Turkish Neobank Papara Expands with Sadapay Acquisition

Hey FinTech Fanatic!

Just over three months after initially reaching an agreement, the Turkish neobank Papara has officially confirmed its successful acquisition of Sadapay, a prominent fintech startup in Pakistan.

The deal, which has been in the making for several months, awaited final approval from the central bank since February.

Although the specific details and valuation of the acquisition have not been publicly disclosed, sources indicate that the all-stock deal is valued at approximately $30 million, significantly lower than Sadapay's recent valuation of nearly $100 million.

Additionally, Papara plans to invest $10 million into the startup as part of the agreement.

Following Papara's acquisition of Rebellion in Spain last year, this marks their second major deal, with more expected in the near future.

Cheers,

#FINTECHREPORT

📊 How Do Instant Ad Hoc Payment Costs Impact Small SMBs? Check out this great report by PYMNTS and Ingo Payments to find out

FINTECH NEWS

🇸🇪 Klarna's Q1 2024 results are in, announcing a 𝗽𝗿𝗼𝗳𝗶𝘁𝗮𝗯𝗹𝗲 start to 2024. Check out the Key Highlights here

🇳🇬 MoMo, the payment service bank owned by MTN has released an open Application Programming Interface (API) aimed at increasing digital wallets on the platform. The PSB expects companies using the open API to integrate it as a payment or collections option.

🇸🇪 BlackRock-backed FinTech Trustly says IPO still at least one year out even as profits jump 51%. Trustly is holding out on an IPO even after reporting a strong set of financials, with results shared exclusively with CNBC showing the firm reported revenues of $265 million in 2023.

PAYMENTS NEWS

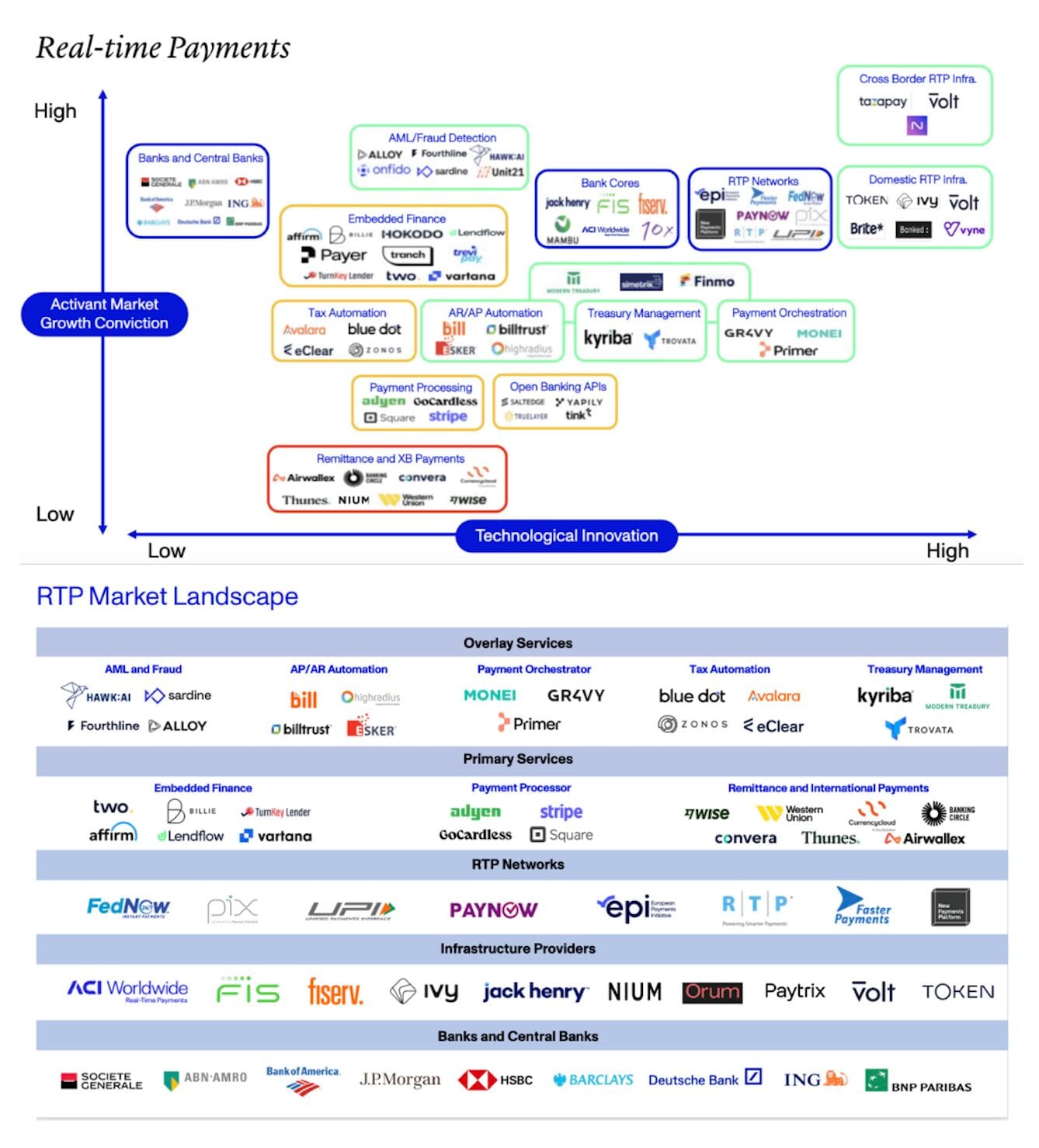

What is a Real-Time Payment (RTP)? And why is it so important?

Let me explain:

🇧🇷 Pix will no longer be limited to Brazilians: foreigners will also be able to use the Instant Payment feature, which is called: 𝗣𝗶𝘅 𝗥𝗼𝗮𝗺𝗶𝗻𝗴. The FinTech’s solution is a platform integrated with foreign banks and digital wallets.

🇬🇧 payabl. partners with Zimpler to accelerate instant payments growth. With the new direct integration to Zimpler, payabl.’s merchants can now offer customers the option to pay via instant bank transfers at checkout. Read more

🇮🇳 Axis Bank partners with Mastercard to launch NFC Soundbox. The new soundbox will act as an all-in-one solution that will allow the users to accept Bharat QR, UPI, Tap & Pay and Tap + Pin payments, and will be powered with 4G + Wifi capability.

OPEN BANKING NEWS

🇬🇧 Yapily and mmob streamline open banking solutions for more businesses than ever. This collaboration aims to simplify and accelerate the deployment of Yapily’s open banking solutions by various firms, with effective technical implementation in just two hours.

REGTECH NEWS

🇱🇺 Mangopay debuts AI-driven fraud prevention package. Mangopay’s Fraud Prevention solution provides a fully integrated and payment processor-agnostic AI-driven cybersecurity solution to guard against an evolving range of threats.

DIGITAL BANKING NEWS

🇮🇳 PhonePe launches secured lending platform with banks, FinTech firms. PhonePe said it has more than 535 million registered users and aims to create a “powerful and seamless user experience” in the secured loans category. Customers can access to lending solutions on the PhonePe app in six major categories.

🇪🇺 Swift has today announced two AI-based experiments in collaboration with its member banks, to explore how the technology could assist in combatting cross-border payments fraud and save the industry billions in fraud-related costs.

🇧🇷 Olist, a Brazilian startup that helps 40,000 clients sell their products on large marketplace platforms, is pushing into banking to drive more efficiency for customers while creating a new revenue stream for the business.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 PayPal adds stablecoin to Memecoin-Favorite Solana blockchain. PayPal chose Solana for speed and low cost, despite outages. It currently measures at 1,423 transactions per second (tps), according to blockchain data tracker SolanaFM.

🇺🇸 Payments vets launch USD stablecoin. FinTech company Stable. com announced the launch of USD3, its 1:1 backed stablecoin, declaring its determination to disrupt the current stablecoin landscape and bring serious competition to existing industry players.

🇺🇸 Robinhood Crypto customers in the United States can now use an API to view crypto market data, manage portfolios and account information, and place crypto orders programmatically. Read the full release

DONEDEAL FUNDING NEWS

🇬🇧 FinTechOS, a London, UK-based provider of an end-to-end financial product management platform, raised $60M in Series B funding. The company intends to use the funds to expand operations and its development efforts.

🇺🇸 NYC based FinTech startup Frich has raised $2.8 million in a seed funding round led by Restive Ventures. Frich makes money by partnering with banks and brands such as a credit builder or a lifestyle brand, and charging them a flat fee to be on its platform. That fee varies based on the partner.

🇮🇳 Vegapay, a business-to-business (B2B) FinTech firm, has raised $5.5 million in a seed round that saw the participation of Elevation Capital and Eximius Ventures. The company will utilise the capital raised towards expanding product and technology teams and investing in operations and compliance requirements.

🇺🇸 Bootstrapped for over a decade, this Dallas company just secured $110M to help people pay bills by text. Solutions by Text, a company that gives people a way to pay their bills and apply for loans via text messaging, has secured $110 million in new growth funding.

🇺🇸 Slingshot raises $2.2 million to provide financial services to artists. Slingshot emerged in the wake of the booming $250 billion creator economy, but it’s not the first company to try and build out infrastructure for this bustling economy. Read on

M&A

🇹🇷 Turkey’s leading FinTech, Papara, which has reached 20 million users, has expanded into South Asia through the 100 percent purchase of SadaPay. This strategic move follows Papara’s recent European expansion through the acquisition of Spanish Rebellion in 2023.

🇺🇸 Financial Information Technologies (Fintech) has acquired Nexxus Group to expand its B2B payment capabilities. This acquisition, which closed in May, adds Nexxus Group’s consignment-selling technology to FinTech’s business solutions for the hospitality and retail industries, the companies said in a May 29 press release.

MOVERS & SHAKERS

🇸🇬 Thunes, the global money movement innovator, announced Ruwan De Soyza as General Counsel to oversee all legal, compliance and secretariat affairs as the company accelerates growth worldwide. De Soyza will lead a team across a broad range of practice areas.

🇬🇧 Revolut, the UK FinTech firm, aims to top up its talent pool with 12 new hires as it pushes to expand its crypto business. Their hiring efforts are testament to the industry’s renewed optimism amid regulatory approval of both Bitcoin and spot Ethereum exchange-traded funds this year.

🇬🇧 XYB names Derek Joyce as CEO. Joyce’s commercial strategic acumen and deep knowledge of the FinTech ecosystem will help to position XYB as the go-to provider for cloud-based modular banking. Read the full article

🇬🇧 Small business lender Funding Circle plans to cut around 120 jobs as part of efforts to reduce costs and boost its flagging share price. It also announced the departure of its finance chief. The London-listed FinTech said in a stock market update that it had launched cost efficiency measures to create “a simpler, leaner and better positioned UK focused operation”.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()