Trade Republic Hits €100B Milestone as User Base Doubles to 8M!

Hey FinTech Fanatic!

Trade Republic just hit a major milestone—crossing €100 billion in assets and doubling its user base to 8 million in just a year!

The Berlin-based broker is expanding fast, launching national branches and localized banking services in France, Spain, and Italy. France alone brought in over 1 million customers, thanks to commission-free savings plans for PEA accounts and new domestic current accounts with national IBANs.

Staying profitable through 2024, Trade Republic offers competitive 3% rates on deposits, matching the European Central Bank’s benchmark. Their international user base now makes up over a third of total customers, fueled by debit cards and current accounts driving growth.

Co-founder Christian Hecker put it best: "A new generation of savers is emerging across Europe, and many are starting with Trade Republic. Saving over €100 billion in six years shows the scale and future potential."

With this significant growth, Germany's second most valuable FinTech has drawn attention as a potential IPO candidate. However, the company has vowed to stay private, with Hecker downplaying the prospects of a public market debut in an interview with the FT.

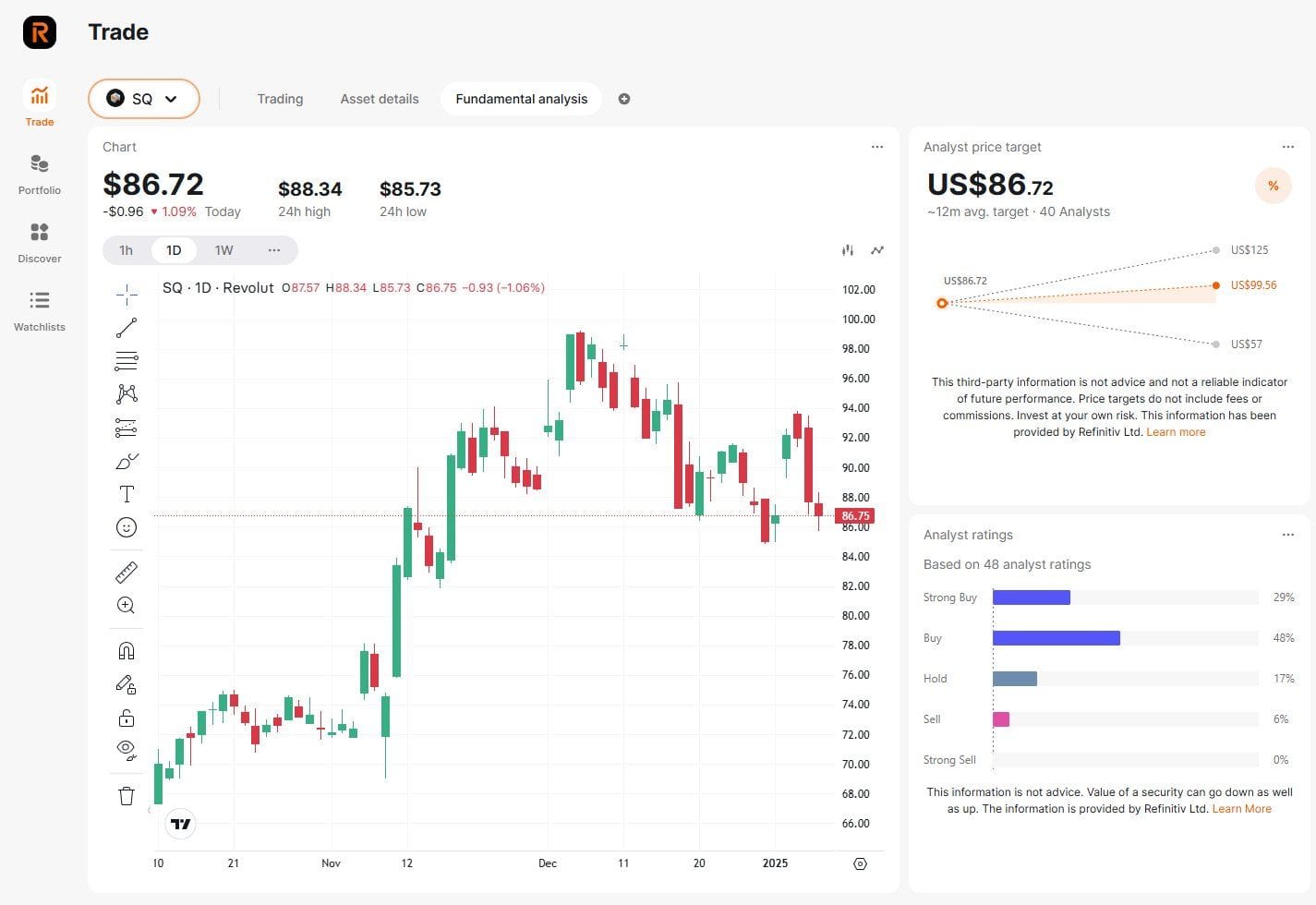

In another update: The FinTech expert Jevgenijs Kazanins spotted something interesting – Revolut's web trading interface is now live!

Sergei Riabov, Head of Product at Revolut - Wealth & Trading confirmed in a comment: "Yes, we have made the web interface available to all customers. The standalone app is still in a pilot test phase in three EU countries, but all the features are also available in the main Revolut app".

Have a great start to the week and I'll be back with more FinTech industry updates tomorrow!

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

#FINTECHREPORT

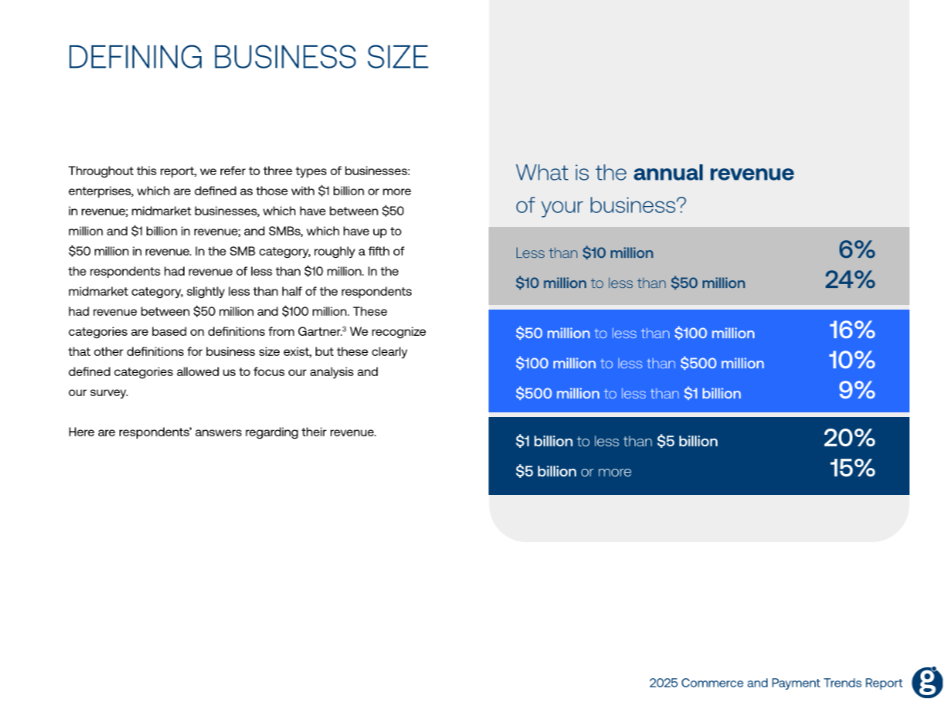

📊 Global Payments Inc.'s 2025 Commerce and Payment Trends Report👇

PODCAST

🎙️ Challenger banking is just getting started. In this podcast episode, Jane Wakefield speaks with Bianca Zwart, Chief Strategy Officer at Bunq, who discusses the massive issue of fraud, how Brexit has affected the company’s UK operations and the exciting future of the banking sector. Listen to the full episode here

FINTECH NEWS

🇺🇸 Ally lays off hundreds of employees. A spokesperson said the job cuts, which aren’t specific to any location or line of business, amount to less than 5% of its workforce. He called the cuts “a right-siz[ing],” noting that the bank continues to hire in certain areas of business.

🇬🇧 FinTech nsave launches investment platform, offering people from distressed economies protection from inflation with compliant and safe investments abroad. This means that customers can access US equities, ETFs and soon funds managed by some of the world's largest asset managlaunchers via the nsave app.

🇬🇧 FinTech Innovation in Scotland delivers growth with 8% increase in employment. This growth underlines the significant contribution FinTech will make in delivering the UK Government Modern Industrial Strategy and the importance of clusters to “unleash the full potential of our cities and regions”.

🇬🇧 Stenn went from $900 million to insolvency in days. Stenn’s collapse was shocking in its speed, snuffing out almost a decade of work by Karpovsky to create what he portrayed as an ambitious company using technology to plow up its humdrum industry and strike more than $20 billion worth of deals.

🇩🇪 Trade Republic hits €100B milestone as user base doubles to 8M. The company operates across 17 countries, offering services including savings plans, fractional trading of shares, ETFs, and cryptocurrency investments. Despite its recent growth, the company has shunned an IPO and vowed to stay private.

PAYMENTS NEWS

🇪🇺 EU auditors concerned over price interventions in the card market. EU price interventions aim to reduce the harmful effects of unfair competition or to meet certain policy goals, potentially in consumers’ favour. The EU's digital payments system includes fee caps, surcharge bans, free open banking, SEPA, and cross-border euro price parity.

🇬🇧 Apaya partners with Telr. The partnership will combine Telr’s comprehensive and secure payment solutions in the regions of the UAE, KSA, Bahrain, and Jordan, with Apaya’s no-code commerce automation platform to enable merchants and businesses to build and scale optimised payment experiences for their clients in a fast and efficient manner.

🇸🇦 MENA-focused HyperPay licensed from Sama. Through this step, HyperPay aims to enable businesses to benefit from secure and seamless payment services, in line with the goals of Saudi Arabia's Vision 2030 to improve the efficiency of the financial system and support digital transformation.

🇺🇸 New payment processing module for Treasury4 Platform unveiled. Treasury4 announced the launch of Payments4, a module for its software platform for treasury and finance practitioners designed to consolidate payment activities and help with cash and forecast management.

🇸🇬 Skyee receives In-Principle Approval (IPA) for Major Payment Institution License (MPI). “Being granted this IPA from the Monetary Authority of Singapore is a big milestone for Skyee, especially as we expand our reach and payment services across geographical borders, solidifying our position in one of the most significant financial markets globally,” said CEO of Skyee Singapore.

🇮🇳 India’s digital payments strategy is cutting out Visa and Mastercard. As digital payments morph into strategic assets, India is offering a template for other nations seeking to reduce dependence on Western payment networks. Regulators around the world are notching up scrutiny on Visa and Mastercard over the fees they charge merchants.

DIGITAL BANKING NEWS

🇩🇪 UniCredit to internalise back-office activities. The internalisation will involve building out a back-office platform for the bank's custody services business, initially focused on Germany, while staffing teams to manage these operations in house - creating more than 140 new jobs.

🇪🇺 BNP Paribas signs a partnership with Oracle. This new step in BNP Paribas' cloud strategy aims to enhance the security and confidentiality of customer data. This agreement will allow the bank to centralize databases operated via Oracle solutions on a single platform while benefiting from the automation advantages offered by Oracle Database.

🇺🇸 UBS nears settlement of US case. The bank is set to pay hundreds of millions of dollars in the settlement of the case brought by the U.S. Department of Justice. The case involves Credit Suisse’s violations of an agreement with the DOJ. The bank failed to follow through on its promise to provide the authorities with information about undeclared American-held accounts.

BLOCKCHAIN/CRYPTO NEWS

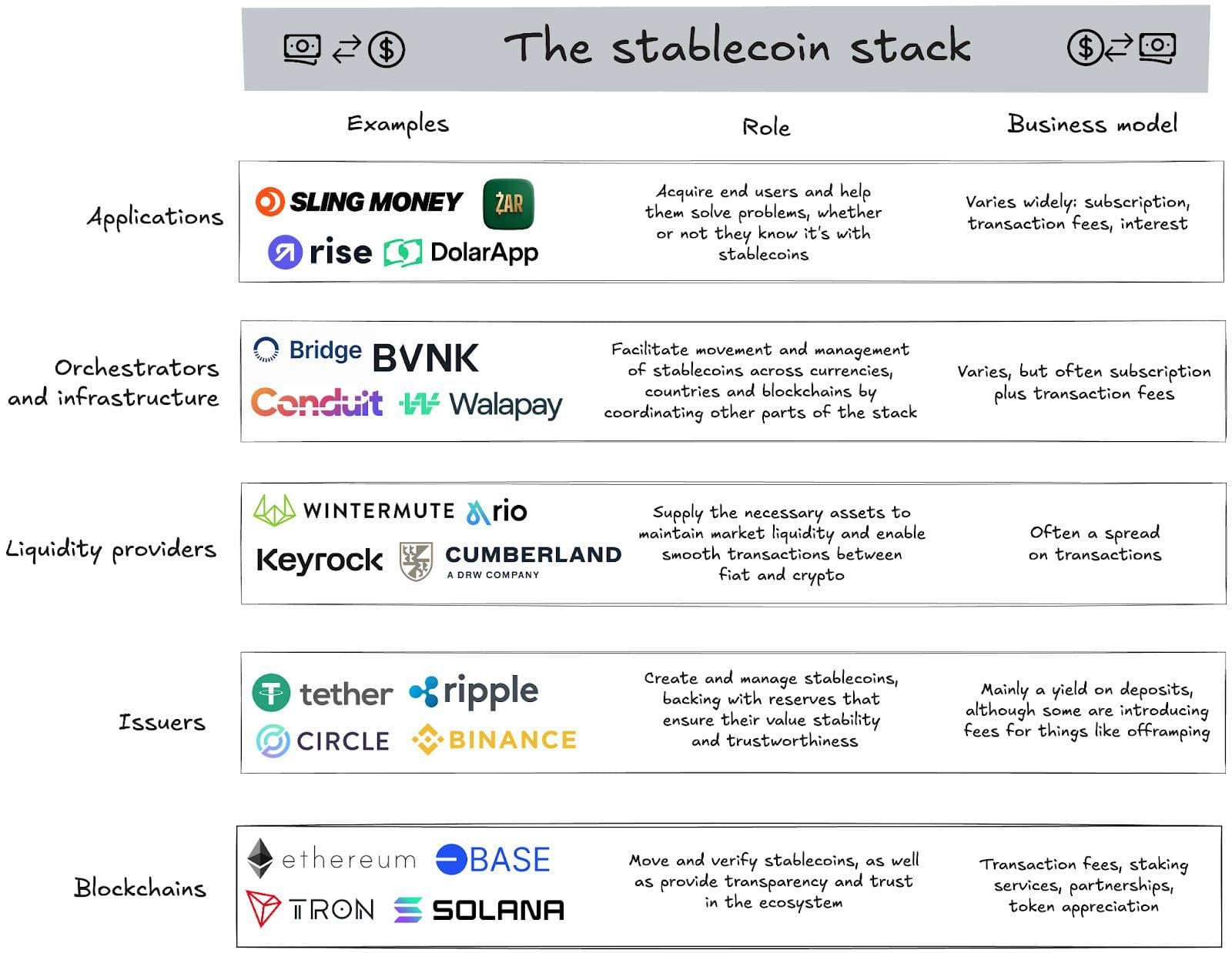

The Stablecoin Stack 👇

Where does value accrue in the rapidly evolving stablecoin stack?

🇸🇻 Tokeny partners with Ditobanx in El Salvador. The partnership’s goal is to create a legal framework for tokenized regulated assets. Ditobanx currently provides various financial services like payments, credit cards, wallets and Bitcoin services. Continue reading

🇺🇸 Five key sectors and Trump's crypto impact. HTX has released its latest report, HTX 2024 Global Web3 Blockchain Ecosystem Review and 2025 Outlook, which provides forward-looking insights into the development prospects of the crypto industry.

🇦🇪 Mastercard Crypto Credential launches in the UAE and Kazakhstan. The service simplifies the consumer experience allowing crypto exchange users to send and receive cryptocurrencies using simple aliases instead of complex blockchain addresses.

🇩🇪 Bullish Group secures cryptoasset licences in Germany. The firm secured a trio of licences to operate cryptoasset trading and custody services and hired a new managing director to help guide its launch in the country. The licences will enable the company to expand its services across the European Economic Area under the MiCA regulatory framework.

🇺🇸 Next wave of US crypto ETFs already in the pipeline. "Everyone is now aware of how much money there is to be made, and with a new, more friendly administration, there's no reason not to go ahead and file your best ideas with regulators," said founder and CEO of digital assets hedge fund Asymmetric in Miami.

🇨🇳 Tether wants to hire AI filmmakers: Bloomberg Crypto. “AI-based roles, particularly in filmmaking, bring unique advantages that align with Tether’s vision of innovation and efficiency, from scale to speed and cost being a few examples,” Tether’s CEO, said in an email to Bloomberg. Read More

🇺🇸 US regulator plans to toughen customer protection on crypto accounts. The CFPB said it wanted to mandate service providers to pay back consumers who lose funds owing to hacks or unauthorised transactions. The move would force digital asset businesses to increase their security and reserves to counter operational threats.

DONEDEAL FUNDING NEWS

🇱🇻 Latvia’s Jeff App, billed itself as a “MoneySuperMarket,” targets $20m funding round and is testing the waters on a European launch. The company is looking to make a big push in India as well as launching in other South American countries like Peru, after recently launching in Colombia.

🇨🇭 Nevermined raises $4M to build the PayPal for AI-Commerce and to enable seamless payments between AI agents, actively driving the transformation of all commercial landscape. The company's protocol is designed to address the unique challenges of AI-Commerce, where traditional rigid payment systems fall short.

M&A

🇬🇧 ReFi™ from Paylink Solutions becomes part of Experian to enhance debt support for millions stuck in revolving debt trap. The technology bolsters Experian’s capabilities in helping consumers and lenders with debt consolidation and affordability challenges.

🇵🇰 Bank Alfalah acquires Jingle Pay. The bank announced its acquisition of a 9.9% equity stake in Jingle Pay. This collaboration leverages Bank Alfalah’s extensive infrastructure to amplify Jingle Pay’s impact on cross-border payments and digital banking, advancing its ambitious vision for the MENAP region.

🇦🇪 Arcapita and Dgpays buy NEOPAY stake for $385M from Mashreq. This strategic partnership represents a milestone for NEOPAY as it aims to scale its operations, enter new markets, and enhance its innovative service offerings across the Middle East.

MOVERS AND SHAKERS

🇩🇪 ABN Amro picks former BNP Paribas banker Marguerite Berard as CEO. Berard will be proposed as the next CEO at ABN Amro's general shareholders meeting in April. She will succeed Robert Swaak, who in August unexpectedly said he would resign three years before the end of his term.

🇺🇸 Akuvo names William Coffey as new Chief Risk and Data Officer. Coffey spent nearly 20 years working across several senior roles at Vanguard, including head of the programme management office, and Chief Technology and Operations Officer for the asset manager’s legal and compliance division. Read on

🇺🇸 Ed Olebe to lead Wells Fargo’s credit card business. Wells Fargo has reportedly hired the former head of JPMorgan Chase’s branded credit card business to lead its own. Olebe left JPMorgan Chase late last year and will take over for Ray Fischer at Wells Fargo upon Fischer’s retirement.

🇬🇧 Toby Wootton joins Crowd2Fund as CEO. With a proven track record of scaling FinTech success stories like Funding Circle, WorldFirst, and SimplyVAT, Toby’s expertise will drive the next phase of growth for our platform and community. Read More

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()