UK's Open Banking Preps for 2025 with Variable Recurring Payments Launch

Hey FinTech Fanatic!

The Financial Conduct Authority (FCA) and Payment Systems Regulator (PSR) have announced next steps for open banking in the UK, which now serves 11.7 million active users and processes 22.1 million monthly payments. Open Banking Limited will establish an independent central operator to coordinate variable recurring payments (VRP), launching in 2025.

VRP will enable consumers to control payment limits and timing for regular expenses, while businesses benefit from reduced processing fees and improved payment completion rates. The system will support payments to utilities, government services, and financial firms, backed by voluntary funding from 20 leading companies.

Under joint FCA and PSR oversight through a steering committee, the initiative is enhancing fraud analysis capabilities and consumer protections, with continued focus on developing commercial arrangements for VRP and open banking e-commerce applications.

Dive into more industry updates below 👇, and I'll catch you in your inbox again on Monday!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily Digital Banking updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

#FINTECHREPORT

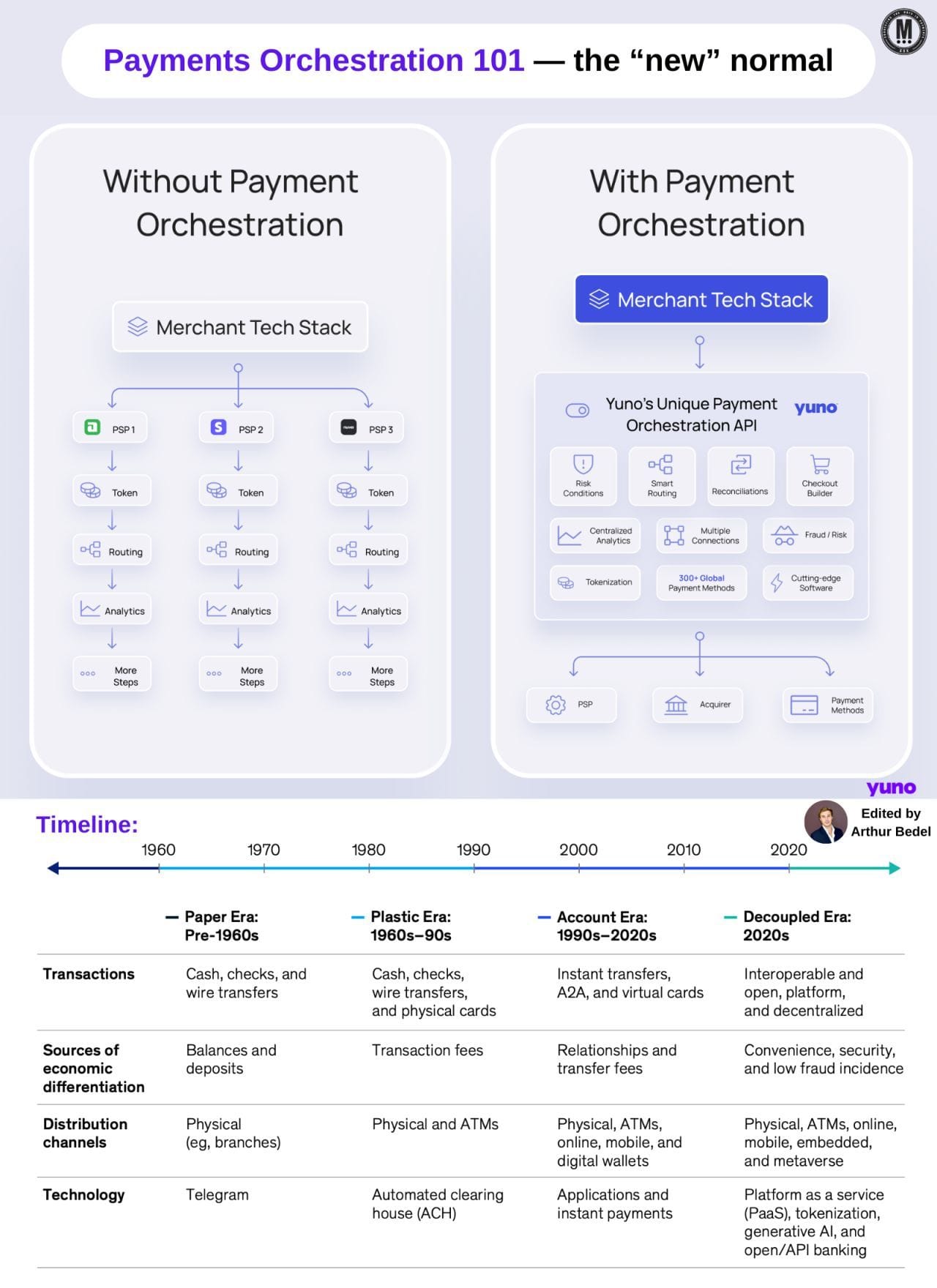

Payments Orchestration 101 - The "new normal" by Arthur Bedel 💳 ♻️

FINTECH NEWS

🇫🇮 XTX Markets plans €1 billion data center push. The ambitious project kicks off with the construction of the first facility scheduled for completion in 2026. The initial facility will span 15,000 square meters and feature three data halls with 22.5MW of IT power capacity, alongside office space for 50 personnel, according to the official press release.

🇮🇳 Broadridge to boost India headcount by 26% in 3 years. The plan comes at a time when multinational companies are increasingly setting up local offices, or global capability centres (GCCs), in India to support their daily operations, research and development and cybersecurity.

PAYMENTS NEWS

🇬🇧 Checkout. com achieves 45% growth and sets stage for return to profitability. These milestones underscore the company’s commitment to delivering the best possible value to global digital enterprises through better payment performance. CEO Guillaume Pousaz revealed that the company is targeting 30% growth in net revenue and a 15% increase in employee headcount in 2025.

🇳🇱 Mollie announces partnership with Originem.io. As an expert in e-commerce integrations, Originem empowers businesses with the Sylius e-commerce framework and Mollie’s advanced payment solutions. This collaboration sets the stage for future developments like bank accounts, sales invoice API, and innovative B2B KYC solutions.

🌏 Thunes and Hyperwallet expand payout access for merchants across Asia-Pacific. With this alliance, Hyperwallet can help its expansive global merchant base, including some of the world’s well known ride-hailing super apps, marketplaces, and social media platforms, offer customers their preferred method of access to funds.

🇬🇧 PayDo releases physical and virtual cards. The PayDo Card is available for both businesses and individuals, offering secure online and in-store shopping, payments via Apple Pay and Google Pay, easy ATM withdrawals worldwide, and more, making it a practical and versatile tool for everyday financial management.

🇩🇪 Deutsche Bank partners with Yonyou. The now signed memorandum of understanding (MoU) sees both companies collaborating to connect Yonyou’s treasury management system with Deutsche Bank’s financial system. This is said to enable seamless data access and efficient cross-border payment solutions for enterprises across both regions.

🇳🇬 Moniepoint gets Visa backing, plans to work on contactless payments. The business banking and payments platform received a “strategic investment” from the global payments giant as both companies look to drive financial inclusion and support the growth of small and medium-sized enterprises (SMEs) across Africa.

OPEN BANKING NEWS

🇬🇧 FCA and PSR set out next steps for open banking. These will include a new independent company to drive forward variable recurring payments, that will give consumers and businesses more choice in how they make and receive payments safely, securely, and efficiently.

REGTECH NEWS

🇪🇺 EU Commission investigates depth of EU safety net for stablecoin holders. The commission is investigating the extent to which EU rules on crypto assets protect the redemption rights of the bloc's investors in identical e-money tokens (EMTs), the value of which is pegged to that of a single official currency.

🇺🇸 Persona unveils significant advances in detection of AI-based face spoofs. The new updates bolster Persona's ability to detect and prevent AI-driven fraud through: a comprehensive signal library, improved detection of visual artifacts, compromised hardware detection, and scaled pattern detection.

DIGITAL BANKING NEWS

🇩🇪 N26 makes trading free for all. The company aims to make investing even more accessible, offering a way to trade Stocks and ETFs without applying transaction, currency conversion, custody or inactivity fees. Its app allows eligible customers to buy and sell fractional shares of more than 4,000 US and European stocks and global ETFs in just a few taps.

🇺🇸 Method is helping FinTech companies like SoFi build repayment functionality into their apps. Method works by leveraging consumer credit access protections enacted into law. By tapping into identity verification data from credit bureaus and telecom companies and combining it with data from core banking systems.

🇬🇧 Lightyear looks to disrupt “herd mentality” with ISA launch. The app is looking to take on established players like Hargreaves Lansdown and AJ Bell in the competitive UK investment market. It has also raised $35 million to date and is backed by Virgin Group and Mosaic Ventures, competing against the likes of Robinhood and Revolt.

🇬🇪 TBC Uzbekistan launches Payme Plus subscription, combining banking and lifestyle services. The subscription enables users to take advantage of cutting-edge financial management tools, such as automated spending analysis and interest-free money transfers. Continue reading

🇬🇧 Chip launches WealthScore a revolutionary tool to help users grow their wealth. The tool is designed to celebrate progress, educate users, and inspire positive action. By analyzing over 50 metrics and millions of data points, the feature provides a daily-updated, algorithm-driven score to help users make smarter financial decisions.

🇬🇧 Revolut opens instant access savings accout at a market-beating rate of 5%. Savers can start earning immediately with no minimum deposit required, a maximum limit of £200,000, and no additional costs. Its users can accelerate their savings by turning on Spare Change to roundup each transaction to the nearest pound, automatically putting the difference into savings.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Mesta launches hybrid fiat-stablecoin payment rails for cross-border payments. It combines real-time fiat payment rails with blockchain-powered stablecoin rails, addressing inefficiencies in global payments and trade. The platform has already processed $12 million in Total Payment Volume, demonstrating rapid market adoption.

🇺🇸 AngelList and CoinList partner to help crypto startups raise and manage funds. Crypto is having a big comeback that AngelList and CoinList are launching a way to help raise capital for crypto-specific founders using crypto coins. The partnership will give users a way “to raise with syndicates and manage crypto startup investments the crypto way.”

🇨🇳 Crypto’s richest man CZ turns VC Firm into giant family office. Changpeng "CZ" Zhao, recently released from prison and worth $70 billion, is transforming Binance's venture capital arm, Binance Labs, into a family office. The new name will be YZi Labs, overseeing $10 billion in crypto assets. Read on

🇫🇷 Co-founder of French crypto startup freed after kidnapping. David Balland, a co-founder of Ledger was released after being kidnapped from his home in France.The kidnappers demanded a "large ransom in cryptocurrency", they said, without giving its size or saying whether it had been paid.

PARTNERSHIPS

🇬🇧 cTrader partners with Acuity Trading, bringing its suite of advanced analytics tools directly to one of the industry’s leading trading platforms. This collaboration aims to transform trading experiences by integrating cutting-edge data and insights into brokers’ and traders’ workflows.

DONEDEAL FUNDING NEWS

🇦🇪 Pluto closes $4.1 million pre-Series A to drive KSA expansion. This raise is a significant step forward in Pluto’s growth strategy. The fresh funding will propel Pluto’s expansion in KSA and solidify its newly launched product, Pluto Connect, in the GCC market.

🇸🇪 Open Payments secures €3M. The funding will support the company’s continued growth, enable product development, and enable it to expand further across Europe. The platform combines Open Banking API connections with ISO-based payment integrations, enabling the management of domestic and cross-border payments.

🇸🇪 Regtech Adclear secures £510k pre-seed for automated FinTech compliance. With the funding, Adclear will further develop its AI capabilities, hire and aim to consolidate the UK market whilst extending its compliance coverage to EU and US regulatory frameworks.

M&A

🇸🇬 Pomelo Group acquires Singaporean Arrow Checkout. The acquisition is expected to bring the technology and payment expertise of the company to the Pomelo team, as well as accelerate the shared commitment of building an optimised payments infrastructure platform for emerging markets.

🇬🇧 Neonomics acquires open banking payments FinTech Ordo. “This acquisition strengthens our commercialisation strategy and time to market while expanding our product offering,” says the founder and CEO of Neonomics, who adds that the Ordo team “represents some of the most experienced payments experts in the UK”.

MOVERS AND SHAKERS.

🌍 Yuno announces the appointment of Miguel Duarte Fernandes, as its SVP, Head of Growth and Commercial for Europe, further expanding its geographic footprint. This strategic hire marks a significant step in strengthening Yuno’s global presence and accelerating the company’s expansion into Europe.

🇪🇸 BBVA set to name new internal Chief for Banco Sabadell Deal. The bank has picked Jordi Garcia Bosch as the new head of so-called Integration Office. The team is in charge of coordinating how the bank will merge Sabadell if the takeover bid succeeds, the people added. Continue reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()