The Impact of Apple Pay in Korea, Airbnb's 'Pay Over Time' launch, and SumUp's Mega Round

Hey FinTech Fanatic!

Apple's recent moves have been stirring up significant discussions, especially in the U.S., where it's poised to part ways with Goldman Sachs for its financial services like the Apple Card. However, the spotlight isn't solely on the U.S. market; there's interesting development in South Korea too.

Here, Hyundai Card has reported a loss of 2.27 billion Won (approximately $1.72 million) following its partnership with Apple Pay.

This scenario illustrates a common pattern observed among credit card companies aligning with mobile payment systems like Apple Pay. Initially, there's an undeniable allure for new customers, but maintaining long-term profitability remains a complex challenge. Hyundai Card, the sole and exclusive partner of Apple Pay in South Korea, exemplifies this trend.

After rolling out Apple Pay in March, Hyundai Card saw an impressive influx of 203,000 new customers, as per the Credit Finance Association's data. But this surge was short-lived. The following months witnessed a gradual decline: 166,000 new customers in April, 145,000 in May, and 120,000 by July.

A deeper dive into the financials reveals that Hyundai Card is shouldering a hefty fee of 0.15 percent per transaction to Apple, a rate that's notably higher than in other countries. This expense, among other factors, has contributed to Hyundai Card's substantial loss of 2.27 billion Won since March, the month they introduced Apple Pay.

Yoon’s office estimates that the fees paid to Apple and Visa alone would amount to 341.7 billion won if Apple Pay took over 10 percent of the credit card market in South Korea.

Meanwhile in Europe, Airbnb launches Pay Over Time with Klarna in the UK. Pay Over Time with Klarna recently launched in eight other countries across Europe including Czechia, France, Germany, Greece, Ireland, Italy, Portugal, and Spain, with more expected early next year.

Finally, a massive funding round for SumUp. The mPos Payments company raised €285M more in growth funding in a bumper round that values the company at $8.5 billion.

FinTech is alive and kicking!

Enjoy more FinTech industry news I listed for you below👇, and I'll be back tomorrow!

Cheers,

POST OF THE DAY

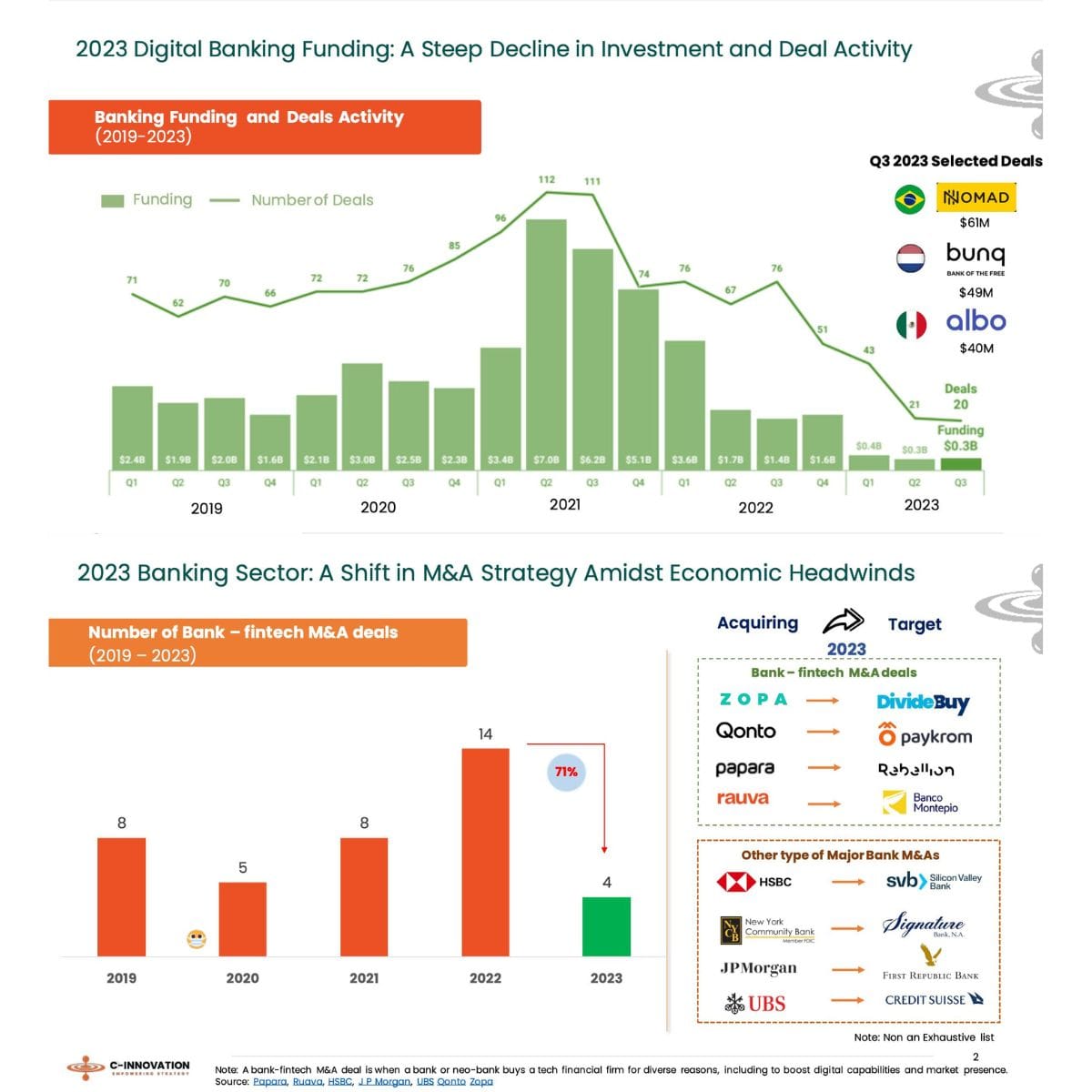

The digital banking sector in 2023 is experiencing a notable shift in its merger and acquisition (M&A) dynamics. Lets dive in👇

#FINTECHREPORT

FinTech Wales, an independent membership association and champion of the Fintech and Financial Services industry in Wales, has published the “Fintech in Wales Annual Report for 2022/23.” Read the full report here

FINTECH NEWS

🇺🇸 PayQuicker launches exclusive deals and offers for US account holders. U.S. payees can now access exclusive deals and financial wellness offerings through PayQuicker’s payout portal, providing convenient ways to utilize their earnings with trusted partners.

🇬🇧 Moneyhub granted Credit Information Services permissions by the Financial Conduct Authority. This functionality will be rolled out across Moneyhub’s award-winning consumer app and to clients utilising its Open Finance technology. Read more

🇺🇸 Chipper services 100% of States in the US and holds 40 money transmitter licenses. This is possible through Chipper’s US licensing program, having secured money transmitter licenses for 80% of US states, while well-established banking partnerships support operations in the remaining 20%.

Paytron selects Thredd as global issuer processor. Using Thredd’s cutting-edge issuer processing tech, Paytron can now effortlessly issue global virtual cards through its new employee expense management tool.

PAYMENTS NEWS

🇨🇦 Visa and Mastercard lower Canadian interchange fees. From next Autumn, small businesses and non-profits with less than $300,000 in Visa sales and less than $175,000 in Mastercard sales will qualify for fee cuts of up to 27%. Read more

🇮🇹 Intesa Sanpaolo rolls out contactless payment ring for customers to tap and pay at the checkout. The Italian bank has collaborated with Mastercard on the roll out of the ring developed by Swedish fintech Tapster. The wearable is shipped in an inactive state together with a QR code that allows activation only by the cardholder.

🇬🇪 Visa partners with TBC to launch Visa Direct in Georgia. This platform empowers TBC customers for quicker and more efficient international payments, enabling fund transfers, payments, and receipts through leading electronic wallets and mobile services globally.

🇦🇺 Zip faces heavy refinancing burden in 2024. As the ranks of Australia’s loss-making BNPL sector thin out, the industry’s second largest provider Zip Co is facing a material refinancing challenge in 2024. According to disclosures in its 2023 accounts, Zip needs to refinance more than half of its secured funding facilities next year

DIGITAL BANKING NEWS

🇦🇺 Neobank Volt enters solvent liquidation as wind down continues. Numerous entities affiliated with failed neobank Volt have entered solvent liquidation with expectations all creditors will be paid in full over the course of a wind-down process that could take another year.

BLOCKCHAIN/CRYPTO NEWS

🇮🇹 Conio adds Coinbase Prime to liquidity pool. This new agreement will enable a quicker and more secure channel for Italian banks and financial institutions to meet the growing demand for digital assets accessing Coinbase’s liquidity.

DONEDEAL FUNDING NEWS

In the past week, we saw 6 deals in Europe for a total amount of €88.9m raised officially with two deals in Germany, two in the UK, one in Spain, and one in Estonia. Click here for more info.

🇯🇵 Revenue-Based Financing Platform Yoii Secures $5.5m in a series A funding round anchored by Emellience Partners. The company intends to use the funds to expand operations and its business reach in Japan and across the Asian market.

🇺🇸 Simply Homes nabs $22M, leverages AI to tackle affordable housing crisis. The company looks for stable markets that aren’t susceptible to wild fluctuations in the housing industry. It currently operates in Pittsburgh, Pennsylvania and Cleveland, Ohio. Read more

🇮🇹 Perugia-based fintech Cents bags €1.15 million pre-seed to pave the way for IAAS in Italy. The funding will be used to launch the first European Impact-as-a-Service™ (IAAS) platform and to enhance a B2B (and B2B2C) offering that allows companies to seamlessly integrate social and environmental causes into their core business.

🇨🇴 Citi leads investment in Fintech Supra for expansion in Colombia. The new capital will enable the growth of Supra's Colombian operations to fulfill its role as a payment aggregator, in partnership with Foreign Exchange Market Intermediaries (IMC) and authorized payment service providers.

M&A

🇮🇩 TikTok set to restart e-commerce in Indonesia with $1.5 billion Tokopedia investment. TikTok has agreed to spend $840 million to buy most of Indonesian tech conglomerate GoTo's (GOTO.JK) e-commerce unit - a move that appears to allow it to restart its online shopping business in Southeast Asia's largest economy.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()