Trolley Secures $23M Series B to Expand Global Payouts Platform

Hey FinTech Fanatic!

Trolley, a Toronto-based global payouts platform, has raised $23M in Series B funding, led by Wavecrest Growth Partners with support from Pace Capital.

The funding will drive product expansion, targeting enhanced features for global payouts, compliance, and fraud prevention. Trolley also plans to broaden its customer base across industries and geographies, scaling its platform for startups and Fortune 500s alike.

Led by CEO Tim Nixon, Trolley empowers businesses like SoundCloud, Envato, and BandCamp to streamline payouts, tax compliance, and ID verification, reducing risks and boosting efficiency.

Excited for Trolley’s next chapter? Share your thoughts below!

Cheers,

INSIGHTS

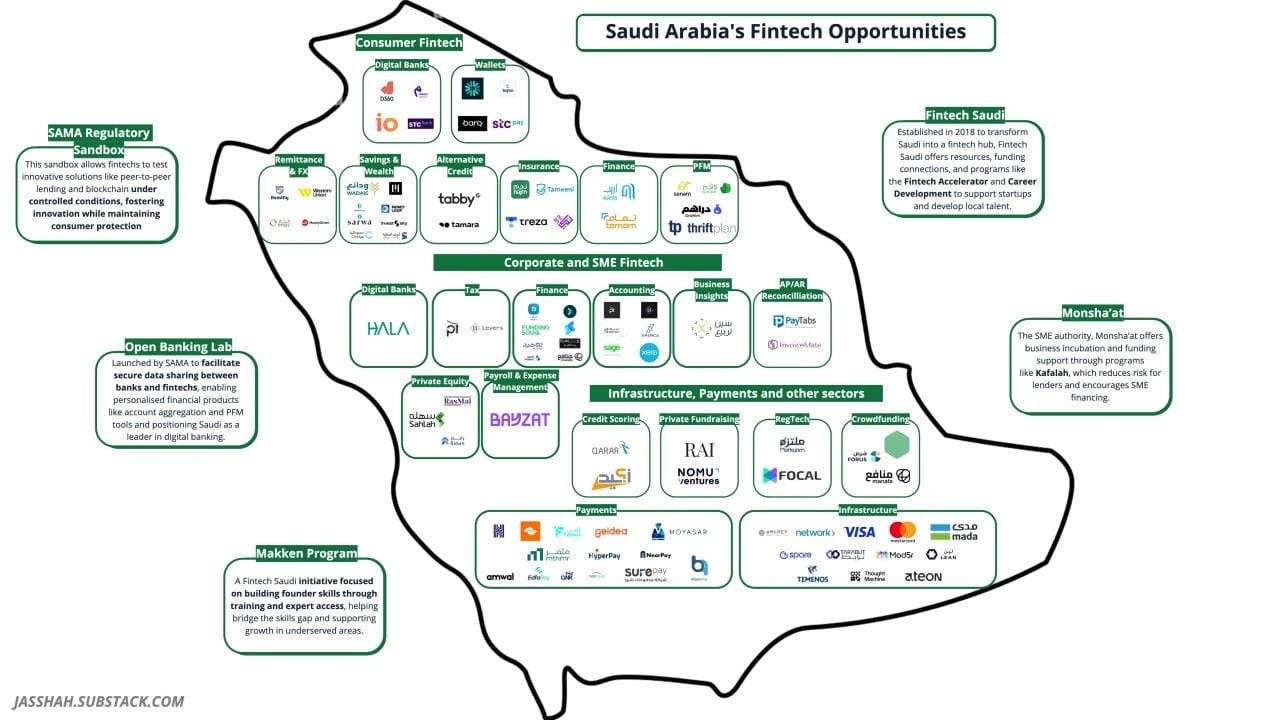

🗺️ Saudi Arabia’s FinTech Map👇

Which company is missing in the overview?

FINTECH NEWS

🇪🇺 Visa says European antitrust watchdog investigating its acquirer fees. The company disclosed the European Commission's (EC) preliminary probe in its annual report on Nov. 13. It also noted that the EC had concluded a nearly two-year investigation into Visa’s incentive agreements with clients in October.

🇨🇳 Ant Group's quarterly profit nearly triples, primarily driven by the conclusion of a prolonged regulatory overhaul that included a 7.07 billion yuan fine imposed the previous year by the Chinese government for violations related to consumer protection and corporate governance.

🇸🇪 Klarna’s Seb Siemiatkowski — from burger flipping to billionaire club. Siemiatkowski co-founded Klarna in 2005, pioneering the “buy now, pay later” model. Despite a valuation collapse from $46 billion in 2021 to $6.7 billion later, the US IPO marks a possible redemption for Klarna and a significant personal milestone for its CEO. Read the full piece

🇸🇪 The 11 Klarna alumni who’ve become entrepreneurs since last year. According to Accel and Dealroom’s reports released the past month, Klarna alumni have now launched a total of 62 startups, pipping last year’s top dog Revolut to second place with 49. Discover eight businesses launched by ex-Klarna employees in 2023 and 2024.

PAYMENTS NEWS

🇬🇧 UK Government unveils National Payments Vision, which is based on insights from the independent Future of Payments Review 2023 led by Joe Garner, outlining challenges and opportunities in the payments sector while providing a framework for growth and innovation.

🇧🇪 Qover and Mastercard secure return shopping fees in two European markets. Mastercard credit cardholders in Belgium and Luxembourg can access return shipping cost protection via Qover’s platform. Available on mastercard.be and mastercard.lu, it will add an extra layer of shopping protection for the entire retail experience.

HSBC partners with Dandelion in a move to reshape cross-border payments. This collaboration shifts away from traditional banking intermediaries, and aims to reach over 100 destinations through a direct-to-local network, bypassing the conventional Swift system.

🇶🇦 Qatar Central Bank clarifies use of Himyan card for payments at government agencies. The bank has stated that this is part of a phased digital transformation initiative, set to launch in February 2025, aiming to enhance transaction security and reduce payment processing costs.

🇺🇸 Volante Technologies launches real-time payments intelligence solution. The Volante Payments Intelligence feature provides financial institutions with enhanced visibility and control over payment operations, streamlining decision-making and boosting performance.

🇺🇸 Mesa debuts homeowners credit card, offering rewards on mortgage and home expenses. The Mesa Homeowners Card, allows customers to earn ‘Mesa Points’ on various purchases, including car fuel, home maintenance and utilities. Continue reading

OPEN BANKING NEWS

🇹🇷 Innovance and Salt Edge collaborate to enhance open banking solutions across EMEA. The partnership will help financial institutions achieve Open Banking compliance with minimal resources, ensuring security and peace of mind throughout the process.

REGTECH NEWS

🇱🇹 iDenfy KYB workflow boosts sole proprietorship onboarding. iDenfy’s unified dashboard streamlines onboarding for sole traders, businesses, and legal entities, helping compliance teams efficiently gather KYB verification data tailored to sole proprietors' needs.

DIGITAL BANKING NEWS

🇦🇺 Revolut Business sees 11-fold revenue growth in Australia. Since its launch in the country last year, Revolut Business has demonstrated remarkable growth. In the most recent quarter, the company reported an 11-fold increase in revenue and a 10-fold surge in transaction volume compared to the same period last year.

🇬🇧 Revolut is currently gaining 1 Million users every 3 weeks 🤯. "Strategy is not important. It’s all about Execution" - according to Antoine Le Nel at Web Summit in Lisbon. Checkout Antoine's complete presentation in this video (starting at 2.56).

🇻🇳 MSB, Backbase and SmartOSC announce partnership. This milestone marks a pivotal step in MSB’s journey toward customer-centric modernization, advancing its digital factory, and delivering seamless experiences that drive financial innovation in Vietnam.

🇸🇪 SEB Embedded has selected Thought Machine’s cloud-native core banking platform, Vault Core, to power its new BaaS offering. Through Vault Core, SEB Embedded has launched a banking service for its first client, Hemköp, one of Sweden's largest supermarket chains, in under 10 months.

🇺🇸 Gate City Bank has partnered with Alkami Technology to deploy its full suite of cloud-based digital banking solutions as it looks to enhance the online banking experience for customers. The selection includes Alkami’s unified banking platform, Positive Pay for ACH monitoring, and account-opening tools.

🇺🇸 US Government investigating Citigroup’s Anti-Money Laundering policies. U.S. agencies, including the DOJ, FBI, and IRS, are reportedly probing Citigroup’s anti-money laundering (AML) practices and connections to a trust linked to Russian billionaire Suleiman Kerimov, a sanctioned individual.

BLOCKCHAIN/CRYPTO NEWS

🇫🇷 SocGen crypto arm to launch its Euro Stablecoin to XRP Ledger. SG-FORGE, the digital assets-focused subsidiary of French bank Societe Generale, said it will deploy its euro stablecoin, EUR CoinVertible (EURCV), on the XRP Ledger (XRPL) network as it looks to expand across multiple blockchains.

🇬🇧 Stablecoin startup BVNK seeks funding after a major deal by Stripe. The startup is in talks to raise at least $50 million, according to sources who requested anonymity due to the private nature of the discussions. The funding size and BVNK's valuation may still change.

DONEDEAL FUNDING NEWS

🇬🇧 Kody raises US$20m in Series A financing. This highlights the company's progress and commitment to expanding internationally, attracting talent in the UK, Europe, Hong Kong, and Singapore, while forging strategic partnerships to enhance its product offerings.

🇬🇧 Mutual Vision aims big following significant investment. This investment accelerates Mutual Vision's product roadmap, expanding digital solutions to help banks and mutuals stay at the forefront of financial innovation with advanced, scalable technology.

🇨🇦 Trolley raises $23M in series B funding. The company plans to use the funds to accelerate product development, broaden its market presence, and enhance its platform to better serve businesses ranging from startups to Fortune 500 companies.

M&A

🇺🇸 Blackstone, Warburg weighing $12 Billion sale of IntraFi. The alternative-asset managers have begun talking to investment banks about soliciting interest in IntraFi — which could fetch $12 billion or more in any transaction — in early 2025, according to people familiar with the matter.

🇦🇺 Crypto.com acquires Australian brokerage firm Fintek. With this acquisition, Crypto. com will expand its range of financial services to include deposit products, derivatives, securities, foreign exchange, and managed investment schemes.

MOVERS & SHAKERS

🇬🇧 Laurence William Booth appointed Trust Payments Group Chief Executive Officer with immediate effect. His appointment has been made following a robust and competitive evaluation process carried out by the board with support from international search advisers.

🇬🇧 Tandem Bank has appointed Matt Dobson as its CFO. Dobson will assume the CFO role on 1 January, pending regulatory approval. His appointment aligns with Tandem's financial strategy, following its Q3 securitisation of over £250m in second charge mortgages.

🇺🇸 PayJunction appoints Scott Herriman as Vice President of Engineering. As VP of Engineering at PayJunction, Scott will lead the engineering team in advancing the No-code Payments Integration® platform and driving innovations to expand the company's capabilities.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()