The Hindenburg Effect: Temenos Market Value Plummets

Hey FinTech Fanatic,

Welcome to the latest edition of my newsletter!

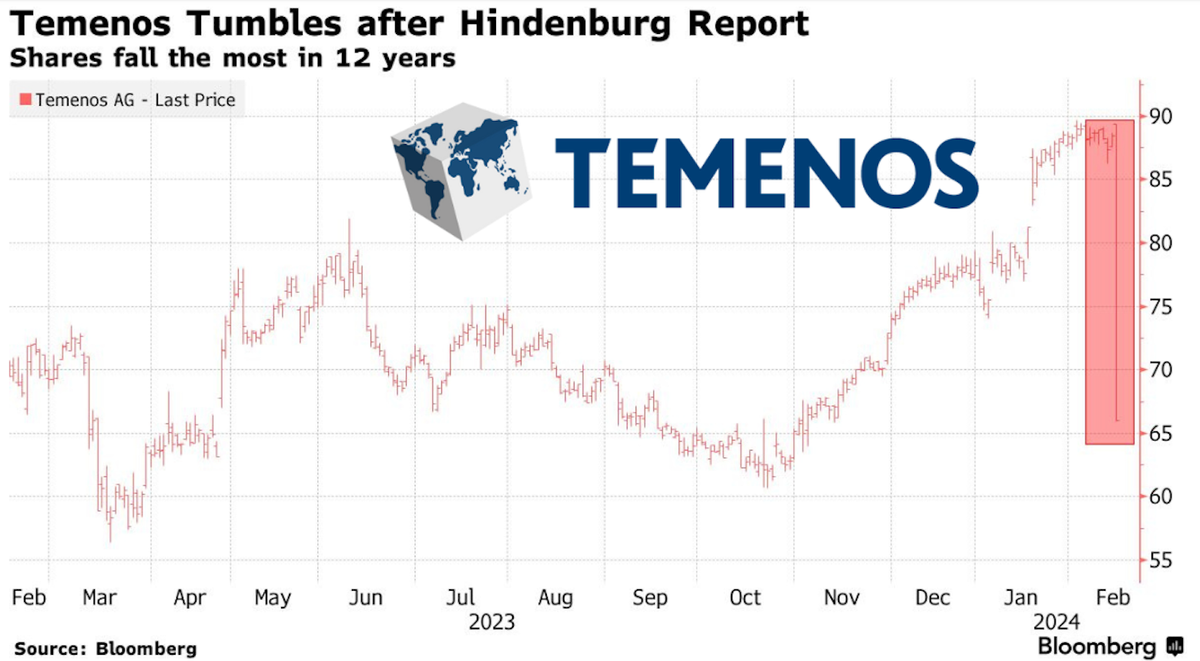

Temenos experienced a dramatic fall, losing up to 33% of its market value, a reduction amounting to $2.4 billion, following accusations from Hindenburg Research.

The firm, known for its investigative short-selling, claimed to find significant discrepancies in the financial records of the Swiss-based banking software provider, alleging the company engaged in serious financial misconduct and earnings manipulation.

These allegations, which Hindenburg described as well-known secrets among Temenos employees, led to a significant sell-off in the company's stock.

The impact on Temenos' stock was profound, with a 32% decrease to 60 francs per share by mid-afternoon in Zurich, marking its most substantial decline since the end of 2002. This plummet has reduced the company's valuation to roughly a third of its 2019 high of 13 billion Swiss francs ($14.7 billion).

Hindenburg Research, under the leadership of Nate Anderson, gained notoriety for its aggressive stance against major corporations and high-profile business figures such as Gautam Adani, Jack Dorsey, and Carl Icahn, previously causing significant drops in their companies' market values.

But wait, there is more breaking news from JP Morgan, see the Breaking News section below👇

In addition to this breaking news, I've compiled more updates from the global FinTech industry for your perusal.

Have a great weekend!

Cheers,

BREAKING NEWS

J.P. Morgan accused of trying to drive down the valuation of Greek payments company Viva.com. Haris Karonis has begun legal proceedings against the Wall Street bank over what he claims are tactics to suppress his company’s growth.

J.P. Morgan approached Greece’s central bank with concerns about “serious governance failings” at Viva.com, a Greek FinTech company it partly owns, as well as “misconduct” of the firm’s CEO and co-founder.

FINTECH NEWS

🇨🇭 Shares in core banking vendor Temenos have plunged, after Hindenburg Research shorted the company alleging "accounting irregularities, failed products and an illusive turnaround". Read the full article here

🇺🇸 Zillow is expanding its “housing super app” to more markets after seeing how well it has been received. The company is also continuing to add functionality to the app for both the real estate sales and rentals markets, With this new app, users can experience a 360-degree view of every room in homes that are for sale, Zillow said in a press release.

Tonik partners with Xendit to extend payment options. The partnership marks a significant milestone for both companies, as they join forces to deliver secure, convenient, and customer-centric financial solutions, and will further enrich Tonik’s ecosystem by providing customers with new and convenient channels for their Tonik accounts.

PAYMENTS NEWS

🇪🇬 Contact and Al Ahly Momkn partner to improve payment services in Egypt. This partnership reflects the shared vision of the two companies to facilitate payment operations for customers through Al Ahly Momkn’s branches and points of sale across Egypt, with more than 90,000 points of sale and over 5mln users.

🇵🇱 2023 was a very impressive year for BLIK Payments. It now has 15,8 million users (3 million more than a year ago), and the total value of transactions in 2023 reached almost a quarter of a trillion PLN (243 billion PLN – 56.2 billion EUR), among other stats that will blow you away. Keep reading.

🇫🇷 Adyen expands its partnership with Uber to incorporate the CB payment network for transactions in France. The Dutch fintech stresses that this initiative will offer Uber's French customers more choice in the way they pay, with the introduction of a new payment option, with CB being the most widely used payment method in the country, and more than 76 million branded cards in the market.

REGTECH NEWS

🇨🇦 Canada's EQ Bank partners with Trulioo for Identity Document and Biometric Verification. EQ Bank chose Trulioo Identity Document Verification, Workflow Studio and Business Verification to streamline customer and business onboarding. Read more

DIGITAL BANKING NEWS

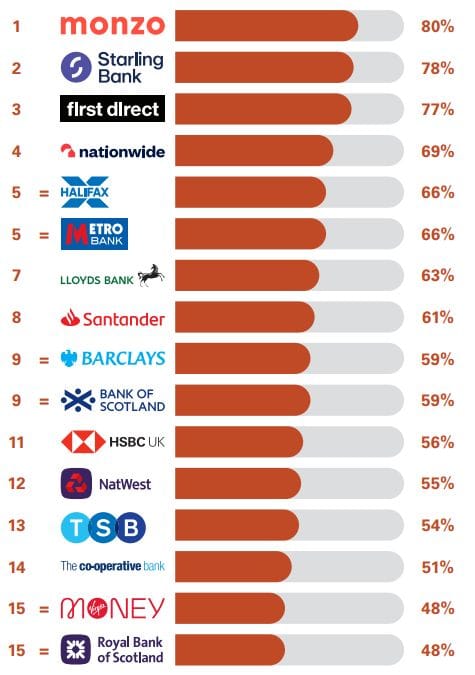

Named and shamed: UK 🇬🇧 Banks by overall service quality by City AM👇

🇨🇴 Ualá, an Argentine FinTech company operating in Colombia with a financing company license for two years, has not only surpassed 400,000 clients in the country but also become a financial refuge for over 90,000 Venezuelans residing in Colombia under temporary protection permits (PPT). Many financial institutions often close their doors to these individuals.

🇺🇸 US seeks more than $1 billion from collapsed SVB for taxes. The US Internal Revenue Service is seeking to recover about $1.4 billion in taxes it claims are owed by SVB, the regional lender that failed last year. The complaint comes on the heels of a similar one from NYC, which is trying to collect more than $2.1 million in back taxes it claims SVB owes.

🇲🇽 FitBank, a Brazilian Banking as a Service platform, is solidifying its operations in Mexico and gearing up to make its debut in Guatemala. FitBank signed an alliance with the financial group Actinver in June 2023, offering in Mexico all the solutions it already has in Brazil. The first operation was carried out in August, and billing started in November.

🇯🇵 Rakuten Bank surpasses 15 million customer accounts, and the bank recently achieved the milestone of 10 trillion yen in total balance of non-consolidated deposits at the end of December 2023. Rakuten Bank customers are using multiple services after opening their accounts, such as bank transfers and using their accounts to receive salaries and bonuses.

Revolut has announced the launch of an advanced scam detection feature to help protect customers from card scams. Customers can now experience an added layer of security protection, on top of the technology already in place to detect APP scams. The firm will soon launch in-store payments and more business banking services. Some of the features will be tested in Ireland ahead of other countries.

🇦🇺 A network outage at a key supplier to Australian challenger banks has left customers unable to make online transfers or use mobile banking apps. Data Action, a software company which provides online banking services, has confirmed a series of incidents that have crippled the online banking services of at least six banks, including Ubank, Bank Australia, Defence Bank, Beyond Bank, People’s Choice and P&N Bank.

🇿🇦 TymeBank's TFG partnership hits 1 million customers, and will soon offer loans. TymeBank reached its first month of profitability in December 2023, less than five years since its launch in February 2019, and now has about 8.7 million customers in South Africa.

BLOCKCHAIN/CRYPTO NEWS

Revolut unveils $BONK incentive for crypto learning. The fintech giant proposes an engaging 93 billion BONK giveaway to encourage users to explore cryptocurrencies. The initiative aims to educate users on crypto, pending approval from a DAO Council vote.

DONEDEAL FUNDING NEWS

🇨🇴 Colombian payments startup Bold raises $50m. The startup boasts more than 150,000 monthly active merchants as it works to foster financial inclusion through the democratisation of Colombia’s digital economy. More on that here

🇮🇳 Mwyn Tech, which operates the digital banking platform Freo, has raised debt funding from the Small Industries Development Bank of India (Sidbi). The company will utilise the funds for growth into newer categories and segments as well as to expand into new pan-India geographies.

M&A

Carbon completes acquisition of Vella Finance and launch of a revolutionary AI-powered SME banking platform. This dual announcement marks a significant leap forward in Carbon’s mission to empower small and medium-sized enterprises (SMEs) with advanced, accessible financial services that leverage the latest in artificial intelligence.

🇮🇳 Juspay acquires LotusPay to strengthen recurring payment offerings. This acquisition represents a significant advancement in India’s payments landscape, offering businesses enhanced recurring payment solutions and bolstering the digital payment ecosystem.

🇮🇳 Paytm is considering the acquisition of Bitsila. Specifically, moneycontrol.com has reported that Paytm is reportedly finalising an acquisition deal with Bitsila amidst uncertainties surrounding its payments business due to regulatory issues.

🇫🇷 Crédit Agricole Consumer Finance (CACF) has announced its intention to acquire Pledg, a Paris-based fintech specializing in interest-free installment payments. This move aims to enhance Sofinco, CACF's brand, by upgrading its technological capabilities.

MOVERS & SHAKERS

🇬🇧 Duncan Cockburn has announced that he is stepping down as CEO of OneBanx, the UK fintech he founded in 2019. Cockburn took to LinkedIn last week to confirm his decision to “step back from the role and embark on a new challenge”. This new challenge, he reveals, will see him installed as the interim finance director of London-based automotive insurtech Zego.

PPRO appoints new CCO and CMO. The leading digital payment platform based in London, has announced the appointment of two senior leaders. Eelco Dettingmeijer as Chief Commercial Officer and Mariette Ferreira as Chief Marketing Officer. These strategic hires come at a time when PPRO is gearing up for a new phase of growth.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()