Sokin Secures $31M Investment from Morgan Stanley and More

Hey FinTech Fanatic!

I’m excited to share some great news about one of my portfolio companies, Sokin. Morgan Stanley has led a $31 million investment into this international payments FinTech. Notable investors include Aurum Partners and former PayPal CCO Gary M., who will join Sokin’s board.

Sokin’s founder and CEO, Vroon Modgill, highlighted their choice of Morgan Stanley to distinguish them from other FinTechs, ensuring customers know they are backed by a trusted tier one bank.

Founded in 2019, Sokin serves around 500 businesses, offering multi-currency accounts for international transfers and payments. With high-profile supporters like Rio Ferdinand, Sokin has been profitable for two years, reporting $4.5 million pre-tax profit last year and aiming for over $10 million this year.

A huge congrats to Vroon and the rest of the team!

On the topic of portfolio companies, I’ll be heading to Bogota soon to meet with Treinta and spend a week connecting with other promising companies like Payment Orchestration FinTech Yuno. If you know of any other exciting FinTech companies or industry leaders in the area, please let me know. Let’s catch up over coffee or a beer while I’m there!

Cheers,

Join my Telegram channel for instant access to daily updates and exclusive breaking news from the FinTech industry. Connect with fellow FinTech Fanatics and stay ahead with the latest trends and insights.

POST OF THE DAY

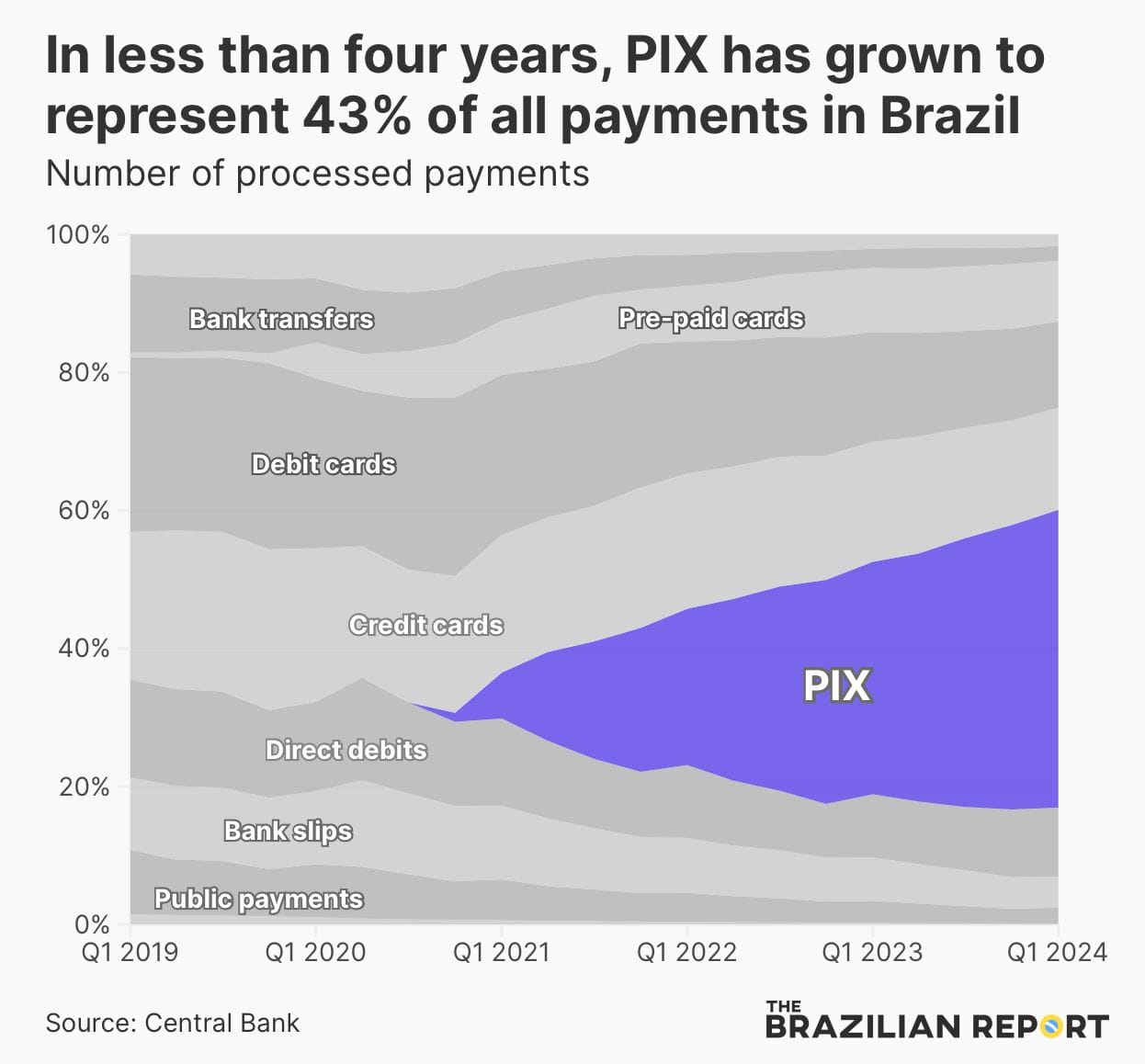

📈 In less than four years, PIX has grown to represent 43% of all payments in Brazil 🤯

FEATURED NEWS

📜 The Federal Trade Commission requested information from Mastercard, and seven other companies, in a quest to better understand differential pricing strategies based on personal consumer data, the federal agency said in a Tuesday press release.

FINTECH NEWS

🇵🇭 Careem Pay expands offering in Philippines to simplify remittance process. UAE residents will now be able to send up to AED 45,000 per transaction and up to AED 135,000 per month to bank accounts in the Philippines using the recipient’s bank account number and sort code, or IBAN, at competitive exchange rates and speed.

🇺🇸 Visa reports rare quarterly revenue miss, shares drop. Visa's third-quarter revenue growth fell short of Wall Street targets in a rare miss for the world's largest payments processor as steep borrowing costs limited consumer spending, sending its shares down 4.6% in extended trading.

🇩🇪 Liberis partners with Nexi to launch revenue-based financing into Germany. Nexi Financing, powered by Liberis, will provide 120,000 merchants with the flexible funding options they need to maintain and grow their businesses. Read on

🇨🇳 As of June 2024, Ant Group’s AI-powered smart financial manager Zhixiaobao has served 59 million individual users via the Ant Fortune and Ant Insurance platforms in the Alipay app, according to QuestMobile. The report highlights significant mobile traffic growth across various sectors, including financial services.

PAYMENTS NEWS

💳 Visa prevented $40 bln worth of fraudulent transactions in 2023. Worldwide, Visa has invested over $10 billion over the past five years in technology, including $500 million on AI and data infrastructure to protect clients and customers from fraudulent activity.

🇧🇷 Brazilian instant payments FinTech Caliza has raised $8.5 million in a pre-Series A round led by Initialized Capital. Caliza will use the funds to expand its operations, doubling its workforce in Brazil, and to launch operations in Mexico. Read more

🇦🇺 Customers of FinTech lender Plenti now have a faster and more simple way to make additional loan repayments through NAB’s Pay by Bank. Plenti is the first NAB business customer to integrate the new account-to-account payment solution in its online lending platform, allowing its customers to make real-time payments via PayTo to pay down their debt faster.

🇶🇦 Qatar Islamic Bank (QIB) launches “Request to Pay” feature on Fawran instant payment service. The Fawran Request to Pay service enables customers to request a payment from a registered Fawran user instantly through the QIB Mobile App.

OPEN BANKING NEWS

🇨🇦 Columbia Valley Credit Union partners with Flinks to offer Open Banking ahead of regulations. By choosing Flinks, CVCU leverages an industry-recognized partner whose solutions are already live in the market, ensuring an easy and efficient adoption process.

🇬🇧 Zopa Bank partners with D•One for Open Banking services. The integration will see Zopa Bank add D•One to its roster of partners that provide open banking connectivity and transaction categorisation intelligence. D•One will initially be focussing on Zopa’s loan origination journeys.

DIGITAL BANKING NEWS

🇬🇧 Monzo launches pension consolidation product. Monzo Bank has launched a new product called 'Monzo Pension', aimed at simplifying pension consolidation by bringing old pensions together into one fund within its app.

🇬🇧 Small businesses can now get 5.15% interest on their cash with Lightyear. The neobroker has launched accounts for small businesses. The new business accounts will give customers access to money market funds, which Lightyear says have traditionally been reserved for large corporates.

DONEDEAL FUNDING NEWS

🇬🇧 Morgan Stanley leads $31m investment into international payments FinTech Sokin. The investment follows other financial institutions taking a larger role in funding Europe's FinTech this year. Read the complete article

🇪🇸 The flexible payment startup Payflow has raised €6 million in its latest funding round. The company aims to expand across Spain, Portugal, and Latin America, where it sees potential for introducing its solutions. Almost a year ago, Payflow raised 32 million euros in a mix of equity and debt to decuple its growth. Benoît Menardo, co-founder of Payflow, commented on the new funding: "The investment market is now seeking efficient startups, making us leaders in financial efficiency."

🇺🇸 FinTech firm Powder closes $5 million in seed funding. The round round will allow the company to continue scaling its technology, taking advantage of the AI boom that is rapidly transforming industries. Read the full piece

🇲🇽 Digitt secures US$50M from CoVenture to help prime borrowers in Mexico pay off predatory credit card debt. The Facility will help expand Digitt's existing debt refinancing product, expand its product offering and deepen the company's relationship with its growing customer base.

M&A

🇮🇹 UniCredit announced that it has entered into a binding agreement for the acquisition of the entire share capital of Vodeno and Aion Bank. The combined purchase price is around €370m. The companies offer end-to-end BaaS for financial and non-financial firms across Europe, combining a cloud-based platform with Aion's ECB-licensed banking services.

MOVERS & SHAKERS

🇺🇸 US Faster Payments Council appoints Carl Slabicki chairperson. The FPC Board is made up of influential leaders from all sectors of the payments ecosystem, including financial institutions, technology providers, business end users, payment network operators, consumer advocacy groups, and others. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()