Visa and HSBC Join Forces to Launch Zing Payments App

Hey FinTech Fanatic!

Visa, HSBC, Tink, and Currencycloud have teamed up to support HSBC Group's latest international payments app, Zing.

Zing allows users to hold and send funds in multiple currencies and transact in over 200 countries, all through a single app and multi-currency card. Launched in the U.K. in January 2024, Zing will soon expand to other markets.

Through Visa's partnership, Zing integrates Currencycloud technology for a multi-currency wallet and Tink's open banking for quick bank transfers. This collaboration enables Zing to offer low-cost currency exchange, financial management, real-time exchange rates, and P2P payments, all linked to a Visa card.

Visa's ready-made solutions from Currencycloud and Tink accelerated Zing's market entry, reducing development time and costs. The global agreement between Visa and HSBC will allow Zing to introduce new features, add more currencies, and expand internationally.

Enjoy more news I listed for you below while I'm having a beer and dreaming about a win against England today 😉

Cheers,

#FINTECHREPORT

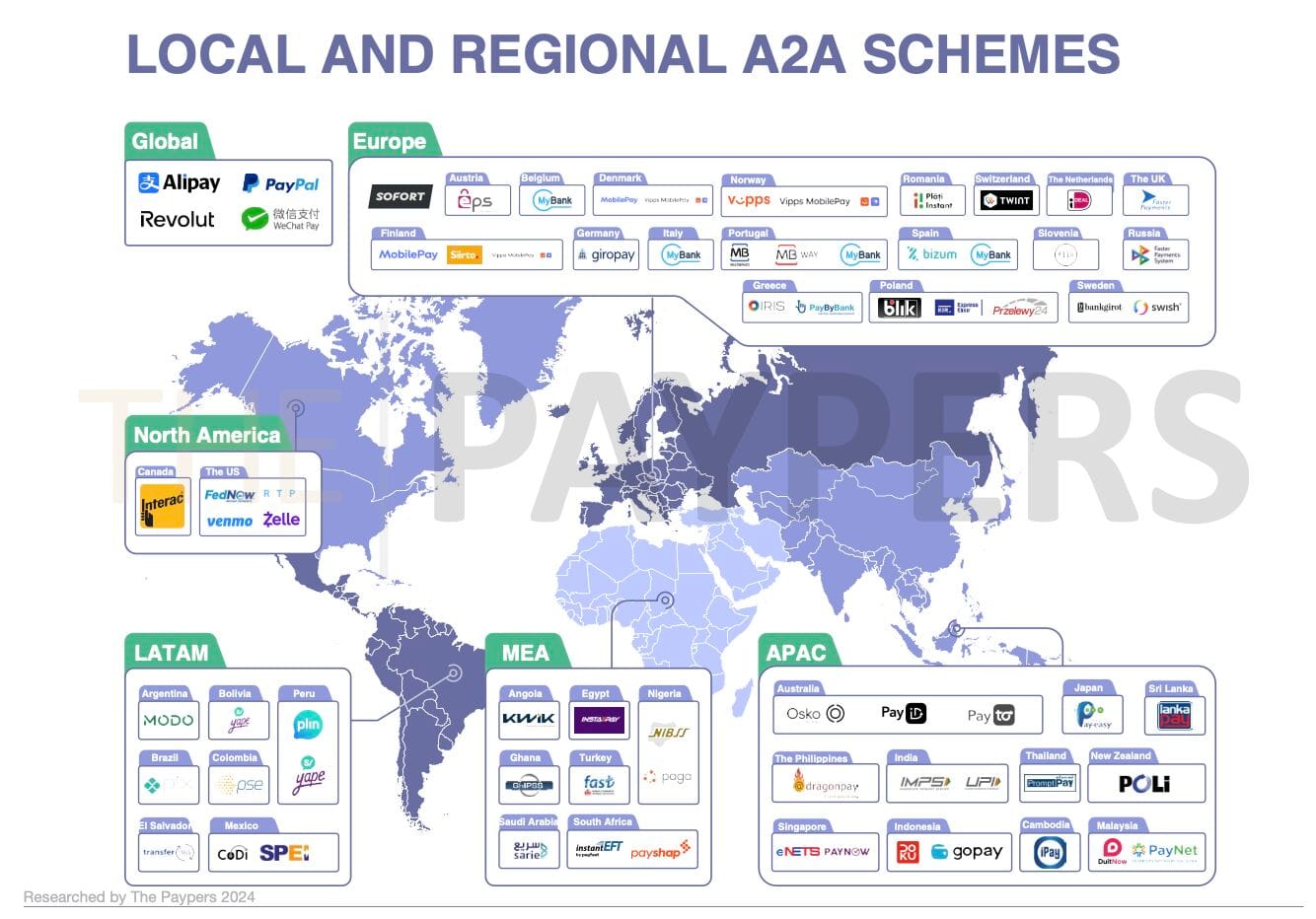

📊 Local and Regional A2A Payments Schemes.

Let's dive in:

PODCAST

🎙️ In this FinTech Leaders episode, Miguel Armaza sat down with Rakefet Russak-Aminoach, Managing Partner at Team8, a global Venture-Creation and VC Fund with over $1 billion in AUM, that creates and invests in companies focusing on FinTech, Cybersecurity, Data & AI, and Digital Health. Listen to the full podcast episode here

INSIGHTS

🛡️ Discover how to block fraudsters while allowing more legitimate customers to complete their purchase. Download this Mangopay report to learn all about it

📄 In today’s fast-paced world, the concept of getting paid early has gained significant traction. Employees are increasingly looking for ways to access their earned wages before the traditional payday, seeking financial flexibility and security. But how does it work? Payquicker shared a great explainer

FINTECH NEWS

🇬🇧 Divido, a London-based FinTech company backed by HSBC, has gone into administration, according to a notification on their website. Their white-label platform is used by banks, lenders, and enterprise merchants to launch embedded retail finance solutions.

🇬🇧 Conferma and Pliant partner to expand the use of virtual cards for business travel payments. The partnership will enable virtual cards, generated by Conferma, to be issued through Pliant’s app, increasing the access of virtual cards for travel management companies and online travel agents throughout Europe.

🇦🇪 NOW Money partners with Mastercard to empower customers with enhanced financial access. This move aligns with NOW Money’s mission to offer inclusive financial solutions to underserved communities and improve the financial well-being of its users across the GCC.

🇺🇸 P2P lender SoLo Funds settles with Pennsylvania Attorney General over allegations of “Illegal Typ and Donation Scheme”. In a public statement, the AG claimed that Solo Funds “deceptively led borrowers to belive they were receiving interest free loans.” Allegedly, the loans actually incorporated “outrageously inflated interest rates."

🇬🇧 According to accounts filed at Companies House, Super Payments reported losses of £7.5 in the year ending 2023. In accordance to its website blurb, Super Payments wants to “power free payments forever and everywhere for businesses, and more rewarding shopping for our members, so that everyone wins”.

🇬🇹 MayaPlus launched an app to revolutionize remittances in Guatemala. MayaPlus, a FinTech company focused on empowering the migrant community, has launched a new app designed to revolutionize the handling of remittances in Guatemala.

PAYMENTS NEWS

📉 New research by leading global payments and financial platform, Airwallex, has revealed 66 percent of travel companies are seeing their profit margins impacted by outdated or complicated payment systems, with nine in 10 expected to prioritise modernising their financial operations this year.

🇬🇧 Ecommpay works with PayPal to enable subscription payments. Keen to expand the company’s already extensive list of payment methods as well as take advantage of all the capabilities offered by PayPal, the additional feature has already been implemented for Ecommpay’s existing customers and is ready to use.

🇺🇸 Congress members egg on US payments system expansion. A bipartisan group is nudging the Federal Reserve to explain why it can’t speed up a plan to extend the operational availability of the U.S. payments system. Read the full article

🇿🇦 Stitch launches smartphone wallets solution for Apple Pay, Samsung Wallet, Google Pay transactions. The Stitch solution specifically enables merchants to optimise and tailor authentication and 3DS in order to minimise dropoff risk and maximise acceptance rates.

🇺🇸 EBANX and Zuora partner in 15 countries across Latin America and Africa. The collaboration aims to support Zuora’s global expansion by enhancing local payment methods in 13 Latin American and two African markets, aiding subscription-based businesses in these regions.

🇧🇬 Phos partners with Shift4 to bolster merchant acquiring capabilities across Europe. Through this partnership, Phos customers will gain access to Shift4’s global acquiring and payment processing capabilities, enabling them to accept and process payments using global card schemes and digital wallets.

🇨🇭 Azqore selects Volante Technologies’ Payments as a Service. The extension of the partnership to incorporate SEPA instant payments represents an important step forward in Azqore’s payments modernization strategy. Read on

🇮🇳 India's Paytm gets government panel nod to invest in payments arm, sources say. The approval, which still has to be vetted by the finance ministry, will remove the main stumbling block to the unit, Paytm Payment Services, resuming normal business operations.

OPEN BANKING NEWS

🇨🇴 First Open Finance Training Institute in Ibero-America launched. The aim of this institution is to promote knowledge transfer, the exchange of best practices, research, and regulatory debate. Click here to learn more

DIGITAL BANKING NEWS

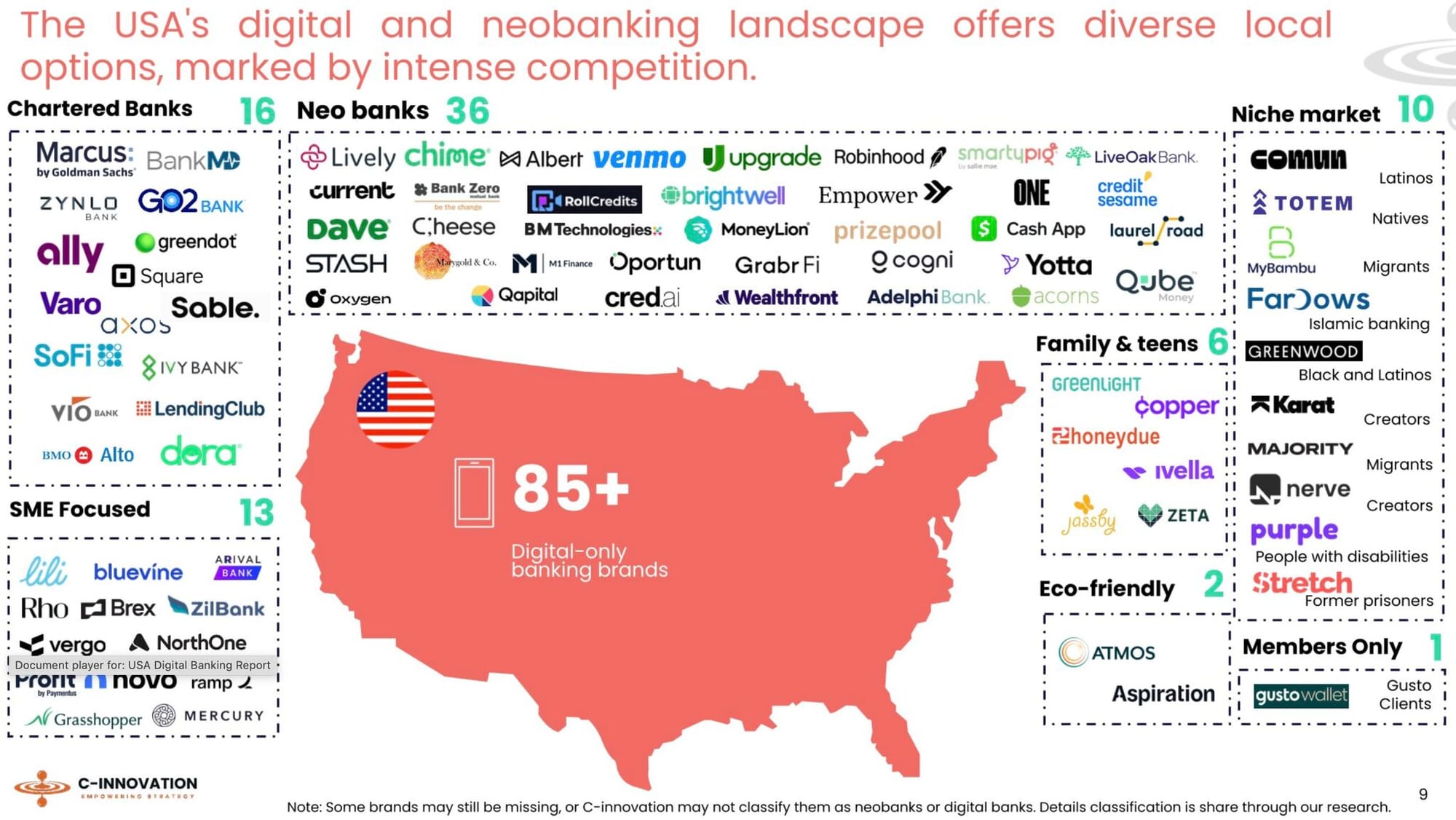

🇺🇸 The US Digital and Neobanking Landscape by C-Innovation.

🇬🇧 HSBC partners with Visa to develop Zing International money app. Thanks to its cooperation with Visa, Zing developed a multi-currency wallet and multiple top-up methods, including 'quick bank transfer,' using Currencycloud and Tink technologies.

🇦🇪 Commercial Bank of Dubai signs exclusive strategic partnership agreement with Visa. This agreement aims to further accelerate digital payments in the UAE, offering innovative and customer-centric solutions to CBD cardholders across all segments.

🇺🇸 Galileo Financial Technologies helps FinTechs meet demand for fast, secure money movement with wire transfer capabilities. By enabling Fedwire transfers, Galileo is helping FinTechs capitalize on this growth, with a scalable solution that caters to the increasing demand for rapid financial transactions.

🇺🇸 Cross River and MassPay broaden domestic Instant payment access, simplifying complex real time payment operations. This collaboration helps businesses offer their clients, contractors and employees faster access to funds and a smoother payment experience

DONEDEAL FUNDING NEWS

🇮🇪 Cork-based payments company Trustap has raised $5.5 million in funding to help drive product growth as the company expands overseas. The new funding will allow the company, which aims to tackle the lack of trust between buyers and sellers in peer-to-peer transactions, to expand its product offering.

🇬🇧 NALA, a leading UK FinTech company, announced that it has raised $40 million in Series A funding to support its global expansion and enhance the reliability of payments to Africa by developing its payment rails. Read the full piece

🇵🇾 BucksApp, a B2B FinTech startup founded in Paraguay and Bolivia, has successfully secured $1 million in a pre-seed funding round, marking a significant milestone in its journey. With this financial backing, BucksApp becomes the first Paraguayan startup supported by venture capital firms from Paraguay, Bolivia, and Ecuador.

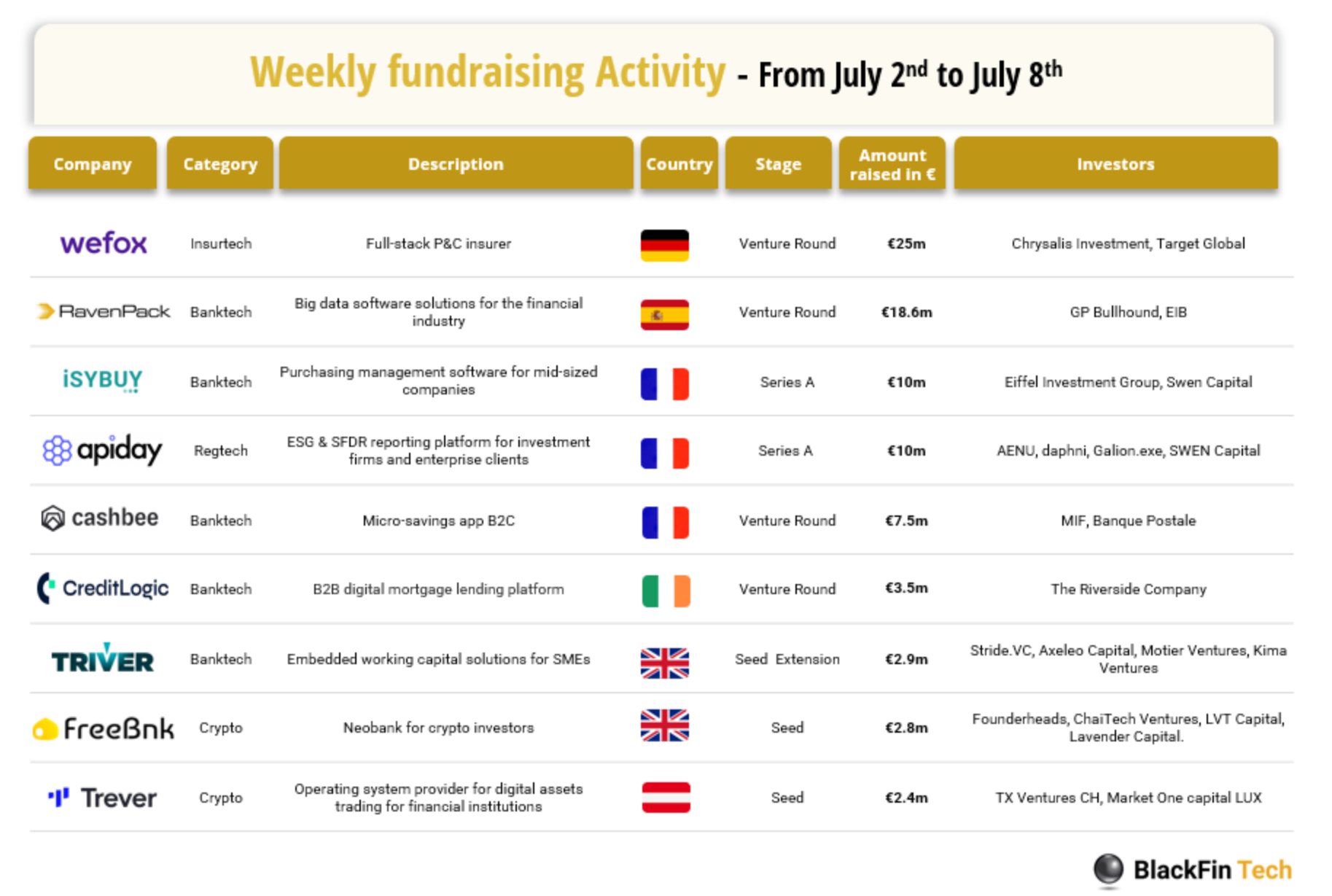

💰 Last week we saw 9 official FinTech deals in Europe for a total amount of €82.7m raised with 3 deals in France, 1 deal in the UK, 1 deal in Ireland, 1 deal in Germany, 1 deal in Spain, 1 deal in Lithuania and 1 deal in Austria. Read the complete BlackFin Tech article here

M&A

🇺🇸 Private equity firm Bain Capital is nearing a deal to acquire Envestnet, a U.S. financial software vendor with a market value of about $3.5 billion. If the negotiations conclude successfully, a deal with Bain could be announced as soon as this week and would value Envestnet at close to its current stock price.

🇨🇦 Bank of Montreal leads $2.55 billion loan in Nuvei deal. Bank of Montreal is reportedly leading a group of underwriters launching a $2.55 billion loan to back the previously announced acquisition of Canadian payments processor Nuvei.

MOVERS & SHAKERS

🇵🇱 A big change in Blik's authorities. The shareholders' meeting of Polski Standard Płatności (PSP), the operator of the Blik Payments System, has changed the composition of its supervisory board. Click here to learn more

🇮🇳 Mashreq appoints Tushar Vikram as Country Head and CEO for India. Vikram will spearhead Mashreq’s Indian operations, driving strategic growth and direction. This appointment underscores Mashreq’s commitment to strengthening its presence in the Indian market.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()