Stripe, Wise Founders Push for a European Tech Renaissance

Hey FinTech Fanatic!

On Monday, some of the biggest names behind Europe’s tech unicorns rallied together, signing an open letter for a “tech renaissance” across the bloc. The proposal is for a single pan-European entity named EU Inc to streamline growth, cut through the tangled web of regulations, and spark innovation like never before.

Industry heavyweights like Stripe’s Patrick Collison, Wise’s Taavet Hinrikus, and Pigment’s Eléonore Crespo, along with top VC firms like Index Ventures and Sequoia, are backing this action.

Their message emphasizes that while Europe’s rich diversity is an asset, the fractured regulatory framework is holding back startups from reaching their full potential. By uniting under EU Inc, these leaders aim to create a simpler, faster path to growth, making it easier for European startups to scale, attract capital, and thrive.

This comes as Europe faces growing competition from the U.S. and China, both of which are home to tech giants that dominate the global scene.

The bottom line, if EU Inc receives approval, Europe’s startup landscape could undergo a significant transformation, potentially leveling the playing field with the world’s major economic powers.

Stay tuned—this could mark the beginning of a new era for tech in Europe! I'll be back with more tomorrow!

Cheers,

#FINTECHREPORT

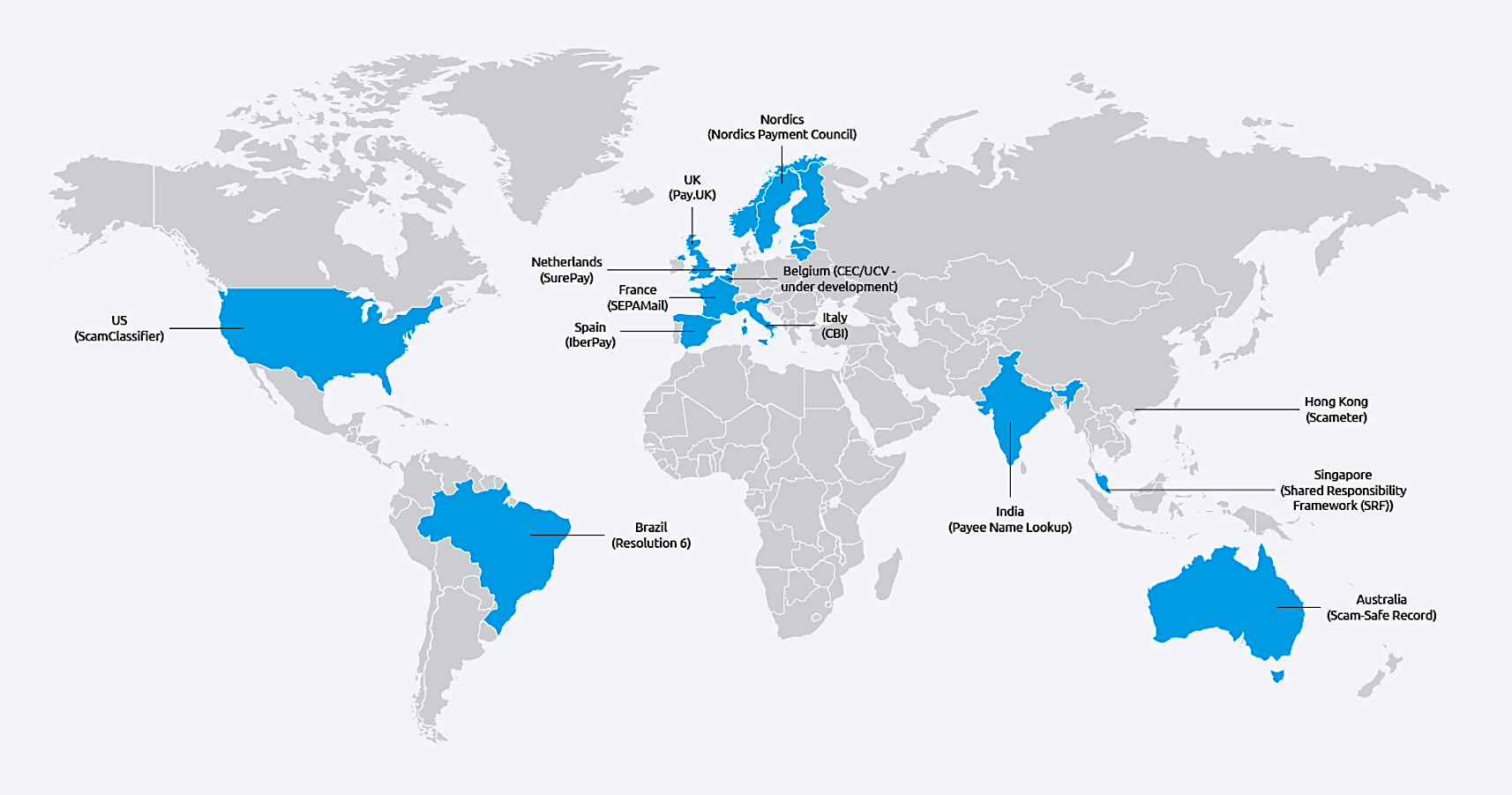

📊 Secure and simple instant payments. As instant payments rise, so does the need for a unified global Confirmation of Payee solution to protect consumers, banks, and reduce fraud. Read this insightful report by Capgemini to get all the details.

FINTECH NEWS

🇪🇺 Stripe, Wise founders want a ‘tech renaissance’ in Europe to help the region rival Silicon Valley. Founders of some of Europe’s largest technology unicorns on Monday backed an open letter calling for a “tech renaissance” fueled by the creation of a single pan-European entity to promote startups and innovation in the bloc.

PAYMENTS NEWS

🇺🇸 PayQuicker has been recognized as the Best Cross-Border Payments Solution at the 2024 PayTech Awards USA, hosted by FinTech Futures. The company is proud to continue driving innovation in the FinTech space with the smartest, fastest, and easiest way to send payouts to recipients globally.

🇬🇧 Revolut takes on Square and SumUp with payment terminal for larger businesses. The London-based banking firm is set to roll out a device, called Revolut Terminal, in the UK and Ireland ahead of the busy festive season in a push to grow its business-to-business offering.

🇷🇴 TOKEN secures authorisation from NBR and becomes a payment institution. Aligning with PSD2 regulation, TOKEN can now accept online payment operations and transactions at physical Point-of-Sale (POS), as well as to conduct money remittance procedures, which facilitates the activities of online marketplace stores.

🇪🇺 Mastercard to pilot enhanced ID verification service in Europe. The new service gives issuers the ability to verify more detailed personal information about cardholders, eliminating the need to upload documents like photo ID, proof of residency or passport.

🇫🇷 G7 integrates Alipay+ with PayXpert. This partnership aims to enhance the travel experience for global visitors to France, while continuing to meet client needs and comply with local regulations in an evolving market. Click here to learn more

🇬🇧 Wirex Pay innovates DeFi Space with launch of Node Rewards in WPAY. The introduction of the Wirex Pay Node Rewards Center marks a major leap forward in simplifying the earning process within the decentralized finance ecosystem.

🇦🇪 Mansa surpasses $3 million in transaction volume one month after launch, providing liquidity to payment companies. Launched in September 2024, Mansa leverages decentralized finance to tackle the liquidity shortfall limiting cross-border payment companies.

OPEN BANKING NEWS

🇬🇧 AperiData introduces credit score fully powered by open banking. AperiScore will enable lenders to move beyond the boundaries of traditional CRA data, allowing them to score all applicants accurately in real-time, including those with limited credit history or thin credit files.

🇸🇪 Swedish open banking FinTech Trustly to expand DACH region operations. The goal is to boost the FinTech firm’s overall presence in the region and to “precisely” meet local needs and expectations of customers on the product side. Read on

DIGITAL BANKING NEWS

🇬🇧 Lloyds performs “groundbreaking” digital node-to-node transactions. The bank has completed a series of digital transactions alongside Mercore Capital unearthing new use cases for digital cross-border payments. Discover more

🇺🇸 GM and Barclays sign long-term credit card partnership agreement. The collaboration will help expand Barclays' credit card footprint in the U.S. As part of the agreement, Barclays will acquire the card program's receivables from the current issuer next year.

🇺🇸 Citi launches Token Services for Cash for institutional clients. The service is expected to facilitate multi-million-dollar transactions for Citi’s institutional clients, providing 24/7 cross-border liquidity and payments between participating Citi branches.

🇦🇪 AFS and Zand Bank partner to empower FinTechs in MENA. This collaboration aims to provide FinTechs and emerging players with AFS’s processing services and Zand Bank’s BIN Sponsorship and banking facilities, enabling them to issue prepaid cards and other banking solutions quickly and easily.

🇬🇧 The bank named in more fraud complaints than any major UK competitor. Online bank Revolut has been named in more fraud complaints than any major UK banks last year, with some customers questioning how much they were protected from scammers.

🇳🇿 Revolut launches eSIMs in New Zealand, a seamless way to avoid unexpected roaming charges. Revolut eSIM allows customers to get mobile data abroad, and stay connected without unexpected roaming charges and interruptions. Read on

🇬🇧 Standard Chartered launches RFQ module. The digital request for quote (RFQ) module allows clients to request pricing quotations for their letters of credit (LCs) confirmation and discounting/negotiation, and receive a digital response on demand, from anywhere and at any time.

🇩🇪 Deutsche Bank goes live on new correspondent banking system, dbx, which will give financial institutions (FI clients) access to new and enhanced functionalities designed to better leverage the bank’s thought leadership, investment and extensive global network.

🇺🇸 Bank of America folds FinTech investment banking team into tech. The lender is moving about 50 bankers into its roughly 200-strong tech group, according to Kevin Brunner, the bank’s chairman of global M&A and global head of technology, media and telecom investment banking.

BLOCKCHAIN/CRYPTO NEWS

🇩🇰 Cryptomathic unveils Obsidian: The Next-Generation payment platform for the cloud era. The platform provides a cloud-based solution for payment card issuers and FinTechs, enabling rapid card issuance and transaction authorization while offering flexibility and cost savings.

PARTNERSHIPS

🇬🇧 TSB partners with Doshi app to deliver money confidence in schools. Over the next six months, TSB will be visiting schools to encourage students to use the Doshi app and complete short learning modules to boost their money confidence and financial literacy ahead of adulthood.

🇬🇧 RegTech innovator GSS teams up with Swift to drive frictionless cross-border payments. The companies announced an extended partnership, allowing financial institutions worldwide to access GSS’ unique sanctions screening platform via the same trusted infrastructure used to move money across 200 countries and four billion accounts.

DONEDEAL FUNDING NEWS

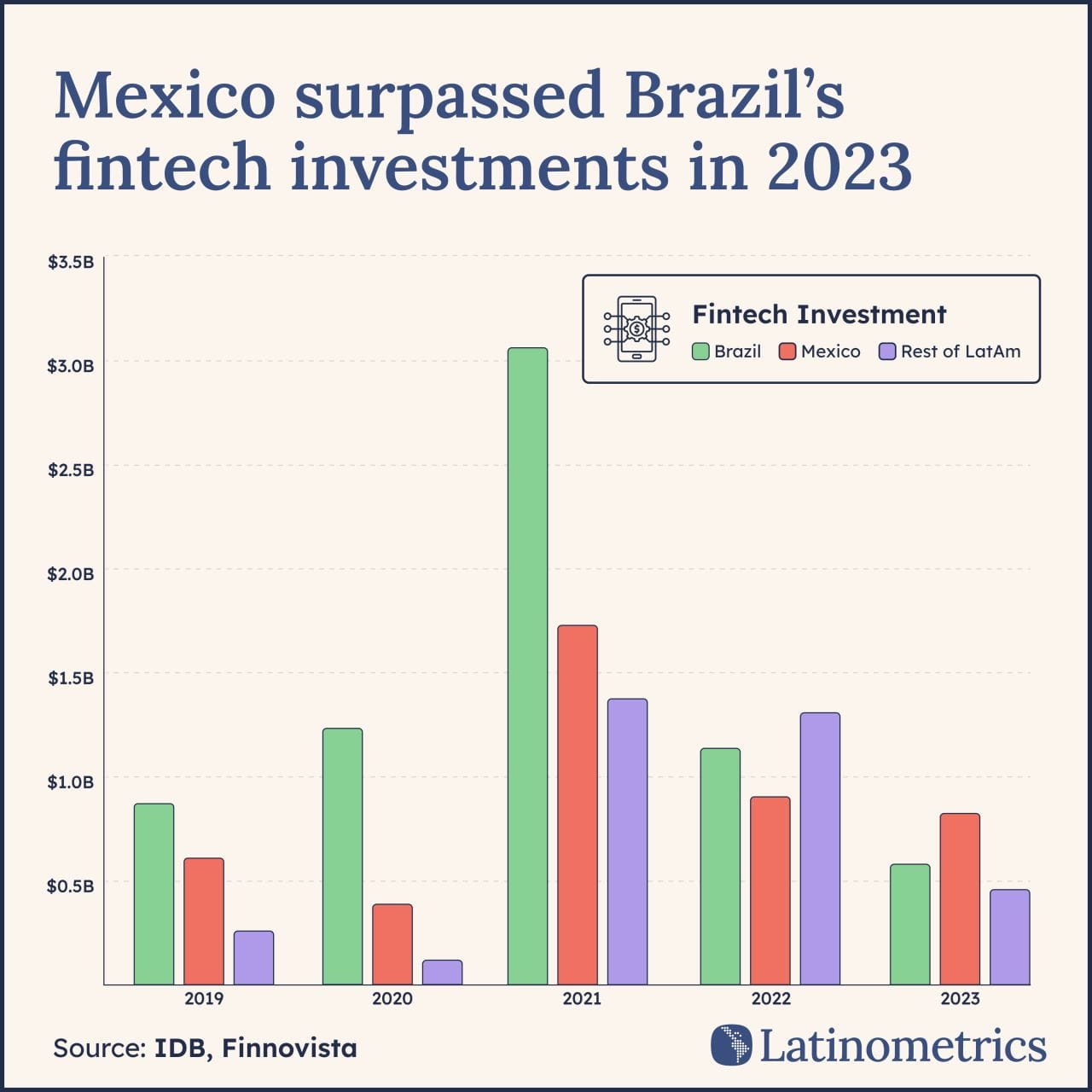

🇲🇽 Mexico is now leading the charge, surpassing Brazil 🇧🇷 on investment in FinTech in 2023 🤯

🇫🇷 French FinTech fund raising to pick up early 2025, Villeroy says. Bank of France Governor Francois Villeroy de Galhau said fund raising for financial technology firms in the country could pick up at the start of next year as lower European Central Bank borrowing costs have reduced financing costs.

🇬🇧 Rerail as a new early-stage micro-fund focused on investing in FinTech startups. It operates as a solo GP fund and can also be seen as a micro-fund, or an angel fund due to its focus on small, early-stage investments. Rerail brings new opportunities to help young companies grow.

🇺🇸 SoFi strikes deal with Fortress for $2 billion of personal loans. The online bank, which aims to be a one-stop shop for financial services after starting out in student-loan refinancing, said the agreement will expand its loan platform business of brokering deals for pre-qualified borrowers and originating loans on the behalf of third-parties.

🇸🇬 Helicap bags US$3 million investment from GMO Payment Gateway for credit fund. The fund offers debt financing to FinTech companies across Southeast Asia, supporting their growth in a rapidly expanding market. Keep reading

M&A

🇧🇷 Warburg Pincus snaps up minority stake in Brazil’s Contabilizei for $125m. The move will see Warburg Pincus become the largest shareholder of Contabilizei, acquiring stakes from venture capital funds that had invested in Contabilizei since 2014.

🇬🇧 Trading platform Ziglu adds customers with acquisition of Damex arm. The deal, which is expected to be announced in the coming days during Gibraltar Finance Week, will enable Ziglu to broaden access to its range of cryptocurrency, investment and banking services.

MOVERS & SHAKERS

🇬🇧 Acquired.com fuels further growth with capital raise and strategic leadership hire. The firm announced the appointment of industry leader Eline Blomme as Chief Strategy and Product Officer, and capital raise of £4m. Blomme will lead the company’s strategy and focus on delivering market-leading solutions in recurring commerce.

🇬🇧 Augmentum FinTech appoints William Reeve as an Independent Non-Executive Director of the Company and Chairman of the Board, with effect from 1 November 2024. He will also serve on the Company’s Nominations, Audit, Valuations and Management Engagement & Remuneration Committees.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()