Toku Raises $48M in Record-Breaking Series A to Fix Latin America's Broken Billing Systems

Hey FinTech Fanatic!

Latin American FinTech Toku just pulled off a record: a $48 million Series A—the largest ever for a female founder in the region. Led by Oak HC/FT, the round also saw backing from heavyweights like Gradient Ventures, F-Prime, Clocktower, and Y Combinator.

Toku, founded by Cristina Etcheberry, is tackling one of LatAm's biggest pain points: messy, manual bill collection. Its platform automates the entire accounts receivable process—connecting ERPs, banks, and payment systems to boost collection rates from 10% to 90%.

With operations in Mexico, Brazil, and Chile, and over 450 clients including MetLife, Liverpool, and Mapfre, Toku more than doubled its revenue in 2024 and tripled payment volume. The company's net dollar retention hit a standout 160%.

"Latin America still heavily relies on manual and inefficient payment collection processes," said Etcheberry. "This latest investment round further validates the demand for Toku's solutions, and we are excited to bring our technology to even more companies and regions."

Read more global FinTech industry updates below 👇 and I'll be back with more on Monday!

Cheers,

INSIGHTS

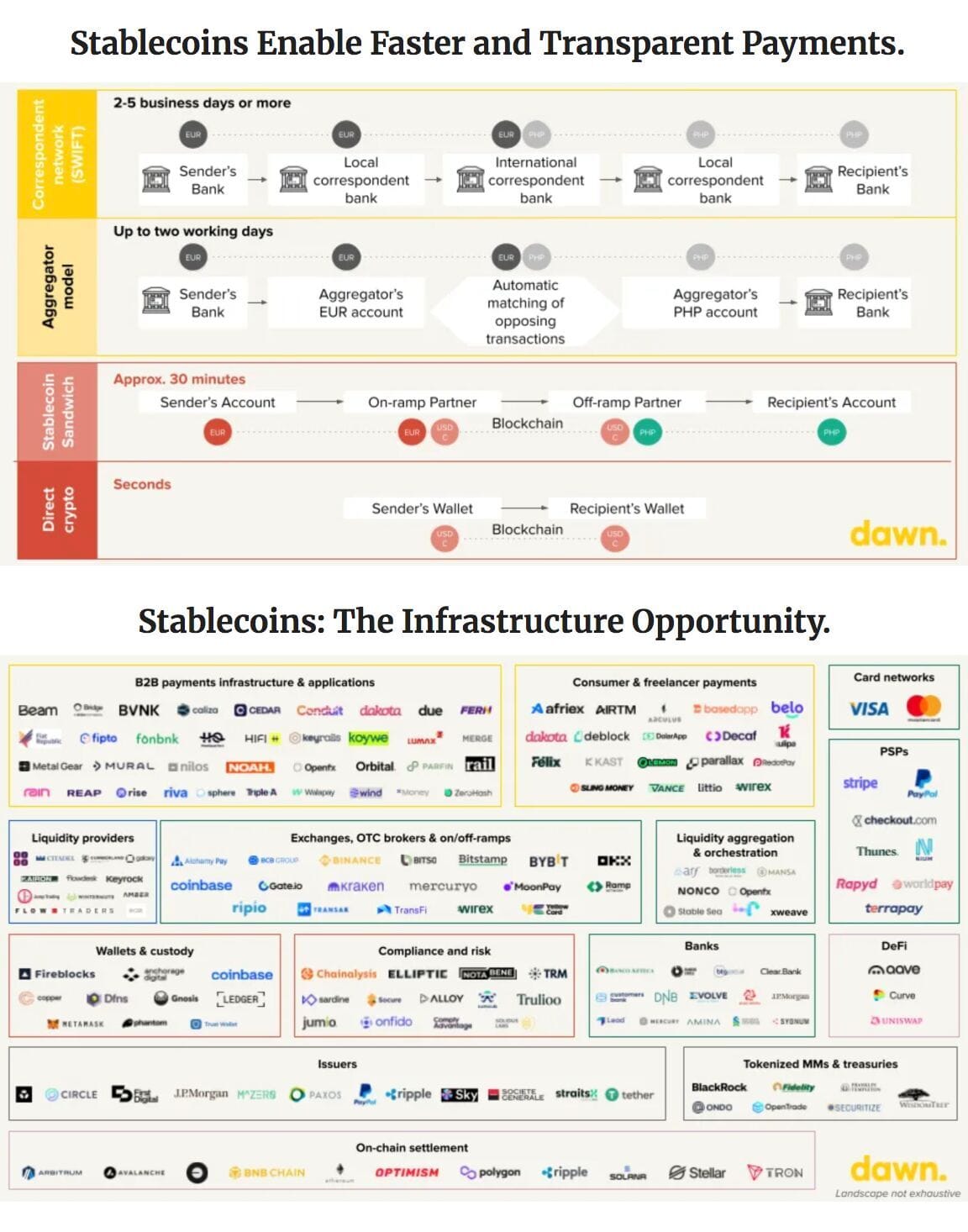

📈 Stablecoin transaction value in 2024 reached a five-year record high, hitting $15.6 trillion, and overtaking traditional payment firms Mastercard and Visa by more than 100% 🤯

FINTECH NEWS

🇺🇸 Recurly rolls out suite of new products. The platform introduced its powerful new AI-powered growth engine, Recurly Compass, a Shopify integration that provides enterprise-grade support for ecommerce subscriptions, and new plug-and-play payments functionality designed to streamline global scale and conversion.

🇧🇷 Nexoos has a life of its own again. The company has repurchased its technology assets and brand, effectively ending its integration with the Americanas Group's FinTech arm. Its decision to regain control aligns with its strategy to scale its CaaS platform, leveraging its expertise in credit infrastructure to compete in the financial services market.

🇸🇩 Zain unveils ‘Bede’ FinTech platform in Sudan. The safe and secure platform will empower Zain customers nationwide to carry out a wide range of financial transactions directly via their mobile phones, without the need for a traditional bank account or card.

🇬🇧 Inflation down further to 2.6%, raising hopes for bank rate cut in May. The Bank of England is thought likely to cut the rate to stimulate economic activity in the face of a global slowdown triggered by increased trade tariffs. Read more

PAYMENTS NEWS

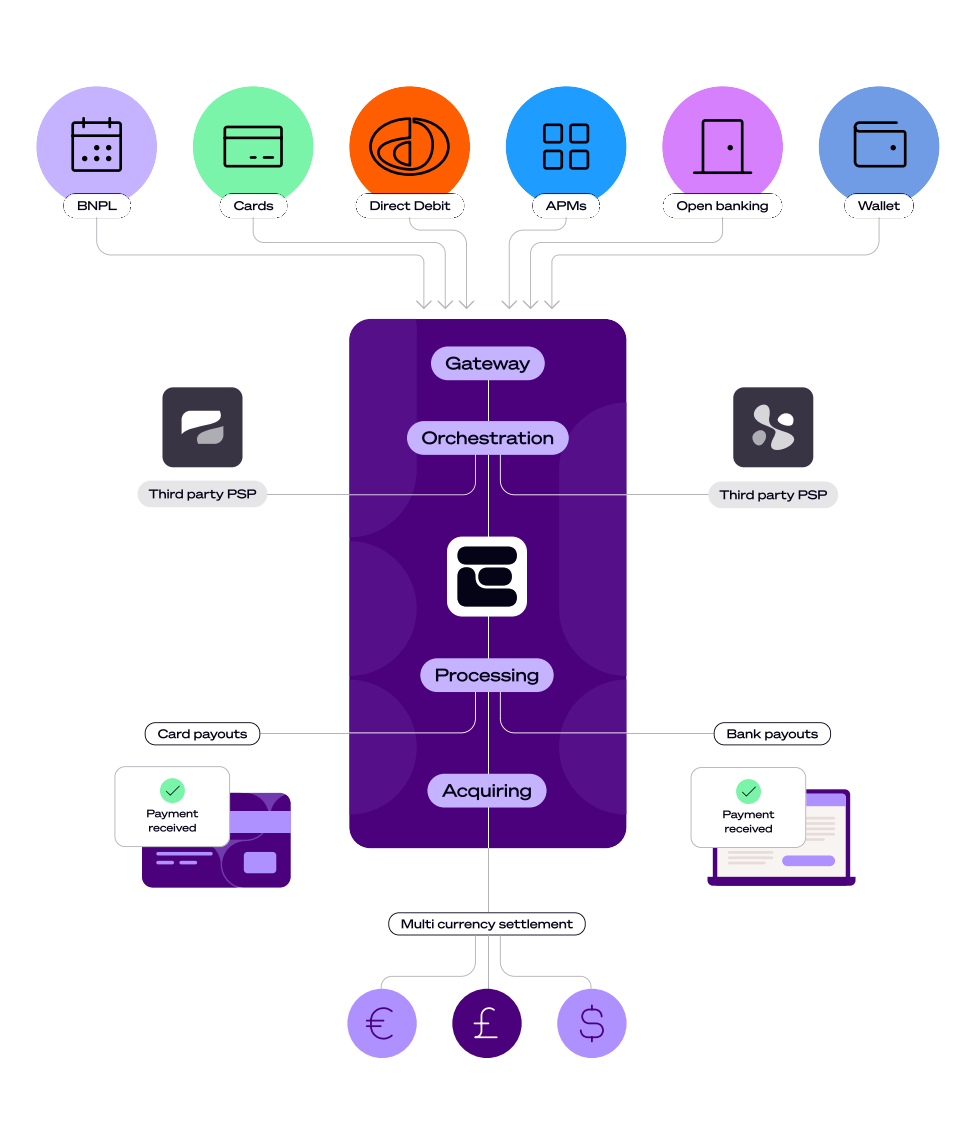

🇬🇧 Let’s grow with bespoke payment solutions by Ecommpay — from acquiring to open banking, direct debits, and 100+ APMs, all in a single integration. Discover how Ecommpay’s full-stack orchestration powers seamless transactions and drives business growth. Explore now

🇳🇵 NepalPay domestic card scheme goes live. NCHL had previously signed an agreement with ACI Worldwide to establish and operate the National Payment Switch, which enables interoperability of card-based transactions and includes the rollout of the NepalPay domestic card scheme.

🇳🇵 Bolt launches SuperApp combining one-click crypto and everyday payments. The app is available for download at the Bolt website. Full access is expected to be granted selectively to iOS users early next week, and Android users will follow in the coming months.

🌍 Swift rolls out investigation tool to track late payments. The tool claims could save its member banks millions of dollars in operational costs and significantly reduce the time it takes to identify and resolve issues when international payments are delayed.

REGTECH NEWS

🇰🇪 Central Bank of Kenya lifts 10-year ban on new bank licences. Starting July 1, 2025, the regulator will begin accepting applications for fresh banking licences. This move comes as the Central Bank of Kenya cites significant improvements in the legal and regulatory framework governing Kenya’s banking industry.

🇦🇺 ANZ continues to work on a data "one-stop shop" for its Risk function. Artur Kaluza, head of data strategy and transformation within ANZ's Risk function, shared that three Google Cloud services are being used - Dataplex, BigQuery, and Vertex AI Platform.

DIGITAL BANKING NEWS

🇧🇷 Revolut launches interest-bearing account and begins Credit Card tests in Brazil. The goal is to expand its banking services and become the primary bank for its users. At the same time, the company has introduced instant access savings for under 18s. 'Revolut 18' is designed for children aged 6-17, and is linked to a parent or guardian's account. It said this new feature aims to empower children to make their pocket money earn money.

🇬🇧 Monzo surpasses 12 million customers. This milestone comes on the back of strong product momentum, with Monzo giving its customers even more visibility and control over their money with multiple new products and features over the past year. Read more

🇧🇾 Belarus to fully launch CBDC. The country is getting ready to launch its central bank digital currency into full circulation by the second half of 2026. The plan is for businesses to begin using the digital ruble in 2026, followed by government agencies and individuals in 2027.

🇬🇧 New report suggests 79% of Londoners are open to ditching traditional banks for digital options. With the rise of mobile banking technology, a growing number of digital, branchless banks are emerging across the UK, offering a seamless and convenient banking experience.

🇹🇭 Thailand reportedly approves three digital bank bids, targets 2026 rollout. The selected groups are anchored by Krungthai Bank, SCB X, and Ascend Money. They were evaluated based on their financial capacity, business models, and readiness to meet regulatory requirements for digital banking operations.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 VanEck to launch ‘NODE’ ETF targeting crypto-related stocks on May 14. The U.S. Securities and Exchange Commission has approved its upcoming ETF, NODE. The firm plans to launch the ETF offering equity exposure to companies shaping the digital asset and blockchain economy.

🇺🇸 Unstoppable Domains and the Bitcoin Cash have joined forces to launch .BCH, marking a major step forward in simplifying blockchain-based payments. The new domain extension gives Bitcoin Cash (BCH) users a personalized, secure, and user-friendly way to manage their crypto presence.

PARTNERSHIPS

🇬🇧 Haboo Money partners with Griffin to improve the loan repayment experience for lenders and borrowers. With this partnership, Haboo is going to offer a save-as-you-repay wallet that helps borrowers pay off their debt in a more flexible way.

🇵🇹 TAP announces partnership with FinTech Klarna for the adoption of flexible payments. Customers booking flights through TAP's official website can choose to pay in three equal, interest-free installments or opt for the traditional full payment. This initiative aims to provide travelers with greater control over their travel budgets.

🇺🇸 MoneyGram and Plaid partnership drives seamless global payments. Customers in the United States can now use Plaid's technology to help authenticate their bank accounts, enabling fast and secure funding for both domestic and cross-border payments.

🌏 AEON partners with Stellar to expand web3 mobile payments across Southeast Asia and beyond. This collaboration enables AEON Crypto Payment solution to support $XLM and Stellar-native USDC, allowing users to pay seamlessly with these tokens, whether checking out online or shopping at local retail stores.

🇺🇸 Google and Nvidia team up for the rollout of AI agents. Google’s AI model Gemini will be deployed on Nvidia’s Blackwell servers at businesses using them, which will enhance the security of sensitive data, including financial and health records.

🌎 BlueSnap partners with Shopware to unlock seamless payments for North American businesses. Shopware selected BlueSnap to deliver secure transactions, flexible payment methods, and seamless integrations tailored for its United States and Canada merchants.

DONEDEAL FUNDING NEWS

🇨🇱 Santiago-based Toku has secured $39 million in new funding, which values the startup at more than $175 million, bringing Stripe-like Payments to LatAm. Toku is combining the $39M Series A with a previous $9M SAFE round into a total $48M Series A. With its new funding, the firm plans to focus on growing in Mexico and Brazil. Keep reading

🇺🇸 FinTech startup Crux raises $50 million to build capital market platform for clean energy developers. The recent raise brings the company’s total funding to $77 million and will help it expand its team and improve its technology, including the integration of AI, as it expands the platform to include more types of debt financing.

M&A

🇺🇸 Payments provider Global Payments Inc. has struck a $24.2bn cash-and-stock deal to buy rival Worldpay from GTCR, less than two years after the private equity group bought a majority stake in the company. As part of a three-way deal, GTCR will receive 59% of the deal value in cash and the remainder in Global Payments stock.

🇩🇪 Pliant acquires hi.health, expanding into digital insurance payments. The acquisition enables Pliant to apply its payment expertise to the insurance sector while also gaining valuable industry-specific know-how. Continue reading

MOVERS AND SHAKERS

🇦🇺 Pismo appoints Vishal Dalal as global CEO in post-acquisition leadership shift. Dalal brings nearly 30 years of experience to his new position, including leadership roles at Citigroup, Barclays, and McKinsey, where he served as a partner in Sydney, Australia.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()