US Giant Robinhood is Coming to Europe

Hey FinTech Fanatic!

It all started with a trading app in California. Now, ten years later, Robinhood is not launching its first product in Europe — but it is finally bringing the product that started it all in the United States: stock trading.

The Bank of Lithuania has granted Robinhood Europe a Category A financial broker license — the highest available in the country — allowing the company to offer investment services across the European Union. Lithuania, once considered a FinTech underdog, now counts 14 licensed brokerage firms, serving more than six million clients across the EU.

Robinhood Europe was officially registered in Vilnius in August 2023, under the umbrella of its US parent company, Robinhood Markets. Leading the local operation is Laurynas Spangevičius, a well-known figure in Lithuania’s FinTech scene from his previous role at Revolut Bank Lithuania.

Robinhood’s entry into Europe began in late 2023 with the launch of its crypto trading platform in the EU, offering access to over 25 cryptocurrencies. In early 2024, the company expanded into the UK with commission-free stock trading — marking its first international brokerage launch.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

#FINTECHREPORT

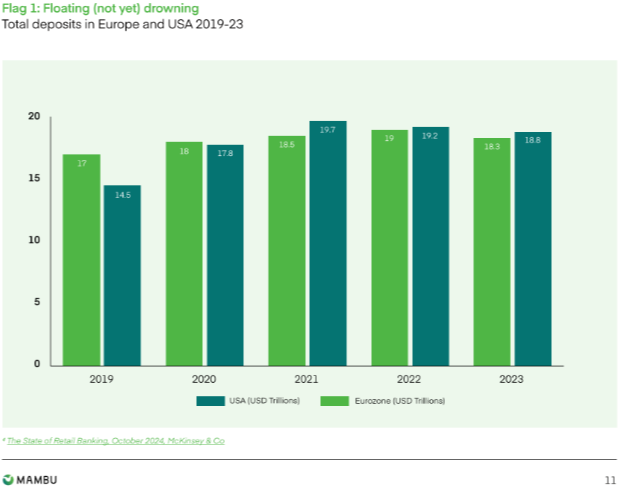

📊 The Future of Deposits 2025.

INSIGHTS

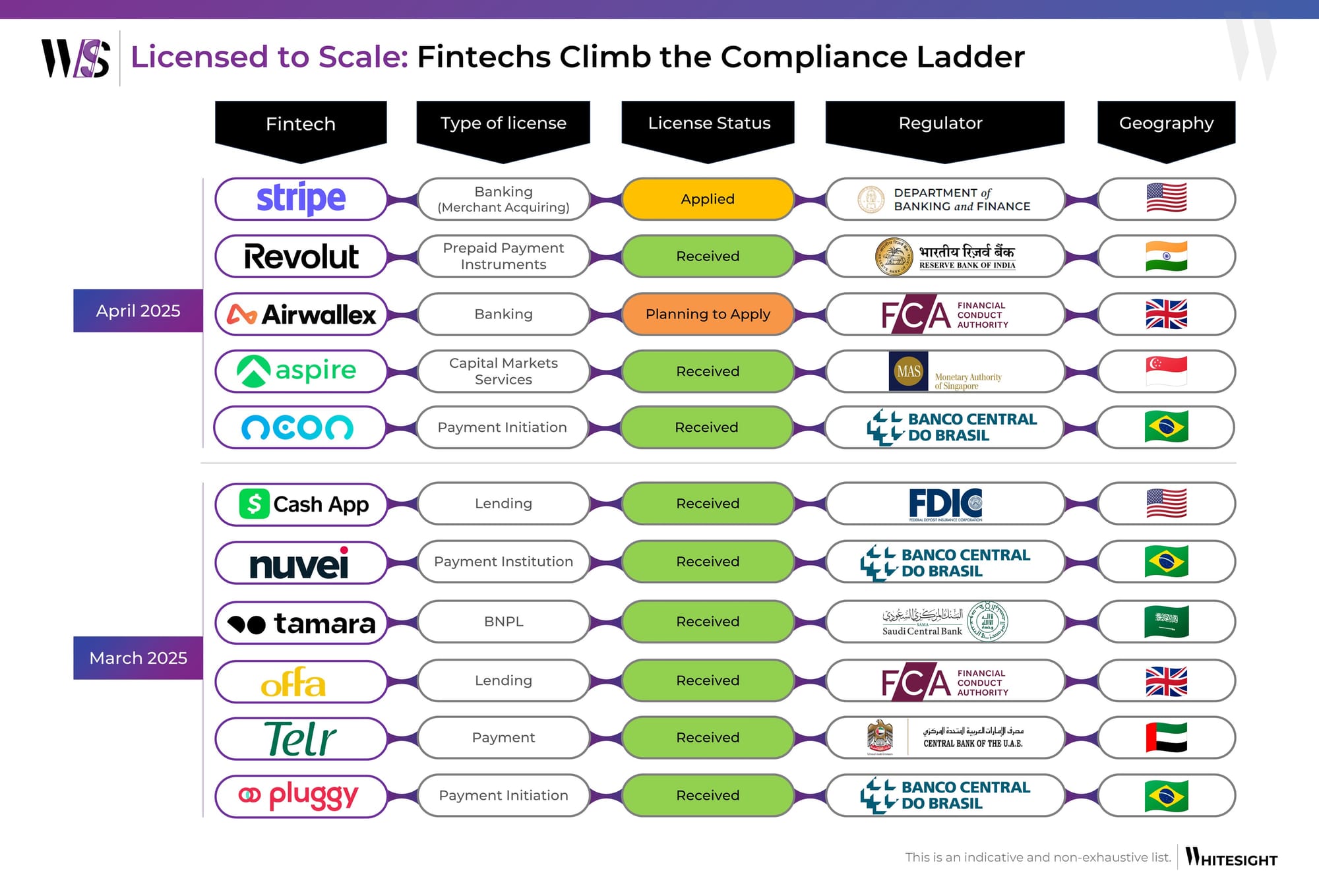

📈 Licensing has emerged as FinTech’s new growth engine.

FINTECH NEWS

🇸🇬 Airwallex reports triple-digit full year revenue growth in Singapore for 2024, unveils SME trends shaping business outlook in 2025. FY2024 revenue more than doubled, growing 153% year-on-year (YoY), fueled by strong transaction volumes and a standout Q4. In early 2025, it announced its launch in New Zealand and acquired Vietnam-based CTIN Pay.

🇺🇸 BaaS platform Solid has filed for bankruptcy after years of controversy. What is known so far: Linked to banks like Evolve, CBW, and Lewis & Clark, the company faced a lawsuit from its own investors, FTV Capital, accusing it of inflating revenue during its Series B round. The case was settled with Solid buying back FTV’s stake at a 56% discount. Read the full story

🇺🇸 Stripe is not becoming a bank. Some wondered if Stripe would now be considered a bank. The short answer is: No. What is true is that this marks the first time that Stripe has applied for a banking license. This does not mean it will be accepting deposits, but will process its own payments if approved.

🇨🇦 Affirm and Shopify accelerate global expansion of shop pay installments. Local merchants will be able to seamlessly activate the product directly from their Shopify admin dashboard. From there, customers can apply to split eligible purchases into biweekly and monthly payments.

PAYMENTS NEWS

🇸🇦 Telr teams up with Saudi Awwal Bank to boost eCommerce payments. Merchants will gain access to a wide range of tools, including payment links, QR codes, digital invoicing, recurring payments, BNPL options, and other proprietary features.

🇺🇸 Amex-backed Blackbird wants restaurants to cut payments middlemen. The Blackbird app allows customers to pay for meals and accumulate points in a blockchain-based program called $FLY, which can be used to pay for meals at other restaurants in the network.

REGTECH NEWS

🇦🇪 Tap Payments granted UAE retail payment licence, completes GCC regulatory approval. The new license enables the Saudi-headquartered firm to offer its payments suite, which supports over 20 different payment methods, to businesses in the UAE.

DIGITAL BANKING NEWS

🇧🇷 Nubank launches NuScore. The tool allows customers to understand the factors impacting their credit score within the bank. It includes behavioral insights, such as credit card usage, savings habits, and debt levels. Nubank aims to provide financial education and help users improve their credit profiles over time.

🇺🇸 Bank of America: More than 90% of its employees now use AI. By answering employees' questions, the assistant, Erica for Employees, has reduced calls to the IT help desk by more than half, the bank said. The bank has also quietly rolled out generative AI in different areas to help advisors and relationship bankers.

BLOCKCHAIN/CRYPTO NEWS

🇱🇹 Robinhood is coming to Europe. The Bank of Lithuania has granted Robinhood Europe a Category A financial broker license. It is the 14th company to be granted a financial brokerage license in Lithuania, and the WealthTech market participants licensed in the country serve more than 6 million clients across the EU.

🇺🇸 Ark Invest acquires $13.3m Coinbase shares, dumps Bitcoin ETF. This follows closely on the heels of Ark's US$13.4 million Coinbase share purchase on April 4, 2025, in ARKK, ARKW, and ARKF. The company is now made of 5.92% of ARKW and 7.65% of ARKF, with fourth and second-largest holdings in those funds.

🇺🇸 BlackRock adds Anchorage Digital as crypto custodian, as its second digital-asset custodian alongside Coinbase Inc., to meet growing demand from both retail and institutional clients. Read more

🇨🇭 Crypto FinTech Taurus launches interbank network for digital assets, which is designed to simplify and improve digital asset transactions between regulated financial institutions worldwide. It aims to improve collateral mobility, optimize settlement speed, and reduce counterparty risk while benefiting capital and liquidity management in digital assets.

PARTNERSHIPS

🇬🇧 Yapily and Allica Bank join forces to bring the power of open banking’s seamless, secure top-ups to UK SME current accounts. By leveraging Yapily’s open banking technology, Allica Bank is now building on its mission to give established businesses the banking they deserve by enabling them to top up their accounts even faster.

🇺🇸 BitGo and Voltage partner to launch instant bitcoin payments via lightning network. The collaboration will allow exchanges, neobanks, payment providers, and FinTech firms to execute instant Bitcoin and stablecoin transactions with greater efficiency and security.

🇺🇸 PayPal’s Xoom partners with Tenpay Global to offer cross-border remittances to Weixin. This new partnership allows Weixin Pay users to receive money directly into their Weixin Pay Wallet Balance or bank accounts linked to Weixin Pay through Xoom or PayPal's mobile app and website.

🇮🇳 FinTech firm Razorpay launches Turbo UPI Plugin on BHIM Vega platform. The solution enables businesses to offer seamless in-app payment experiences, allowing customers to complete transactions instantly without switching to third-party apps.

🌎 FinTechOS extends longstanding partnership with Fort for global cybersecurity readiness. This will rely on Fort’s capabilities to ensure compliance with cybersecurity and digital resilience requirements across global jurisdictions by mandatory third-party risk assessment criteria set by global banks, insurance companies, and financial institutions in their procurement processes.

🇳🇿 First AML and Know Your Customer join forces to streamline global KYB compliance. The primary aim of the collaboration is to simplify and strengthen cross-border compliance procedures. Keep reding

🌎 Spreedly and EBANX team to promote local payments in LatAm. The partnership is designed to help international companies access local payment options in the Latin American (LatAm) region. It provides a unified framework for businesses to offer payment methods.

🇿🇦 BNPL in South Africa gets boost with Happy Pay and Peach Payments partnership. The collaboration will allow thousands of online merchants using Peach Payments to offer customers interest-free, deposit-free payment options through Happy Pay.

DONEDEAL FUNDING NEWS

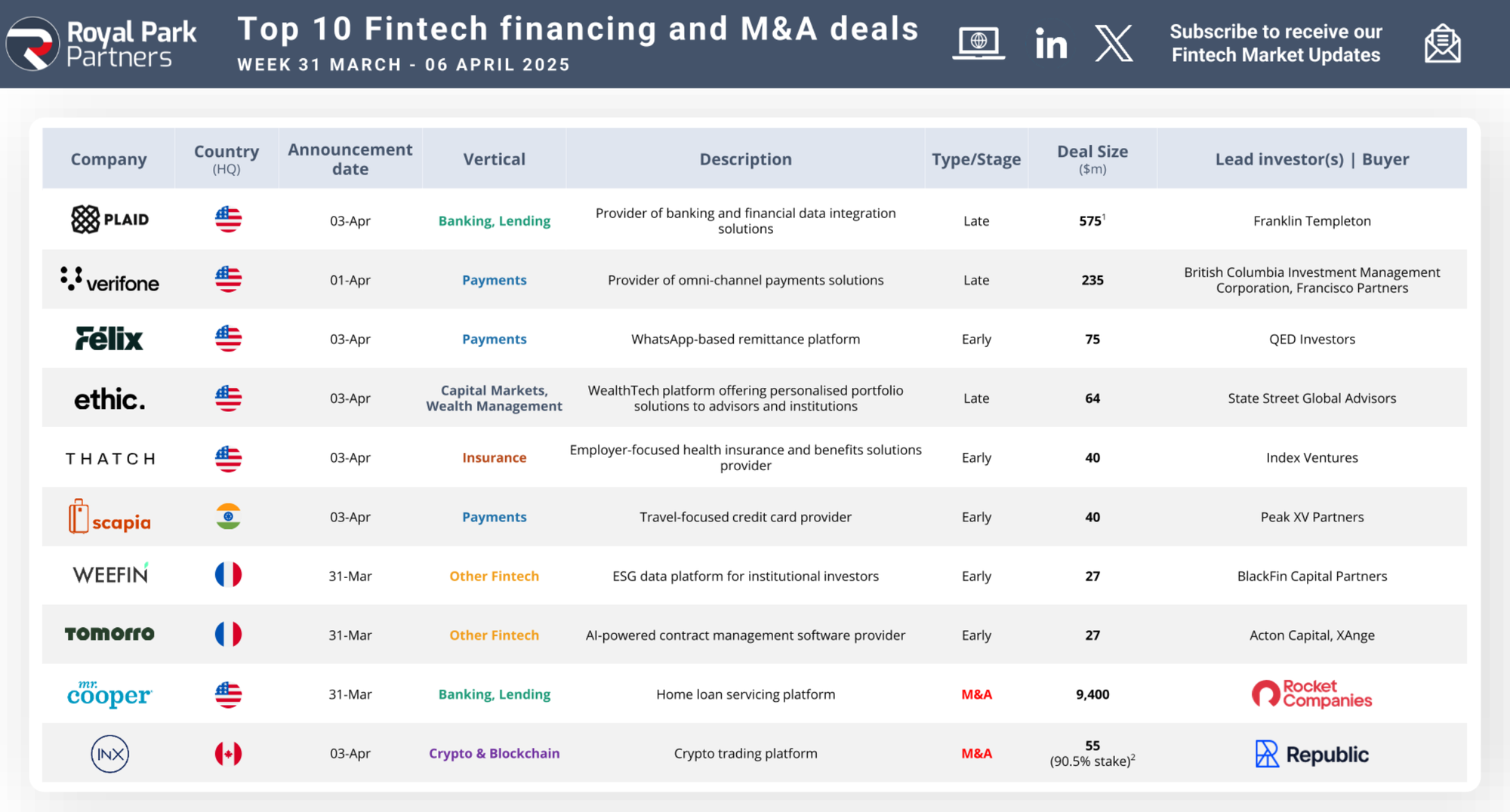

💰 Spotlight on this week’s FinTech deals, with the United States 🇺🇸 in the spotlight, sealing 6 of our top 10 deals.

The Payments vertical led with 3 deals👇

🇺🇸 Los Angeles-based Rain raised a $75M Series B in another good sign for FinTech. The startup plans to use the new funds to help it add credit card and saving products to its roster. It aims to attract employers who want to help employees access earned wages between their paychecks with automation.

🇲🇦 Moroccan FinTech PayTic secures $4M to expand payment automation across Africa. The recent funding is expected to bolster PayTic’s efforts to address the increasing demand for efficient payment processing solutions in Africa. Continue reading

🇬🇧 FinTech Ryft raises £5.7M Series A to challenge Stripe and Ayden. It plans to use the new funding to support its international expansion and grow its team. The company's technology enables acquiring banks to split payments and process payouts at a much lower cost than alternatives.

🇺🇸 FinTech Alinea Invest raises $10.4 million for Gen Z Wealth Platform. This platform is designed to help younger generations manage and grow their wealth through personalized financial services. It aims to provide an accessible, user-friendly approach to investing and financial education, leveraging technology to engage and empower younger users in the financial world.

M&A

🇺🇸 Grasshopper Bancorp, Inc. announces completion of Grasshopper Bank’s merger with Auto Club Trust, FSB. Grasshopper's acquisition of Auto Club Trust creates a $1.4 billion financial institution and expands its consumer and business banking offerings.

MOVERS AND SHAKERS

🇦🇺 iGoDirect appoints Hamish Moline as new CEO. Under his leadership, iGoDirect will focus on strengthening partnerships, streamlining product offerings, and delivering enhanced value to clients and customers. With a proven track record of driving growth, innovation, and strategic partnerships, Hamish is well-positioned to lead iGoDirect into its next phase of expansion.

🇺🇸 LexisNexis Risk Solutions has appointed Valentina Isakina as Executive Vice President and Chief Strategy Officer. Isakina will play a pivotal role in helping to shape and execute the company's long-term strategy, identifying new growth opportunities and strengthening its competitive position in the global marketplace.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()