Thunes Raises $150M to Expand U.S. Network

Hey FinTech Fanatic!

Thunes has secured $150 million in its Series D round, the largest in the company’s history, surprassing previous valuations. The funding round was led by Apis Partners and Vitruvian Partners.

Now profitable and maintaining steady growth, Thunes is poised to use this capital to accelerate its U.S. expansion, leveraging newly acquired licenses across all 50 states, pending regulatory approval.

Thunes operates a Direct Global Network connecting 130+ countries and 80 currencies with more than 550 direct integrations. Its platform enables real-time payments across a diverse range of markets, bridging traditional, digital, and emerging currencies.

As cross-border payments edge closer to a $150 trillion market, this fresh capital will support the company’s efforts to include the “next billion end users” in emerging economies, delivering fast, secure, and cost-efficient global transfers.

“Thunes’ latest funding round is a clear validation of our strategy and our commitment to sustainable growth. Our performance, marked by a Revenue run-rate of $150 million and positive EBITDA, demonstrates our ability to balance rapid expansion with financial prudence, even in a tumultuous market,” said Floris de Kort, CEO of Thunes.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Dominate the Payments Space! Subscribe to my Daily PayTech Newsletter for daily updates and trends in the evolving world of payment technology. Revolutionize your payments expertise today!

PAYMENTS NEWS

🇺🇸 ACI Worldwide Revolutionises Payments at Pay360. ACI Worldwide's Andrew Moseley shares insights on the transformation of payments infrastructure, regulatory challenges, and the rising importance of AI in fraud prevention, as the industry shifts towards instant processing. Read on

🇧🇷 Automatic Pix enters the Central Bank's testing phase. This phase, known as "homologatory testing," began on April 28, 2025, and involves all service providers within the Instant Payment System (SPI) to ensure the system functions correctly before its official release.

🇦🇿 Azerbaijan sees surge in cashless payments as card usage hits record high. As of the end of March, the number of payment cards in circulation across banks and “Azərpoçt” (Azerpost) LLC systems increased by 221,000 compared to the previous month, reaching a total of 20.46 million cards.

DIGITAL BANKING NEWS

🇵🇭 Uno Digital Bank adopts new loan system to boost lending agility. The implementation is intended to address challenges the lending sector faces, such as increased operational complexity and the need to quickly adapt to changing market dynamics and regulatory requirements.

🇩🇪 N26 to offer mobile service to boost growth. The company is seeking to expand beyond its core offerings and main markets, and is planning to break even or be slightly profitable this year.

🇷🇴 ING Bank says that through Home'Bank for iPhone and Android it has launched the Security Kit, a collection of tools designed to strengthen account protection against fraud attempts. Also, it will continue to offer customers the most advanced digital banking solutions in Romania.

🇺🇸 Citizens State Bank and Apiture to optimise the digital banking experience. CSB aims to introduce business banking tools such as augmented cash management and expanded payment capabilities. These tools allow customers to manage their finances more conveniently through extended access.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Nexo re-enters US market: 'America Is Back,' says Co-Founder Antoni Trenchev. Trenchev emphasized the company’s commitment to innovation and resilience, stating, “America is back, and so is Nexo,” while crediting the leadership of President Donald J. Trump for fostering an environment conducive to innovation.

🌎 Stripe launches testing for global stablecoin payments after Bridge acquisition. It aims to accelerate its development plan to meet the needs, preferences, and demands of clients and users in an ever-evolving market, while prioritising the process of remaining compliant with the regulatory requirements and laws of the local industry as well.

🇦🇪 UAE set to launch its first regulated national stablecoin. This initiative is part of the country’s broader Digital Dirham strategy, which aims to establish a framework for stablecoin operations. AE Coin is expected to streamline remittances for UAE residents, with the country ranking among the top ten global sources of remittances.

🇲🇽 Bitso Card will cease operations in Mexico. The decision aligns with Bitso's strategic shift toward developing financial solutions focusing on savings, investment, and long-term wealth management. Keep reading

🇺🇸 Coinbase to launch yield-bearing Bitcoin fund for institutions. This fund aims to offer Bitcoin exposure to institutional investors outside the US. The yield will be generated through a cash-and-carry strategy, through the difference between spot Bitcoin prices and derivatives.

🇺🇸 New MetaMask Metal Payment Card: self-custody crypto card with direct payments unveiled by CompoSecure, Baanx, and MetaMask. This metal card enables users to securely pay directly from their self-custody MetaMask wallets, eliminating the need for traditional banking intermediaries.

PARTNERSHIPS

🇺🇸 Airwallex and Panax partner to transform the way companies manage cash globally. The partnership enables finance teams to gain full visibility and control over their cash while reducing operational complexity and enhancing liquidity management.

🇪🇪 iDenfy partners with Coolbet to optimise KYC and fight fraud. The collaboration will enable Coolbet to integrate iDenfy’s automated identity and address verification solutions, as well as improve its compliance operations and reduce fraud risks in the customers’ onboarding procedures across its global markets.

🇬🇧 UnionPay International partners with Dojo to expand card acceptance. The partnership will allow UnionPay cardholders to make payments at multiple UK merchants, primarily in the hospitality sector, while also offering Dojo’s merchants the possibility to gain access to global UnionPay users.

🇺🇸 Copper partners with Circle. The integration allows Copper’s clients to convert off-exchange balances into USDC and use the stablecoin for instant trading and settlement across connected exchanges. Read more

DONEDEAL FUNDING NEWS

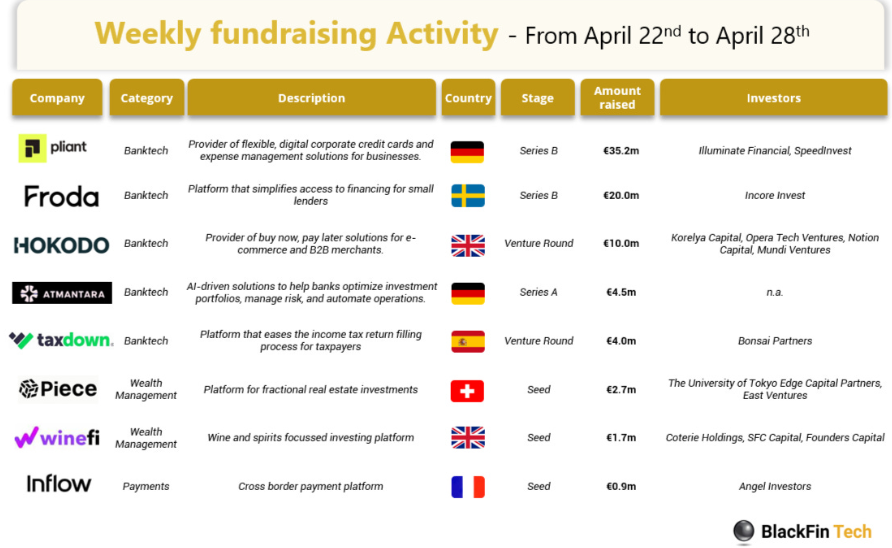

💰 Over the last week, there were 8 FinTech deals in Europe, raising a total of €87 million in equity, 2 deals in the UK, 2 deals in Germany, and one deal in each of Sweden, Switzerland, Spain, and France.

🇺🇸 Thunes raises USD 150 million in series D, led by Apis Partners and Vitruvian Partners. Thunes plans to leverage this capital to supercharge its expansion in the United States, supported by the recent acquisition of licenses across 50 U.S. States, subject to regulatory approval.

🇺🇸 European FinTech Pliant banks $40M to build the future of corporate card infrastructure. Pliant is utilising this new capital to enhance its talent and infrastructure in preparation for global expansion. The team, currently comprising 170 people from 35 nationalities, is expected to expand beyond 200 soon.

🇺🇸 Theo raises $20m for on-chain trading infrastructure. Theo’s platform provides access to institutional-grade trading infrastructure that supports a range of strategies traditionally reserved for hedge funds and proprietary trading firms.

🇸🇬 Singapore FinTech Surfin nets $26.5m in fresh funding round. It says the funds will be used to support its growth in new markets, driven by an intended expansion to its research and development capabilities. Continue reading

🇪🇺 Stablecoin payment system Next Generation secures $5 million in Seed funding. The firm says the fresh capital will finalise technical development and expand partnerships for the blockchain-driven platform. One of the products features direct integration between IBAN accounts and crypto wallets.

🇦🇪 Zest Equity secures $4.3 million pre-Series A led by Prosus Ventures. The new funding will be deployed to grow Zest's presence in the KSA and UAE, acquire specialised talent, develop new products, and scale the technology infrastructure to support growing volumes and types of transactions.

🇬🇧 Volution launches $100m fund for growing FinTech and AI firms. Through the new fund, the firm said it aims to bridge this gap by backing businesses that have already established strong revenue streams but require additional capital to expand.

M&A

🇺🇸 FinTech platform FundThrough announces acquisition of Ampla. This acquisition strengthens FundThrough’s digital-first ecosystem, creating a platform explicitly designed for small businesses that sell to larger companies and wait to get paid after invoicing.

🇺🇸 Argentex accepts IFX Payments £3 million offer for the company. The Argentex Directors said that they unanimously intend to recommend the Acquisition, which is still subject to a shareholder vote, which has yet to be scheduled. Read more

🇮🇳 FinTech unicorn Perfios acquires healthtech firm IHX. This acquisition aims to strengthen Perfios’ capabilities in claims management within the healthcare insurance sector. The financial details of the transaction were not disclosed.

🇮🇹 Mediobanca hits back in Italy's bank M&A war with $7 bln Banca Generali bid. The 13% stake dates back to the 1950s and makes Mediobanca the biggest Generali investor. It has led the Milanese bank to clash with the other two major shareholders: construction magnate Francesco Gaetano Caltagirone and Delfin.

🇵🇱 Erste in talks with Santander to buy 49% of its Polish unit. A potential divestment in Poland would come at a moment when Santander is expanding its U.S. footprint in corporate and investment banking and with its digital offering, Openbank.

MOVERS AND SHAKERS

🇦🇺 PAX Technology appoints Michael Johnson as new CEO as it scales up Australian operations. PAX Vice-President Heidi Hoo expressed enthusiasm about the recent appointment, stating that the company is "delighted to welcome Michael," highlighting his corporate experience as a key asset in scaling PAX Technology to become the leading vendor across Australia and New Zealand.

🇺🇸 REPAY announces CFO Transition. Tim Murphy will be stepping down from his role to pursue an opportunity outside of the payments industry with a private equity-backed company. Murphy will remain with the Company until May 15, 2025, to help facilitate a smooth transition.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()