UK Tightens Oversight on Critical Tech Providers in Finance

Hey FinTech Fanatic!

The Financial Conduct Authority (FCA) and the Bank of England have rolled out new rules targeting the resilience of critical third-party technology providers. With financial institutions relying more heavily on a small pool of tech firms to keep operations running smoothly, this framework is designed to mitigate risks that could disrupt services across the board.

Under these new guidelines, certain third-party service providers—now classified as Critical Third Parties (CTPs)—will be directly overseen in relation to the essential services they provide to financial firms. If HM Treasury designates a provider as a CTP, they’ll be required to meet rigorous standards, including resilience testing, scenario-based exercises, and regular reporting on major incidents, such as cyber-attacks or natural disasters.

The FCA has made it clear that while these new measures add oversight, financial firms themselves remain responsible for managing third-party risk effectively and ensuring they can handle operational shocks.

We’ll be keeping a close watch on how this unfolds and what it means for the industry.

Now, let's not waste any more of your time and dive straight into today's FinTech news I listed for you below👇

Cheers,

P.S. Want to boost your brand's visibility in the digital banking, FinTech, and payments sectors? Join us as a partner and connect with a highly engaged audience eager for industry-leading insights. This is a unique opportunity. to showcase your brand directly to decision-makers and innovators in the space.

Ready to make an impact? Sign up here, and let's take your brand to the next level!

POST OF THE DAY

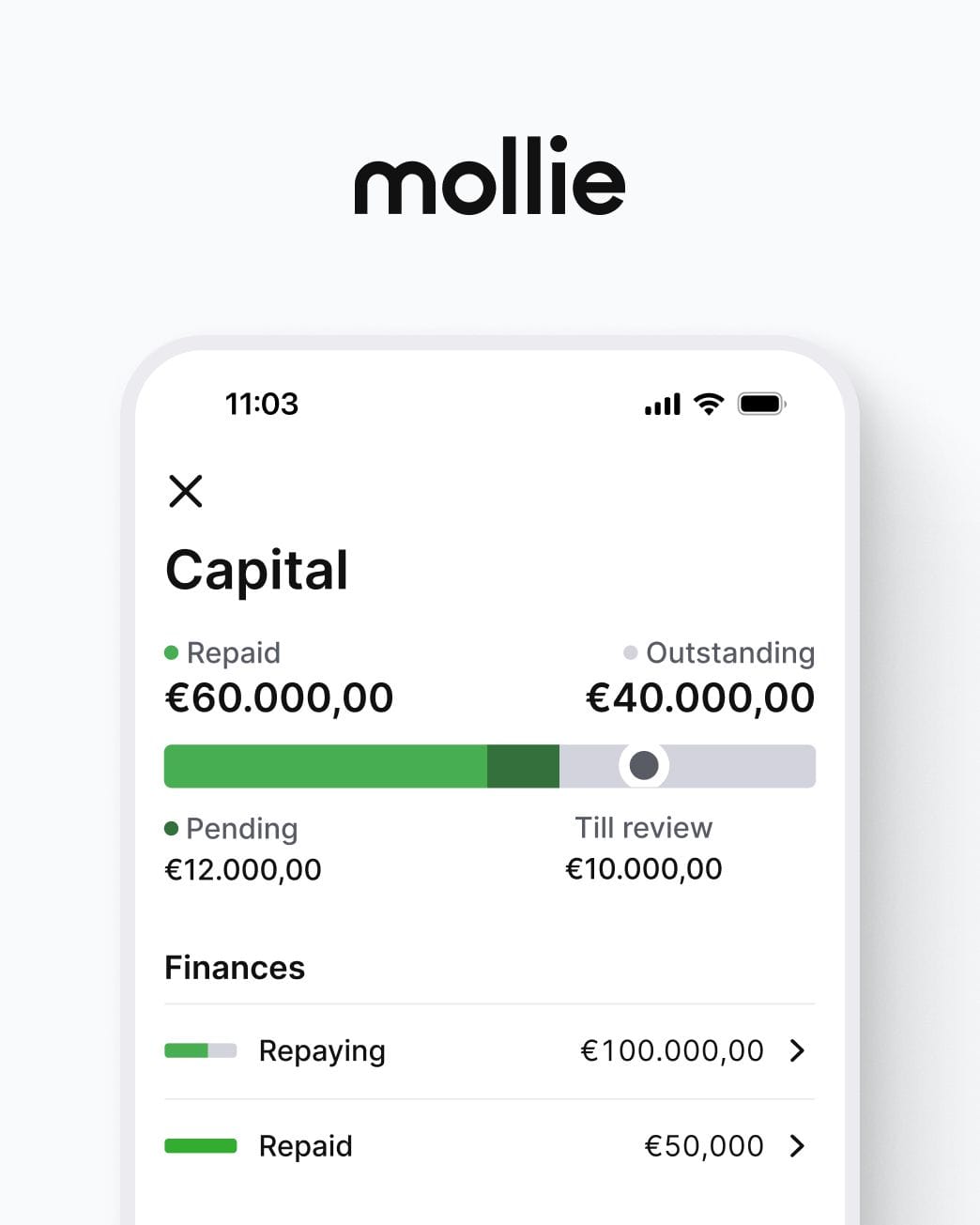

📱 With Black Friday around the corner, balancing cash flow amid extra expenses is challenging. In the past, companies seeking funds faced long waits and heavy paperwork for uncertain bank decisions.

Fortunately those bad-old-days are firmly in the past. Today, companies can get fast, simple access to extra cash through their PSPs.

Let’s take Mollie Capital, as an example:

#FINTECHREPORT

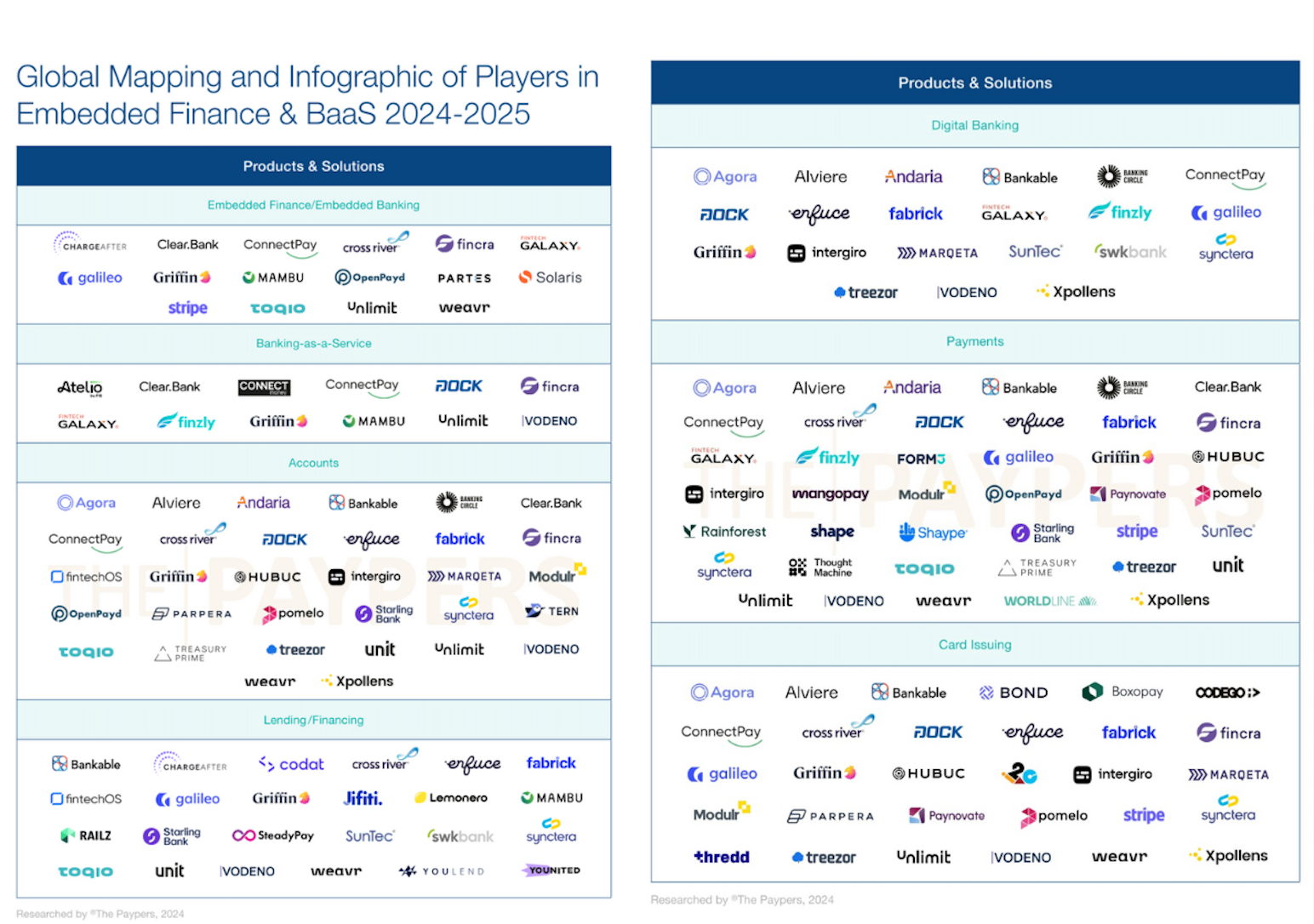

🌐 Global Mapping of Players in Embedded Finance & Banking as a Service (BaaS)

Is anyone missing on this map? 👇

FINTECH NEWS

🇫🇷 Mirakl and Mangopay announce strategic partnership to accelerate growth of European marketplaces with Mirakl Payout. Through this partnership, Mirakl Payout integrates Mangopay’s e-wallet technology and know-your-business (KYB) capabilities, enhancing marketplace payouts.

🇪🇺 Which FinTechs are winning the battle for Gen Z? FinTechs are facing challenges capturing the Gen Z market despite the potential of this growing demographic. Dive into the full article to see who's winning the race.

🇬🇧 UK financial watchdogs set out new rules for overseeing critical third party tech providers. UK financial regulators have announced new rules to strengthen the resilience of technology and other third parties that provide essential services to financial firms.

🇺🇸 Western Union launches Media Network Business supported by user data. This allows companies to advertise to its customers through company-owned channels, including its website, mobile app, digital-out-of-home (DOOH) screen network, and audience extension.

🇵🇹 Visa recognizes creators as small businesses. At Web Summit in Lisbon, Visa announced new commitments to digital creators, officially recognizing them as small businesses. Now, creators can securely manage payments using Visa’s financial tools, resources, and products for small businesses worldwide.

🇨🇭 Temenos shares jump as investors greet ‘More Realistic’ targets. Temenos shares jumped after the Swiss banking software company pushed back its mid-term targets by one year to 2028, a move that was welcomed by investors as more realistic.

🇵🇱 Cinkciarz.pl (Conotoxia) transforms into a joint stock company and prepares an application for a banking licence. The company states that once the banking license is acquired, customers' funds will be protected by the Bank Guarantee Fund, ensuring a high level of security.

🇬🇧 FinTech Payhawk reports 114% YoY revenue increase. In addition to revenue growth Payhawk reported an increase in group gross profits from “71% to 77%, driven by key strategic moves that strengthened its financial infrastructure and expanded its customer offerings.

PAYMENTS NEWS

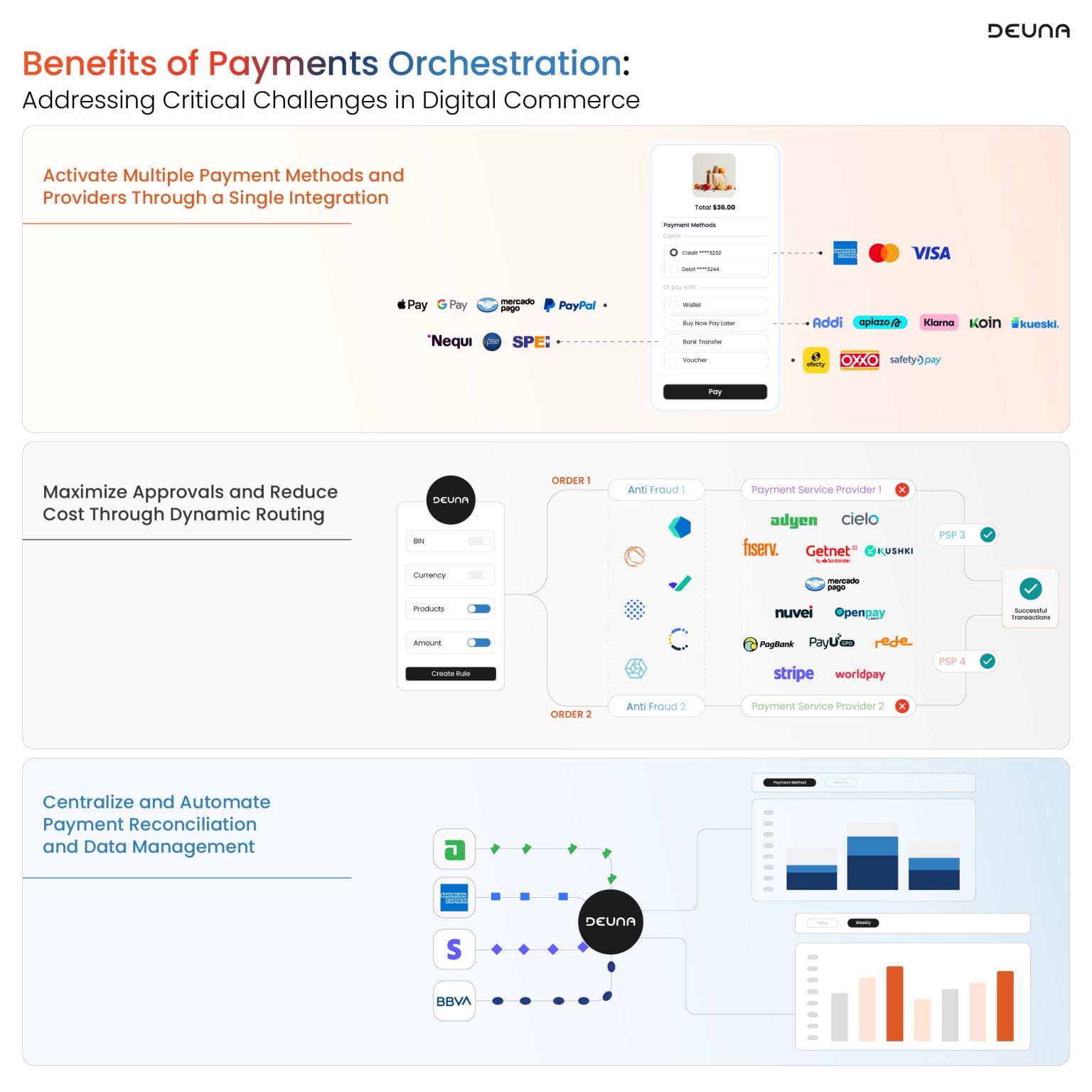

💳 Payment Orchestration: Addressing critical challenges in digital commerce, by DEUNA.

According to LexisNexis, declined payments could cost global businesses up to $𝟭𝟭𝟴 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 in losses annually 🤯

Discover how 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗢𝗿𝗰𝗵𝗲𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 can prevent this:

🇩🇪 Mollie enables Tap to Pay on iPhone in The Netherlands, France and Germany. This exciting development empowers Mollie’s customers with a fast, convenient, and secure way to accept payments in the palm of their hand, adding new benefits for businesses that use the app daily to track payments, access funding, and manage accounting.

🇬🇧 Settlements and Settlement Reconciliation with Solidgate. The company announced a new feature in its payment orchestration platform: Integrated settlements and settlement reports from multiple PSPs, acquirers, processors, and APMs — now accessible in its admin panel and API.

🇧🇷 Pix Assistant: How AI reads and listens to messages for easy transfers on WhatsApp. This innovative tool allows users to initiate transfers through text, audio, photos, and screenshots, with a virtual assistant identifying data and initiating the transaction. Users then complete it in their banking app.

🇺🇸 The Visa 𝐅𝐥𝐞𝐱𝐢𝐛𝐥𝐞 𝐂𝐫𝐞𝐝𝐞𝐧𝐭𝐢𝐚𝐥 is now LIVE with Affirm and Liv Digital Bank. Affirm customers can now choose to pay immediately or split the payment using the Flexible Credential. Liv customers can now use their existing card to support accounts in other countries if they're expats or travel. Read on

🇺🇸 America loves instant payments, as New RTP® Network records show. The RTP® network, operated by The Clearing House, now averages over 1 million payments per day. The RTP network also set single day records of 1.46 million transactions valued at $1.24 billion on November 1.

🇦🇪 Mastercard collaborates with Tap Payments on first global launch of ‘Click to Pay’ with Payment Passkey service for ecommerce. This partnership will help transform the ecommerce experience by merging streamlined checkout processes with enhanced security.

🇺🇸 Mastercard debuts platform to help small businesses consolidate digital tools. The Mastercard Biz360 platform provides a “one-stop shop” that allows business owners to access new features while also integrating their existing digital tools, the company said in a press release.

🇰🇭 Cambodia and Mastercard roll out ‘Bakong Tourists’ app for seamless payments. The app simplifies digital payments for international tourists visiting Cambodia, allowing them to download it upon arrival and seamlessly top up their Bakong accounts using a Mastercard issued in their home country.

🇬🇧 CLOWD9 partners with Discover Global Network. The partnership follows specific demands from customers, with Discover Global Network enabling CLOWD9 to provide a third network option for FinTech companies and programme managers, scaling opportunities for cross-border card issuance.

🇧🇷 Brazil’s PicPay begins offering instant payments via Meta and Microsoft. According to a press release, PicPay believes that the combination of a trusted payment method and a widely used messaging tool in Brazil will drive the adoption of a new way to make payments with Pix.

DIGITAL BANKING NEWS

🇬🇧 Metro Bank fined nearly £17m for failure to monitor potential money laundering. The FCA said that while Metro started automating the monitoring of customer transactions for potential financial crime in 2016, the system did not work as intended. More on that here

🇺🇸 FinTech Chime has reportedly submitted a comment to Joint Banking Regulators’ Request for Information on bank-FinTech partnerships. Chime explained they did so to share more about their business and how they’re working to “keep members’ funds safe and continue unlocking their financial progress.

🇸🇬 GXS Bank deposits triple since last year, reaching US$1.1 Billion in Q3. Grab Holdings reported significant growth in its financial services and digital banking segments for the third quarter of 2024, driven by an expansion in lending and deposit services.

🇬🇧 Digital bank Kroo reaches £1 billion in customer deposits. This comes less than two years after launching its first current account, cementing its place among the challenger banks that are shaping the UK’s pioneering FinTech industry.

🇺🇸 The FTC comes after Dave, stating the neobank misled consumers by marketing $500 cash advances as “instant” with phrases like “on the spot” while rarely offering them and charging an “Express Fee” for immediate access, which was only disclosed after users signed up and granted bank account access.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Alchemy Pay obtains four new Money Transmitter Licenses in US. The crypto payment gateway has received four new US Money Transmitter Licenses (MTLs) in Minnesota, Oklahoma, Oregon, and Wyoming bringing the company's total number of U.S. state licenses to eight.

Binance Labs invests in Brevis to advance off-chain, verifiable computation in Web3. This partnership is part of Binance Labs’ strategy to support early-stage projects aiming to innovate and broaden access to Web3 technologies. Read more

PARTNERSHIPS

🇦🇪 Paymentology announces strategic partnership with Zand Bank to accelerate FinTech growth in the UAE. Through this partnership, both firms will enable FinTechs to thrive by offering a range of specialised services, including BIN-sponsorship, virtual IBANs, and Client Money Accounts.

🇩🇪 NVIDIA & GFT: Innovating for Banks in Open-Source AI Deal. Per the deal, GFT will implement NVIDIA's suite of AI tools, including NIM microservices for model deployment, Triton Inference Server for model serving and NeMo for model development. Explore more

DONEDEAL FUNDING NEWS

🇯🇵 SmartBank secures $26M for its personal finance management app. The startup will use the new capital to double down on hiring from 49 staff in October to around 100 employees by 2025; half of the total workforce will be the engineering team.

🇧🇷 Stay raises $2.6M to expand private pension offerings in Brazil. The company will use the funds to grow the team and expand product offerings across the country. Read the full piece

🇫🇷 Treasury management platform Agicap closes on €45 million Series C. The firm currently supports 8000 clients, integrating banking & ERP connectivity, cash management, liquidity planning, accounts receivable, accounts payable and spend management.

🇯🇵 Modifi raises $15M, inks MoU with Japan’s SMBC to support SMEs with cross-border financing solutions. The partnership will make Modifi’s BNPL solutions and integrated risk management tools available to SMBC’s corporate export clients to “optimise cash flow and expand their international reach.

🇺🇸 Apollo invests in FinTech to boost service for private markets. Apollo Global Management Inc. is investing in startup Vega and adopting its technology that looks to improve service for clients looking to further their investments in private markets.

MOVERS & SHAKERS

🇬🇧 Sibstar appoints GoHenry co-founder and CEO Louise Hill as on-Executive Director. Louise will offer independent advice and provide oversight to Sibstar’s executive directors, ensuring optimal performance while providing strategic guidance and support to the executive team as needed.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()