TD Bank Slapped with $3 Billion Fine for Failing to Prevent Cartel Money Laundering

Hey FinTech Fanatic!

TD Bank is in hot water, slapped with a record $3 billion fine for failing to monitor drug cartel money laundering activities. The settlement includes a $1.3 billion penalty to the US Treasury’s FinCEN and a $1.8 billion payout to the Department of Justice (DoJ). TD also pleaded guilty to violating the Bank Secrecy Act.

According to the DoJ, more than 90% of transactions between 2018 and 2024 went unmonitored, enabling three money laundering networks to move $670 million. Treasury officials slammed TD for prioritizing growth over compliance, fueling drug trafficking and harming communities.

To address the fallout, TD is ramping up anti-money laundering efforts by hiring 700 specialists and enhancing surveillance. They’ll be under FinCEN’s watch for four years, with additional growth restrictions in the US.

TD’s shares dropped 6%, and analysts believe the bank will need to rethink its growth strategy.

What do you think? Let me know in the comments!

Cheers,

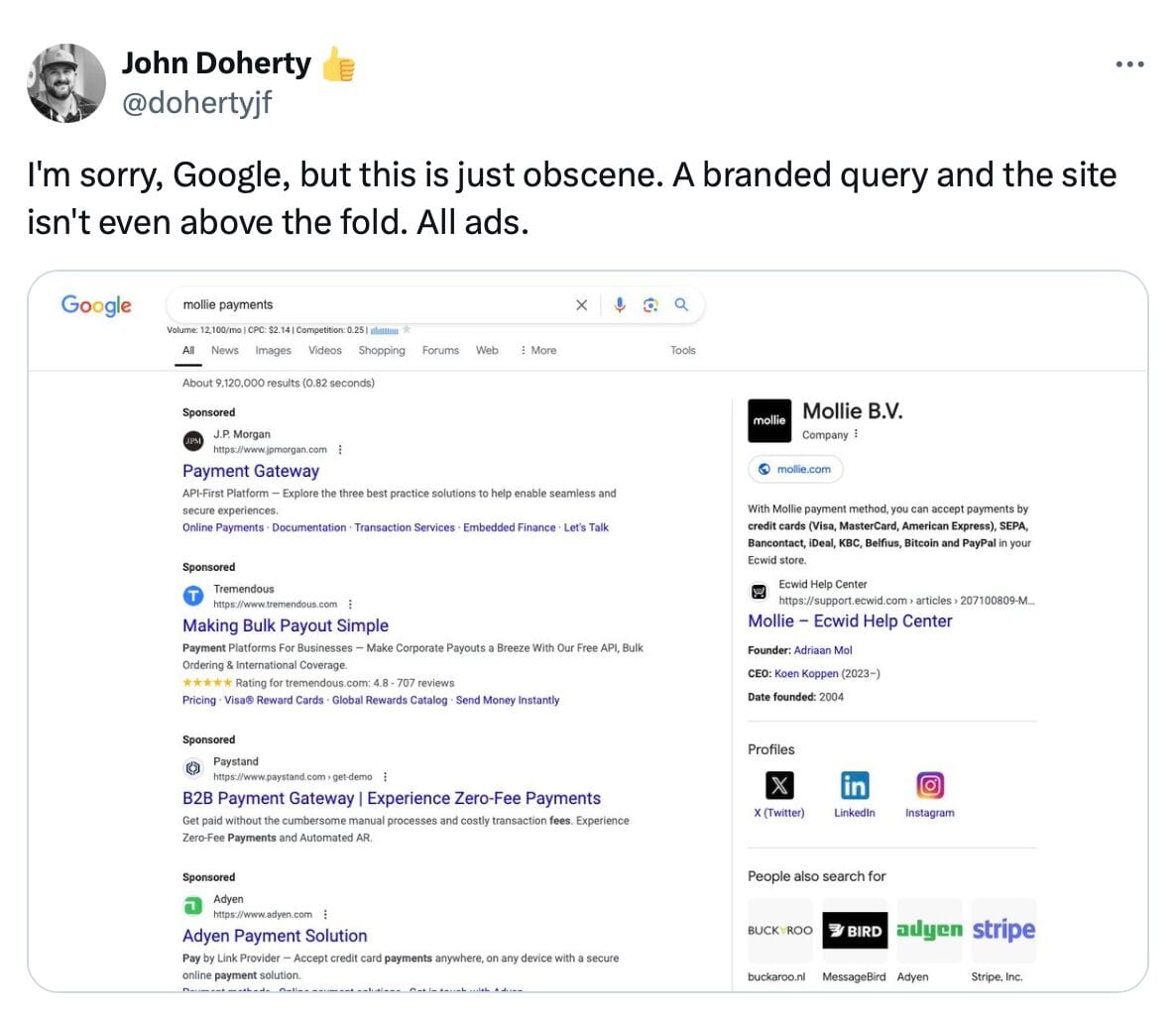

POST OF THE DAY

➡️ Looks like everyone’s bidding on Mollie in Google 🤣

FEATURED NEWS

🇧🇷 Pix by approach: BB comes out ahead and launches service in Brazil. Banco do Brasil (BB) and payment terminal operator Cielo are ahead of the game, starting on Friday (11/10), by offering “Pix por aproximação” to a select group of the bank’s customers enabling them to make purchases by simply bringing their phone close to the payment terminal at participating retailers.

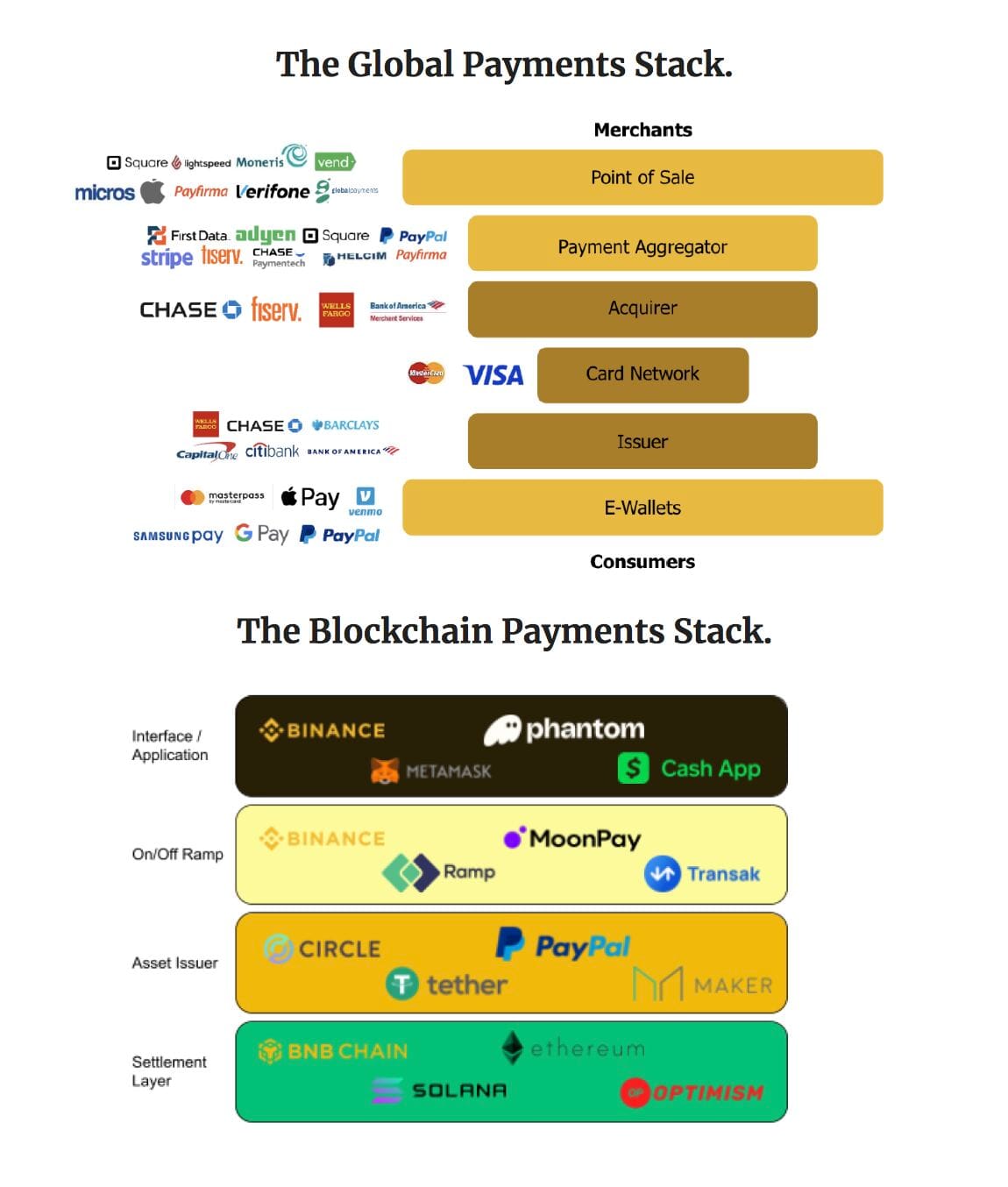

#FINTECHREPORT

📊 Global Payments Stack 🆚 Blockchain Payments Stack

Let’s dive in:

FINTECH NEWS

🇸🇬 Digital wealth platform Arta Finance launches in Singapore. The digital wealth management platform is now open to accredited investors in Singapore and those managing their wealth in the city. Read more

🇬🇧 Smart Money People launches vulnerability working group. The group aims to refine the questions financial services companies ask vulnerable people to better understand their needs and develop industry recommendations for identifying and communicating with them effectively.

🇸🇪 Klarna Cashback drives $100M-worth of sales in just six weeks. Klarna launched cashback in 12 countries simultaneously on 15 August, to reward app shoppers. At launch, rates varied between 1% and 10%. However, as merchants observed impressive initial results, many have increased their cashback rates, with some even doubling them.

🇺🇸 Visa sees cloud-native banking and flexible credentials as modern issuing must-haves. Visa's digital credentials empower consumers with seamless options, blending credit, debit, and BNPL for a modern payment experience. Read the full piece

🇬🇧 UK FinTech firms push Government to back growth, IPO dreams. Executives from some Britain's top FinTech firms warned the Labour government that London could fall behind if the UK doesn't address key industry concerns, such as challenges with share listings and regulatory decision-making speed.

PAYMENTS NEWS

🇮🇳 UPI transactions jump 52% fuelling India’s digital payment boom. This growth underscores UPI’s dominance in the digital payment ecosystem as it continues to expand beyond India, according to a Worldline report that also suggests that its growing presence could lead to larger transactions, reinforcing its role in India’s payment landscape.

🇺🇸 Citi, Mastercard team up on cross-border debit-card payments, enabling 24/7 global transactions for consumers and businesses. Citigroup is the first to adopt Mastercard Move, facilitating payments like insurance payouts, airline refunds, and e-commerce transactions.

🇰🇪 Network International launches new payments services in Kenya. Network International launched POS with QR code payment tools to improve accessibility for merchants seeking digital transactions. This ensures no client is excluded, creating more business opportunities and boosting revenue for traders.

🇷🇺 Russia pitches BRICS payment system aiming to break US dominance. The country is proposing changes to cross-border payments conducted among BRICS countries aimed at circumventing the global financial system, as the heavily penalized country seeks to sanctions-proof its own economy.

🇮🇹 Italy’s Fabrick partners with TerraPay to expand global payment services. This partnership marks a significant milestone in Fabrick’s international growth strategy, building upon its presence in Italy, Spain, and the United Kingdom, according to their announcement.

🇮🇳 Amazon-backed payments startup ToneTag is in early talks with Mumbai-based Iron Pillar to raise at least $50 Mn through a mix of primary and secondary share sales, with new investors also joining the cap table. The startup offers audio-based authentication and proximity payment solutions for online and offline commerce.

DIGITAL BANKING NEWS

🇦🇺 Revolut is close to getting an Australian bank licence. Revolut is making serious inroads in the local market; it’s signed up 670,00 customers already in Australia and has transaction volumes annualised at an estimated $1bn. Continue reading

🇺🇸 TD Bank hit with a record $3 billion fine over drug cartel money laundering. The fine includes a $1.3 billion penalty that will be paid to the US Treasury Department’s FinCEN, a record fine for a bank. The US DoJ stated that TD Bank had “long-term, pervasive, and systemic deficiencies” in its procedures of monitoring transactions.

🇳🇱 ClearBank onboards first clients to T2 European payments system. Following the opening of ClearBank Europe N.V. and the company’s securing of a Credit Institution Licence in the summer, ClearBank has joined and completed testing and onboarding clients to the T2 payment system via De Nederlandsche Bank.

🇮🇩 Indonesian digibanks encroach on P2P lending by going direct. Indonesian digital banks are now lending directly to customers, targeting aspiring entrepreneurs and diversifying credit portfolios. This shift provides easier access to credit through user-friendly apps, potentially disrupting partnerships with FinTech platforms.

BLOCKCHAIN/CRYPTO NEWS

🇨🇴 Colombian neobanking FinTech Littio leverages OpenTrade to provide interest-bearing USD accounts to clients via Avalanche Network. Via OpenTrade, Littio reportedly provides clients “yield-bearing” savings Pots with returns that are said to be backed by U.S. Treasury Bills.

🇺🇸 Stripe says stablecoins payments made in more than 70 countries after relaunch. The company said individuals from more than 70 countries have used stablecoins for online transactions during the first 24 hours after allowing merchants using its platform to accept crypto payments again.

🇦🇹 Bitpanda Technology Solutions announces availability of security tokens for investors. All Bitpanda customers are now able to invest in security tokens, starting with Steelcoin — which is described as Vienna-founded token linked to the value of steel products and traded on the Ethereum blockchain.

DONEDEAL FUNDING NEWS

🇺🇸 Zeal secures $15M series B funding to revolutionize payroll for modern work. This latest investment marks a significant milestone in Zeal’s mission to redefine payroll for innovative staffing companies, gig-work platforms, and HR service providers.

🇺🇸 Farther raises $72m Series C to revolutionise wealth management. The newly secured funds will be used to expand Farther’s advisor network and further enhance its wealth management platform. The firm aims to set a new benchmark for wealth management services, providing both advisors and clients with superior experiences.

🇺🇸 Imprint raises $75 Million series C to fuel innovation and partnerships as it reinvents co-branded credit cards. The financing will bolster: Advancements in Imprint’s proprietary cloud-based credit card and risk platforms, continued deployment of machine learning and AI across its platforms, and more.

🇸🇬 Earlybird AI secures Antler-led funding to simplify finance admin for SMEs. “The capital will help us accelerate our go-to-market and minimum viable product release development and hire top quality design, engineering, and AI talent,” said founder Bhavana Ravindran. Keep reading

🇦🇪 Octa raises $2.25m to automate accounts receivable for SMEs. The platform automates the process of collecting payments, from when a contract is signed until the cash is in the business’ account. Read the complete article

MOVERS & SHAKERS

🇬🇧 SMEB hires Amanda Harrison as Chief Revenue Officer. Based in London and bringing more than 15 years of payments industry experience, specialising in B2B technology sales, Amanda will be responsible for developing and overseeing SMEB’s commercial strategy and ensuring long term business growth across its key business lines.

🇺🇸 Former UBS chief Ralph Hamers joins AI wealth management start-up. Hamers has agreed to become an external senior adviser to Arta Financial, a wealth management start-up founded by several former Google employees. Read on

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()