UAE Makes Crypto Transactions VAT-Free

Hey FinTech Fanatic!

The UAE has taken a significant step in the digital finance landscape by exempting all crypto transactions from value-added tax (VAT).

Effective November 15th, this regulatory change means that digital assets are now treated similarly to traditional financial services, free from the usual 5% VAT. This isn't just a minor adjustment—the exemption applies retroactively, impacting transactions as far back as January 2018.

This move comes as part of the UAE's broader strategy to become a global leader in blockchain and digital finance. By clarifying crypto regulations, the country is not only removing tax hurdles but also creating a more attractive environment for crypto innovators.

Meanwhile, tech talent from across Asia is increasingly drawn to the UAE, with 76% of surveyed professionals citing favorable policies as a key factor for relocation.

Stay tuned as we keep you informed on the latest in the global crypto scene, and don’t miss the FinTech updates coming up next.

Cheers,

POST OF THE DAY

🇺🇸 Cash App is the competitor big banks forget about

Top satisfaction ratings for consumer banking:

#FINTECHREPORT

📊 Check out Revolut's Consumer Security and Financial Crime report, which highlights prevalent fraud types, Revolut's efforts to combat fraud and protect customers, and tips for customer self-protection. It also includes an analysis of fraud origin and a focus on the rise of ticket scams in recent months, driven by seasonal events.

FINTECH NEWS

🇺🇸 FinTech Storfund has partnered with TikTok Shop to launch Daily Advance, the first fully embedded cash flow solution in a major US marketplace. This service will provide sellers with immediate payment once they ship their goods, benefiting high-growth sellers on the platform.

🇬🇧 eToro upgrades its Price Alert functionality with new features and an access widget, enabling users to create, update, and delete multiple price alerts for a single instrument. This enhancement offers traders greater control and flexibility in monitoring price movements.

🇦🇺 Lockton launches Lockton Pulse digital insurance platform for SMEs in Australia. The new platform enables customers to quickly obtain quotes and purchase insurance online from anywhere. This move responds to the growing demand for faster, more convenient insurance services for SMEs and individuals.

🇳🇬 Flutterwave’s chief on the company’s executive hires, product focus, and IPO plans. The firm recently appointed Mitesh Popat as its new CFO. As the startup focuses on growth and executive hires, it also has plans for a future IPO, aiming to strengthen its presence across Africa with a $50 million investment.

PAYMENTS NEWS

🇬🇧 UK banks to hold suspicious payments for 72 hours to combat fraud, and mitigate substantial losses, which reached £460 million last year. This departs from the current rule requiring payments to be processed or rejected by the next business day.

🇲🇻 Rupay card in Maldives, Hanimaadhu Airport and more. On Monday, Prime Minister Narendra Modi and Maldives President Mohamed Muizzu held talks on repairing and strengthening India-Maldives relations. The leaders witnessed the first transaction using RuPay cards in the Maldives, signaling strengthened digital ties between the two countries.

🇸🇪 Klarna is about to oust another board member. According to the FT, seven directors just agreed to oust investor Mikael Walther from Klarna’s eight-person board, nearly eight years after he joined it. It’s the second time Klarna’s board has changed in dramatic fashion this year.

🇮🇳 Paytm focusing on consumer payments business: CEO Vijay Shekhar Sharma. The firm's immediate priority is to invest in its consumer payments business to recover its lost user base after the RBI restricted Paytm Payments Bank from accepting deposits and facilitating credit transactions, a top official stated on Sunday.

🇬🇧 The Payments Association shares comments after UK’s payment systems regulator updates APP rules. Riccardo Tordera, director of policy and government relations at The Payments Association said that they will be monitoring the overall / anticipated impact of the latest APP fraud rules closely in the UK. Read more

🇯🇵 JCB to offer Google Pay in Japan. Android smartphone users can now use Google Pay in stores where JCB Contactless is accepted, by adding their credit/debit cards issued by the JCB Group in Japan to Google Pay.

🇬🇧 BKN301 launches payment solution for MENA FinTechs. This payment solution is designed to address the evolving needs of the MENA region’s financial sector, with a focus on supporting traditional banks, FinTech companies, and neobanks.

🇬🇧 Paysafe launches strategic partnership with GiG. Under the agreement, Paysafe becomes the GiG-endorsed payments platform for all UK, continental European, North American and Latin American operators integrating its market-leading CoreX solution.

OPEN BANKING NEWS

🇺🇸 MoneyLion adopted a new solution from Plaid that allows consumers to link their bank accounts and get pre-qualified for loans. When consumers share this information, lenders gain cash flow underwriting insights that enable them to offer credit options that are tailored to the consumer and are more competitive, Plaid said in a blog post.

DIGITAL BANKING NEWS

🇬🇧 Tensions rise between banks and tech companies over online fraud liability in the UK. Now that the mandatory fraud compensation is being rolled out in the U.K., questions are being asked about whether financial firms are facing the brunt of the cost for helping fraud victims. More on that here

🇩🇪 Commerzbank would lose clients in UniCredit merger, German lender's CEO says. Bettina Orlopp stated that a tie-up with the Italian bank would result in customer losses. In her first interview since becoming CEO of Commerzbank, Orlopp was downbeat on the prospects for big bank mergers.

🇺🇸 Navigating data privacy in financial services. David Ritter, CEO of Privacy Lock, and Robert Zondag, partner at Wipfli, discuss the intersection of AI technology and data privacy regulations, the growing number of data privacy laws, and more in this engaging interview. Click here to learn more

🇬🇧 Coreless banking provider XYB to help modernise core banking with IBM. Together, they offer a componentized core banking platform on IBM Cloud for Financial Services®, designed to accelerate digital transformation while prioritizing security, providing banks with an agile and scalable solution for core modernization.

BLOCKCHAIN/CRYPTO NEWS

🇦🇪 UAE updates crypto laws, exempts transactions from value-added tax. The UAE government seeks to align digital assets with traditional financial services that have similar exemptions. This update covers the exchange and transfer of digital assets, meaning all cryptocurrency conversions and transfers will be VAT-free.

🇺🇸 Crypto firm FalconX hunts for acquisitions after a record quarter. Raghu Yarlagadda, FalconX’s co-founder and CEO, expects the cost of doing business in crypto to rise as more institutional players enter the market and regulations tighten. That in turn will trigger a “wave of consolidation” in 2025, he said in an interview.

PARTNERSHIPS

🇬🇧 Experian partners with Oakbrook to launch innovative Debt consolidation loans. This partnership will enable customers to simplify their finances and save money by consolidating their existing credit commitments, including personal loans and credit cards, into a single, manageable debt consolidation loan.

🇳🇱 Intersolve announces a new partnership with Visa. The partnership has already been implemented in projects such as a prepaid card programme for low-income families, created in cooperation with the Red Cross. Both companies aim to continue collaborating to deliver effective financial solutions and broaden their impact.

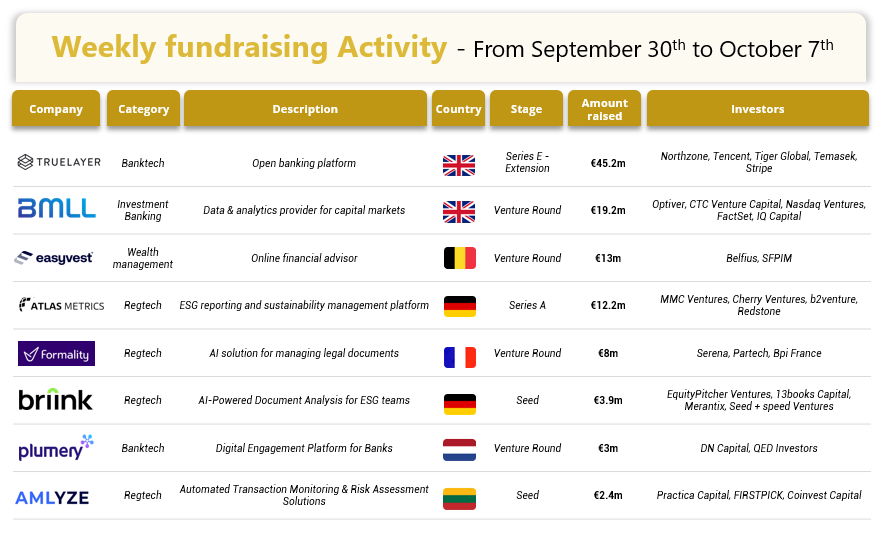

DONEDEAL FUNDING NEWS

💰 Last week, there were 8 official FinTech deals in Europe, raising a total of €106.8 million, with 2 deals in the UK, 2 deals in Germany, 1 deal in France, 1 deal in Belgium, 1 deal in the Netherlands and 1 deal in Lithuania. Read the complete BlackFin Tech overview article

🇧🇷 Brazilian FinTech Barte secures $8m Series A to advance modular payments across Brazil. The company primarily operates by offering robust and flexible payment solutions and plans to use the newly acquired funds to expand its payment and cash flow solutions throughout the country. Continue reading

MOVERS & SHAKERS

🇭🇰 Ben Wong to lead Adyen’s Southeast Asia and Hong Kong commercial operations. In his new role, Wong will manage the company’s commercial operations across the region, focusing on growth strategies and strengthening partnerships in key markets, including Singapore, Malaysia, and Hong Kong.

🇨🇭 Temenos names Barb Morgan as Chief Product and Technology Officer. Morgan will focus on expanding Temenos' global reach through a cloud-based platform and AI-driven solutions for financial institutions in her new role. Read on

🇫🇷 Paul Marriott-Clarke joins Worldline to drive Merchant Services business. Paul brings a wealth of expertise and a proven track record of success. He will be based at Worldline Headquarters in Paris La Défense, France. As a member of the Group’s Executive Committee, he will report directly to the CEO.

🇬🇧 Atom Bank appoints Ayshea Robertson as Chief People Officer. She will work with the Executive Committee and People Experience team to deliver a high quality employee journey, and will oversee Atom’s recruitment strategy, ensuring it attracts and retains the highest calibre of talent.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()