Ualá Adds $66 Million to Series E Fundraising, Reaching $366 Million

Hey FinTech Fanatic!

Seven years ago, a new player was born in the financial landscape in Argentina: Ualá. Since then, the FinTech has expanded across Latin America, gaining millions of users and drawing the attention of investors. Now, Ualá has secured an additional $66 million in funding, adding to its latest investment round.

The first closing of this round in November 2024, led by Allianz X, valued Ualá’s at $2.75 billion. With this latest investment, which includes TelevisaUnivision, the company continues to attract attention as it expands in Argentina, Mexico, and Colombia.

“We are proud of the investor demand to be part of our story, which reaffirms their trust in our long-term vision of creating better and fairer financial services for Latin America,” said Pierpaolo Barbieri, Ualá’s Founder & CEO. “The future is inspiring. We will continue to develop world-class financial products, increasing investment, and exploring new growth opportunities across Latin America.”

Ualá now serves over nine million users. What began with a debit card has grown into a wider range of financial services, including credit, loans, investments, and payments. The company’s credit assessment tool, UaláScore, applies AI-driven insights to offer financial products to a broader audience.

By November 2024, Ualá had:

• More than 8 million users, now surpassing 9 million.

• Issued over 7 million loans.

• Reached 17% of Argentina’s adult population.

• Enabled 2.7 million users to invest through its platform.

• Recorded a 55% increase in Total Payment Volume (TPV) for merchant acquiring over the past year.

With millions of users, growing transaction volumes, and continued investor participation, Ualá is expanding its presence in Argentina, Mexico, and Colombia. As it broadens its financial services, the company moves forward with new funding and a focus on reaching more people in the region.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

SPONSORED CONTENT

Power your FinTech, bank, or brand with full-service embedded banking—seamless account funding, transfers, payouts, and issuing, all backed by enterprise-grade risk management and compliance. Simplify operations, reduce costs, and launch faster. Find out more today.

INSIGHTS

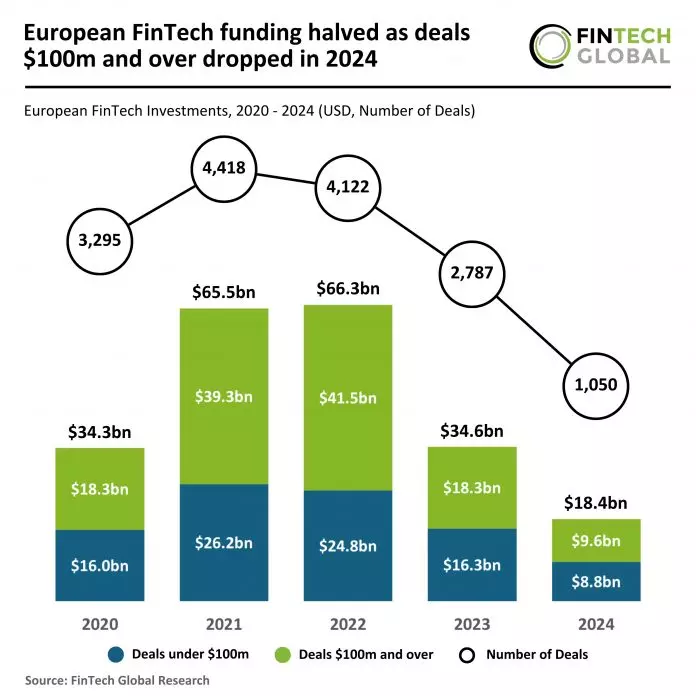

📈 European FinTech funding halved as deals $100m and over dropped in 2024. The year closed with 1,050 deals, marking a 62% drop from the 2,787 deals recorded in 2023 and a 68% decline from the 3,295 deals seen in 2020.

FINTECH NEWS

🇬🇧 Revolut is the fastest-growing bank brand in the world, skyrocketing nearly 800%. The total brand value of the world’s 500 most valuable banking brands has surged by 13% YoY to reach USD 1.6 trillion, according to the latest report by Brand Finance.

🇺🇸 Affirm CEO: We’re a replacement for credit cards, not debit cards. Affirm CEO Max Levchin joins ‘Closing Bell Overtime’ to discuss competition with Klarna, which just partnered with Walmart, in a CNBC exclusive. Watch the full interview

🇪🇺 EU FinTech regulations continue to intensify. The Digital Operational Resilience Act (DORA) came into force in January, requiring financial institutions to follow stringent guidelines to safeguard against ICT-related incidents including measures for protection, detection, containment, recovery, and repair.

🇨🇭 Swissquote targets CHF 500 million profit by 2028 after closing last year with record revenue of CHF 661 million and a pre-tax profit of CHF 345.6 million. For 2025, the company has set a revenue guidance of CHF 675 million and a pre-tax profit of CHF 355 million.

PAYMENTS NEWS

🇳🇬 Flutterwave powers digital tax collections for Nigeria’s Federal Inland Revenue Service (FIRS). This development allows the FIRS to leverage Flutterwave’s seamless and secure payment infrastructure to collect taxes, levies, and other payments from businesses and individuals across Nigeria.

🇬🇭 Introducing Ghana virtual accounts: pay with bank transfer. This new feature enables Ghanaian customers to pay Flutterwave merchants using Pay With Bank Transfer (PWBT), one of the most popular payment methods on its infrastructure, offering a seamless, secure, and fast payment experience.

🇧🇷 Cumbuca closes accounts, CEO affirms company is ‘firm and strong’. The decision aims to allow the company to focus on building a "larger" vision. CEO Daniel Ruhman assured Cumbuca isn't shutting down and will soon launch new features, including "Jornada Sem Redirecionamento" and automatic Pix payments in June.

🇬🇧 Paytech pioneer MuchBetter launches B2B account: an alternative to traditional banking for underserved and non-banked businesses. MBB’s offering is specifically designed for Licensed Gaming Entities and regulated industries facing banking access challenges or high costs with mainstream banks.

REGTECH NEWS

🇦🇪 Telr has been granted the Retail Payment Services License from the Central Bank of the UAE. Having met all regulatory conditions and requirements through a thorough approval process, this approval allows Telr to expand and revolutionize merchant acquiring and enhance payment aggregation solutions within the UAE.

🇺🇸 Sift offers identity insights and other upgrades to its platform. Identity Trust ID includes introducing global identity insights, improvements to Sift’s payment fraud protection model, and several Sift Console augmentations designed to optimize operations and decision-making accuracy across the platform.

🇦🇺 Australia’s crypto regulation framework includes digital assets, tokenization, and CBDCs. It aims to modernize its financial system. The government will work with major banks to combat de-banking and add anti-de-banking measures to DAP licensing.

DIGITAL BANKING NEWS

🇳🇿 Payments platform Airwallex has put its first boots on the ground in New Zealand. The Australian FinTech unicorn has hired the Auckland-based Lowry Gladwell as its country lead and first local staffer. Gladwell will hire 10 other New Zealand staff before year’s end in business, sales, and operations roles.

🇧🇷 Nubank has announced a reduction in interest rates on its credit card for a limited time. This promotion aims to encourage increased card usage, including for domestic and international purchases or travel, offering a more favorable rate for those making larger or longer-term payments.

🇺🇸 Chime introduces instant loans, a product that provides instant access to up to $500 in funds with a fixed interest rate that is lower than what’s typically observed in the industry. Members are pre-approved for a loan and notified of their eligibility within the Chime app.

🇮🇪 Revolut started rolling out Joint Saving Accounts to first customers in Ireland, with other countries coming soon. Couples can now earn interest on their emergency fund; save for a goal or build long-term wealth with our amazing UX on top. Keep reading

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Uniswap passes $165M funding plan after DAO vote. The plans include a new grants program, liquidity incentives, and the potential activation of a "fee switch" to redirect a portion of protocol revenue from liquidity providers to UNI token holders, with over 80% approval.

🇺🇸 Coinbase is in advanced talks to buy derivatives venue Deribit. The companies have notified regulators in Dubai about the discussions as Deribit holds a license there, which would be taken over by any acquirer. Continue reading

PARTNERSHIPS

🇬🇧 Lloyds Banking Group expands collaboration with Oracle. This allows Lloyds to deploy Oracle database services either in Azure data centers or on-premises, offering consistent capabilities and an efficient operating model. The move enhances Lloyds' ability to serve customers with increased speed and agility.

🇱🇹 iDenfy partners with Evemo to help boost KYC conversions in the sharing mobility industry. Through this collaboration, it will use iDenfy’s automated identity verification solutions to enhance security and streamline customer onboarding, boosting conversion rates and providing a simpler registration process for Evemo.

🇸🇪 Lunar and Fortnox partner to streamline business startups. The Commercial Manager at Lunar, stated, "The collaboration with a well-established player like Fortnox reflects the company's focus on creating modern and digital solutions for entrepreneurs, marking another strategic step toward becoming the best everyday bank for small businesses and individuals."

🇮🇹 KIKO Milano and Adyen: the future of beauty passes through innovation and effective payments. The companies partner with the aim of optimizing the payment experience of their customers, making the moment of purchase unique and meaningful.

🇬🇧 Finrax and FXBO team up: Crypto meets Forex. This collaboration aims to deliver seamless, innovative solutions for brokers worldwide, combining Finrax’s expertise in crypto payments with FXBO’s powerful CRM capabilities. Continue reading

🇨🇦 Flinks teams up with Koxa to expand ERP banking for Canadian FIs. The partnership aims to “streamline” financial institutions’ direct, secure connections with large ERP platforms. The partnership will broaden ERP integration support for Flinks’ FI partners.

🇬🇧 Natwest partners with OpenAI as FTSE giant scales up tech. The firm said it would deploy “some of the latest and most powerful developments in generative AI” through its access to OpenAI’s latest technology and insights. Keep reading

DONEDEAL FUNDING NEWS

🇦🇷 Latin American neobank Ualá boosted its Series E round by $𝟲𝟲 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 in a second close bringing the total raised to $𝟯𝟲𝟲 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 USD. The funds raised through the equity sale will be used to continue growing across Latin America, with a special focus on Mexico.

🇬🇧 Qlarifi successfully closes €1.6 million pre-seed round to revolutionise BNPL. The funding will be used to build out a best-in-class real time data infrastructure using modern technology and drive customer acquisition across key markets.

🇬🇧 Multiply Mortgages raises $23.5 million. Michael White, CEO and co-founder, Multiply said, “Our mission is to help employees - whether frontline workers or corporate staff - access lower mortgage rates and expert guidance, at zero cost to their employer.”

M&A

🇮🇳 PayU acquires strategic stake in Mindgate Solutions. Through this strategic investment, the company intends to utilise Mindgate’s capabilities to scale digital payment advancement worldwide. Additionally, the deal includes PayU acquiring a 43.5% stake in Mindgate.

MOVERS AND SHAKERS

🇳🇴 Enfuce welcomes Paralympic Gold Medallist, Birgit Skarstein, as CIO. In this newly created role, Birgit will bring her incredible story of resilience and experience defying limits to company training programmes, webinars, and speaker series to create industry awareness around topics close to her and Enfuce’s heart to jointly drive meaningful change.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()