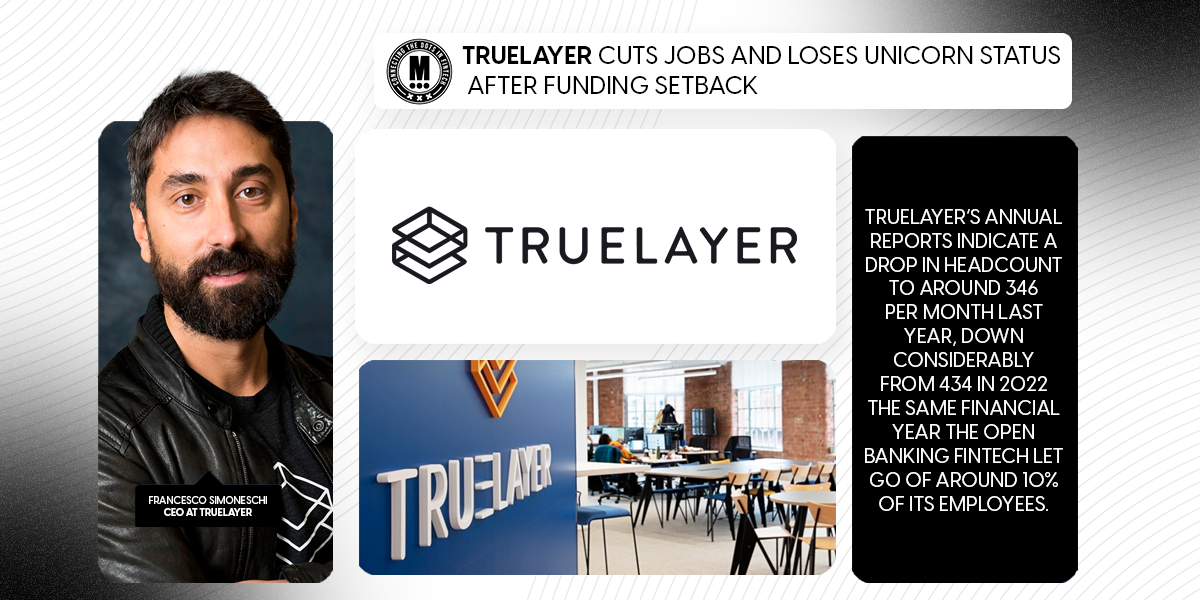

Truelayer Cuts Jobs and Loses Unicorn Status After Funding Setback

Hey FinTech Fanatic!

UK's TrueLayer, backed by Tiger Global and Stripe, just closed a $50M funding round - but at a 30% lower valuation than their 2021 peak, losing their unicorn status.

According to sources, the company made some significant moves in September, cutting 71 employees (25% of its workforce). Sources revealed that workers were given just 2-hour notice for a meeting about the job cuts, with the impacted employees exiting the firm the same day.

Despite growing payment volumes, its latest financials show operating losses at £54.1M, with administrative costs reaching £ 61.9 M. "The funding environment is way tighter than it used to be," explains CEO Francesco Simoneschi.

Their numbers tell an interesting story - from nearly doubling their team to 434 people in 2022, to dropping to 346 last year after two rounds of layoffs. While a company representative called the new funding round "another vote of confidence," it's clear that market conditions are pushing even well-funded FinTechs to make major adjustments that are not always positive.

More global FinTech updates below 👇 and I'll see you all back here tomorrow with more industry news!

Cheers,

#FINTECHREPORT

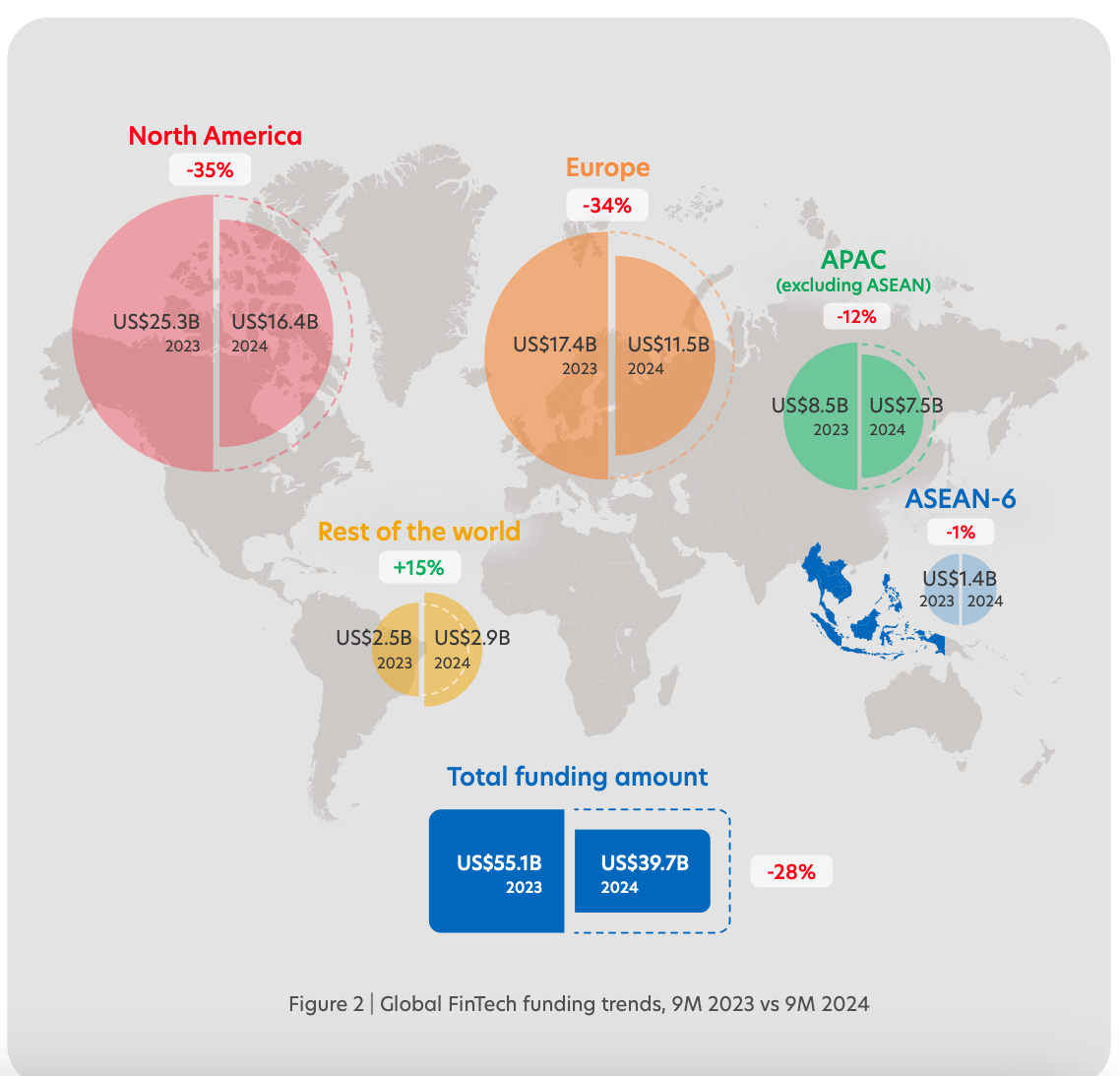

📊 FinTech in ASEAN 2024: A Decade of Innovation. Over the last decade, ASEAN FinTech funding has grown over tenfold, peaking at nearly $6.4 billion in 2021. While global funding trends waver, ASEAN remains resilient; 2024 funding is down less than 1% year-on-year, compared to sharp declines of over 35% in North America and Europe. Link here

FINTECH NEWS

🇬🇧 UK FinTech Truelayer announces layoffs, loses Unicorn status in latest funding round. The firm laid off 71 employees in late September, a week before announcing a $50 million funding round that lowered its valuation. Workers reportedly received just 2-hour notice of a meeting announcing the cuts.

🇸🇬 Singapore AR startup launches AI-driven FinTech tool. BuzzAR has launched BuzzPay, an AI-powered driven FinTech tool that works with the company’s AI tour guide, BAE, to improve digital and payment services for tourists in the MENA region.

PAYMENTS NEWS

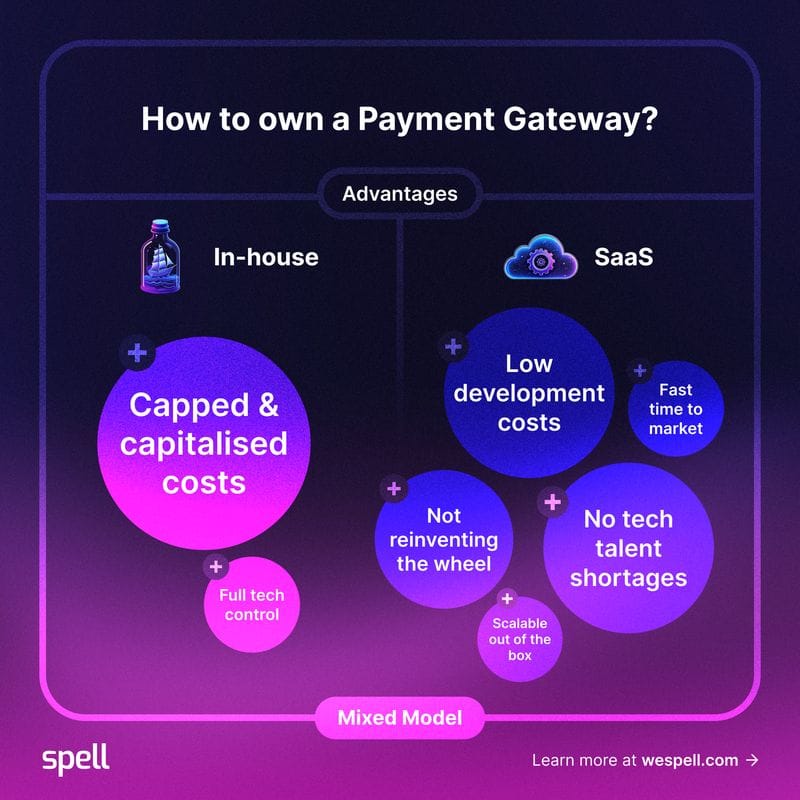

In House Payment Gateway 🆚 White Label SAAS, by Spell

Let's dive in:

🇬🇧 Getting a payment strategy ready for the festive rush. Amid fierce Black Friday and holiday competition, Ecommpay helps merchants optimize checkouts, reduce drop-offs, and tackle failed payments. Chief Revenue Officer Moshe Winegarten highlights how even small checkout delays can cost sales. Ecommpay's new free e-book offers practical tips, including using alternative payment methods, open banking, and tokenization to increase conversions and minimize chargebacks.

🇬🇧 Solidgate pre-dispute alerts for PayPal. Solidgate's pre-dispute alert solution streamlines PayPal chargeback management by offering full visibility into pre-dispute alerts for Visa and Mastercard. With real-time monitoring, automated prevention, and strategic insights, it reduces dispute fees, mitigates chargeback risks, and enhances refund workflows.

🇳🇿 Airwallex launches ‘Airwallex for Startups’ in New Zealand to support the next generation of Kiwi startup successes. The initiative has been created to empower Kiwi entrepreneurs scale efficiently by offering tools and tips to manage finances effectively from the start of their business journey.

🇯🇵 Boku and Amazon Japan ink payments deal. The new agreement with Amazon JP allows Boku to process payments for sales on the amazon.co.jp website. Boku’s revenue from the partnership will be based on the transaction value processed, potentially triggering the vesting of warrants issued to Amazon.com, Inc.

🇪🇸 Spanish banking community joins instant cross-border payments plan. As part of this program, banks can tap into Iberpay’s service, instant payment technology, standards and processing capabilities to allow for instant cross-currency payments. Read more

🇺🇸 Stripe's Pay with Crypto product now supports invoicing. Stripe merchants can now easily accept stablecoins as payment from other merchants by creating and sending invoices that settle as fiat right into their Stripe balances. Read on

🇭🇰 DBS Bank unveils the world’s first UnionPay Multi-Currency Diamon debit card. The card supports direct payments in 14 currencies eliminating multi-currency conversion fees for cardholders and aiming to significantly enhance the cross-border payment experience.

🇺🇸 From boardroom brawls to IPO ready: Inside Klarna’s wild year. Klarna's boardroom drama this year felt like a soap opera—and now it might become one. A Swedish production company, known for Netflix features, has acquired rights to portray Klarna's rise from a payment startup to an IPO sensation. Explore more

REGTECH NEWS

🇮🇳 India cenbank plans 2025 launch of cloud services, countering dominance of global firms. The country’s central bank will launch a pilot programme in 2025 offering local cloud data storage to financial firms at affordable prices, according to two confidential sources aware of the matter, who declined to be identified.

🇰🇷 South Korean authorities accuse Upbit of breaching KYC rules. A local newspaper reports that the Financial Services Commission found inadequate KYC procedures for 500,000–600,000 Upbit accounts, including blurred IDs and unverified accounts, during a license renewal review.

DIGITAL BANKING NEWS

🇮🇳 Revolut is gearing up to expand its footprint in India with an ambitious plan to offer affordable forex and domestic payment solutions: Having established its presence in India in 2021, the company secured in-principle approval for a Prepaid Payment Instrument (PPI) license earlier this year.

🇵🇱 Revolut just announced its first stage integration with BLIK, the most popular Polish 🇵🇱 merchant (online and in-store), P2P and ATM payment system, and they’ve already onboarded over 180,000 users. Find out more

🇬🇧 Revolut gets UK trading license, set to offer UK & EU stock trading. The company, which currently has more than 650,000 UK trading customers, announced it has got the trading license from the British financial regulator that will allow the firm to offer trading of UK and EU-listed stocks and ETFs from 2025.

🇦🇺 CommBank app updates enhance security against scams. CommBank has introduced three new security features to its mobile app: a digital wallet review, interactive warnings for first-time payments, and a QR cardless function, aimed to protect customer funds and prevent scams.

🇺🇸 Goldman readies plans to spin-out its digital assets platform. Goldman Sachs Group Inc. is in talks with potential partners to spin off its digital-assets platform into a new company, aimed at enabling large financial firms to create, trade, and settle financial instruments using blockchain technology.

🇬🇧 Westpac ups the ante on scam protection. Westpac is expanding its Fraud and Scam Operations team by 50 members and introducing a feature in its app for customers to report scams, fraud, or mistaken payments. This is part of the bank's efforts to strengthen detection and prevention, which saved customers $237M in FY24.

🇬🇧 NatWest Group modernises self-service banking with NCR Atleos. Through this collaboration, NatWest is upgrading its network of 5,500+ ATMs and multi-function devices. The initiative aims to streamline branch and self-service operations, improve availability, and speed up the deployment of new transactions and services.

🇺🇸 After Okla. bank failure, Chopra calls for expanded deposit insurance. The CFPB Director Rohit Chopra is asking Congress to reconsider deposit insurance limits after the failure of an Oklahoma bank will likely cause some to take a haircut on their deposits.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Bitcoin hacker sentenced to 5 years for laundering $10.5 billion from Bitfinex. Ilya Lichtenstein has been sentenced to five years in prison for his role in laundering approximately 120,000 Bitcoin stolen in the 2016 Bitfinex hack. The DOJ disclosed that the laundering scheme employed was “particularly sophisticated.

🇪🇺 Quantoz Debuts MiCA-compliant Euro and U.S. Dollar Stablecoins. The launch is part of its strategy to claim a share in the burgeoning European Economic Area market, currently dominated by Circle’s EURC and Société Générale’s EURCV.

🇬🇧 Xapo Bank launches a Bitcoin inheritance solution that allows UK and global members to designate multiple beneficiaries for their assets, including Bitcoin. This is in response to a key user need, as about 13% of UK adults (7 million people) hold crypto but lack secure banking options to transfer this wealth to future generations.

🇺🇸 Crypto’s banking ‘Choke Point’ could ease under Trump. Bank regulators could quickly warm to crypto under Trump—solving a major headache for the U.S. crypto industry. Read full article

🇸🇬 Starknet goes live on Travala: Bringing crypto-powered travel payments to the masses. This integration allows users to book travel with ETH and other ERC-20 tokens, expanding crypto utility. The partnership improves travel convenience for Starknet’s community while showcasing its performance capabilities.

PARTNERSHIPS

🇺🇸 Blackhawk Network (BHN) and Mastercard announce global environmental sustainability initiative. BHN is transitioning its open-loop prepaid products from plastic to paper-based materials, supporting Mastercard's goal to eliminate first-use PVC plastics from its cards by 2028 to reduce environmental impact.

🇪🇬 Mastercard collaborates with eNovate to modernize payment platforms in Egypt. The collaboration will allow eNovate to leverage Mastercard's payment technology expertise to strengthen its position in building market-ready hubs, aiming to drive digital payments adoption across Egypt and the broader region.

🇦🇪 Network International partners with National Bank of Fujairah. The partnership will enable NBF to offer Network’s omni-channel payment services, including online and in-person payment solutions, to its corporate clients, enhancing customer experience with secure, comprehensive payment tools.

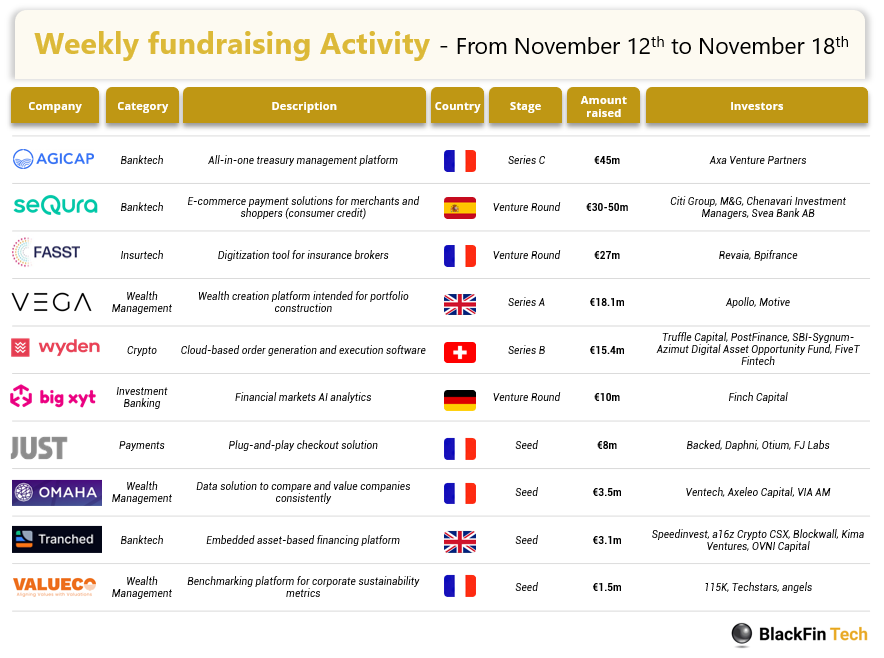

DONEDEAL FUNDING NEWS

💰 Last week, there were 10 official FinTech deals in Europe, raising a total of ~€171.5 million, with 5 deals in France, 2 deals in the UK, 1 deal in Spain, 1 deal in Germany and 1 deal in Switzerland. Read the complete BlackFin Tech overview article

🇮🇳 Indian rural FinTech firm raises $67.8m series D. The investment round was led by Peak XV Partners. The firm aims to use the funds to expand its credit products across India. Continue reading

🇺🇸 Zeplyn raises $3M seed funding for AI Assistant to streamline wealth management workflows and improve client experience. The company enables financial advisors to streamline meeting admin from prep to follow-up, automatically updating client records while protecting personally identifiable information.

🇩🇪 Partech invests over €25M in QPLIX's wealth management platform. The investment will support the company’s growth and expansion into key markets, including France, Switzerland, the UK, the Middle East, and the APAC region.

M&A

🇳🇱 Amsterdam-based Payaut acquired by Ryan Reynolds-backed FinTech company Nuvei. “Payaut is entering a new phase. We’re now part of the Nuvei family. Thank you, Phil Fayer and the Nuvei team, for your trust. Looking forward to the next phase, where I will stay on as CEO of Payaut, Nuvei Group,” CEO Ernst Van Niekerk has said.

🇬🇧 Barclays Bank in talks over giving away 80% stake in merchant acquiring business. The Bank is in early talks with Brookfield Asset Management to sell an 80% stake in its merchant acquiring division, while retaining a 20% share, according to Sky News. Read on

🇺🇸 Celero Commerce buys Precision Payments. The acquisition of Precision is set to solidify Celero’s presence within the multi-lane retail industry and expand its network of sales professionals serving local communities across North America.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()