Stripe’s $1.1 Billion Investment, Big Payoff Ahead?

Hey FinTech Fanatic!

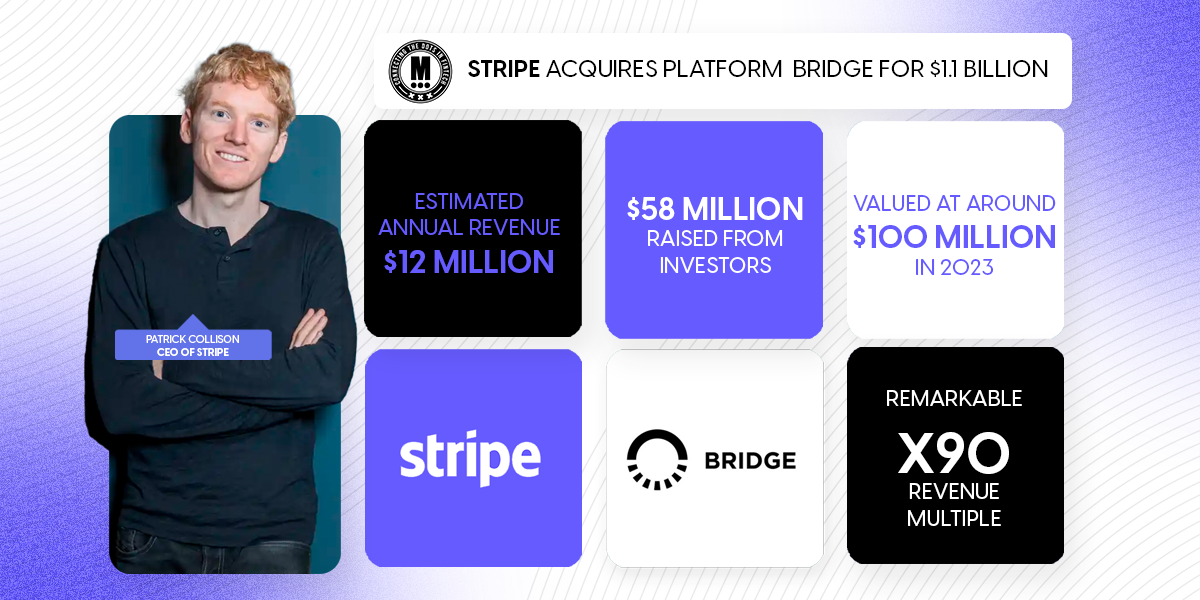

Stripe has made a bold $1 billion bet on blockchain technology by acquiring Bridge—a company with an estimated annual revenue of $12 million. What stands out is the remarkable 90x revenue multiple Bridge is commanding, underscoring the value it has built in the space.

Bridge’s rise has been impressive. With a total of $58 million raised from investors like Ribbit Capital, Index Ventures, Haun Ventures, and Sequoia Capital, it was valued at around $100 million just last year during its Series A. Now, Stripe aims to integrate Bridge’s stablecoin expertise to further its global payments expansion.

The hefty price tag could be worth it for Stripe, which was recently valued at $70 billion in an employee tender.

This acquisition signals Stripe's clear intent to embrace blockchain technology, and it aligns with a growing interest from tech giants like Apple, which has already been briefed by Bridge executives on the potential of stablecoins.

In recent months, Bridge’s executives reportedly met with Apple to discuss stablecoin technology, highlighting growing interest from major tech players. Stripe’s acquisition further demonstrates its commitment to embracing blockchain technology.

It’s clear that the long-anticipated convergence of crypto and mainstream payments may be on the horizon, what do you think about this acquisition? Tell me more in the comments.

Cheers,

BREAKING NEWS

🇺🇸 CFPB Orders Apple and Goldman Sachs to Pay Over $𝟴𝟵 𝗠𝗶𝗹𝗹𝗶𝗼𝗻 for Apple Card Failures 🤯 The Consumer Financial Protection Bureau (CFPB) took action against Apple and Goldman Sachs for customer service breakdowns and misrepresentations that impacted hundreds of thousands of Apple Card users.

#FINTECHREPORT

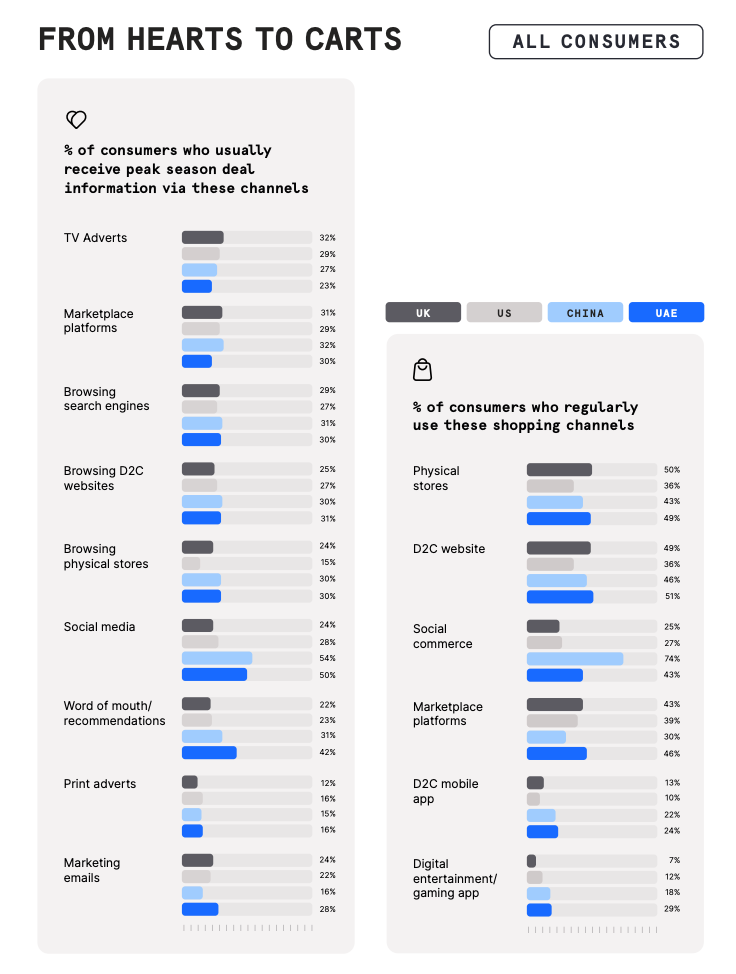

📊 Peak Season Trends 2024: How consumer behavior shapes the digital economy. This new report by Checkout.com analyzes the shopping patterns at play – and offers valuable insights to help businesses strategize for peak season and beyond. Get the full report here

FINTECH NEWS

🇺🇸 Marqeta has introduced two new products – UX Toolkit and Portfolio Migrations – to its card program management tools. These solutions leverage Marqeta's technology and expertise to enhance the success and scalability of its customers' card programs. Continue reading

🇬🇧 FCA uses criminal powers in latest crackdown on 'finfluencers.' The watchdog is interviewing 20 'finfluencers' under caution who may be touting products illegally, extending its crackdown on financial product promotions via social media personalities.

🇲🇽 Clothing retailer Shein launches its first branded credit card worldwide with Mexican FinTech Stori, the firms said on Tuesday, touting synergies that should help both expand in Latin America's second-largest economy. The push aims to attract more Mexicans to the credit market while drawing shoppers to the low-cost retailer's website.

🇬🇧 Moneybox and GoCardless join Revolut and Monzo in secondary share sale surge. Moneybox, valued at £550m after a £70m investment, is offering investors the chance to sell 10-15% of shares. Meanwhile, GoCardless plans a secondary share sale with up to $200m in stock changing hands and a £100m windfall for employees. More here

🇺🇸 Lending FinTech SoLo Funds faces class action lawsuit, according to a copy seen by TechCrunch and first reported by Bloomberg. It accuses SoLo Funds of misleading consumers by advertising zero interest fees on loans yet encouraging “tip fees” and “donation fees” to obtain said loans.

🇺🇸 Green Dot launches brand focused on embedded finance capabilities. This new platform offers businesses a range of embedded finance capabilities, including banking-as-a-service (BaaS), bringing together Green Dot’s banking and money processing solutions.

🇨🇦 Canada’s Koho launches a new eSIM feature into its money management app with Boxo and Airalo. The feature will allow Koho’s 1.7 million customers in Canada to purchase and activate eSIMs directly within its app. Keep reading

🇸🇦 Mastercard launches local technology infrastructure in Saudi Arabia. This will enable ecommerce transactions processing, offering a seamless and secure payments experience for both Mastercard partners and consumers, while supporting the acceleration of the Kingdom’s digital commerce.

PAYMENTS NEWS

🇺🇸 Ingo Payments and Sardine announced a new partnership to offer instant, risk-managed account funding via card and ACH, backed by an optional zero-liability fraud guarantee. Combined with Ingo’s leading check funding solution, this offers issuers a fast, secure solution for funding via check, card, and ACH.

🇺🇸 PayPal and Global Payments join forces to simplify checkout with Fastlane. This partnership allows Global Payments to provide U.S. merchants with enhanced PayPal and Venmo checkout solutions, along with Fastlane by PayPal for quicker guest checkouts, improving the shopping experience and increasing conversion rates

🇨🇳 HSBC launches Global Virtual Account Solution for E-commerce payments in EUR and GBP. The virtual account allows Chinese businesses on e-commerce platforms to receive EUR and GBP payments directly into their local bank accounts, eliminating the need for foreign accounts.

🇸🇬 Tribe Payments expands into APAC with new Singapore office. The move comes as part of Tribe’s strategic expansion into the Asia-Pacific (APAC) region, signalling its ongoing commitment to delivering world-class digital payment solutions across global markets.

🇬🇧 USI Money, dLocal enter cross-border payment partnership. This collaboration will focus on addressing the challenges of high costs, slow speeds, and limited access in cross-border transactions.

🇮🇳 Paytm's shares jump as nod for new UPI users clears key risk. Shares of the Indian FinTech firm jumped nearly 6% on Wednesday after the country's payments regulator allowed the company to sign new users for digital payments via UPI.

🇶🇦 QCB offers QPay payment through using 'FAWRAN' payment service. This platform allows merchants to register and accept payment transactions for customer purchases using the system. Read more

OPEN BANKING NEWS

🇺🇸 Dwolla partners with Plaid to Future-Proof Pay by Bank Payments. This will enable customers to onboard with Plaid through Dwolla's Open Banking Services, creating a modern A2A payment offering for mid- to enterprise-sized businesses.

DIGITAL BANKING NEWS

🇸🇦 HALA Payments has been inducted into the Saudi Unicorns Program as it pursues global expansion and a potential IPO. This recognition highlights HALA's rapid growth, having facilitated over $7 billion in transactions since its founding in 2018.

🇮🇹 N26 is back to business in Italy, as the regulator lifts off the limit on new bank accounts opening. Previously blocked, the option to open new current accounts has been available since June, with the Bank of Italy resolution notices now removed.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 FinTech and crypto companies partner with Formula 1 teams to attract new customers. CNBC’s MacKenzie Sigalos reports on a growing trend of FinTech and crypto companies partnering with Formula 1 racing teams. Watch more

PARTNERSHIPS

🇨🇦 Nuvei and BigCommerce partner for integrated payment solutions. The partnership aims to bridge the gap between online and in-store experiences, offering a single payment processing partner. Read the full piece

DONEDEAL FUNDING NEWS

🇧🇷 Agrolend raises $53M in series C round. The company plans to expand its credit offerings to small and medium-sized farmers, in partnership with resellers, cooperatives, and agricultural input and equipment industries.

🇺🇸 Interface.ai raises $30M to help banks field customer requests. Interface’s core product is a collection of voice- and text-based AI agents designed to handle basic bank customer service requests. Read the complete article

🇺🇸 Valon announces series C capital raise. Valon states that it will use the new funding to accelerate technology development, with many new products and features in the pipeline and a growing client base to support.

🇺🇸 YouLend announces 3-Year financing facility with Castlelake to fund US SMBs, expanding US financing capacity potential to $1 billion. The financing facility builds on a multi-year relationship between YouLend and Castlelake across multiple geographies in Europe.

MOVERS & SHAKERS

🇳🇱 Tom Adams formally appointed as Adyen’s CTO and Management Board Member. Adams will oversee Adyen's vision for its single platform, covering payments, data, and financial products. The appointment has been approved by the Dutch Central Bank and awaits shareholder approval at an upcoming EGM.

🇬🇧 Pockit bolsters Monese acquisition with new board appointments: Gene Lockhart and Malcolm Le May. In a statement, Pockit says the appointments will “support management in the next phase of the company’s growth.” Continue reading

🇲🇽 Bitso appoints Aimee Fearon as its new Chief Financial Officer. Throughout her career, Fearon has accelerated company growth by driving value creation, raising capital, and building strong teams and alliances with strategic investors.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()