Understanding Open Banking Payments

Open banking payments utilize Application Programming Interfaces (APIs) to execute direct transfers between banks.

Open banking payments utilize Application Programming Interfaces (APIs) to execute direct transfers between banks.

Unlike traditional electronic payments, which depend on intermediary payment processors to conduct transactions, open banking payments leverage APIs for swift and direct sharing of financial information between authorized entities.

As a result, verifications are immediate, eliminating the need for third-party intermediaries.

Moreover, these payments are governed by the overarching open banking policies and standards.

Advantages of Open Banking Payments

- Cost-Effective: Open banking payments are notable for their low transaction fees. In traditional systems, every card, e-wallet, or Buy Now Pay Later (BNPL) transaction can siphon off up to 6% as a processing fee. This affects not only small businesses but also large enterprises. With open banking, these exorbitant fees are minimized.

- Speed: The absence of intermediary approval stages—like those from payment gateways or networks—means open banking payments are swift.

- Security: Leveraging APIs ensures that only essential data for each transaction is transferred. This minimizes the potential for unauthorized access and data breaches, making open banking payments a more secure option.

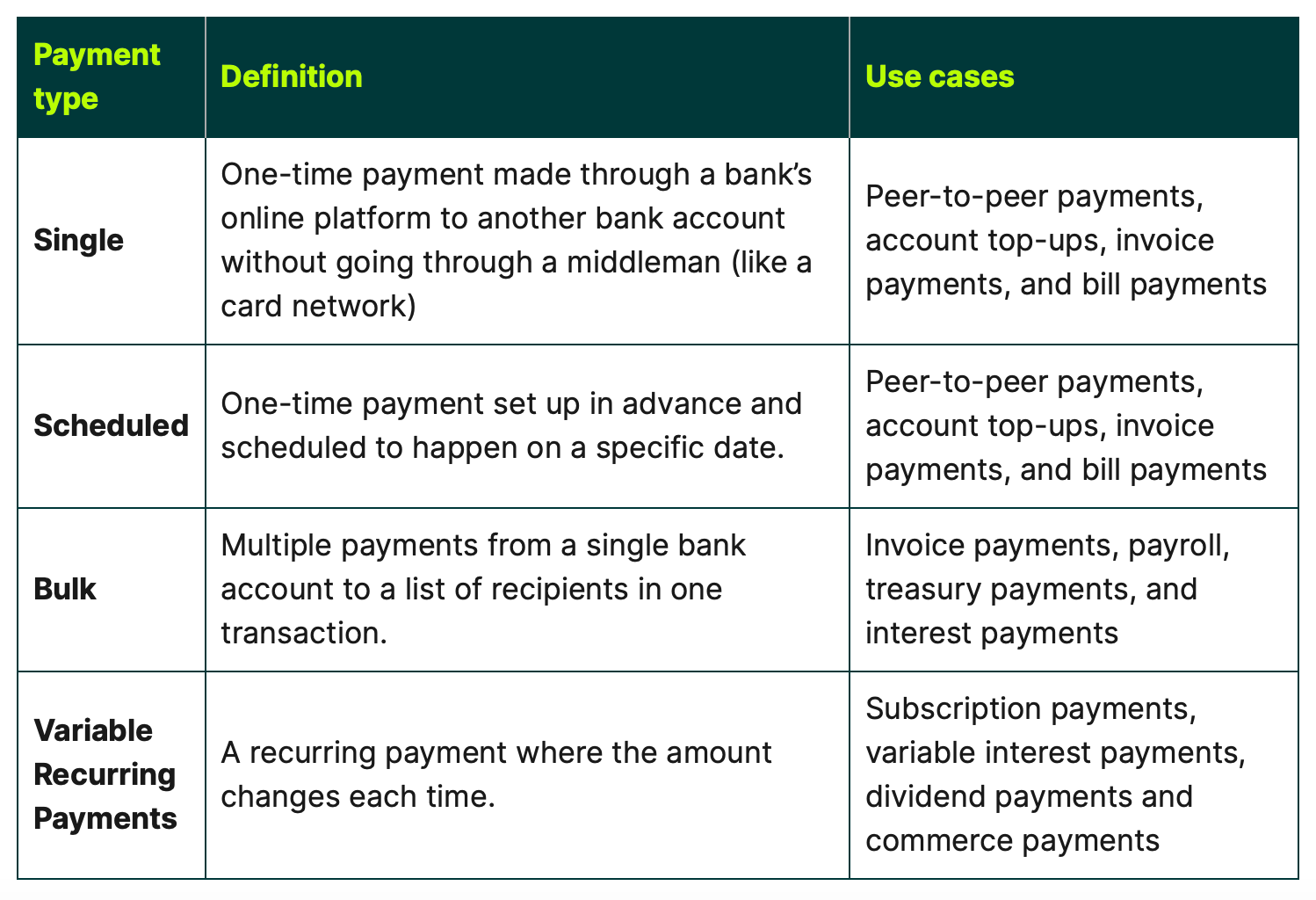

There are different types of open banking payments: single, scheduled, bulk, and variable payments.

The benefits of each type are the same: faster, cheaper, and more convenient transactions. Yapily wrote an interesting piece where they explain all types in more detail.

How do PayPal, Visa, banks, and open banking interact with each other?

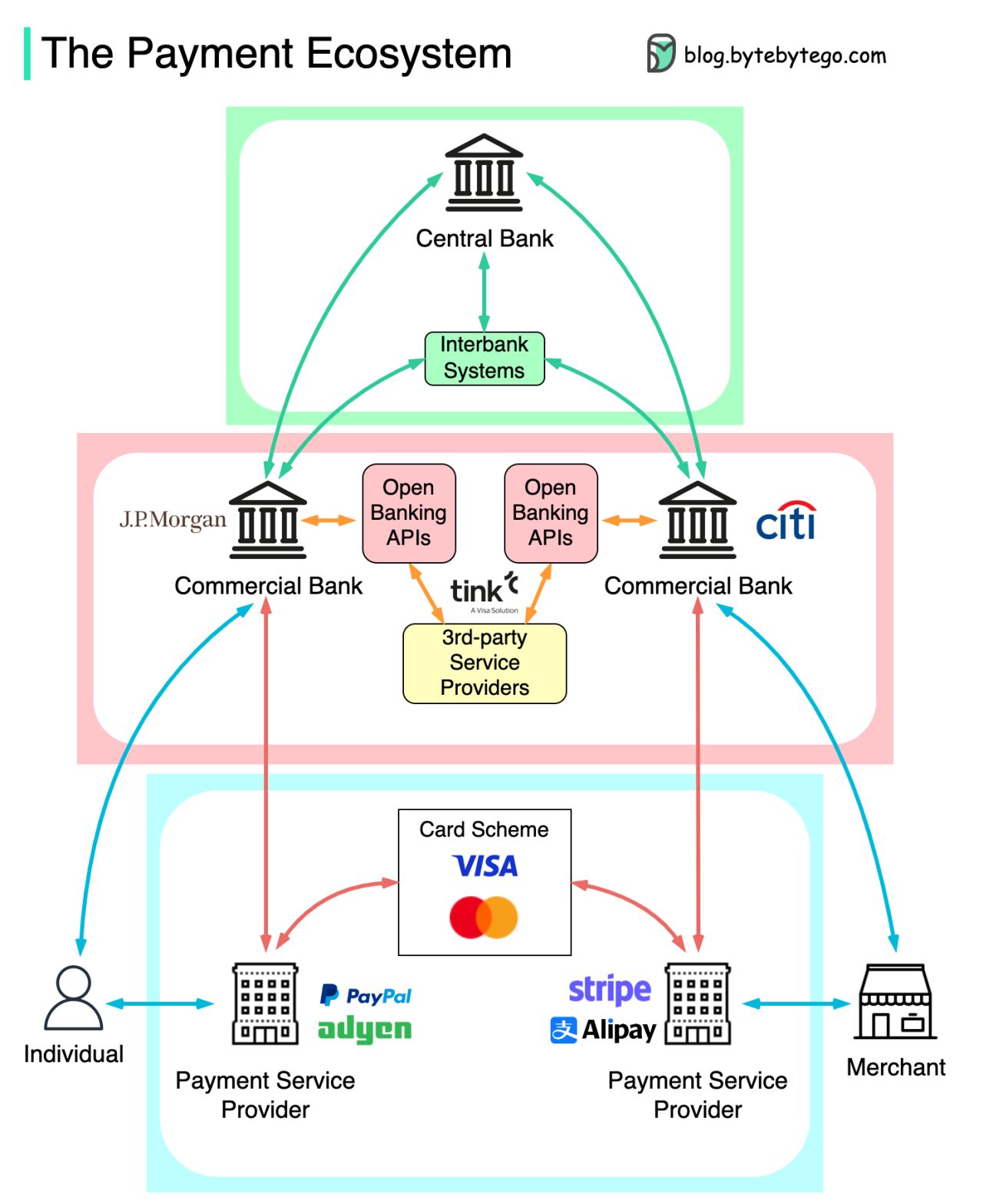

The diagram below by Hua Li from Bytebytego shows how the payment ecosystem works from a bird’s eye:

From bottom to top:

⚫️ A bank or a PSP (Payment Service Provider) provides payment services to merchants and card holders.

⚫️ The card schemes such as VISA and Mastercard connect to PSPs on both card acquiring and issuing sides. They do clearing for credit/debit card transactions.

⚫️ The commercial banks have reserve accounts in the central bank, where the actual money movement happens.

⚫️ Open banking provides universal APIs for 3rd-party service providers to access bank accounts and create transactions. By creating a 𝐬𝐡𝐨𝐫𝐭𝐜𝐮𝐭 in the current systems, open banking APIs are already fostering innovations.

In payment systems, the information flow and settlement flow are separated. So although there are layers of systems in the diagram, they don’t need to happen at the same time.

Comments ()