Steve McLaughlin's FT Partners Poised to Lead $2-4B Banking Circle Transaction

Hey FinTech Fanatic!

FT Partners, the powerhouse dealmaker in FinTech led by Steve McLaughlin, is set to take charge of a major transaction involving Banking Circle, valued at $2-4 billion and backed by EQT. Known for driving marquee deals, including capital raises for Revolut ($33 billion), Monzo, Mollie, Mambu, and PPRO, FT Partners is taking on yet another high-profile assignment.

According to Bloomberg, a sales process for the Luxembourg-based Banking Circle is expected to begin in Q1 2025. The deal could attract interest from private equity firms, credit card giants, and major banking players. EQT acquired Banking Circle in 2018 from Saxo Bank A/S, and recent reports from Reuters indicate that Morgan Stanley is already involved in working with EQT on the potential sale.

FT Partners' exclusive focus on FinTech transactions and its unmatched track record position are perfect for steering this significant deal. Stay tuned for updates on what's shaping up to be one of the biggest FinTech transactions of 2025.

Cheers,

#FINTECHREPORT

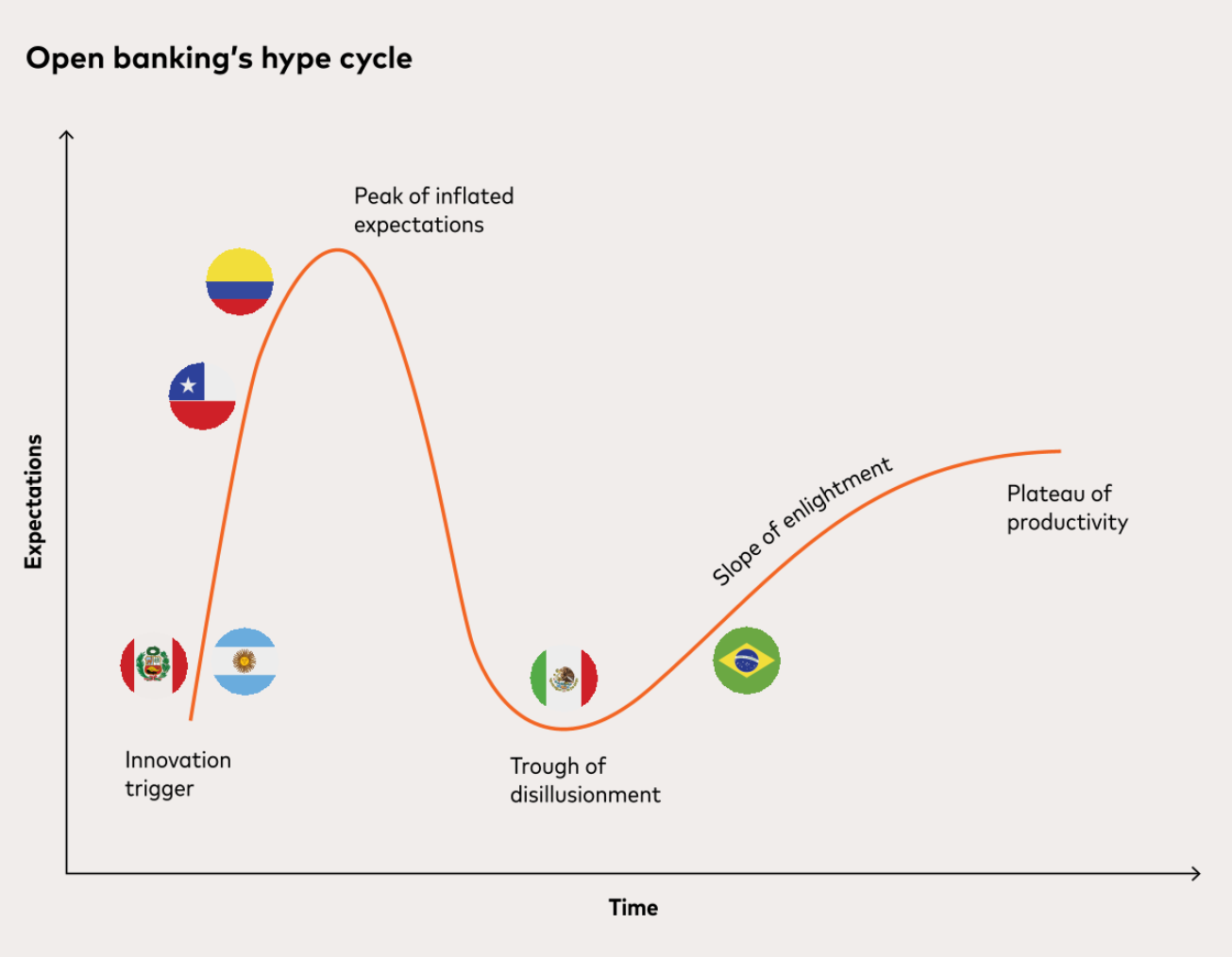

📊 Check out 'Open Banking in LATAM.' This report explores open banking and real-time payment developments across Latin America, with a focus on Mexico, Brazil, Colombia, Chile, Argentina, and Peru. Click to view the full insights

FINTECH NEWS

🌐 Airwallex expands EMEA presence with new offices: 271% Q3 revenue surge. The firm achieved over $100 billion in global processing volume and $500 million in revenue. It expanded staffing in Tel Aviv and Vilnius and appointed senior executives in London and Amsterdam.

🇺🇸 US explores feasibility of settlement network for multi-asset transactions. The proof-of-concept for the Regulated Settlement Network (RSN) demonstrated the potential of shared ledger technology to enhance multi-asset and cross-network transaction settlements for U.S. dollar and regulated securities users domestically.

🇬🇧 Visa blocks 410% more suspected fraud this Black Friday, as fraudsters target UK shoppers. As consumers hunted for bargains, fraudsters were also looking for their own payday. Throughout the weekend, the network blocked 117% more suspected fraud compared to the previous Black Friday weekend.

🇩🇪 SIX expands its multicurrency swaps. The company will now support the clearing of IRS in six new currencies, including US dollars, Swedish krona, Norwegian Krone, Swiss franc, Danish krone and UK pound sterling. This will be in addition to clearing services for euro denominates IRS, with scope to add more currencies at a later date.

🇫🇷 The PayFit founders factory: Meet 18 employees-turned-founders. The French HR tech has seen many former employees starting their own thing. Meet those who launched a tech startup in Europe. Discover more

🇸🇬 Temasek launches $7.5b private credit arm for global investments. Singapore’s sovereign wealth fund Temasek has launched a private credit entity with an initial portfolio valued This portfolio consists of direct investments and credit funds, according to its statement on Friday.

PAYMENTS NEWS

🇸🇬 Coinbase Commerce integrates with Triple-A, expanding merchant access to cryptocurrency payments. Triple-A’s integration with Coinbase Commerce allows merchants to offer Coinbase-specific payments, enhancing convenience for users and expanding Coinbase’s reach.

🇺🇸 Red River Bank selects Allied Payment Network for real-time payments integration. Partnering with Allied enables Red River Bank to deliver advanced real-time payment solutions while reinforcing its dedication to innovative digital services and superior customer support for its customers and communities.

🇬🇧 Zilch shares Black Friday shopping data. Zilch reported a 116% year-on-year sales growth on Black Friday and a 93% increase after Cyber Monday, more than doubling last year’s figures. The total transaction amount on its platform was not disclosed.

🇨🇿 Škoda and Parkopedia enhance valued in-car payment service. This functionality reduces stress by eliminating reliance on traditional payment methods like cash or cards, avoids issues like out-of-order machines, and minimizes distractions.

🇺🇸 Energy Capital Credit Union (ECCU) partners with Velera for debit card processing. This partnership aims to enhance ECCU's card services and support, optimize vendor relationships, and improve processes to benefit both members and employees. Read on

🇬🇧 Dojo signs new agreement with American Express to simplify payment processes for small businesses. The strategic agreement will enable Dojo’s small business customers to accept AmEx payments seamlessly with a unified contract, offering consolidated statements, simplified onboarding, and a single point of contact for support.

DIGITAL BANKING NEWS

➡️ Revolut applies for New Zealand 🇳🇿 Banking license and launches eSIM in Singapore 🇸🇬 Revolut has applied to the Reserve Bank of New Zealand for a banking license, as it aims to challenge banks' savings and lending products. Additionally, the company has launched eSIMs in Singapore, allowing customers to avoid unexpected roaming charges while traveling in the region.

🇨🇦 TD Bank says earnings growth ‘Challenging’ amid AML remediation. The bank said this in an earnings release in which it reported that during its fourth quarter, which ended Oct. 31, the reported net income of its Canadian banking business rose 9% year over year, while that of its U.S. banking business fell 32%.

🇩🇰 Lunar launches standalone BaaS business and says it can rival bank revenues. The Danish challenger bank is the latest bank to hive off its Banking-as-a-Service (BaaS) business as a separate entity- and claims its revenues can rival that of its core bank.

BLOCKCHAIN/CRYPTO NEWS

🇱🇻 The Central Bank of Latvia offers fast-track to EU Mica license acquisition. Latvijas Banka is offering free pre-licensing consultations for crypto-asset service providers seeking the EU MiCA license. Applications and operating permits will open in January 2025, when the MiCA license becomes effective.

🇺🇸 FV Bank boosts TradFi with real-time USDT-to-USD Conversion Service. This latest enhancement aims to simplify cross-border payments and remittances while reducing costs and processing times for international transfers. Read on

🇺🇸 BofA’s Hartnett warns froth is building in US stocks, crypto. A powerful rally in US stocks as well as cryptocurrencies has left the asset classes looking frothy, according to Bank of America Corp.’s Michael Hartnett.He said there’s a high risk of “overshoot” in early 2025 if the S&P 500 nears 6,666 points — about 10% above current levels.

₿ Bitcoin hit $100,000. What’s next?. It’s challenging to discern what’s on the horizon for crypto after this big round number, given the well-known and glaring problems with trying to figure out how much a bitcoin should be worth. Access full article

PARTNERSHIPS

🇺🇸 BlueSnap named a preferred payments partner for Zuora. By integrating Zuora with BlueSnap, businesses can automate global payments acceptance for their subscription and recurring billing processes, accepting payments all over the world with local card acquiring in 40+ countries.

🇺🇸 Equifax and Mastercard partner on fraud management in Latin America. This collaboration will make these tools available to Mastercard business customers in Latin America — including financial institutions, payment service providers, acquiring banks and merchants — through Equifax’s Kount Payment Fraud solution.

🇦🇪 RAKEZ partners with Edenred UAE to simplify salary processing for labourers. This collaboration introduces the innovative C3Pay payroll card, designed to provide labourers and blue-collar workers with solutions to manage their money. Read more

DONEDEAL FUNDING NEWS

🇬🇧 Zopa Bank raises $86 million ahead of current account launch. Zopa did not disclose its valuation, but said it retained its $1 billion unicorn status. “This capital allows us to maintain the growth trajectory that we have been on,” Chief Executive Officer Jaidev Janardana said in an interview with Bloomberg News.

🇮🇳 MobiKwik’s IPO will value it at $250M, 73% less than its last private valuation. The startup has cut the size of its planned IPO for the third time and is seeking to raise about $69 million, well below the $255 million it initially targeted in 2021.

🇺🇸 Trading platform eToro taps Goldman Sachs as it plans US IPO. The trading and investment platform may go public as early as Q2, though plans could shift. It aims for a valuation exceeding the $3.5 billion achieved in its last private funding round, according to sources.

🇧🇷 CloudWalk raises $444M to fund merchant payment advances. This funding comes 6 months after a $313M FDIC in May 2024, and is the largest in CloudWalk’s history. The company will use the funds to provide upfront payments to merchants for their credit card sales, ensuring they get paid faster.

M&A

🇺🇸 EQT is working with investment bank Financial Technology Partners / FT Partners to find buyers for payments-services provider Banking Circle, which could fetch $𝟯 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 𝘁𝗼 $𝟰 𝗯𝗶𝗹𝗹𝗶𝗼𝗻. A sales process for the Luxembourg-based company is slated to kick off in the first quarter of 2025, according to a source who spoke to Bloomberg on condition of anonymity, the details are not public.

🇮🇩 Lamudi acquires mortgage FinTech platform to boost home loans. The acquisition allows Lamudi to integrate Ideal’s 28 financial partners into its network, which includes 500 property developers and 30,000 agents. Ideal, founded in 2021, will maintain its brand and leadership team.

🇲🇽 Klar acquires Tribal assets in Mexico. Klar announced its entry into the business sector through the acquisition of assets (SMB payment and financing tools) in Mexico from Tribal, a finance company specializing in business services. Klar’s stated goal is to establish a financial operating system for small and medium-sized enterprises (SMEs).

MOVERS & SHAKERS

🇬🇧 Revolut has made two big-name hires as Britain’s biggest FinTech expands its board after receiving a UK banking licence: Fiona Fry and Sir Peter Estlin are set to join the company's UK board. The move is the latest by Revolut as it strengthens its operations amid a transition to becoming a fully-licenced bank.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()