The AI Revolution in Identity Fraud: Bypassing KYC with Fake IDs

Hey FinTech Fanatic!

OnlyFake's Telegram account recently declared the end of traditional document forgery, as the underground site offered fake IDs from 26 countries for $15, using AI to generate realistic images complete with customizable credentials and backgrounds.

These IDs, according to its founder "John Wick," could bypass Know Your Customer (KYC) checks on major crypto platforms like Binance, Kraken, and Coinbase, as well as traditional finance apps like Revolut.

This claim was substantiated by 404 Media's successful attempt to pass OKX's verification using one of these fake IDs.

The advancement of AI in creating convincingly fake identities poses a significant challenge for online verification processes, which previously relied on photographs or video verifications to ensure authenticity.

Recent incidents, including a $25 million scam involving AI-generated personas on a Zoom call, highlight the escalating difficulty in distinguishing between real and AI-generated identities.

Experts suggest that the solution might lie in employing AI to combat AI fraud, focusing on unique biometric data for verification. However, this raises concerns about privacy and the security of biometric databases.

The ongoing battle against digital identity fraud forces a choice between continuing to fight against increasingly sophisticated fake identities or risking the misuse of real ones, potentially reverting to in-person verification methods.

The disappearance of the OnlyFake site following media exposure does little to mitigate the issue, as the technology and methods for creating fake IDs are now widely accessible, indicating a persistent and evolving challenge in digital authentication.

Talking about Regtech; Founders Factory is hosting an invitation-only breakfast on Unmasking Wirecard – Insights Over Breakfast with my friend Pav Gill on Thursday 29th February (9am-10.30am GMT) at their offices in London.

Pav Gill is the whistleblower who brought the Wirecard scandal to light but is also founder & CEO of Confide, a governance, risk and integrity platform.

During breakfast, Pav will discuss the Wirecard saga, diving into the lessons learned and how they reshape our understanding of corporate misconduct and the essential strategies for protecting brand reputation, nurturing an ethical work culture. Apply for an invite of you like to learn more!

Finally, I would like to invite you to share your thoughts on the Apple Card success in todays Poll.

Stay tuned for more FinTech insights, and I look forward to reconnecting with you in tomorrow's newsletter!

Cheers,

BREAKING NEWS

🇺🇸 Capital One Is Buying Discover Financial. The deal would combine two of the largest credit-card companies in the U.S. A deal could be announced as soon as Tuesday, according to people familiar with the matter.

ARTICLE OF THE DAY

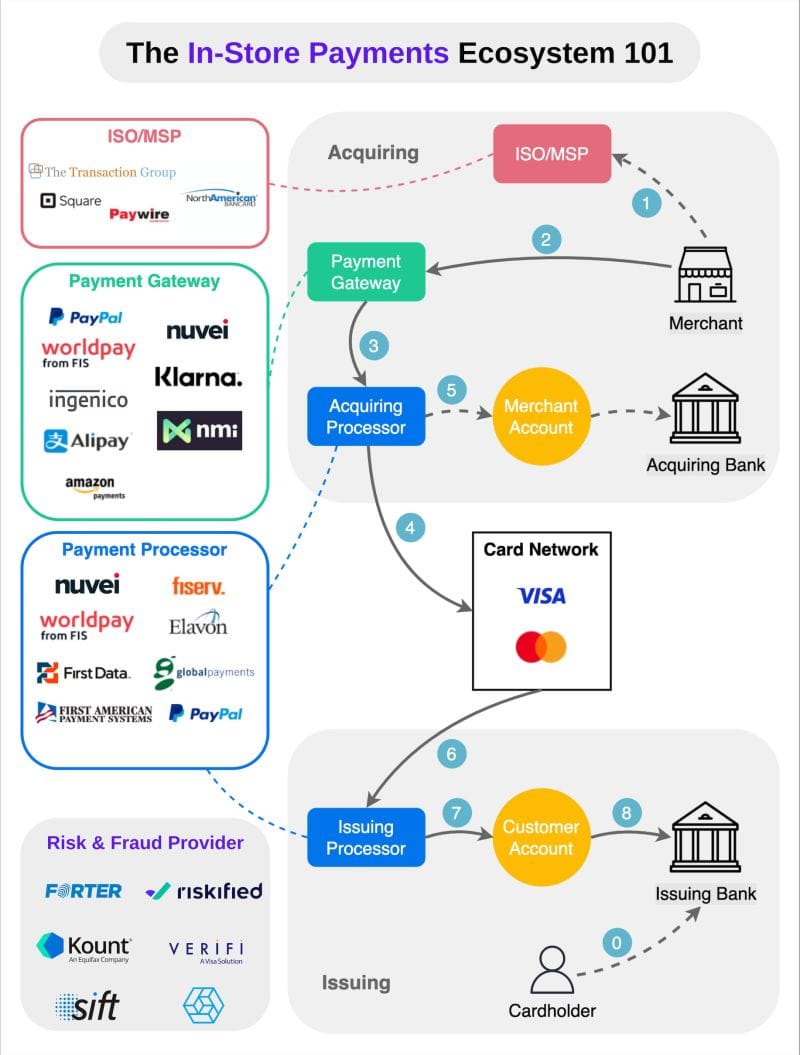

The first edition of my Payments Newsletter with Arthur Bedel is out!

The In-store Payments Ecosystem 101 explained in 8 steps:

#FINTECHREPORT

Check out “FinTech: State of the Industry,” by PitchBook.The note dives into the latest trends and opportunities within the space as the sector enters a period of normalization. Access the full report here

INSIGHTS

🇺🇸 Can real-time payments help change the world? Thomas Warsop, President & Chief Executive Officer at ACI Worldwide, shares his views. Click here to read the complete blogpost.

Sequoia Capital is pushing for one of its most venerated former partners, Michael Moritz, to step down from his personal board position at the “buy now, pay later” company Klarna. Read on

FINTECH NEWS

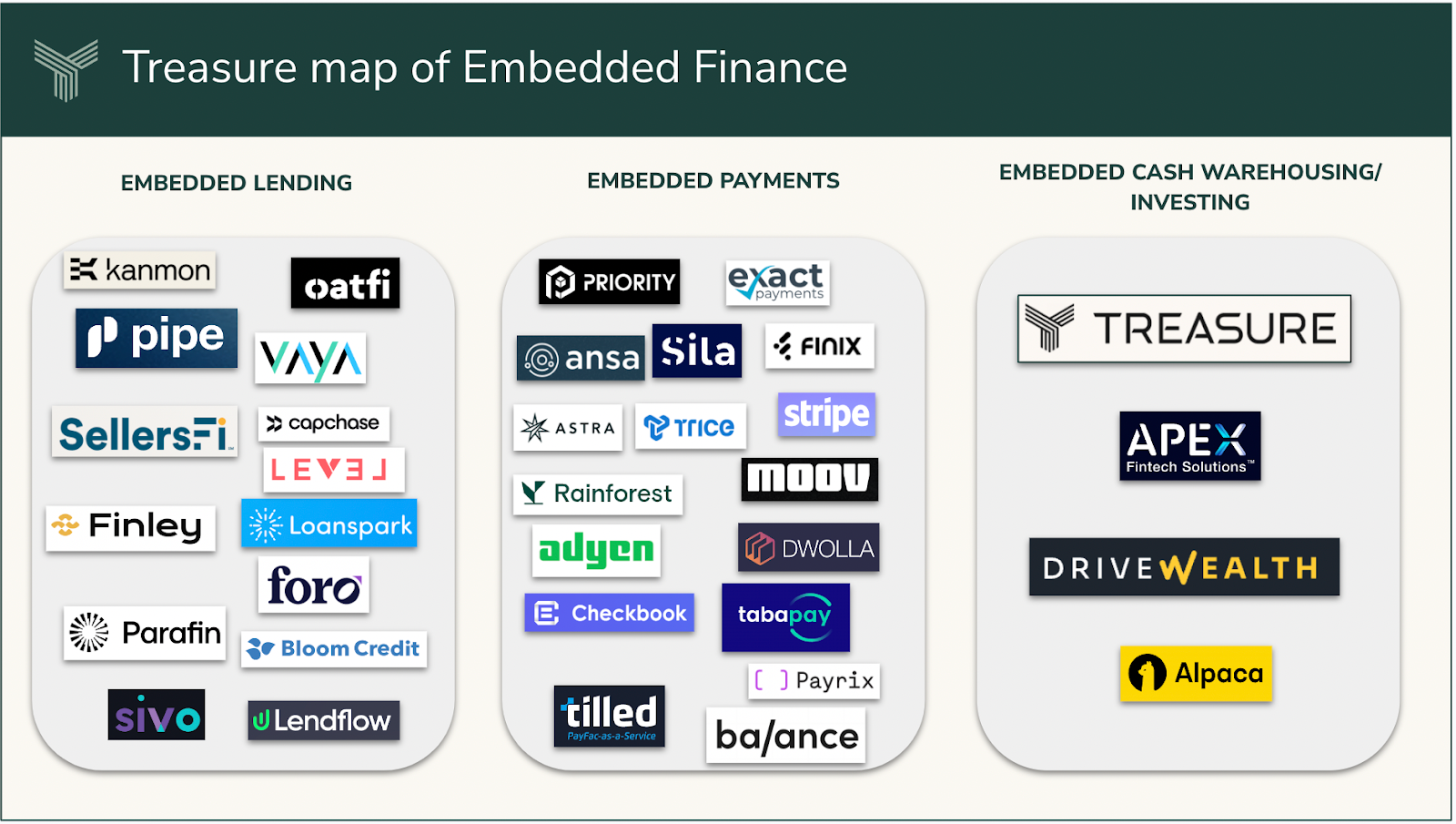

Given the rise of embedded finance, Treasurefi did some research in terms of the different players👇

🇰🇷 Why Kakao Bank is performing better than Kakao Pay. As a core FinTech service, payments are often tougher to monetize than higher-margin segments like lending, and this helps to explain why Kakao’s digital banking unit continues to outperform its payments arm.

The National Bank of Cambodia (NBC) and India’s NPCI International Payments Limited (NIPL) are set to launch a cross-border QR code payment system, aimed at boosting seamless financial transactions between the two nations. This collaboration seeks to enhance payment efficiency and promote the use of national currencies in transactions between Cambodia and India.

🇺🇸 Morgan Stanley-backed TomoCredit isn't paying its bills, faces mounting legal challenges. Click here to read the complete article by Jason Mikula.

🇺🇸 Bolt, once worth $11 billion, slashes share price 97% in buyback. Some investors in Bolt, plan to sell their stakes back to the company at a steep loss, showing the lengths to which venture capitalists will go to get some cashback on flailing investments.

Detected collaborates with Visa to offer improved SME onboarding in US and Canada. Through Detected’s unique intelligence engine and ongoing monitoring capabilities, Visa customers can take advantage of a user-friendly interface. Read more

PAYMENTS NEWS

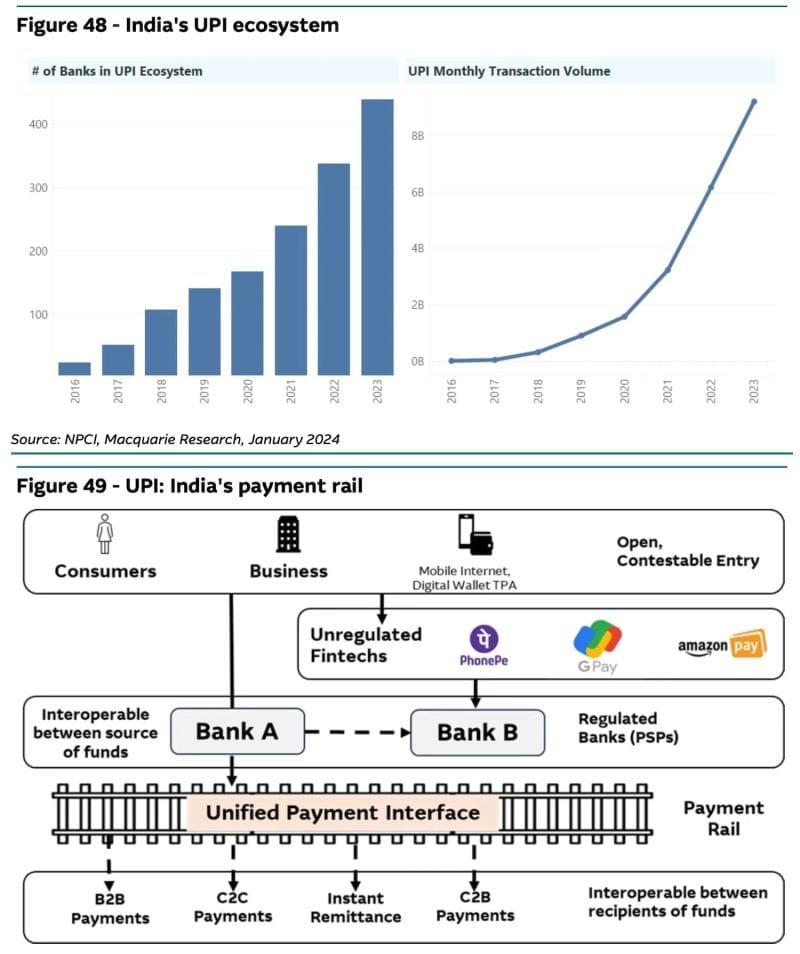

🇮🇳 India stumped on how to cut PhonePe and Google dominance in payments. India is grappling with implementing rules to limit the market share of PhonePe and Google Pay in the UPI payments network to 30%, aiming to reduce their combined 83% control. More on that here

🇬🇧 Mollie announced the UK launch of Mollie Capital – a fast and flexible way for SME merchants to access funding. Mollie Capital gives UK retailers the opportunity to bypass traditional lenders and access up to £250,000 to help drive growth.

🇩🇰 Softpay accepts Dankort wallet payments. Europe-based softPOS provider Softpay has announced that its tap-to-phone solution now supports Dankort wallet payments on iOS, aiming to improve payments in Denmark.

🇨🇦 Engage People, the only loyalty network that enables program members to pay with points (PwP) directly at checkout, reported a 68% increase in transactions from 2022, with more than 23.3 billion points redeemed in 2023 across its Access Plus network, which provides members the ability to pay with their points at any participating e-commerce website around the world.

🇿🇦 WigWag (Powered by Stitch), a subsidiary of South African payment service provider Stitch, has released an AI-powered WhatsApp payment management bot. Targeted at the small and medium market space, the bot aims to eliminate the hassle of juggling multiple apps and browsers to manage payments.

🇦🇪 Visa, Checkout.com and Stake launch innovative cross-border funding solution for real estate investment in UAE. This first-of-its-kind partnership in GCC leverages Visa Direct cross-border Account Funding Solution, enabling consumers to seamlessly and swiftly upload funds to their Stake accounts to invest in prime rental properties in the UAE.

DIGITAL BANKING NEWS

🇵🇭 Love is in the air as Tonik Digital Bank (Tonik), the pioneering digital bank in the Philippines, launches the 'Luv Stash'— the only savings product in the market enabling 2 people to save and earn a 4.5% interest rate. The Luv Stash is designed to bring couples closer through shared financial goals and exclusive interest rates, without the need to open a joint bank account.

Federal financial regulators are exploring allegations by two whistleblowers that Cash App, the popular mobile payment platform, and entities providing transaction services to its users performed inadequate due diligence on customers, potentially opening the door to money laundering, terrorism financing and other illegal activities.

🇲🇽 Mexican neobank Hey Banco’s split from Banregio due for 2025. Banregio won’t fully separate from Hey Banco, the digital bank it launched in 2017, until December this year at the earliest as the journey down the long road to independence continues. Read more

DONEDEAL FUNDING NEWS

Turkish FinTech unicorn Papara set to acquire SadaPay in possible $50mn deal. While the finer details of the acquisition are yet to be announced, the all-stock deal is reportedly valued between $30 to $50 million. The transaction may come as a surprise to sceptics, who have had doubts about EMIs being a profitable business due to limited avenues of earning.

MOVERS & SHAKERS

🇬🇧 TerraPay appoints Visa Direct’s Ruben Salazar as President. The move sees Salazar take up the role inmediately, and comes at a time when TerraPay is looking to expand beyond its core markets, having already established a strong business in areas including P2P payments infrastructure.

Yuno announces Jonathan Hall as the new Asia-Pacific Head, to drive its commercial strategy and regional presence. Simultaneously, Yuno has appointed Carol Grunberg as Director of Business Development. Read the full article here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()