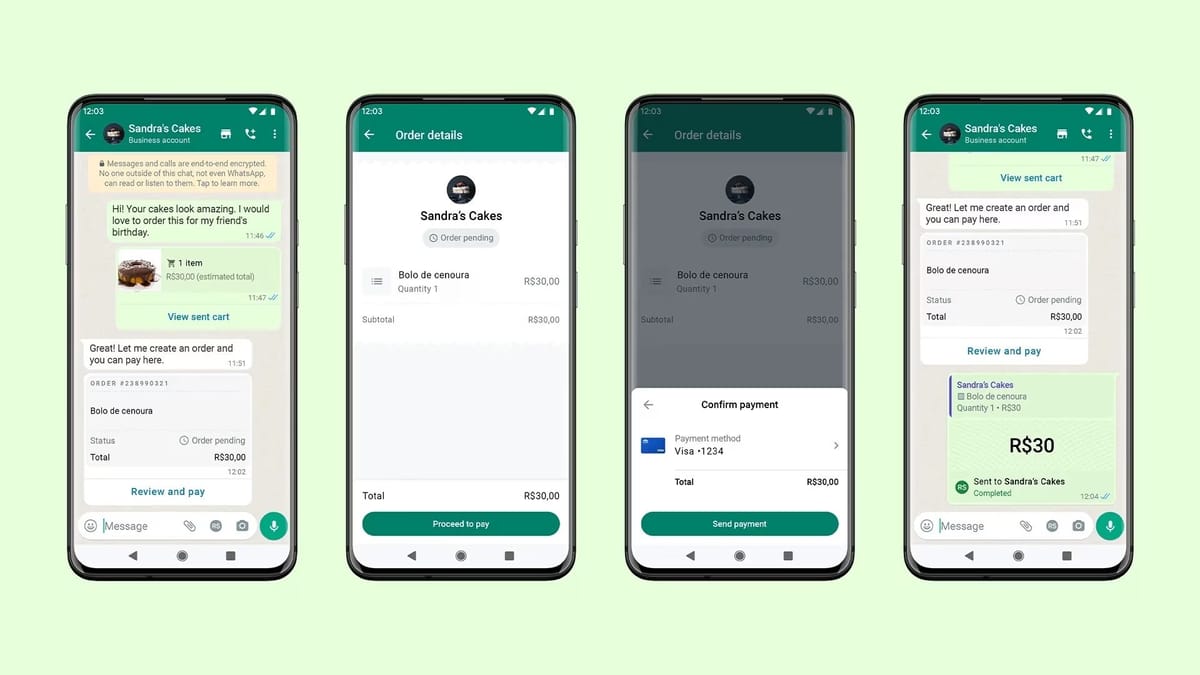

The Success Story of WhatsApp Payments in Brazil

Hey FinTech Fanatic!

Claro receives over 500,000 postpaid customer bill payments via Pix each month through WhatsApp Pay, a native payment feature in WhatsApp officially launched in early June for large companies.

Claro was among the first to adopt this feature, announced on the day WhatsApp Pay was launched in Brazil.

"It's better than we expected. It has generated a lot of efficiency and reduced settlement costs. Customers are also paying more promptly," said Albervan Luz, Claro's Director of Technology and Transformation, in an interview with Mobile Time.

Customer satisfaction among Claro users who paid their bills with Pix via WhatsApp is high, with 80% reporting a positive experience.

History and Business Model of WhatsApp Pay in Brazil

Meta gradually introduced native payment functionality in WhatsApp in Brazil. The service was first announced in June 2020 for credit card purchases but was immediately prohibited by the Central Bank of Brazil due to a lack of authorization from Mastercard and Visa, the partners in the project.

After nine months of adjustments, the Central Bank allowed the service in March 2021, initially only for transfers between individuals using registered debit cards within WhatsApp.

In April 2023, the app started allowing users to make payments with credit cards, but this was limited to small and medium-sized businesses.

Large companies were only permitted to receive credit card payments in June 2024, coinciding with the addition of Pix payments.

Thus, it took four years from the first attempt blocked by the Central Bank in June 2020 for the product to be fully available to the Brazilian public.

It's worth noting that WhatsApp does not charge for the use of WhatsApp Pay. Its business model remains focused on charging for conversations between brands and consumers, with the price depending on who initiated the communication and its purpose.

I'm off to Curacao 😉 Enjoy your weekend!

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

FEATURED NEWS

📜 Informa makes £1.2bn swoop for fellow listed rival Ascential the organizer of major FinTech event Money20/20. Ascential is recommending the offer to shareholders. Informa said it expects significant revenue opportunities to arise through combination, including cross-selling and expanding into fast-growth economies, with a focus on the Middle East and Saudi Arabia.

#FINTECHREPORT

📊 Checkout.com, a leading global digital payments provider, announced the results of its commissioned 2024 Total Economic Impact™ (TEI) study conducted by Forrester Consulting. Access the full report

FINTECH NEWS

🇦🇺 Neobroker Stake dumps Sanlam and eyes new wealth play. The tide is beginning to turn on ‘shadow licensing’ in Australia’s financial services sector as the nation’s third largest retail broker Stake secures a licence in its own right and looks to evolve into a broader wealth management platform.

🇬🇭 Flutterwave’s Ghana payment license paves way for secure transactions. The milestone marks a significant expansion of Flutterwave’s operations in Africa, enabling the company to offer a comprehensive suite of payment services directly within, and through Ghana.

🇺🇸 Klarna argues for a bespoke regulatory framework, while AARP supports the rule, emphasizing the need for consumer protections as buy now, pay later (BNPL) usage grows among older Americans.

🇸🇴 Waafi by Salaam Bank taps Paymentology to enable Somalia’S contactless payment vision. This collaboration marks a significant milestone in the region's financial landscape, introducing digital and contactless payments through Waafi by Salaam Bank's digital first initiative.

PAYMENTS NEWS

🇺🇸 Nium, a FinTech in real-time cross-border payments, has announced the expansion of its local funding and collection capabilities to more than 40 countries and 15 currencies, with more to come. The move makes Nium one of the only providers to offer a network this wide.

🇬🇧 Thredd, a global payments platform, reports both industry-wide growth in FinTech-led digital payments and the renewal of its partnership with Zilch, the world’s first ad-subsidised payments network (ASPN). The two companies work collaboratively on product and service innovations to improve the experience of over 4 million customers using Zilch.

🇨🇴 Colombian Paytech Zulu has processed its first US$100 million from more than 400 clients and has connections in over 50 countries worldwide. Zulu focuses on helping SMBs with their international payments, especially those making their first imports or exports without a treasury team to ease the process.

🇪🇨 Digital Wallet PeiGo now accepts In-Person payments with Visa PeiGo via Google Wallet and Google Pay in Ecuador. This advance highlights the commitment of PeiGo and Minsait Payments to be gateways to banking in Ecuador.

🇪🇬 Paymob fuels MENA’s E-commerce market by offering embedded shopify payments. Paymob is one of the first regional payment service provider (PSP) to offer embedded checkout experiences to merchants in MENA. Read on

🇹🇭 Financial solutions company Opn has announced its strategic partnership with BigPay in order to accelerate its expansion strategy in the region of Thailand. Following this announcement, the collaboration is set to facilitate secure and efficient digital payments, as BigPay will continue to expand its services into the Thai market.

🇬🇧 Judopay adds Cashflows Advance to platform. The strategic move will enable more businesses across the UK and Europe, such as those in the taxi and parking sectors, to access much-needed financing, during uncertain economic times in a way that works for them.

OPEN BANKING NEWS

🇺🇸 Plaid officially announces open finance solution for US data providers. Plaid’s open finance solution is designed to meet the industry's need for API connectivity and more visibility into consumer connections while simplifying compliance for data providers.

REGTECH NEWS

🇳🇱 Global PSSL and Confide Platform unite to enhance sustainable finance governance. In this groundbreaking collaboration, Global PSSL Secretariat will leverage the advanced capabilities of the Confide Platform to ensure the confidential, efficient, and transparent resolution of grievances and internal conflicts.

DIGITAL BANKING NEWS

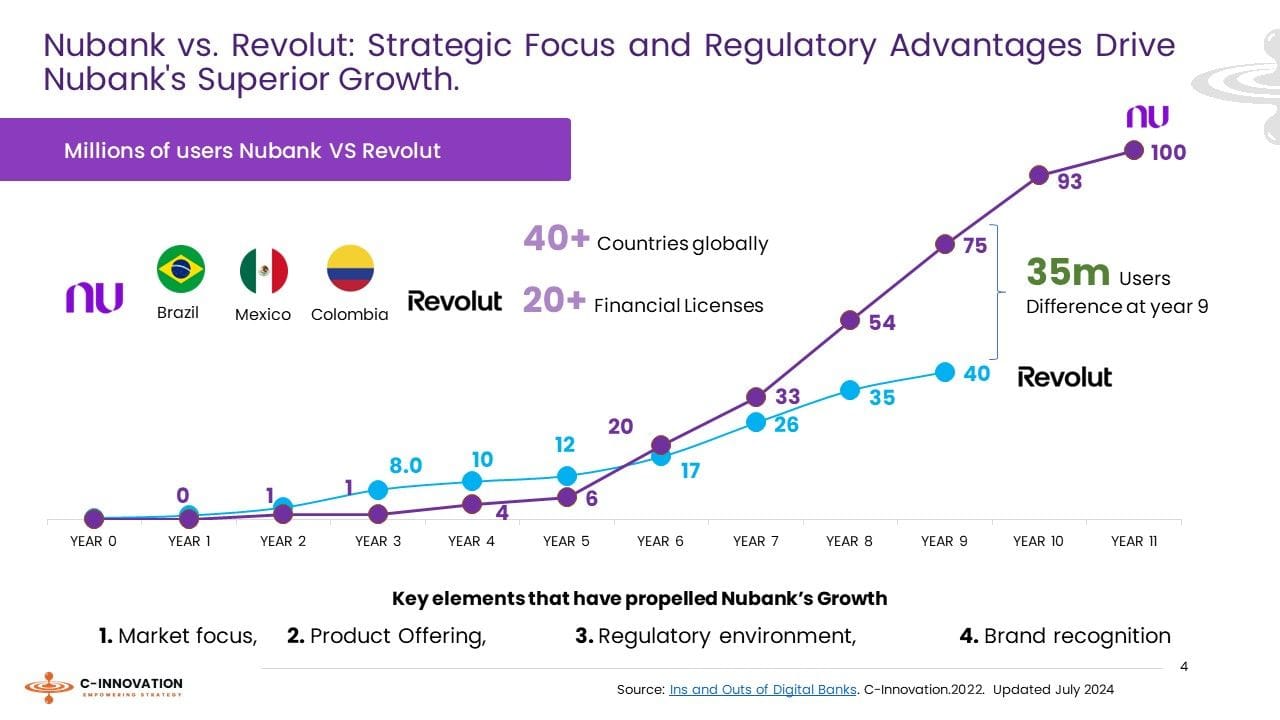

Here is a comparison:

🇦🇺 Up introduces Travel Mode: The ultimate solution for Aussie travellers. By integrating the currency converter toggle into Up’s ecosystem, customers can easily see their spending balance in both AUD and the local currency, simplifying money management.

🇬🇧 Ampere, the neobank providing all-in-one financial services for SMEs, has announced its partnership with Mastercard to expand its services and transfers offering, marking a milestone in its mission to streamline financial solutions for SMEs. Read more

🇳🇬 Raenest, Leatherback, Vesti, and Graph pitch themselves to African founders as Mercury alternatives. African FinTechs that help companies access banking services in the U.S. and Canada are wooing founders affected by Mercury’s recent abrupt compliance changes.

🇫🇷 Paris-based BNP Paribas is working with telecom service provider Orange to provide its 21.8 million customers with personal financing solutions. The “tailored financing” will provide customers with loans up to 3,000 euros ($3,200) to buy mobile phones, according to the release.

🇺🇸 Monzo is introducing new security controls to combat rising fraud, although concerns around the viability of two of these measures suggest uptake may not be strong. This measure cuts the window of opportunity for scammers (if consumers are out, they will not be able to facilitate a transaction). Find out more

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Think you own your crypto? A new UK law would make sure. The UK Law Commission has written a draft law that will patch a legal uncertainty. The commission’s aim is to ensure that crypto is legally treated as personal property.

🇺🇸 Tokenization platform OpenEden has announced that it will bring tokenized US Treasury bills (T-bills), a short-term US government debt obligation backed by the US Department of the Treasury, to the XRP Ledger (XRPL) and its users for the first time.

🇬🇧 Cronos (CRO) partners with Revolut to launch 'Cronos Learn,' a course aimed at educating users about cryptocurrencies and Web3, available on the Revolut app. This collaboration aims to demystify crypto and Web3 technologies, making them more accessible to the general public, according to Cronos Labs.

🇺🇸 Coinbase reports $1.4B in revenue, beating estimates. Transaction revenue came in at $781 million, down 27% quarter-over-quarter, while the company reported $600 million in subscriptions and services revenue.

DONEDEAL FUNDING NEWS

🇲🇽 Mexican FinTech Crediko raises $2.5M. This investment will allow Crediko to pivot its business model for the 2024-2025 school year, generating important insights both in its algorithm and model. For the 2025-2026 school year, a significant increase in loan placements, talent acquisition, and product improvement is expected.

🇮🇳 M2P FinTech to raise $80 Mn at $900 Mn valuation. Sources assert that funding will be used to beef up tech infrastructure and accelerate growth pedal in India and overseas markets among others. Read full article

🇸🇮 Leanpay clinches €10m in Series B to expand BNPL services in Central Europe. “This investment will improve Leanpay’s capital structure and decrease overall financial risk. Additional funds will enable greater investment potential and strengthen the financial stability of all companies in the Leanpay group,” according to the firm’s CEO.

🇮🇳 Neobanking startup Zolve to raise $25 million from Creaegis as part of larger round. The new round values the company at around $330-360 million. Read full article

🇱🇹 Bourgeois Boheme (BoBo) raises €6.5m for financial platform for the rich. BoBo claims to be the first FinTech to digitise family cash flow management and allow secure seamless high-value transactions by using its proprietary security systems enhanced by AI database analysis.

MOVERS & SHAKERS

🇳🇬 E-commerce giant Jumia appointed Anthony Mbagwu as the managing director of its Nigerian FinTech arm, JumiaPay. Mbagwu joins JumiaPay from rival FinTech PalmPay where he was a senior business development and partnership manager for ten months.

🇺🇸 Barclays announced the appointment of Jonathon Traer-Clark as Head of Americas for Barclays Global Transaction Banking (GTB) business. In this role, Jonathon will continue to progress GTB’s growth strategy, as it increasingly supports treasury teams at UK and European based businesses with services in the US.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()