The Evolution and Power of Payment Orchestration in FinTech

As the FinTech sector witnesses unprecedented growth, it's crucial to understand the evolution of its components. A term that has become increasingly relevant and vital in recent years is 'Payment Orchestration'. For the uninitiated, it might seem like yet another tech jargon, but the implications and benefits it carries for the modern commerce world are profound.

From the Roots: Tracing Payment Gateways

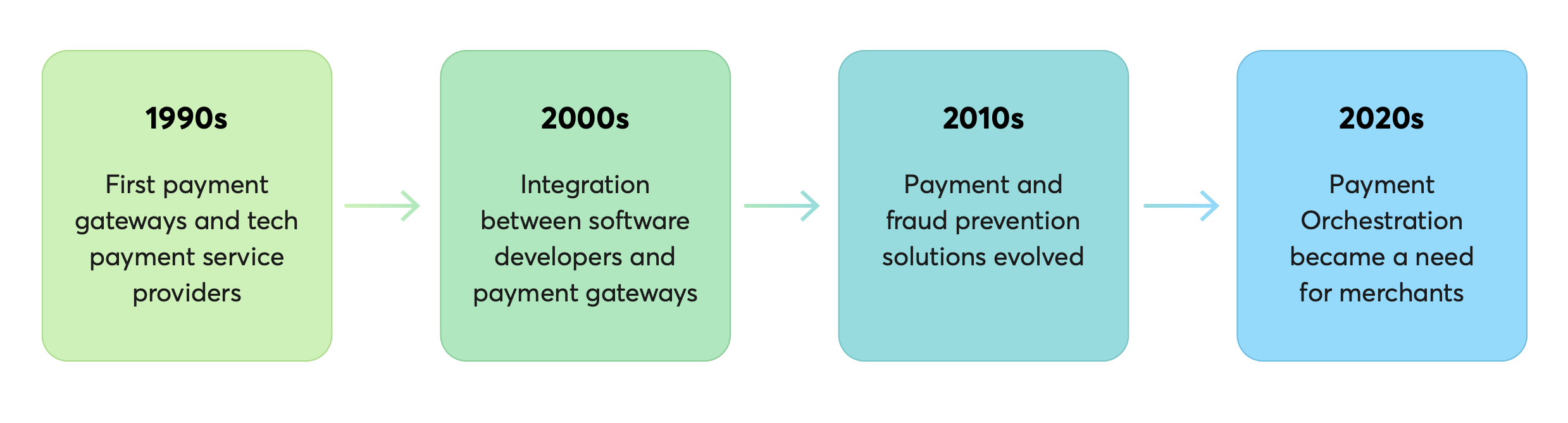

The emergence of E-commerce in the 1990s was an era of innovation, giving birth to the first payment gateways. Yet, they were embryonic, lacking advanced tools for collection and reconciliation.

Fast forward to the 2000s, and the limitations of serving an increasingly diverse customer base via a single gateway led to integrations between developers and gateways.

However, the 2010s brought about a significant transformation. Payment Service Providers (PSPs) began to evolve, encompassing alternative payment methods, fraud prevention mechanisms, and facilitating global payments in local currencies.

It was in the 2020s that the need for a holistic system became more evident. Over 60% of retailers found themselves collaborating with multiple payment providers, making payment orchestration no longer a luxury but a necessity for contemporary businesses.

The Maestro Behind Transactions: What is Payment Orchestration?

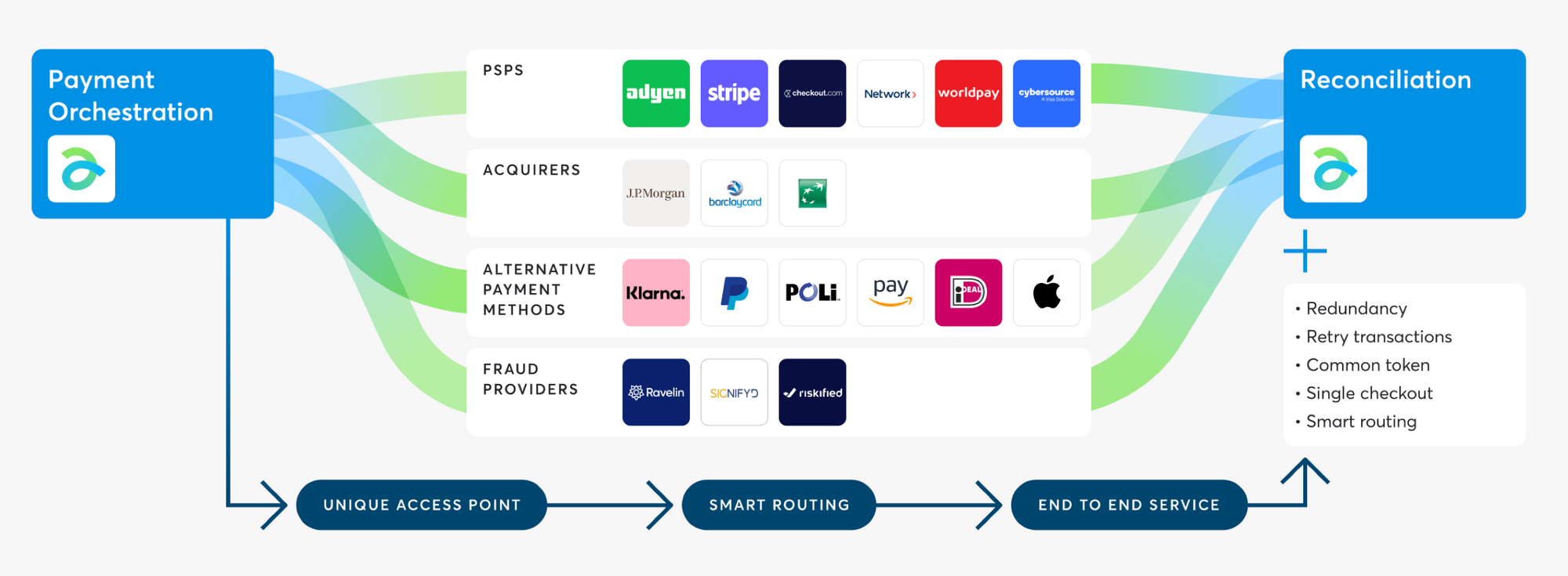

Just as a maestro ensures the harmonization of an orchestra, payment orchestration skillfully integrates and centralizes various payment processes. Think of it as the backbone ensuring the seamless, efficient journey of a transaction from start to finish.

At its core, this system centralizes multiple gateways, paving the way for a seamless consumer checkout experience. "Smart routing", a key feature, ensures transactions find the most efficient path, much like water finding its course. This becomes especially critical when we consider data like Europe's e-commerce statistics from early 2021, where nearly a quarter of Mastercard's payment authentications were unsuccessful. Payment orchestration effectively combats such bottlenecks.

According to Business Research Insights, the potential and utility of this sector are vast. By 2027, it's anticipated that the payment orchestration market will command a value close to a whopping $5 billion.

Payment Orchestration: A Game-Changer

Key advantages that make payment orchestration indispensable include:

1️⃣ Cost and Time Efficiency: By offering a range of providers, merchants can opt for ones with the most favorable transaction fees.

2️⃣ Enhanced Conversion Rates: An amalgamation of smart routing, diverse payment options, and local currency support uplift conversion rates.

3️⃣ Optimized Transaction Success: In our digital age, ensuring every transaction goes through is pivotal. Payment orchestration drastically cuts down decline rates.

4️⃣ Cultivating Customer Loyalty: Tailoring preferred payment methods translates to an enhanced buyer experience.

5️⃣ Facilitating Global Outreach: Understanding and catering to regional payment nuances is pivotal for businesses with a global vision.

6️⃣ Swift Scaling: Merchants can rapidly onboard solutions that bolster business growth.

7️⃣ Bolstering Fraud Prevention: A unified platform reduces the risk of fraud.

8️⃣ Efficient Reconciliation: Automation cuts down errors, optimizing internal resource utilization.

9️⃣ Real-time Ledgers: Almost instantaneous data visibility ensures the integrity of every transaction.

For those eager to delve deeper into this fascinating world of FinTech, the report by Axerve offers a treasure trove of insights. You can explore more by visiting Axerve's report.

Comments ()