Tencent Sells Stake in Tide

Hey FinTech Fanatic!

Chinese technology giant Tencent has recently divested its stake in the British neobank Tide, marking a strategic pullback from its international investment ventures. The shares were sold to undisclosed buyers, signaling a shift in Tencent's global investment approach.

Tencent, globally recognized for its super-app WeChat, has been a dominant force in the investment landscape over the past decade, securing stakes in various startups both in China and Western markets. However, there has been a noticeable slowdown in its investment activities in recent months.

As per a recent filing, Tencent Cloud Computing, a subsidiary of Tencent focused on cloud services, completely exited its 14% stake in Tide as of April. The details surrounding the new owners remain unclear, though Tide had earlier facilitated a secondary share sale, providing early investors an opportunity to liquidate their stakes.

Such secondary transactions are increasingly common as tech startups opt to stay private for extended periods. For instance, Revolut recently offered its employees a chance to sell shares at a valuation of $45 billion (£35 billion).

Tide, established in 2015, provides banking and financial services to over 575,000 small and medium-sized enterprises across the UK, India, and Germany. The company has attracted significant investments from prominent firms like private equity powerhouse Apax Partners and Japan's SBI Group.

Tencent's involvement with Tide was part of a broader strategy to gain a foothold in the UK FinTech sector, with prior investments in companies such as Previse and Monzo.

Notably, Tencent recently led a £340 million fundraising round for Monzo, bringing the neobank's valuation to $4 billion.

Now over to you: If you happen to have any insider information on upcoming funding rounds, FinTech mergers and acquisitions, or secondary deals in the works, I’d greatly appreciate a tip-off.

You can reach out to me directly via email or connect with me on Telegram at the username @marcelvanoost. Your insights would be invaluable!

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

INSIGHTS

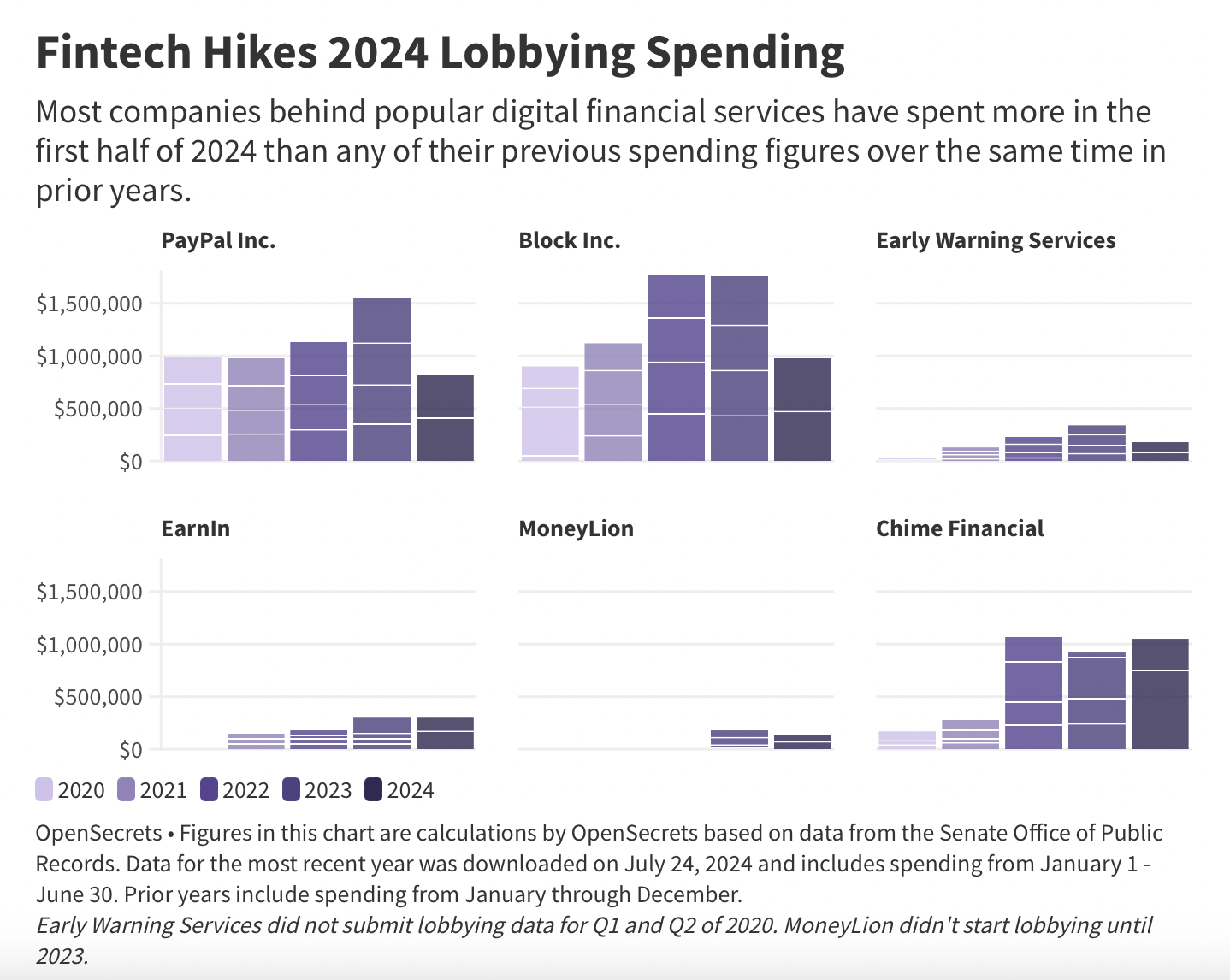

📊 Major FinTech companies ramp up 2024 lobbying spending.

Payment giant PayPal Inc., the owner of both PayPal and Venmo, spent over $800,000 on lobbying in the first half of 2024, outpacing its spending during the same timeframe of every prior year.

This trend continues with the company behind CashApp, Block Inc.. Block has PayPal beat, spending just shy of $1 million on lobbying in the first half of 2024, its biggest six-month spend to date. Continue reading

FINTECH NEWS

🇺🇸 Papaya Global reports a record-breaking quarter. Recent achievements showcase a strong commitment to innovation and client satisfaction. The focus remains on driving innovation, exceeding expectations, and delivering outstanding value to clients worldwide.

🇬🇧 Payhawk expands partnership with Marqeta. The new capability is available across all 32 countries served by Payhawk where it operates its premium Visa debit and credit cards. This marks the next step towards corporate expense management that is safe and convenient in equal measure.

🇦🇪 MultiPass secures licence to operate in the UAE. This milestone marks a significant step in the strategic expansion into the Middle East and will allow our clients to access local currency and payout. Read the full piece

PAYMENTS NEWS

🇧🇷 Pinbank and Yuno have joined forces to enhance payment solutions, aiming to help RappiBank increase its transaction volume by an additional R$ 60 million. The partnership allows merchants connected to Yuno - as is the case with the app - to take advantage of Pinbank's direct acquisition portfolio.

🇺🇸 Kickfin integrated with Shift4’s restaurant point-of-sale solution SkyTab. The integration lets restaurants using SkyTab automatically determine tip pools or shares and send payouts straight to employees’ banks, according to a recent press release.

🇨🇦 Helcim launches automated invoice payments for QuickBooks online. This new integration offers real-time invoice syncing and effortless payment acceptance, simplifying accounts receivables for small business owners, accountants, and bookkeepers.

🇮🇩 Wibmo Services & Ayoconnect team to secure digital payments across SEA. This collaboration aims to boost the security landscape for digital payments for businesses across Southeast Asia. The partnership will focus on integrating advanced security solutions into the card and notecard offerings.

DIGITAL BANKING NEWS

🇳🇱 ClearBank bags Dutch banking licence and expands to Europe. The new banking licence allows ClearBank to meet growing client demand by offering Euro accounts, payments, and access to major European payment systems, alongside its fully licensed banking services and advanced technology platforms. This new European company is expected to recruit over 60 new members of staff in the next five years.

🇦🇷 Ualá, reached 6 Million customers in Argentina, according to founder and CEO Pierpaolo Barbieri on Linkedin on Friday. That means more than 20% of the country uses Ualá. Link here

🇳🇱 Bunq’s boss on the regulatory headaches stifling his Irish mortgage ambitions. Ali Niknam breaks down his firm’s deposit offering and why he is advocating for a single EU mortgage market. Read on

🇺🇸 The middleware-or-direct debate persists in the banking-as-a-service space. Two new clients of Unit, Lincoln Savings Bank and Vantage Bank, believe these layers of technology help them scale their programs and manage risk efficiently.

🇬🇧 Google integrates GoHenry into smartwatch for kids. The collaboration advances Google's Tap to Pay capabilities in its Fitbit Ace LTE devices and enables kids under 13 years old to use a smartwatch to spend their own money safely and responsibly in the digital world.

🇳🇿 Carbon footprint management FinTechs Cogo, and SaaScada, providers of data driven core banking solutions, have joined forces to drive further progress in helping the banking and finance industry take steps to reduce their carbon impact.

🇺🇸 Americans are holding a whopping $7.162 trillion in uninsured cash in their bank accounts, according to an under-the-radar report from the Federal Deposit Insurance Corporation (FDIC). The agency reports that unprotected cash in US banks increased in March for the first time since Q4 2021.

🇺🇸 JPMorgan Chase is giving its employees an AI assistant powered by ChatGPT maker OpenAI. The LLM Suite program is already assisting over 60,000 employees with tasks like writing emails and reports and is expected to become as widespread within the bank as Zoom, sources told CNBC.

BLOCKCHAIN/CRYPTO NEWS

🇹🇭 Thailand launches regulatory sandbox to test crypto innovation, services. Thailand’s Securities and Exchange Commission (SEC) said interested parties are welcome to participate in the Digital Asset Regulatory Sandbox to test their crypto-related services and promote innovative development.

🇭🇰 Hong Kong's Mox Bank moves into crypto investing. The service offers a convenient way to gain exposure to the crypto market through a regulated and familiar investment platform without the complexities of managing a personal crypto wallet.

🇺🇸 Crypto exchange FTX ordered to pay $12.7 billion to customers, US CFTC says. The repayment order implements a settlement between the CFTC and the bankrupt crypto exchange, which has committed to a bankruptcy liquidation that will repay customers whose deposits were locked during its late 2022 collapse.

🇺🇸 Robinhood CEO says firm has responded to SEC on crypto scrutiny. “We’ve spent a lot of time making sure that the response is as high-quality as possible,” he said, adding that he had no further updates to share. More on that here

🇫🇷 France starts issuing crypto service provider licenses. France is the first major European Union economy to implement this step as the bloc's Markets in Crypto Assets (MiCA) regulations are set to become more comprehensive by the end of the year.

🇰🇳 Bitcoin.com launches V-Card Debit Card in self-custody Bitcoin and crypto DeFi wallet app. The self-custody solution ensures users always retain access to their funds, protecting them from the failures of centralized cryptocurrency exchanges.

Crypto exchange activity hits $845 billion in July, up 105% from 2023. The total volume of the largest centralized platforms has maintained multi-month highs, growing by over 100% compared to last year. However, it's impossible to ignore the 60% decrease compared to the record-breaking March.

DONEDEAL FUNDING NEWS

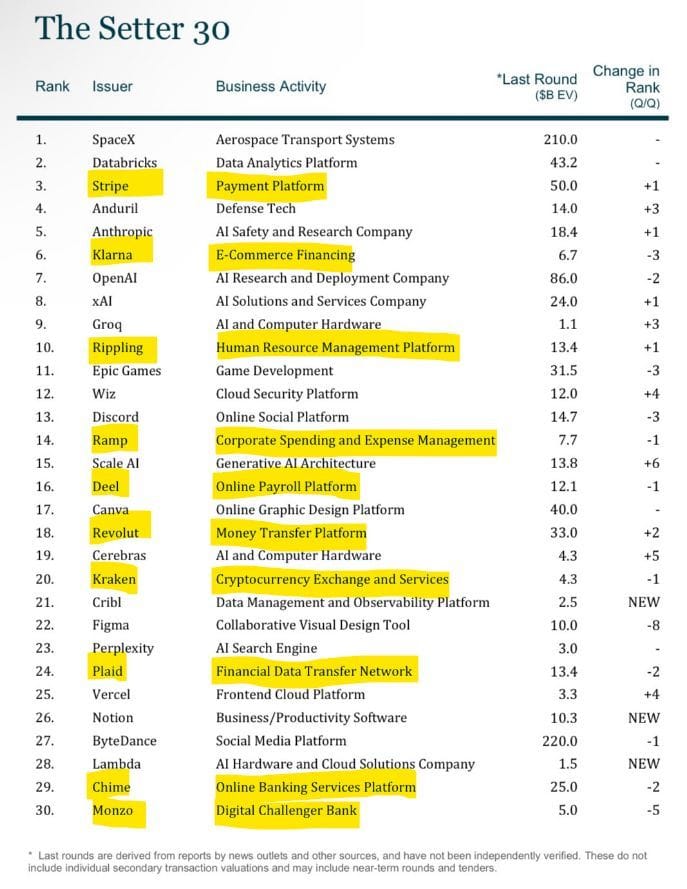

📜 The 30 most in-demand VC-backed secondary shares in Q2

FinTechs and Crypto Payment companies highlighted👇

🇨🇳 Tencent offloads stake in British challenger bank. Chinese Tech titan Tencent has cashed in its stake in the British neobank Tide as part of a retreat from international investments. Tencent has offloaded its shares to an unknown buyer or buyers.

🇬🇧 UK’s CloudPay raises $120m in latest funding round. The funding will enable CloudPay to enhance its product and technology offerings, including AI-driven data management, process automation, and improved connectivity through API solutions within its global payroll, payment, and HCM ecosystem.

MOVERS & SHAKERS

🇺🇸 US personal finance outfit NerdWallet is reducing the size of its 730-strong full-time workforce by about 15% as part of a restructuring plan to slash operating expenses. The job cuts will lead to a pre-tax restructuring charge in the third quarter of $8 million to $10 million in severance payment and employment benefits.

🇺🇸 Zillow promotes Operating Chief Jeremy Wacksman to Chief Executive role. Zillow said that Wacksman has held numerous positions at the company and recently helped launch its mobile real estate shopping offering. As chief marketing officer, he initiated product and consumer marketing strategies to grow the company.

🇬🇧 APEXX Global, a payment orchestration platform, has announced the appointment of Sophia Melas as Vice President of Sales. With an impressive track record in the payments industry, particularly within the travel sector, Sophia brings a wealth of expertise and strategic insight to the APEXX team. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()