Stitch Raises $55M to Expand Payments in Africa

Hey FinTech Fanatic!

Stitch, the Cape Town-based company, has announced a new $55 million funding round to support its goal of building a more complete and accessible payment infrastructure across Africa.

The team behind Stitch — Kiaan Pillay, Natalie Cuthbert, and Priyen Pillay — has steadily developed a platform that connects financial institutions with the businesses that depend on them. Their approach is to create a single interface that supports multiple payment types, making it easier for companies to offer flexibility without added complexity.

In January, Stitch acquired Exipay, a company focused on in-person payments. Now rebranded as Stitch In-Person Payments, the service expands the company’s reach from digital into physical transactions.

This marks Stitch’s entry into the offline payments space and broadens its offering beyond online use. It positions the company to support a wider range of businesses, including those in retail and hospitality.

With the latest funding and the acquisition of Exipay, Stitch is looking to meet more of Africa’s growing demand for flexible and integrated payment solutions.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

ARTICLE OF THE DAY

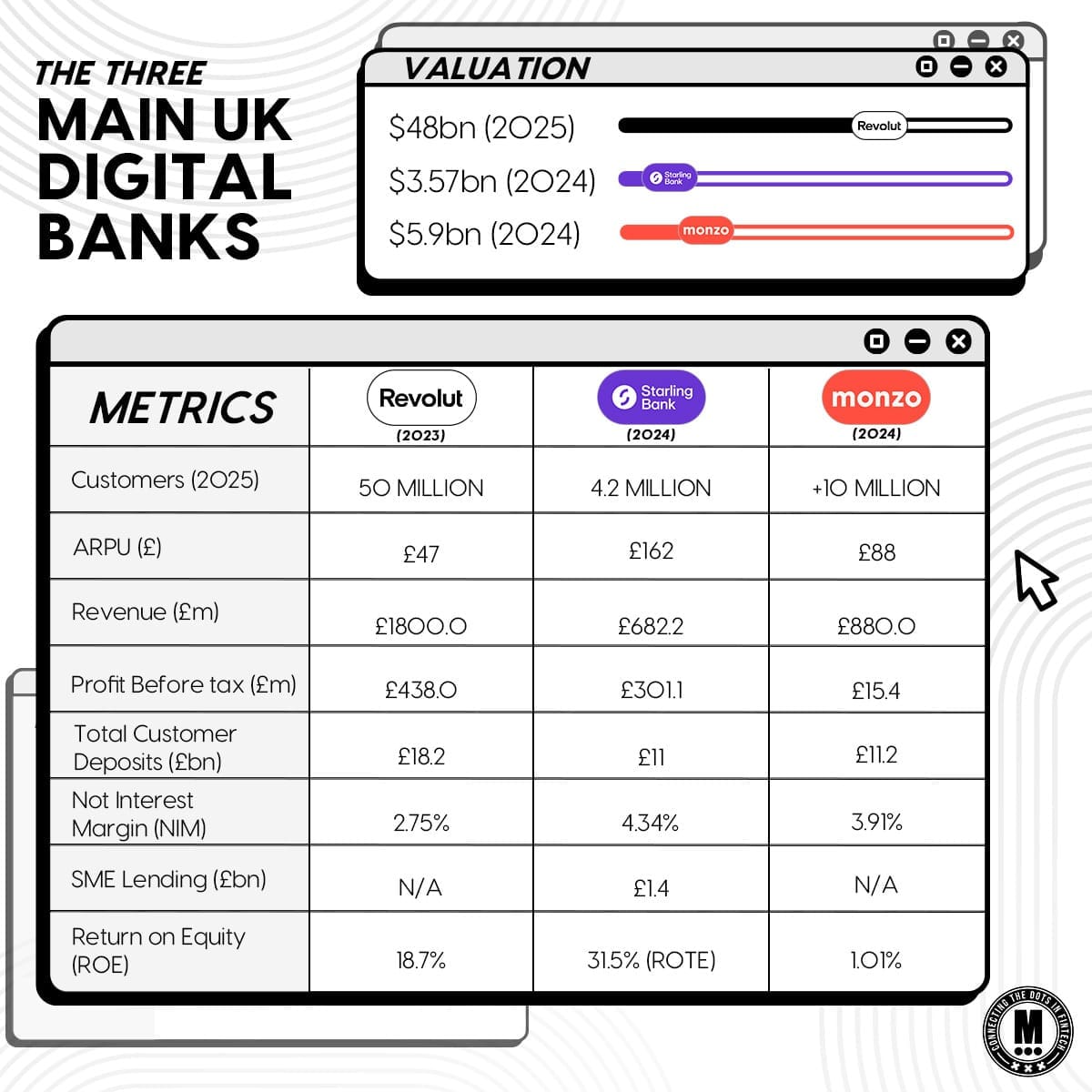

📊 Revolut 🆚 Starling Bank 🆚 Monzo Bank

#FINTECHREPORT

🇧🇷 Digital scams surge in Brazil. In 2024, 24% of Brazilians over 16 fell victim to digital fraud, from internet scams to card cloning. ACI Worldwide estimates that Pix-related fraud could cost Brazil up to R$12 billion by 2028, as cybercriminals increasingly target mobile devices. Discover more

INSIGHTS

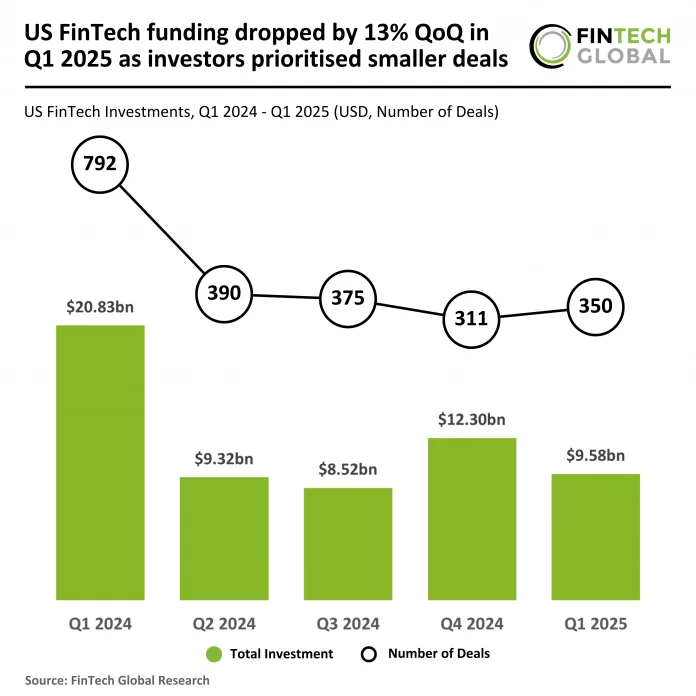

🇺🇸 US FinTech funding dropped by 13% QoQ in Q1 2025 as investors prioritized smaller deals. The US FinTech sector continued to experience a downturn in deal activity and funding compared to the same quarter last year.

FINTECH NEWS

🇬🇧 Upvest focuses on growth in the UK market. With an FCA license in hand, a new London HQ, and three UK clients set to go live by year-end, Upvest says it is entering its next growth phase in Europe’s “most dynamic” investment market: the UK.

🇳🇬 OPay’s valuation climbs to $2.75B despite slowdown in venture funding. While the valuation increase is notable, the filings also reveal a sharp slowdown in unrealised fair value gains. Opera Limited’s 9.4% stake in OPay rose slightly to $258.3M in 2024, while unrealised gains dropped sharply from $89.8M to $5M, reflecting slower growth.

🇦🇱 Albanian banks apply to join SEPA credit transfer scheme. These schemes allow businesses to make euro credit transfers between bank accounts that are part of the payment area. Keep reading

🇬🇧 Trading apps and neobrokers get reviewed by the FCA. The new multi-firm review entitled ‘Trading apps: high-level observations’ aims to support new firms and traditional investment brokers seeking to offer these services to help them better understand their existing obligations.

PAYMENTS NEWS

🇬🇧 CellPoint Digital and Checkout.com announced a strategic partnership to maximise payment performance for Travel Merchants. This collaboration will enable travel brands to streamline payment complexity, optimise conversion rates, and deliver a frictionless payment experience through a single, AI-driven integration.

🇺🇸 Ozone API launches industry-first tool for US banks to calculate the cost of building API infrastructure. The tool helps financial institutions understand the complexity and cost involved in building APIs and the hidden maintenance costs.

🇦🇷 Ualá, the Argentine FinTech company, has joined Google Wallet, allowing users of its prepaid card to make contactless payments using their Android devices. The integration offers a faster and more secure payment experience, thanks to Google Pay’s multiple layers of security.

🇦🇺 Xero offers Tap to Pay on iPhone for Australian SMBs with a Stripe account. This enables businesses to accept all forms of contactless payments, including contactless credit and debit cards, Apple Pay, and other digital wallets. The payment will be securely completed using Near Field Communication (NFC) technology.

🇬🇧 CurrencyFair selects tell.money to enhance open banking capabilities for seamless global money transfers. The company continues to develop solutions in the international payments space, ensuring its customers enjoy greater speed, security, and transparency when sending money abroad.

🇺🇸 Branch adds ‘Full-Service Paycard’ to workforce payments platform. The paycard is delivered through the Branch App and Card, enables payments to a dedicated bank account, and allows employers to provide workers with a path to a complete banking experience.

🇰🇵 North Korea expands foreign currency payments through smartphone apps. North Korean smartphones are processing more payments in foreign currencies, and an increasing number of businesses are now required to offer electronic payment systems, Daily NK has learned.

🇳🇵 QR code drives Nepal’s digital payment boom. The number of QR codes issued by banks and financial institutions to merchants increased from 282,000 in mid-July 2021 to 2.34 million in mid-January 2024. Read more

🇮🇳 Payments via mobile phones clocked a 41% jump in July- Dec 2024. India's digital payments ecosystem witnessed a significant surge in the second half of 2024, driven by Unified Payments Interface (UPI), mobile payments, and cards. Continue reading

REGTECH NEWS

🇳🇬 Nigeria’s new capital market laws officially classify crypto and other virtual assets as securities. Nigeria’s President recently added digital assets to the Investment and Securities Act (ISA) 2024. The landmark legislation is expected to provide greater transparency and increased investments.

DIGITAL BANKING NEWS

🌏 BNY scales up its Asia Pacific offerings in cross-border payments, liquidity management, and digital trade finance. The Bank of New York Mellon Corporation (BNY) is transforming its global business through a unified platform operating model designed to deliver more for its clients, run its company better, and power its culture.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase CLO slams FDIC for 'absurd' delays in crypto debanking records lawsuit. The case centers on internal communications that Coinbase believes show the agency engaged in a covert campaign, dubbed “Operation Chokepoint 2.0,” to isolate crypto from the U.S. financial system.

🌎 Coinbase launches KYC-Verified Pools for DeFi swaps and trades in select regions. They are available to institutional and retail traders and offer KYC-verified liquidity pools to maintain the company's position regarding the openness and efficiency of on-chain markets.

🇺🇸 Andreessen Horowitz wants a new crowdfunding regime to fund NFTs. The venture group defines NFTs as “crypto assets whose value, utility, or significance is primarily derived from being a record of ownership or rights to a tangible or intangible good.”

🇬🇧 Kraken teams up with Beeks to offer low-latency colocation, bringing Wall Street-grade trading speed to everyday crypto users. Initially, the service will be provided in Kraken's European data center, and it will include active individual traders and institutional clients.

🌎 Bitso Business launches Euro Ramps to connect Latin America and Europe through SEPA and Stablecoins. The new service aims to streamline cross-border payments by leveraging the advantages of stablecoins to enable companies to seamlessly send and receive funds in Euros, benefiting from greater speed, cost efficiency, and transparency.

🇦🇪 OKX and Standard Chartered pilot crypto collateral mirroring offering in UAE. The Pilot will be carried out under the umbrella of Dubai’s VARA. OKX institutional clients will be able to use crypto and tokenized money market funds as collateral.

🇪🇺 Bitpanda receives MiCAR License from the FMA, paving the way for EU-wide crypto expansion. With approvals in Austria, Germany, and Malta, Bitpanda can now offer unified crypto services across the EU. The platform serves 6.5 million users and emphasizes trust, security, and compliance in digital asset trading.

PARTNERSHIPS

🇪🇺 Paysend partners with Tink to enhance open banking payments for faster, seamless transfers. This means more customers can fund their international transfers with minimal friction, greater security, and improved speed. Continue reading

🇳🇴 Neonomics and Ovoro partner to enhance crypto investor payments with Nello Pay. This collaboration is set to redefine how users across the Nordics buy and sell crypto, making transactions faster, safer, and more cost-effective for investors. Users will connect their bank accounts directly, bypassing unnecessary intermediaries and reducing transaction costs.

🇵🇭 Visa and USSC Money Services enable Visa Direct for cross-border B2B payments. With Visa Direct, UMSI’s business clients can reportedly make faster cross-border outbound payments. It facilitates the transfer of funds directly to eligible Visa Direct cards, bank accounts, and wallets in many jurisdictions around the world.

DONEDEAL FUNDING NEWS

🇿🇦 South African FinTech company Stitch has successfully secured an additional $55 million in funding, aimed at enhancing its comprehensive payment solutions for businesses throughout Africa. This strategic investment is poised to strengthen Stitch’s position within the continent’s rapidly evolving payments ecosystem, reflecting the growing demand for innovative financial technologies.

🇺🇸 Blackbird secures $50m Series B for US expansion. The company has used the funding to launch a new tiered loyalty programme called Blackbird Club. The raise brings Blackbird's total funding to $85 million. Keep reading

🇲🇦 PayTic raises USD 4 million to expand across African markets. The funding will be used not only to scale the business in new African markets but also to strengthen the company’s technical capabilities in response to increasing demand for efficient payment systems.

M&A

🇺🇸 MoneyLion stockholders approve acquisition by Gen Digital. The companies said in a statement that all regulatory approvals have been obtained, and the deal is slated to be completed. Once it goes through, MoneyLion will be a subsidiary of Gen Digital, and its common stock will no longer be listed on any markets.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()