Venture Capital and the Innovation Economy: Key Takeaways from H2 2023's Market Report by SVB

There are 622 Tech Unicorns in the US. Only 13% are profitable, 38% have implemented layoffs, and 49% will need to raise funds in the next 2 years.

There are 622 Tech Unicorns in the US. Only 13% are profitable, 38% have implemented layoffs, and 49% will need to raise funds in the next 2 years.

This info comes from the H2 2023 State of the Markets report that offers a comprehensive understanding of the current status of the innovation economy in the US.

A blend of stabilizing valuations and investments, boosted company profitability, significant runway availability, and emerging challenges faced by founders underscore the main points of the study.

Here are the takeaways from the report:

Investment Landscape:

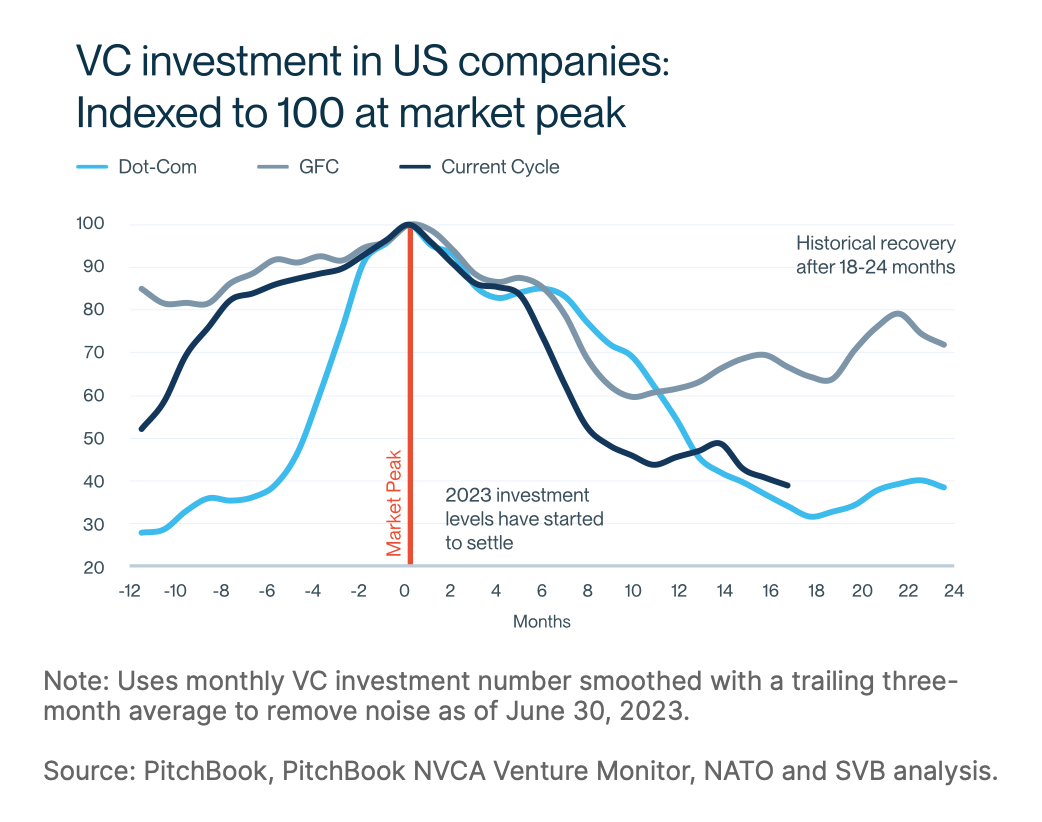

- Stabilizing Investments: After witnessing a downtrend for 18 months, US VC investments, which currently stand at $182 billion for the past year, are beginning to stabilize, reminiscent of the patterns seen in 2019-2020.

- $1+ trillion in Dry Powder: There's a significant amount of 'dry powder' (unallocated funds) available across Private Equity and Venture Capital. Although this can be considered a positive sign, the slower capital deployment anticipated results from a lack of pressure from limited partners to invest.

- VC Influence: 95% of VCs are now advising their clients on banking decisions, as revealed by a survey among 80 leading venture capitalists. This indicates a significant shift in the role VCs play in startups' financial decision-making processes.

Key Market Trends:

- Cautious Optimism: Although VC investment in the US may face further dips, there are indications of a more stable environment. While certain indicators like the inverted yield curve, falling corporate profits, reduced LP distributions, and declining startup revenue growth pose concerns, the report maintains a positive stance on the innovation economy's resilience.

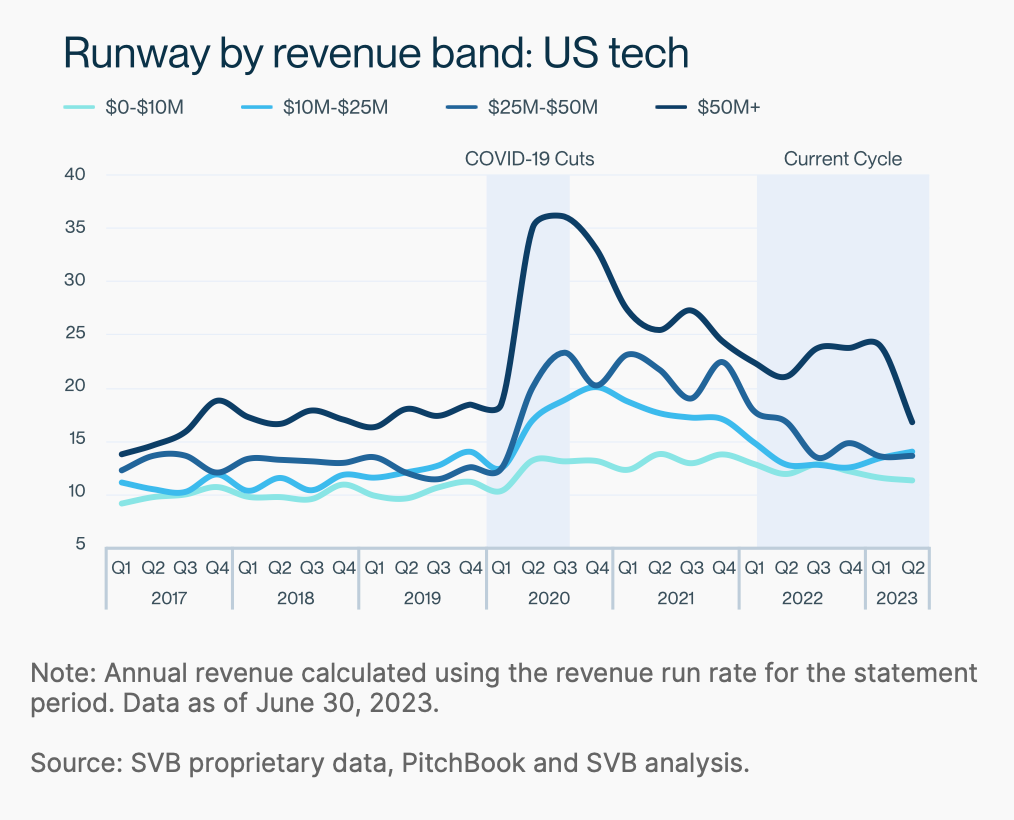

- Dwindling Runway: Over the coming year, merely 46% of US VC-backed tech companies will need to raise funds – a percentage lower than pre-pandemic levels. With a continuously decreasing median runway across stages and sectors, founders confront shrinking runway with limited means of extension. However, a silver lining is that the decrease in runway hasn't been as rapid as VC investments. To navigate this, businesses are cutting down on their burn rate and prioritizing profitability and efficiency.

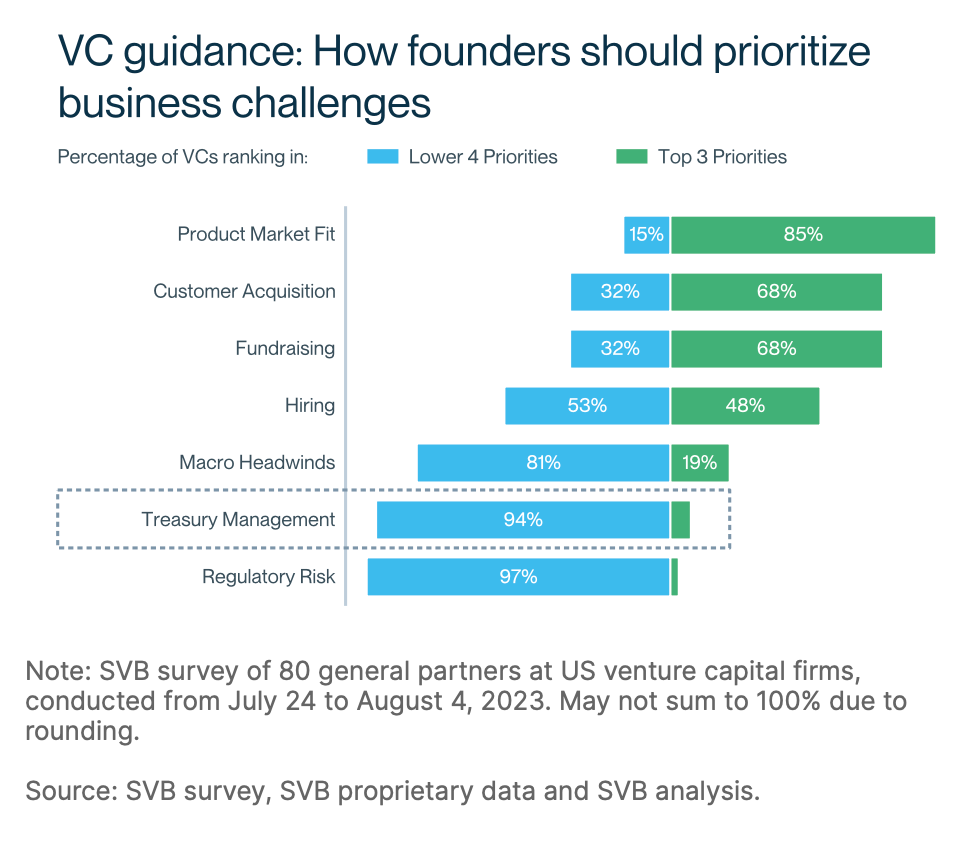

- Treasury Management Gains Traction: VCs emphasize the increasing importance of treasury management. Founders, who might have previously overlooked banking, are now urged to actively manage their cash allocations in line with other crucial business tasks. In the VC's perspective, treasury management's importance is parallel to that of tackling macroeconomic challenges or managing regulatory risks, although it still ranks below core business needs such as achieving a product-market fit.

Sources: Silicon Valley Bank, PitchBook, PitchBook NVCA Venture Monitor, NATO, SVB proprietary data, and SVB analysis (Data as of June 30, 2023).

Comments ()