Solaris Plans to Reduce Its Workforce by One-Third

Hey FinTech Fanatic!

Earlier this month, Solaris announced a sweeping transformation programme that will phase out its EMI and embedded finance operations under Solaris SE.

This marks a significant shift, particularly for its EMI unit, which includes Contis—the UK-based payments firm Solaris acquired and rebranded back in 2012.

According to Handelsblatt, this overhaul will impact around 240 of Solaris’ 700 employees. This news comes after Solaris secured €96 million in a Series F funding round in March, plus a financial guarantee of up to €100 million, set to back a substantial contract with motor association ADAC.

Despite the funding boost, Solaris reported a €56 million loss for fiscal year 2022, adding even more weight to these strategic moves.

You can read more (more positive 😀) FinTech industry updates below👇, and I'll be back in your inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

FINTECH NEWS

🇪🇹 Safaricom extends its M-PESA Global service to Ethiopia. The two companies aim to increase mobile money use and penetration across the region of Ethiopia, as well as boosting local economies and creating new opportunities for individuals, businesses, and institutions nationwide.

🇬🇧 Liberis launches multi-product financial platform, boosting SME growth. The platform is designed to offer flexible funding solutions through its partners, and represents a significant step forward in addressing the financial needs of small businesses.

🇬🇧 Sunshine+Kittens partners with Mastercard, The PayFirm and SaaScada to launch disruptive new kids money account. Sunshine+Kittens aims to disrupt the young person’s finance industry with cool designs and gamified experiences that make learning fun.

PAYMENTS NEWS

🇸🇬 Aspire gets In-Principle Nod from MAS for payments license. This approval will allow Aspire to expand its financial services for businesses and will enable the company to offer more secure financial solutions to its customer base of over 50,000 businesses worldwide.

🇬🇧 RTGS.global launches unique solution for PSPs to drive ‘exponential growth’ with frictionless foreign exchange money transfers. This solution will enable them to offer cheaper and faster international payments to their retail and corporate customers.

🇳🇿 Cross-border payments FinTech Ebury wants to fill a business banking gap. The firm has opened a New Zealand office and targets medium-sized firms, particularly importers and exporters, offering cross-border payment services, including foreign currency hedging and lending.

🇨🇳 China’s UnionPay International teams up with NAPAS. Both parties have agreed to deepen the collaboration on cross-border QR code interoperability and enable QR payments by UnionPay and Vietnamese local bank applications/e-wallets on each other's networks, to enhance the experience of users from both countries.

🇮🇳 Cashfree receives NPCI certification for its own UPI switch. This will allow Cashfree to directly integrate with any bank's core banking software and offer a higher transaction success rate for its merchants. Read the full piece

🇰🇭 Cambodia now accepts QR Payments from international travellers via Alipay+. Cambodia has integrated Alipay+ with its national QR code system, KHQR for seamless international payments. This launch enables users of 12 international payment apps to pay at over one million merchants in Cambodia using KHQR.

OPEN BANKING NEWS

🇳🇴 Neonomics introduces Nello, a Personal Finance Manager app. The app aims to elevate Open Banking through AI-driven solutions and simplified payment experiences. The firm is authorised by the Norwegian FSA and provides payment initiation and account information services to various businesses.

DIGITAL BANKING NEWS

🇧🇷 Brazil’s Nubank announces product updates including competitive crypto transaction fees. Nubank recently launched the Coupon Hub in Shopping do Nu, a centralized discount center for marketplace offers. Additionally, it was noted that the users of Nubank Cripto will benefit from “reduced fees” for buying and selling cryptocurrencies in the Nubank app. Read on

🇬🇧 Metro Bank to offer business customers invoice software from BankiFi. Invoice It is a user-friendly app and web-based service that helps SMEs send and receive payments. Available to Metro Bank Business and Commercial Current Account customers via iOS, Android, or the web-based version.

🇬🇧 Metro Bank plans to collaborate with Pexa to improve the speed and ease of the remortgaging process. The aim of the collaboration is to improve the speed of post-offer processes, remortgage completion times and greater transparency for the bank’s customers and brokers.

🇩🇪 Solaris to lay off a third of workforce with the majority of job losses hitting its British subsidiary Contis. Earlier this month, the German Banking-as-a-Service company announced a major transformation program, which includes discontinuing its EMI and embedded finance business, Solaris SE.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Crypto firms reportedly racked up $32 billion in US regulatory settlements. A CoinGecko report revealed that US regulators have reached $31.92 billion in settlements with crypto companies. Notably, 16 of the top 25 enforcement actions occurred in the last two years, indicating increased scrutiny following the FTX collapse in late 2022.

🇧🇭 Crypto.com and BENEFIT enter into dialogue to support FinTech in Bahrain. Both companies signed a MOU at Bahrain’s FinTech Forward event on October 3, 2024, setting the stage for a potential partnership that will explore solutions pertaining to payment integration and the deployment of Crypto.com’s prepaid cards in Bahrain.

🇺🇸 Crypto company Tether talking to commodity traders about lending them its billions. The crypto company has discussed US dollar lending opportunities with several firms across the credit-hungry sector, according to people familiar with the matter who asked not to be identified discussing private conversations.

PARTNERSHIPS

🇬🇧 Experian UK&I marks next step in fraud prevention with Sardine partnership. The next-generation behavioral biometrics and device intelligence technology will empower businesses to analyze every customer interaction, enhancing their ability to detect suspicious behavior with greater accuracy.

🇳🇬 Flutterwave and 9jahotel.com launch PoS system. This partnership introduces a smart hotel management solution called Roomstatus, which is expected to significantly improve operational efficiency for hotel owners and managers across the country.

🇸🇬 Worldline and FinbotsAI team up to put AI credit modelling in the hands of financial institutions. The collaboration will bring an AI-powered solution to help financial institutions level up their lending business through a no-code SaaS model that puts the ownership of credit modelling in the hands of Worldline’s clients of all sizes globally.

🇪🇨 PXP Financial partners with Kushki in LATAM expansion plan. The strategic partnership aims to provide end-to-end payment solutions for merchants and consumers in the region. PXP Financial is now able to leverage Kushki’s technology and expertise to create tailored payment solutions for the Latin American market.

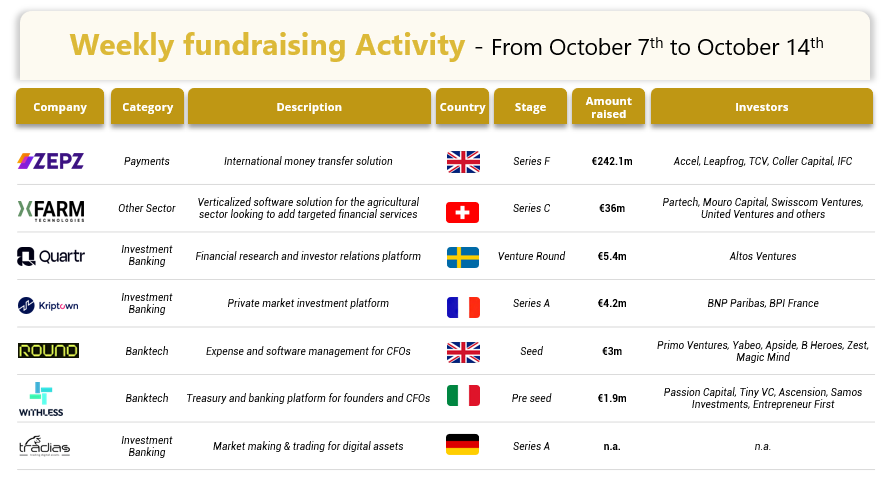

DONEDEAL FUNDING NEWS

💰 Last week, there were 7 official FinTech deals in Europe, raising a total of €291.6 million, with 2 deals in the UK, 1 deal in Germany, 1 deal in France, 1 deal in Switzerland, 1 deal in Italy and 1 deal in Sweden. Read the complete BlackFin Tech overview article

🇳🇱 Ex-Adyen co-founder’s Amsterdam startup Tebi secures €20M to transform retail and hospitality operations. This marks Tebi’s first institutional investment since its founding three years ago. The firm aims to give independent businesses enterprise-level tools with the simplicity of a consumer app.

🇬🇧 Acquired.com secures GBP 4 mln to boost digital payments growth. The new financing will allow the company to invest in its workforce and enhance its core payment offerings—card processing, direct debit, Pay by Bank, and real-time payments—driving growth and innovation in the payments sector.

M&A

🇬🇧 Invex Ventures acquires FinTech infrastructure platform Manigo. Adding to Invex’s portfolio of FinTech solutions, the acquisition will strengthen Manigo’s offering in the core banking and vendor orchestration space. Continue reading

MOVERS & SHAKERS

🇳🇱 Backbase appoints Tim Rutten as Chief Marketing Officer. As CMO, Rutten will lead Backbase's global marketing strategy, focusing on brand positioning, demand generation, and strengthening the company's leadership in digital banking transformation during a key growth period.

🇪🇺 Alexandra Chiaramonti appointed Managing Director, International at GoCardless. In her role, Chiaramonti is responsible for scaling the FinTech’s growth outside of the UK and Ireland, with a focus on Europe and Asia Pacific. Read on

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()