UBS Launches First Tokenized Fund on Ethereum

Hey FinTech Fanatic!

UBS Asset Management, the global giant steering over $5.7 trillion in assets, has launched its first tokenized investment fund on the Ethereum blockchain. uMINT—the UBS USD Money Market Investment Fund Token.

This launch marks an expansion of UBS's Tokenize platform, which is carving out a path to digitize traditional capital market assets—think bonds, funds, and structured products.

The strategy took root after their successful pilot with a tokenized Variable Capital Company fund in Singapore last year.

Thomas Kaegi, UBS Asset Management’s Asia-Pacific co-head, encapsulates this sentiment perfectly: “We have seen growing investor appetite for tokenized financial assets across asset classes. Through leveraging our global capabilities and collaborating with peers and regulators, we can now provide clients with an innovative solution.”

This shift isn’t happening in a vacuum; it aligns with moves from financial giants like Franklin Templeton and BlackRock, both embracing blockchain technology as a vehicle for innovation.

If you’re interested in reading a bit more about what’s been happening in FinTech, keep scrolling!

Cheers,

#FINTECHREPORT

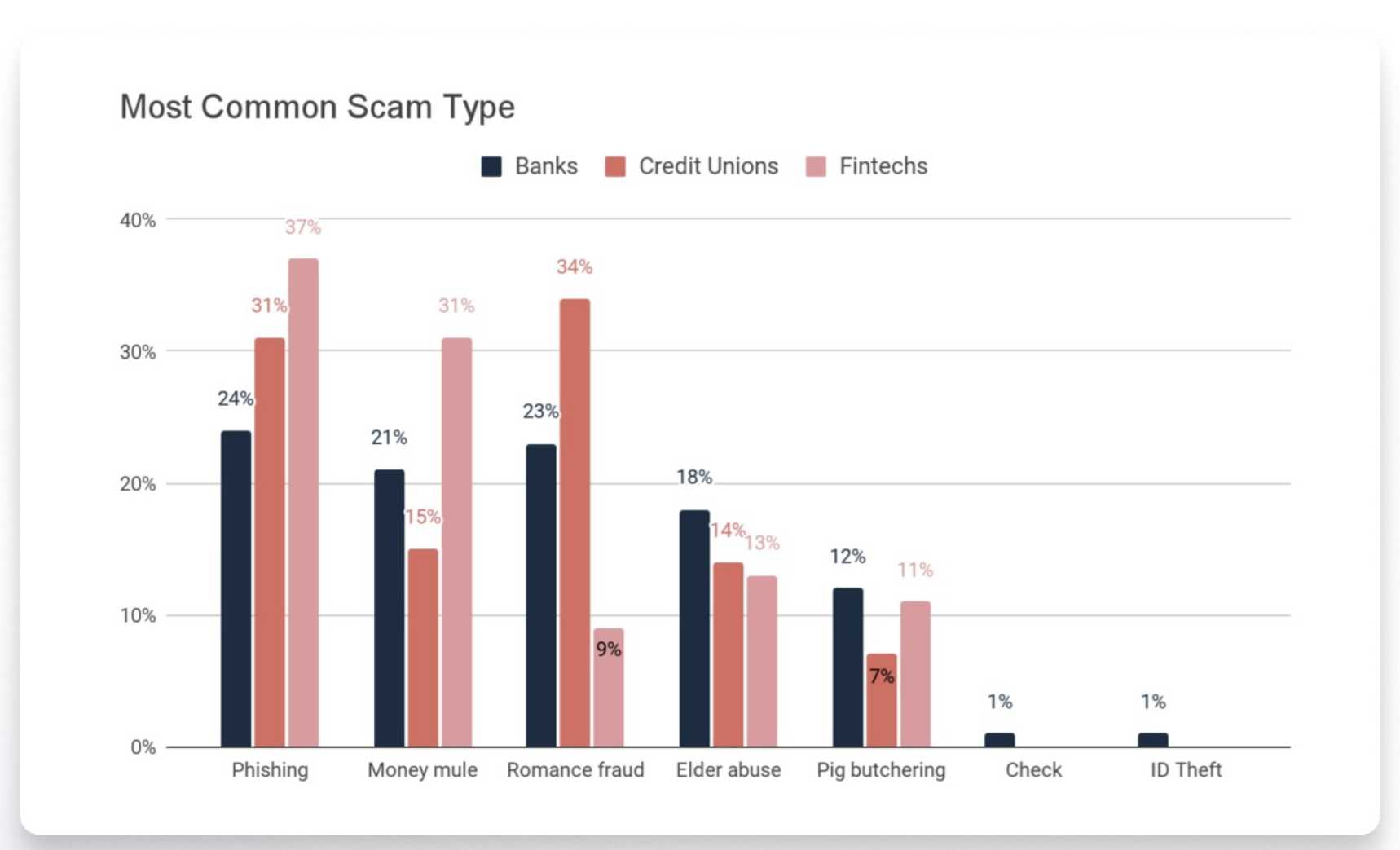

📊 In its third annual 'State of Fraud and AML report,' Unit21 has provided an overview of the current and future impacts of fraud and AML across banks and FinTechs. Discover more

FINTECH NEWS

🇺🇸 FinTech firm FIS' profit rises on strong demand for banking solutions. FIS reported a 37% Q3 profit increase, fueled by rising demand for its banking, payments, and capital market solutions, particularly as small and mid-sized banks adopt digital services to stay competitive.

🇸🇬 Australian FinTech firm Bizcap expands into Singapore. Launching in the first quarter of 2025, Bizcap’s expansion into Singapore addresses a critical gap in the SME financing landscape: the challenge of accessing quick and flexible capital, Bizcap said in a statement.

🇨🇭 BIS exits ‘Project mBridge’ citing maturity amid BRICS speculation. BIS General Manager Agustín Carstens shared the transition during a fireside chat at the Santander International Banking Conference 2024 in Madrid, emphasizing that the decision was due to the project’s maturity and not political reasons or failure.

🇬🇧 New FinTech Attara seeks to bring financial certainty to UK SMEs. Attara combines advanced tech with expert advisory to make hedging solutions accessible to SMEs, offering financial security once limited to large corporations. Read on

🇺🇸 Credit Karma settlement guarantees $2.5M FTC payments to ‘Deceived’ customers. Close to 51,000 customers who filed a claim before the March 2024 deadline will receive payments from the FTC following a two-year court battle. Credit Karma is cooperating with the FTC even though it disagrees with the allegations.

PAYMENTS NEWS

💬 How cloud modernisation is accelerating payments innovation. An interview with Scotty Perkins, Global Head of Product Management and Head of Banking and Intermediaries at ACI Worldwide, who discusses cloud modernisation's impact on payments, financial inclusion, and future trends in FinTech. Dive into the full interview here

🇬🇧 Buy now, pay later giant Affirm expands to the UK in first major international foray. The firm’s expansion to the U.K. marks the first time it is launching in a market outside the U.S. and Canada. Max Levchin, CEO of Affirm, told CNBC that the company had been working on its launch in the U.K. for over a year.

🇳🇿 New digital wallet and POS app Payap gears up for 2025 launch in New Zealand. The company’s app leverages open banking for a low-cost, contactless payment solution, offering consumers a digital wallet that unifies bank accounts, gift cards, and loyalty cards for instant QR payments in-store and online.

🇺🇸 Visa has deployed hundreds of AI use cases. It’s not stopping. Visa is accelerating generative AI use, with over 500 applications, to enhance innovation and counter evolving fraud tactics. Simultaneously, it's restructuring globally, planning 1,400 layoffs by year-end, according to sources.

🇰🇷 Korea’s SentBe goes live with Visa Direct’s card transfer service. SentBe, among Korea's first FinTechs to adopt Visa Direct, enables real-time overseas payments via Visa’s network, offering secure transfers at 90% lower costs than traditional banks for added convenience.

🇵🇭 Wise granted access to Philippines’ InstaPay. Wise’s connection to InstaPay will enhance cross-border payments for its 13 million global customers and millions more from major banks and financial institutions. Continue reading

🇸🇬 Anchorage Digital Singapore Pte Ltd receives Major Payment Institution licence from the Monetary Authority of Singapore (MAS). With this license, Anchorage Digital Singapore now offers a complete, integrated solution including custody, staking, trading, and settlement, including fiat on and off ramps.

🇺🇸 Checkbook joins J.P. Morgan Payments Partner Network, Checkbook and J.P. Morgan Payments will transform digital check payments, allowing J.P. Morgan corporate clients to send digital checks directly from their accounts, enhancing B2B and B2C transactions.

OPEN BANKING NEWS

🇧🇭 Spire and Salt Edge come together to empower Bahrain's Corporate Banking future with Open Banking. The Central Bank of Bahrain now requires all licensed banks to expose APIs for corporate accounts, with mandates on customer consent, authentication, disclosures, and API performance reporting.

REGTECH NEWS

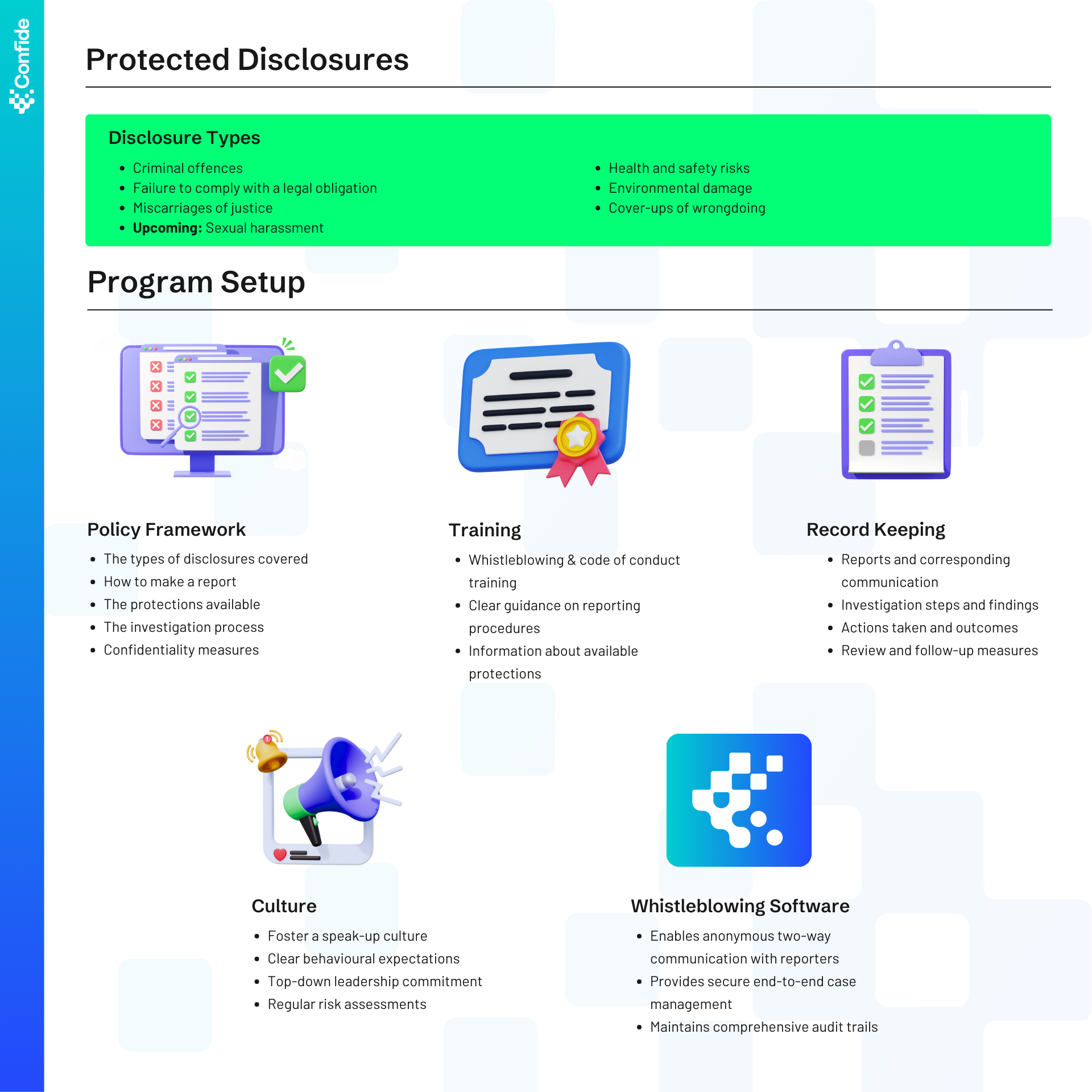

🇬🇧 Understanding Protected Disclosure Requirements. This guidance by Confide, provides a detailed overview of protected disclosures in the UK and offers practical approaches to managing compliance and reducing risks within your organisation. Click here to learn more

DIGITAL BANKING NEWS

🇬🇧 Santander UK faces new hit after years of lagging behind. Banco Santander’s frustrations with its British business are piling up, with job cuts and an expensive car finance review last week just the latest headaches for executives as they make other countries more of a priority.

🇸🇬 ANEXT Bank, Schroders to launch investment funds to MSMEs. Through its partnership with Schroders, Singapore-based ANEXT Bank will expand its product suite to include investment funds, offering MSMEs more wealth growth options alongside its Fixed Deposit product.

BLOCKCHAIN/CRYPTO NEWS

🇦🇺 Kraken launches crypto derivatives for Australian wholesale clients. The derivatives broker offering covers 200+ assets, allowing eligible clients to manage risk and gain crypto exposure without holding underlying assets, the crypto exchange stated.

🇺🇸 Why FinTech giants are betting on stablecoins. CNBC Crypto World offers viewers a look forward with key interviews, explainers, and unique stories from crypto industry. Watch here

🇸🇬 $5.7T banking giant UBS launches first tokenized fund on Ethereum. The new product, dubbed the UBS USD Money Market Investment Fund Token, abbreviated as 'uMINT,' is a strategic move for the Swiss bank. This marks a significant step for traditional finance in adopting blockchain.

🇺🇸 Coinbase, a16z and others pour more than $78 million into pro-crypto PAC for 2026 election. The pro-crypto and bipartisan super PAC Fairshake said Monday that the committee and its affiliates have raised $78 million for the 2026 midterm elections.

🇱🇺 StanChart crypto custodian Zodia in talks to raise $50 million round from investors to fuel its plans to branch out into new geographies and expand its range of products, Zodia Custody CEO Julian Sawyer told Bloomberg News in an interview. Read more

🇦🇷 Argentina’s Central Bank unveils first Bitcoin mining exhibit. The event highlights digital assets and features the work of artist Alberto Echegaray. The exhibit is titled “Art, Artificial Intelligence, and the Future of the Economy,” and marked the first time a central bank showcased Bitcoin mining technology.

PARTNERSHIPS

🇰🇪 FinMont announces strategic partnership with leading African payment processing provider, iPay. This aims to enhance FinMont’s payment ecosystem by integrating iPay’s innovative payment services, offering more flexibility and improved processing capabilities for FinMont’s global network of travel industry merchants.

DONEDEAL FUNDING NEWS

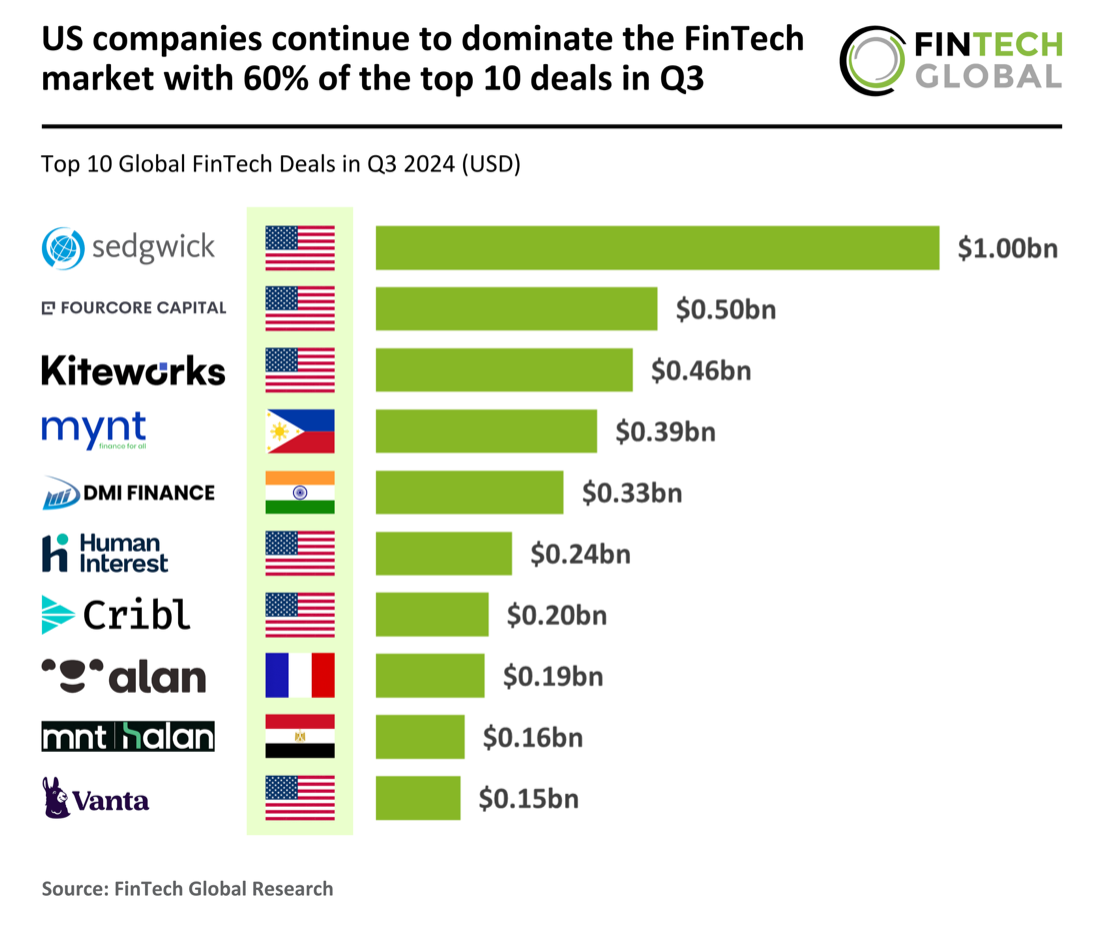

🇺🇸 US FinTechs continue to dominate with 60% of the global top 10 deals in Q3.

🇬🇧 UK’s Recognise Bank lands £25m investment amid leadership transition. The investment supports the bank’s focus on “business lending across multiple sectors.” Phil Jenks steps down as chairman, succeeded by Steve Pateman, while CEO Jean Murphy will be replaced by Simon Bateman by year-end.

🇱🇺 Fundcraft secures a final €6M Series A to digitise and transform fund operations. The additional funding will support product development, focusing on automation, operational efficiency, and transparency to meet growing demand from alternative investment asset managers.

🇬🇧 Auquan raises $4.5m to automate deep work in finance with AI. The new funding will be used to expand Auquan’s engineering and sales teams, focusing on using advanced AI to tackle complex financial industry challenges and grow market presence.

M&A

🇵🇪 Argentina Aleph enters the FinTech sector with purchase: this is its strategy for Peru. After 15 years in Peru, Argentine unicorn Aleph, which connects advertisers and consumers with major digital platforms, has entered the FinTech sector by acquiring Localpayment, a Latin American payment service provider.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()