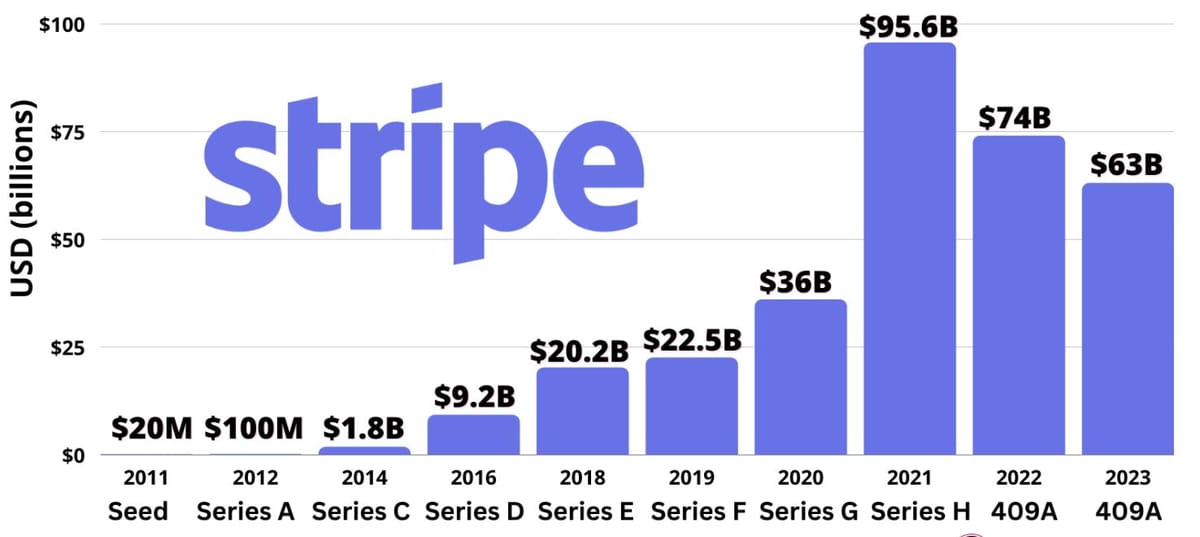

Stripe's valuation hits $𝟳𝟬 𝗕𝗶𝗹𝗹𝗶𝗼𝗻

Hey FinTech Fanatic!

Stripe’s valuation has edged up to $70 billion, spurred by Sequoia Capital's recent move to purchase shares from current investors seeking to exit the FinTech company, which specializes in payment processing for merchants.

Sequoia Capital has proposed a share price of $27.51, as reported by sources familiar with the transaction who requested anonymity due to the private nature of the details. This offer is directed towards limited partners in funds raised from 2009 to 2012 who may be looking to liquidate their holdings, according to Axios. The venture capital firm aims to acquire up to $861 million worth of shares.

Representatives from both Stripe and Sequoia declined to comment on the matter.

Stripe, a leading private tech company, was previously valued at $65 billion following a February deal that allowed current and former employees to sell some of their shares. This valuation marked an increase from $50 billion in March of the previous year, though it remains below the peak of $95 billion achieved during a 2021 funding round.

Founded by brothers John and Patrick Collison, Stripe has seen remarkable growth since its inception over a decade ago.

Now over to you: Do you think Stripe is worth $70 billion?

Cheers,

SPONSORED CONTENT

#FINTECHREPORT

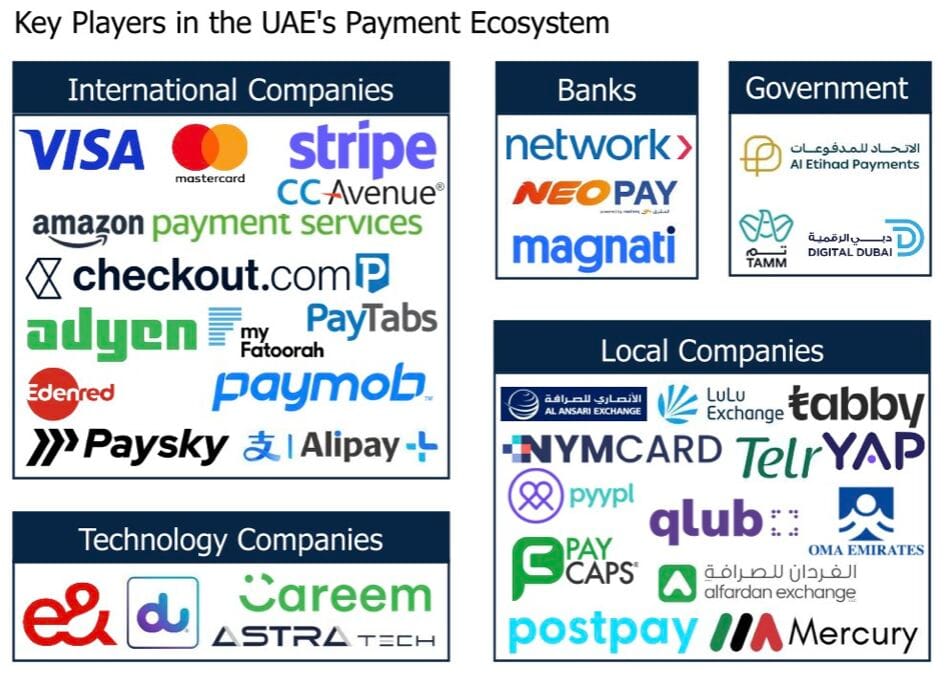

📊 The landscape of the UAE's Payment industry features a mix of international and local players, along with government-backed companies and technology firms. Download and read the complete report by Majid Dodehaki

FINTECH NEWS

🇺🇸 Mastercard and Wells Fargo have partnered with Expedia Group to launch credit cards specific to travellers. The cards will be targeted to US overseas travellers initially, with the main offering being a rewards scheme. Learn more

🇸🇻 Inswitch becomes the official provider for n1co, a FinTech transforming digital payments in Latin America with VISA cards. Thanks to this agreement, n1co users can now make their payments online or at physical points quickly and securely, not only in El Salvador but internationally as well.

🇺🇸 Chase and Marriott have teamed to offer new benefits to Marriott Bonvoy loyalty card members. In addition to the opportunity to earn more points, card members now have access to a new “Travel Now, Pay Later” benefit, the companies said in a news release.

🇵🇭 The Philippine Stock Exchange (PSE) may have to wait before it sees its first e-wallet IPO, as experts suggest that leading players in the sector will hold off until market conditions improve and their financial positions strengthen. The current borrowing rates set by the BSP are one factor affecting e-wallets, particularly in their lending businesses.

PAYMENTS NEWS

🇯🇵 Visa rolls out of BNPL-specific credentials, launches “VIC in a Box” with three partners. Visa is launching the Visa Installment Credential (VIC) in Japan, allowing card issuers to offer flexible installment payments, including interest-free options, at Visa-affiliated stores worldwide. This is the first launch of this BNPL credential in Japan.

🇵🇱 PayPal fined $27.3 mln by Polish watchdog for ambiguous clauses. UOKiK said that prohibited activities which could incur penalties were described in an unclear way and users may not understand exactly what was not allowed and what action the company could take in such cases. The decision is not final and PayPal has the possibility to appeal to a court, the regulator said.

🇬🇧 Payset, an online payments platform that provides a diverse suite of payment solutions for both individuals and companies, has partnered with ClearBank, the enabler of real-time clearing and embedded banking for financial institutions, to allow it to access the UK payment system for both local and cross-border transactions.

🇺🇸 Adaptive builds automation tools to speed up construction payments. Adaptive delivers an array of workflow automations for financial management, including budgeting, expense tracking, accounts payable and electronic payments. Continue reading

🇸🇬 Qashier unveils Treats, an offering that streamlines POS, payment, and loyalty mechanisms into an automated payment-linked loyalty solution. Treats is available for QashierPOS and QashierPay merchants, allowing customers to make payments and earn points seamlessly in-store.

OPEN BANKING NEWS

🇺🇸 Happy Money partners with Method to further streamline debt consolidation for members. Integrating Method's liability connectivity APIs into Happy Money's platform allows real-time identification of members' outstanding credit cards and balance transfers without needing account numbers or passwords.

REGTECH NEWS

📈 Three in ten adults have been a victim of financial fraud; spurring industry to continue investment to protect consumers. As fraud rates continue to rise, nearly all adults in the UK (94%) now say they are taking additional steps to avoid falling victim to scams, according to new research from Featurespace.

DIGITAL BANKING NEWS

🇺🇸 Goldman Sachs has lodged an appeal with the US Federal Reserve challenging its result in the regulator’s most recent “stress test”, which is set to force the Wall Street bank to hold a greater amount of capital, according to people familiar with the matter.

🇺🇸 Synapse’s collapse has frozen nearly $160M from FinTech users — here’s how it happened. Here is a timeline of Synapse’s troubles and the ongoing impact it is having on banking consumers.

🇬🇧 TerraPay and YeePay partner on cross-border payment solutions. The new strategic partnership brings together TerraPay’s global money movement capabilities and YeePay’s enterprise payment services, the companies said.

🇺🇸 Pennsylvania-based Diamond Credit Union has selected Tyfone for its nFinia Digital Banking platform to provide digital banking services to its commercial and retail customers. The API-driven nFinia platform will enable Diamond to connect with third-party retail and business applications to “support members’ specific needs”.

🇺🇸 DiCaprio-backed green finance startup unraveled on dubious deals. Three years after pursuing a $2 billion IPO, Aspiration Partners faces probes by US authorities. Explore the full article

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Wirex and Visa expand partnership to drive Web3 payment adoption. With this partnership, Wirex and Visa aim to make paying with digital currencies easier and more reliable. By combining Visa’s trusted payment network with Wirex’s innovative products, users can expect a smoother and more secure way to manage their money.

🇳🇱 Tornado Cash dev Alexey Pertsev denied bail to appeal money laundering conviction. A Dutch court on Friday rejected the release of Pertsev, as he prepares his appeal. The Court of Appeal of ‘s-Hertogenbosch in the Netherlands ruled Pertsev will continue to be detained.

🇰🇭 A major Cambodian payments firm received crypto worth over $150,000 from a digital wallet used by North Korean hacking outfit Lazarus, blockchain data shows, a glimpse of how the criminal collective has laundered funds in Southeast Asia.

DONEDEAL FUNDING NEWS

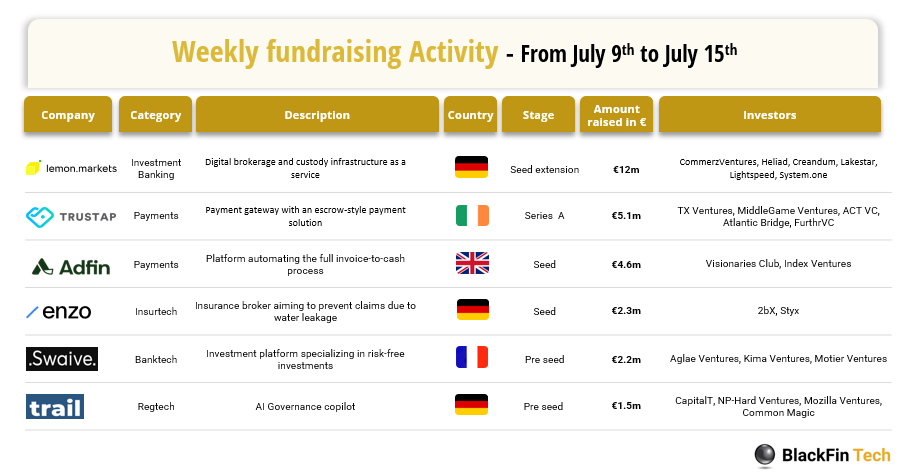

💰 Last week we saw 6 official FinTech deals in Europe for a total amount of €27.7m raised with 3 deals in Germany, 1 in the UK, 1 in Ireland, and 1 in France. Read the complete BlackFin Tech article here

🇲🇽 Argentine FinTech startup Tapi raised $22M in venture funding in a Series A round led by Kaszek as the company expands its operations in Mexico, co-founder and Chief Executive Officer Tomas Mindlin said. Tapi serves as a processor for payments on large Latin American consumer platforms.

🇬🇧 Digital asset management platform Haruko raises $6M Series A. Haruko's platform enables connectivity across CeFi exchanges and DeFi protocols, offering a detailed real-time view of digital asset exposures and risks. Read on

🇲🇽 Mexico FinTech OCN raises $86 million in round led by Caravela. The proceeds of the round will be used to grow the company’s tech infrastructure and to open upper management positions, said co-founder and Chief Executive Officer Mairon Sandoval in an interview.

🇧🇷 Caliza lands $8.5 million to bring real-time money transfers to Latin America using USDC. Most of Caliza’s team of 10 people is based in Brazil, where it plans to double its workforce thanks to its new round of funding. The startup is also following through with its previously announced local launch.

MOVERS & SHAKERS

🇬🇧 Thunes appoints Sigrid Hulsebosch as Chief Financial Officer. Hulsebosch will oversee Thunes’ financial strategies and lead the global finance function, including planning, treasury, tax, reporting, and investor relations. Based in London, Hulsebosch will report directly to Floris de Kort, Thunes’ CEO.

🇸🇬 Sea Ltd. appointed Natalia Goh as the new leader of its Singapore digital bank, picking the operating chief of rival Trust Bank to steer the Southeast Asian internet company’s budding finance arm. Read on

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()