Starling’s Pivot, Nubank’s Global Account & More FinTech News

Hey FinTech Fanatic!

Goldman-backed Starling Bank will not re-apply for a European Union banking license, opting instead for international expansion through its software platform, Engine.

Incoming CEO Raman Bhatia, in his first public remarks since his March appointment, outlined this strategy at the Money 2020 conference last week.

Starling, a digital-only bank with 4 million customers and a valuation of £2.5 billion ($3.2 billion), initially aimed for EU expansion by applying for an Irish banking license but withdrew in 2022. Instead, Starling will now focus on selling Engine, a platform enabling other companies to create digital banks.

Bhatia highlighted opportunities in regions like Thailand and the Middle East, emphasizing the benefits of leveraging proprietary technology over navigating diverse regulatory environments.

Engine, unlike traditional neobank consumer services, aims to dominate the enterprise software market, already securing clients like Salt Bank in Romania and AMP in Australia. Bhatia is confident in the strategy, aiming to capture significant market share.

Meanwhile, in Brazil, Nubank has launched its "Conta Global" borderless account, powered by Wise, to all its Ultravioleta Premium customers, reflecting a global shift towards innovative digital banking solutions.

Never a dull moment in the digital banking space 😉

Cheers,

INSIGHTS

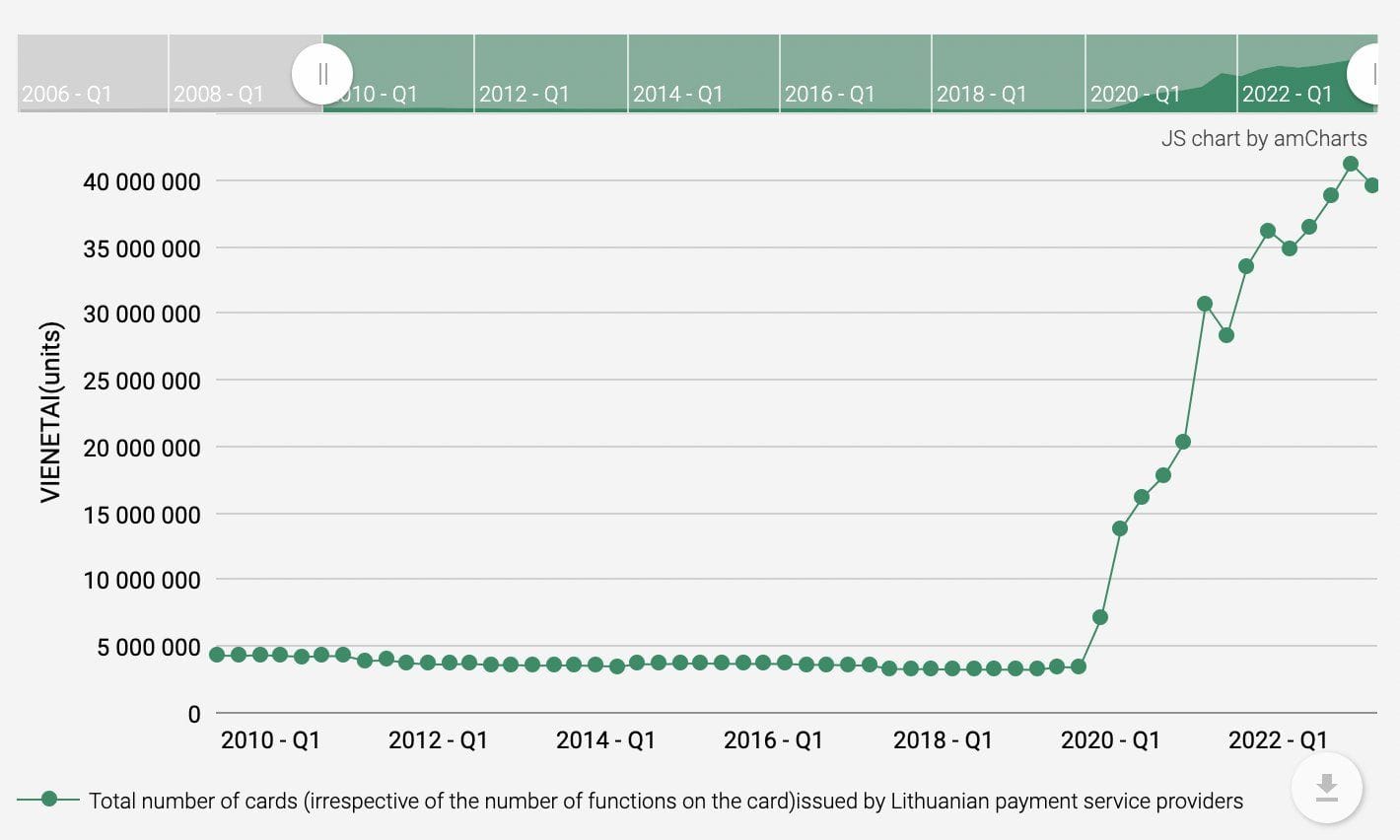

🇱🇹 Lithuania has a population of 2.8 million, but the country's central bank issued a Banking License to Revolut (and a few other FinTechs...) and now there are almost 𝟰𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 cards issued in the country 🤯 Link here

FINTECH NEWS

🇺🇸 AI firm YourStake has agreed to provide API integrations to custodian Apex FinTech Solutions. The first such API will be YourStake’s Document-to-Portfolio, which aims to allow users to upload images or PDF files of account statements from brokerages and banks. After being scanned using AI, YourStake will then digitize this information.

🇮🇳 Initial public offerings (IPO) of Walmart's Flipkart marketplace and PhonePe digital payments platform could take a couple of years, Walmart executive Dan Bartlett said. Walmart may put an initial public offering of PhonePe ahead of Flipkart, even though Flipkart is a more mature business, he added.

🇦🇺 Australian BNPL art company with 'potential to be $1 billion business' on brink of collapse. After almost 10 years of growth, Art Money has run out of operating capital, the difficult decision has been made to pause business operations while recapitalizing, its founder and CEO said in a statement on Art Money's website.

🇬🇧 Barclays and Lloyds-backed UK-based loyalty app Bink enters administration. The advisory firm says Bink had “suffered significant losses for a number of years and recent efforts to secure additional funding had proved unsuccessful”.

PAYMENTS NEWS

💳 Global real-time transactions expected to hit 575 billion by 2028. This would achieve a compound annual growth rate (CAGR) of 17%. By that time, real-time payments are anticipated to comprise more than 27% of all electronic payments worldwide.

🇩🇪 Santander’s Zinia becomes provider of consumer finance services for Apple in Germany. Zinia will offer customers purchasing Apple products both in Apple stores and online the option to defer payments by splitting the total amount into installments.

🇺🇸 Apple announced "Tap to pay for Apple Cash" at its annual WWDC event. Explore more in this live blog coverage and check out all the Apple Wallet updates the company announced.

🇰🇪 AIRTEL Africa has appointed Network International as its payment processor. Through this partnership, Airtel Africa believes it will be well equipped to navigate the dynamic landscape of digital finance, drive innovation and deliver unparalleled value to its users and stakeholders.

🇮🇳 STICPAY integrates UPI to expand Indian e-Wallet market. For STICPAY users in India, the partnership now enables them to enjoy greater accessibility to their funds, and to leverage the widespread adoption and convenience of UPI across the country.

🇬🇧 The UK’s Payments Systems Regulator says new fraud reimbursement rules will proceed as planned. The regulator told PYMNTS that it still plans to roll out regulations requiring banks and payment companies to reimburse victims of authorized push payment (APP) fraud up to £415,000 ($527,000) for each claim.

REGTECH NEWS

🇯🇴 Eastnets, a global player in compliance and payment solutions, has announced a strategic partnership with iPiD, a provider of beneficiary name and bank account verification services aimed to enhance payment security and efficiency for financial institutions, protecting customers and suppliers against global financial fraud.

DIGITAL BANKING NEWS

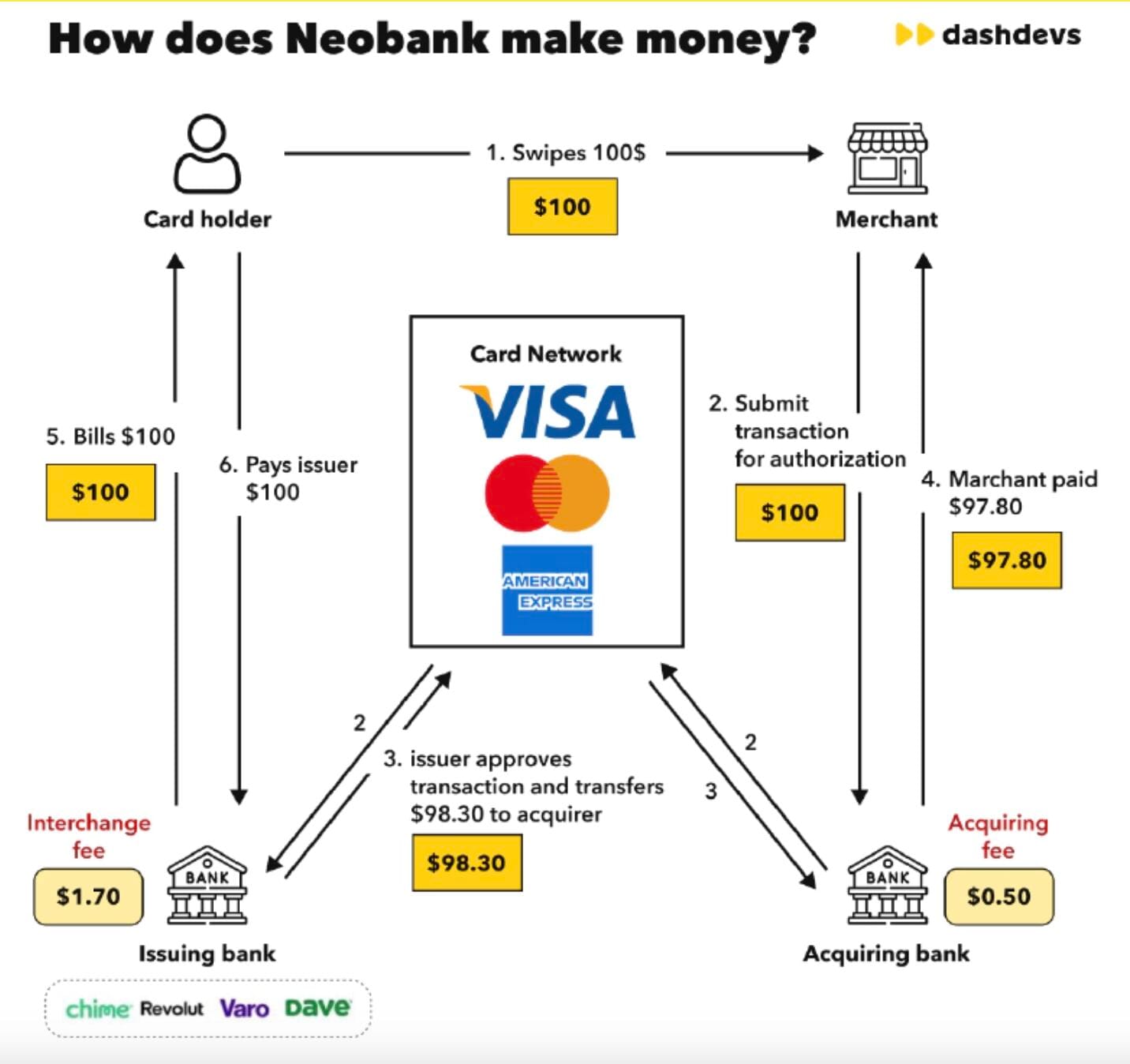

🤔 How does a neobank make money?

Let's dive in:

🇧🇷 Nubank made their "𝗖𝗼𝗻𝘁𝗮 𝗚𝗹𝗼𝗯𝗮𝗹" borderless account (powered by Wise) available to 100% of the Ultravioleta Premium segment yesterday. Click here to learn more

🇬🇧 Revolut has introduced Wealth Protection, an extra layer of identity verification designed to prevent thieves from accessing customer savings within the Revolut app. The feature will help protect customers who have had their unlocked phone stolen or password compromised to stop criminals from withdrawing customers’ savings out of their accounts.

🇮🇩 Julo plans neobanking push and eyes full profitability by year end. Julo focuses on Indonesia's middle-market segment, estimating a $100 billion opportunity. The company aims to issue over $650 million in loans this year.

🇬🇧 Tandem Bank has reported a surge in earnings, attributing the growth to customers switching to the eco-conscious digital bank in pursuit of greener lifestyles. The bank, which was established ten years ago and offers savings and loan products, saw an increase in its customer base and savings balances last year. It also managed to reduce its annual losses to £7.7million, down from a pre-tax loss of £12.4million the previous year.

🇵🇭 Tyme Group expands its customer base to 12.4 Million across SA and the Philippines. The group consistently onboards around 450,000 new customers monthly, with 250,000 joining GoTymeBank in the Philippines,and 200,000 opting for TymeBank in South Africa.

🇳🇱 Online bank Bunq steps up security after scam claims. Neobank Bunq has upped its security measures after an investigation by broadcaster NOS and the NRC newspaper found dozens of people had lost millions of euros to scammers from their Bunq accounts.

🇬🇧 Equals Money, a payments solutions provider, declared its expansion into Banking-as-a-Service (BaaS) during the Money20/20 Europe event. This move aims to broaden its product range, reflecting the company's focus on offering financial solutions across various sectors.

DONEDEAL FUNDING NEWS

🇧🇷 Brazilian FinTech financial reporting firm Accountfy raises $6.5M to continue platform transformation. The German insurer HDI and the investment house Redpoint, have been following the startup since the pre-seed round, and together, they have already invested $18.5 million in the business in recent years.

🇦🇪 Dubai-based digital platform for real estate investment, Stake, raises $14 million in its Series A funding round. The firm will use part of the proceeds to enter Saudi Arabia. It plans to become the first platform to allow individuals outside of the kingdom to invest in the local real estate market.

MOVERS & SHAKERS

🇮🇳 FinTech firm One97 Communications, owner of Paytm brand, is laying off an undisclosed number of employees and claimed that it is providing outplacement support for their smooth transition, according to a company statement. Read more

🇺🇸 NYMBUS, a provider of cloud-based financial technology solutions announced the appointment of Nate Whaley as Chief Revenue Officer (CRO). Nate has dedicated more than 15 years “to delivering business and technology solutions tailored to the banking industry.”

🇺🇸 MoneyGram announces Gary W. Ferrera as Chief Financial Officer. Ferrera will lead all aspects of finance, accounting, tax and treasury, in support of the continued growth and digitization of the business. Continue reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()