Starling Bank Eyes IPO with New Leadership and Strategic Hiring

Hey FinTech Fanatic,

Starling Bank is moving closer to a potential IPO, as it searches for a group head of investor relations to guide the process.

The job listing emphasizes the role's importance in collaborating with senior management and advisors to successfully execute an IPO or other capital event. This indicates that while an IPO is under consideration, it is still in the early stages.

Raman Bhatia, former OVO CEO and HSBC digital banking lead, became Starling's new CEO in March. Valued at £2.5 billion in 2022, Starling iced plans to go public when founder Anne Boden stepped down. Bhatia's appointment is viewed as a potential catalyst for reviving the prospect.

Read more FinTech industry updates I listed for you below and I'll be back with more news tomorrow!

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

FEATURED NEWS

🇬🇧 UK’s Big Plan to Deter Online Payment Scams Risks Misfiring. Hundreds of financial firms are struggling to comply with a new UK regime designed to rein in online payment scams before an Oct. 7 deadline after one of the worst summers for fraud.

PODCAST

🎙️ Tune into this interesting podcast episode where Robin Amlôt interviews Pav Gill, the lawyer who played a crucial role in uncovering the irregularities at Wirecard. Now the Founder & CEO of Confide Platform, Pav Gill discusses his transition from a legal expert in a major corporate scandal to spearheading a company dedicated to improving corporate governance.

INSIGHTS

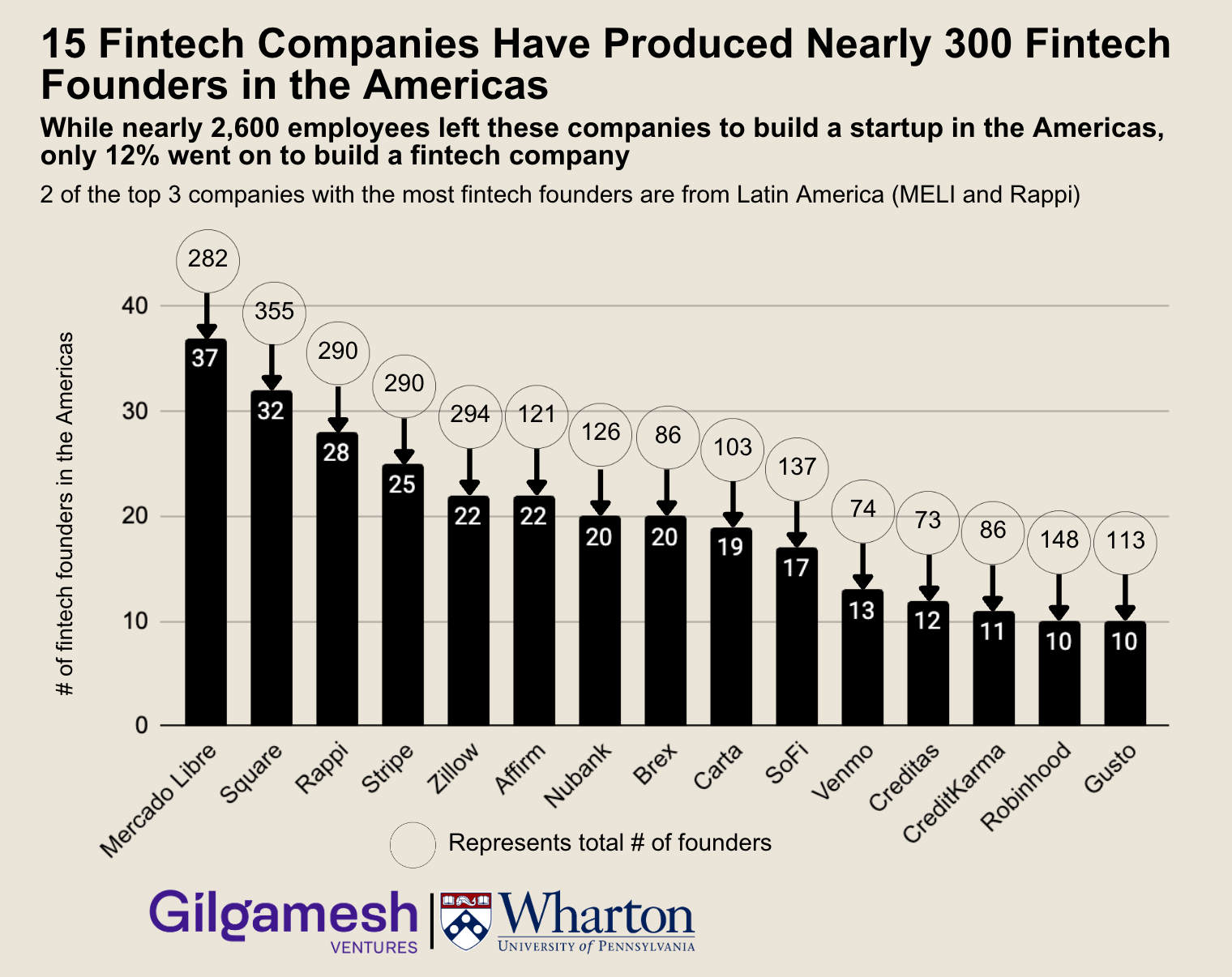

📊 15 FinTechs have produced nearly 300 FinTech Founders in the Americas 🤯

FINTECH NEWS

🇰🇷 Korean FinTech SentBe launches global remittance service. Targeting those who need to send money outside of their country, SentBe’s individual remittance service facilitates remittances to home countries. The company claims $264 million in fee savings from 2016 to 2023.

PAYMENTS NEWS

🇺🇸 Datos names ACI Worldwide Best in Class in Payments Orchestration. The report used four categories to analyze payments vendors: provider stability, client strength, client service and product features. ACI Worldwide achieved the highest ranking and average score across categories and was the only vendor to earn the “Best in Class” accreditation.

🇺🇾 Topper by Uphold and dLocal join forces to expand payment flexibility in emerging markets. The alliance will drive economic growth in emerging markets by offering local payment options. Read on

🇺🇸 Hotels. com partners with Affirm to bring guests a flexible way to book trips. By selecting Affirm at checkout, approved Hotels. com guests can split the total cost of their purchase into budget-friendly payments.

🇲🇽 Shiji and FreedomPay announce partnership to transform Mexican hospitality payment solutions. This partnership underscores the companies’ commitment to enhancing staff and guest experiences in Latin America's hospitality business, in line with the industry's move toward streamlined payments and payment management.

OPEN BANKING NEWS

🇮🇳 India’s Account Aggregator Framework crosses 100 million consents in three years. The 1059% growth in FY 2023-24 makes it the fastest growing Open Finance Network in the World. It also positions India’s AA ecosystem, the fastest growing Open Finance ecosystem in the world.

🇸🇪 European open finance provider Insurely announced the launch of a new product, Investment Data Access. A solution that provides banks and financial institutions real-time access to data on customer investments across stocks, mutual funds, securities accounts, custody accounts, investment savings accounts, and endowment insurance.

🇳🇴 Neonomics tapped by supporter's platform Støtte to simplify micro-donations through open banking. "This partnership will greatly enhance the user experience for both donors and organisations, fostering a stronger community of support within Norwegian sports and humanitarian aid," said Christoffer Andvig, CEO of Neonomics.

DIGITAL BANKING NEWS

🇮🇱 The Bank of Israel has issued Revolut a unique identification code, marking its official entry into Israel's regulated Payment System. The code allows Revolut to assign payment account numbers, streamlining identification within the system.

🇹🇭 Major players vie for Thailand’s first virtual bank licences. A mix of Thai and regional business groups, including SeaMoney Thailand, SCB X, CP Group, Gulf Energy, and VGI, are preparing to apply for virtual bank licences from the Bank of Thailand.

🇺🇸 Treasury Prime partners with Kobalt Labs to bring AI-Powered compliance to its bank network. Banks in Treasury Prime’s network now have the option to leverage Kobalt Labs to better manage their third party diligence with AI, including the ability to streamline legal, compliance and infosec diligence in one platform.

🇧🇷 Agibank posts record 200% growth in half-year net income. The institution's loan portfolio advanced 53.0% year-on-year, reaching R$19.1 billion, standing out for growing five times faster than the market. Find out more

🇨🇭 Swiss banks dive into instant payments, capturing 95% of retail transactions. The country has moved closer to a cashless society with its new instant payment scheme. The Swiss National Bank (SNB) and financial infrastructure operator SIX made the announcement on Wednesday.

📉 Majority of FinTech partner banks report losses over compliance. According to identity risk management platform Alloy’s “2024 State of Embedded Finance” report, an estimated 75% of sponsor banks have suffered losses of $100,000 or more as a result of compliance violations, including fines and direct financial losses.

BLOCKCHAIN/CRYPTO NEWS

🇦🇪 Tether said it would launch a new stablecoin pegged to UAE's dirham as it taps demand for the Gulf currency and seeks to offer alternatives to the U.S. dollar. The UAE is pushing to become a global hub for the crypto industry as economic competition heats up in the Gulf region.

🇫🇮 Coinmotion partners with Bitpanda Technology Solutions to bring expanded Crypto offering to the Nordics. Thanks to Bitpanda’s integration, Coinmotion customers will get access to the full range of cryptocurrencies from within the Coinmotion app.

DONEDEAL FUNDING NEWS

🇦🇺 Moneycatcha, the Perth-based FinTech that delivers open banking solutions to mortgage brokers under the ‘Regchain’ and ‘Stryd’ brands, is accelerating growth plans to capitalise on renewed momentum in Australia’s Consumer Data Right (CDR), boosted by two key board appointments and $1.5 Million in fresh funds.

🇸🇦 Resal raises a $9M funding round. Resal indicated that the investments from this round will be utilized to accelerate its business growth within the Kingdom by expanding its targeting of new sectors, launching various technological products for alternative payment solutions, loyalty programs, and rewards.

🇺🇸 FinTech startup Lettuce Financial closes $15 Million in series A funding to fuel partnerships, product development and growth. Founded, built, and funded by solopreneurs, Lettuce aims to help solopreneurs succeed financially by providing the tools they need to optimize their business taxes.

🇺🇸 Crypto Payment Network for AI agents launched by former Ripple execs. The company, Skyfire, raised $8.5 million to advance AI capabilities, including handling payments, by utilizing third-party aggregators to facilitate AI payments.

🇮🇳 FinTech startup TransBnk secures $4 million in funding round led by 8i Ventures. The fresh capital will be used to expand TransBnk's banking network, drive global growth in West and Southeast Asia, and strengthen its technology and product offerings.

M&A

🇳🇿 Klarna has acquired Laybuy’s assets in New Zealand, the birthplace of the payments provider, and plans to relaunch the service in the coming weeks. Laybuy, which ceased operations in June, is set to make a reenergized return in New Zealand under Klarna.

MOVERS & SHAKERS

🇬🇧 Trustly appoints payments industry veteran Adam D’arcy as CPO. Trustly looks to reinforce its product team by bringing on D’arcy to lead several upcoming product expansions for Open Banking Payments.

🇹🇭 Mastercard appoints Winnie Wong as country manager for Thailand and Myanmar. Winnie will oversee all Mastercard activities in the two markets, including business development, implementation of innovative, safe, and smart payments solutions, as well as the growth and delivery of commercial solutions to corporations and SMEs.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()