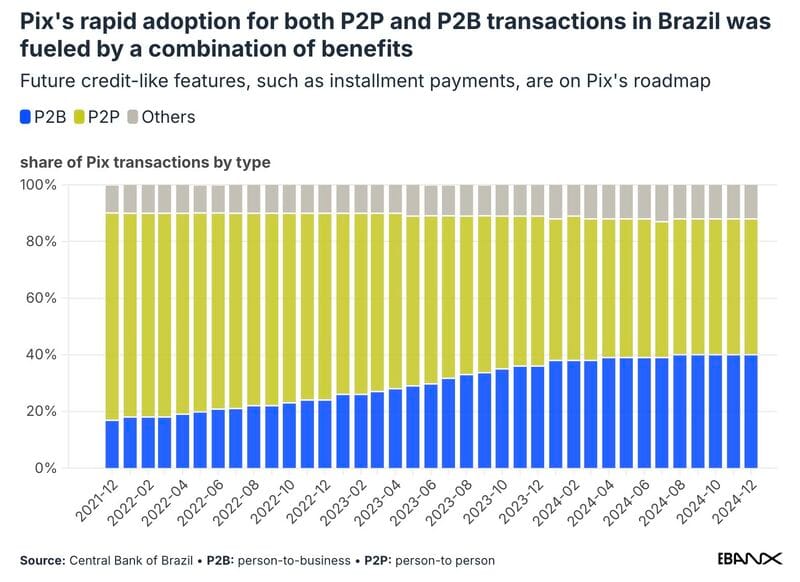

📊Pix is used by 𝟭𝟱𝟱 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 Brazilians reaching 91% of the adult population 🤯

Another interesting movement of Pix in Brazil 🇧🇷 is the rise of P2B transactions👇

FINTECH NEWS

🇺🇸 Cushion shuts down after 8 years and over $20 million in funding. Founder and CEO posted on LinkedIn about the decision to wind down the company at the end of 2024. He said that “despite bringing multiple new FinTech products to market, Cushion didn’t reach the scale needed to sustain the business.”

🇬🇧 UK FinTech jobs market booms. The UK FinTech sector experienced a 44% surge in job vacancies in 2024, driven by venture capital investment and AI. FinTech vacancies hit 12,519 last year, up from just 8,672 in 2023, according to the report, carried out by Morgan McKinley with market data analysts Vacancysoft.

🇺🇸 Nova Credit announces advanced document fraud detection for income navigator. The company unveiled industry-leading fraud detection capabilities in Income Navigator, significantly strengthening its ability to identify falsified documents. The platform improves the analysis of PDFs and images.

💰 Visa tops 4.7 billion credentials and logs 44% growth in tokens YOY. Visa’s fiscal first-quarter results noted significant growth in digital payments by the payments network. CEO said that the shift is driving the quarterly volume of about $4 trillion to digital payments, which now account for more than 60% of volume.

🇺🇸 Sam Bankman-Fried’s parents meet lawyers to secure Trump pardon for son. SBF’s parents are reportedly exploring avenues to secure a pardon for their son from Trump, meeting with lawyers and his allies. His 25-year fraud sentence adds intrigue to the crypto world.

🇳🇬 Moniepoint, OPay, PalmPay responded to 2024 ban. Nigerian FinTechs are experiencing a regulatory shift after overhauling their apps and internal operations, a transition eased by the CBN’s retirement of the former director of other financial institutions. Read More

PAYMENTS NEWS

🇦🇺 NAB and Amazon launch PayTo® payment for Amazon.com.au customers. The new PayTo payment option gives Amazon.com.au customers visibility and control over their payments by facilitating the safe authorisation of PayTo arrangements via their online banking platform.

🇺🇸 CFPB urges Wise to ‘be truthful’ following $2m penalty. The penalties stem from misleading advertising about fees, and failure to disclose exchange rates properly. Wise failed to provide accurate fee information to customers funding prepaid accounts via Apple Pay or Google Pay when using a credit card.

🇺🇸 Stampli to Roll Out Procure-to-Pay Solution. Stampli Procure-to-Pay is designed to eliminate the challenges finance teams face when dealing with disconnected systems and conversations that take place across email, chat and meetings, according to the release.

🇧🇷 AstroPay continues global expansion with payment institution license. The license, from the Central Bank of Brazil, underscores AstroPay’s commitment to delivering secure, compliant, and user-friendly cross-border payment solutions.

🇮🇳 Runa expands into India to streamline Instant Payments for Businesses. With this expansion, Runa allows its business customers the ability to easily send instant, domestic, and cross-border payouts to consumer recipients in India.

🇮🇳 Flipkart goes live with Credit Card Bill Payments. This aims to enable convenient payments for millions of Flipkart customers while driving growth for the Recharges and Bill Payments category on Flipkart Pay via the Bharat Bill Payment Service (BBPS).

OPEN BANKING NEWS

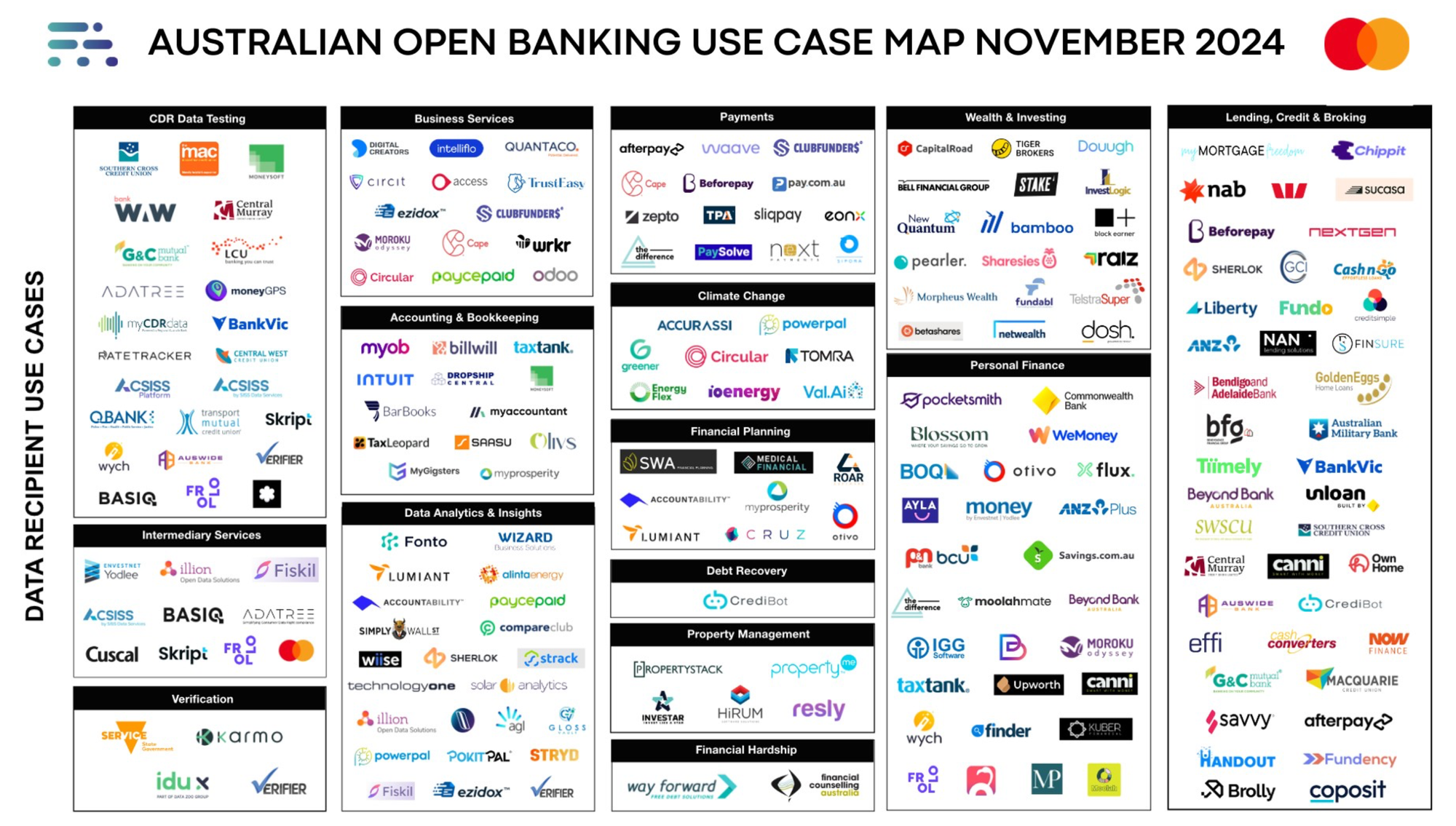

🇦🇺 The Future of Open Banking in Australia

The Australian Open Banking Ecosystem Map and Report👇

🇬🇧 Taxpayers pay HMRC over £12bn using Pay by Bank. Pay by Bank allows to make secure account to account payments between banks, and is based on open banking APIs and banking infrastructure. Using it means taxpayers do not have to manually enter as much sensitive financial information.

REGTECH NEWS

🇺🇸 IDB Bank has teamed up with ThetaRay, for an AI-powered transaction monitoring solution. The bank will use ThetaRay's cognitive AI technology to enhance its financial crime protections, offering instant risk analysis and transparency in compliance operations.

DIGITAL BANKING NEWS

🇷🇺 Putin allows Goldman Sachs to sell its business in Russia. This makes the US firm one of the few Western banks to fully exit the country. Goldman has entered into a binding agreement to dispose of its subsidiary, subject to various conditions, according to a person familiar with the matter who asked for anonymity.

🇩🇪 Commerzbank posts 20% hike in annual profit and launches new share buyback. The results come as Commerzbank has been making a case to stand alone, after a surprise stake build from Italy’s lender UniCredit stoked market speculation of interest in a potential takeover.

🇬🇧 Principality Building Society launches OneBanx cash kiosk. The Buckley cash kiosk follows two installations in Principality's Cowbridge and Caerphilly branches. The service represents a significant milestone for the Buckley community, after the high street's final bank closure in 2019.

🇨🇦 TD’s Keeley leaving bank for external role. Vladimir Shpilsky, who was hired by the Toronto-based bank last fall, will join the senior executive team and take on leadership of platforms and technology. Read More

BLOCKCHAIN/CRYPTO NEWS

🇨🇦 Canadian bitcoin miner Bitfarms mulls pivot to AI data centers. Bitfarms said the consultants, Appleby Strategy Group and World Wide Technology, will analyze its North American sites. They will also advise the company on its computing and AI strategy, while marketing the sites to potential customers.

🇺🇸 Crypto Exchange Kraken says revenue more than doubled last year. The exchange averages more than $2,000 in revenue per customer and holds $42.8 billion in assets. According to the exchange, earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to $380 million in 2024.

🇬🇧 Kraken to delist Tether USDT and 4 other stablecoins in Europe. Kraken will fully delist on March 31 to comply with the European Union’s Markets in Crypto-Assets Regulation (MiCA), according to an official announcement by the exchange. Read more

DONEDEAL FUNDING NEWS

🇹🇷 Deniz Ventures and Rasmal invest $7.6m in TeamSec. The company aims to accelerate its growth operations, focusing on rapid expansion in the Middle East and North Africa (MENA) region. TeamSec also aims to diversify its product and service portfolio and enhance current service offerings.

🇩🇪 Irreducible raises $24m series A. It specializes in zero-knowledge proof (ZKP) generation infrastructure, aimed at improving efficiency and cost-effectiveness. With a current workforce of 25 employees, Irreducible plans to double its engineering team in the next two to three years.

🇸🇦 Lendo raises $690mln facility led by JP Morgan. The facility is expected to contribute to an increase in job creation in the Kingdom, demonstrating Lendo's commitment to domestic economic growth and employment. Continue Reading

🇧🇷 Itaú Unibanco has acquired a 15% stake in NeoSpace, a startup specializing in foundational models for Generative Artificial Intelligence (GenAI) in the financial sector. The bank invested $15 million, leading the $18 million funding round secured by the company.

M&A

🇧🇷 Moove acquires Brazil’s Kovi and takes ARR to $275M. Following the acquisition Kovi will continue to operate under its brand while its executive and management teams remain unchanged. Moove will keep the Kovi brand operating in its existing markets there are plans to expand further across Latin America.

MOVERS AND SHAKERS

🇧🇷 Dock names Thiago Teixeira CTO. He will be responsible for ensuring the continuity of excellence and powerful innovations within Dock’s technological infrastructure, as well as for products and services. He also has more than 20 years of experience in software development and leading mission critical and multidisciplinary teams.

🇸🇬 Thunes appoints Jane Jackson as CPO. Jane will lead Thunes’ People strategy, shaping culture, boosting organisational effectiveness, and enhancing talent development across 14 international locations.

🇺🇸 US Bancorp President Gunjan Kedia to become its first female CEO. She will replace Andy Cecere. "It has been a tremendous honor and a privilege I value deeply, and I believe the time is right to welcome Gunjan warmly to the role I've held for nearly eight years," Cecere said.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()