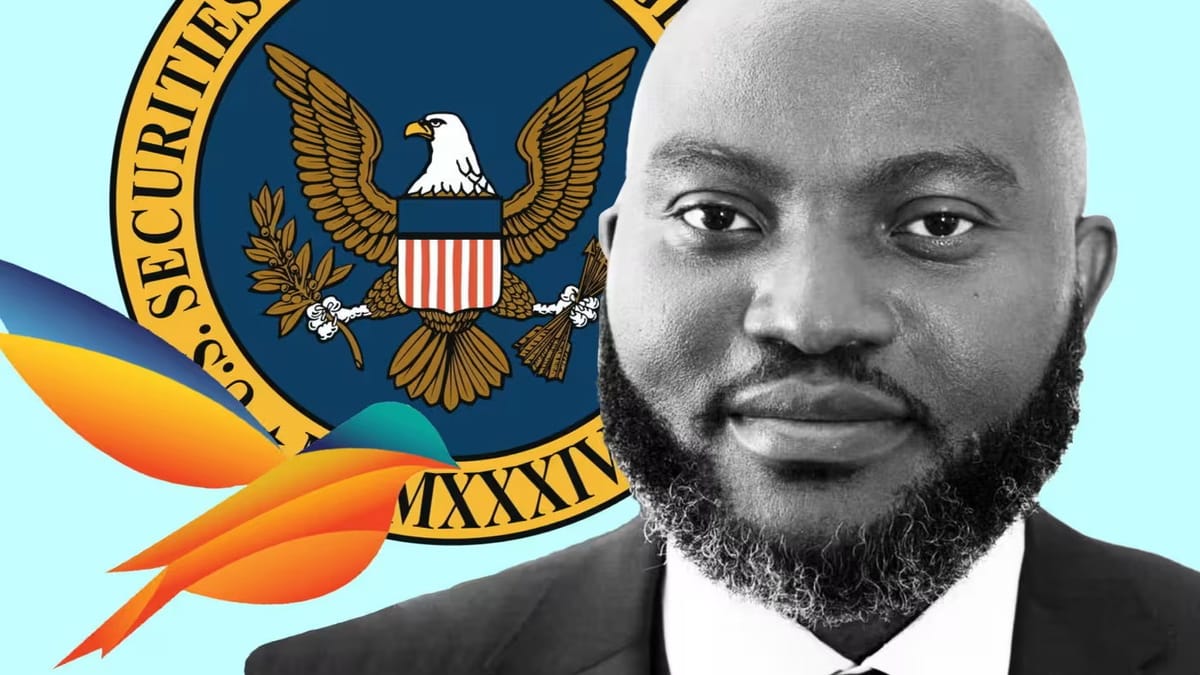

SEC Exposes Massive Fraud: Nigerian FinTech Chief Fined $250M

Hey FinTech Fanatic!

A US federal court has imposed a $250 million fine on Nigerian FinTech entrepreneur Dozy Mmobuosi and his three US-based companies, barring him from holding any directorial position in public companies.

This follows charges by the SEC, which accused Mmobuosi of orchestrating a massive fraud by inflating the financial metrics of his FinTech ventures, including two Nasdaq-listed companies.

The SEC described his empire, which claimed to have over 9 million customers, mostly farmers in Nigeria, as a “fiction,” with most of its assets and revenues fabricated.

One of his companies, Tingo Mobile, reported over $461 million in Nigerian bank accounts for 2022, but SEC investigations revealed the balance was under $50.

The fraud's scale, according to the SEC, was staggering, leading to the suspension of trading in his companies' shares.

According to The Financial Times, Mmobuosi and his companies could not be immediately reached for comment.

Cheers,

Stay Ahead in FinTech! Subscribe to my FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

FEATURED NEWS

🇸🇬 Pav Gill on courage, whistleblowing, and building the Confide Platform. Pav Gill is a pivotal figure in corporate governance and ethics, renowned for exposing the EUR 24 billion Wirecard fraud. He delivers transformative insights on ethical leadership, transparency, and integrity. Dive into the complete interview here

#FINTECHREPORT

📊 How to build and launch a FinTech product in Africa. This guide will help you answer key questions 👉Find out more

FINTECH NEWS

🇺🇸 IKEA U.S. partners with Slope Tech Inc. to enhance financial solutions for business customers. The partnership highlights IKEA for Business's focus on growth, ensuring they continue to meet the evolving needs of their business customers.

🇱🇺 VNX platform integrates Volt for seamless deposits. Volt, with connections to over 2,500 banks across Europe, offers a smooth and secure way to fund VNX accounts through mobile or desktop, ensuring convenience for all users. More here

🇨🇦 Canadian FinTech start-up Hardbacon closes down. On 15 August, co-founder and CEO Julien Brault announced via a company blog post that all employees of Hardbacon (Bacon Financial Technologies Inc.) have been let go, and operations have been suspended.

🇬🇧 Experian and Paylink Solutions partner to launch debt consolidation solution. This partnership aims to enhance financial inclusion by improving access to credit. ReFi™ by Paylink facilitates this by allowing customers to settle existing credit commitments with lenders through a streamlined process.

🇦🇿 Epoint, online payments platform in Azerbaijan receives FinTech license. This recognition – which is the first for any startup in the country – is a testament to the high quality of the services provided by the company and their compliance with the most stringent security and reliability standards.

PAYMENTS NEWS

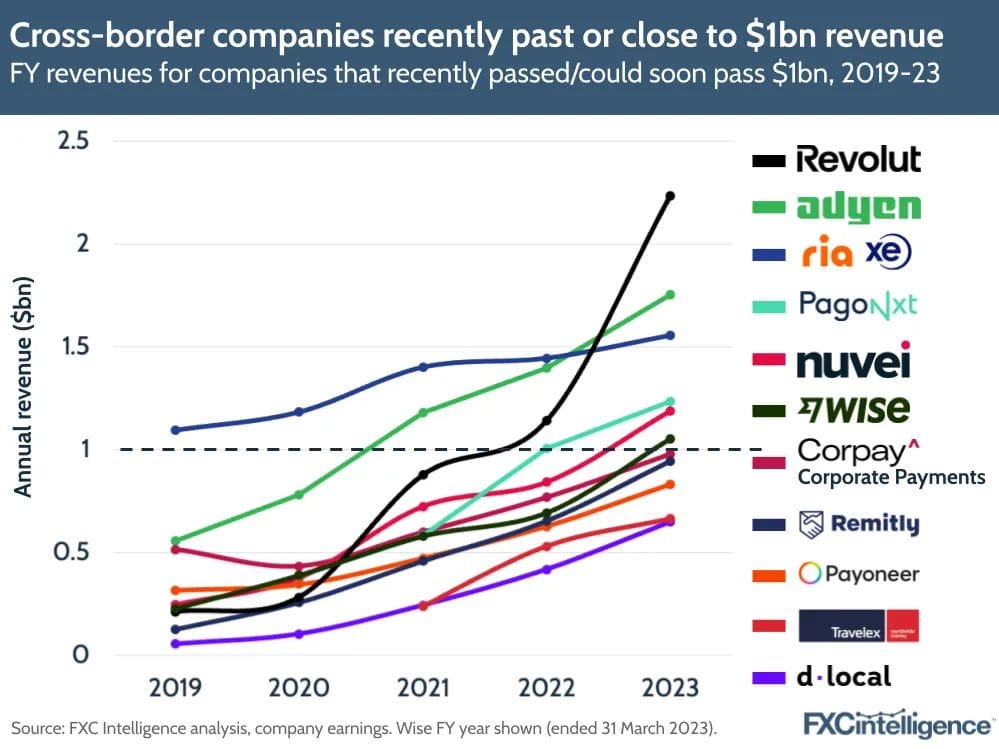

🌐 Which cross-border payments companies have hit $1bn in revenue?

Here is an overview by FXC Intelligence:

🇮🇹 Ecommpay to boost Italian e-Commerce with three new local payment options. The addition of BANCOMAT Pay, MyBank, and Satispay is set to enhance the performance of e-commerce merchants in Italy by offering more tailored payment options that improve conversion rates.

🇬🇧 Modulr adds integration to Xero for payroll services. The integration enables Xero Payroll users to leverage the Modulr real-time payments network. The network supports faster payments, with some payments clearing within 90 seconds, even during weekends and holidays.

🇺🇸 Amazon’s checkout reportedly suffered a technical issue as its Labor Day sale began. The glitch in the eCommerce site happened Friday (Aug. 30), preventing users from completing their purchases, CNBC reported, citing reports from customers on social media.

💵 Cautious approach needed for interlinking fast payment systems, warns Fed Governor. In a recent speech, Fed Governor Christopher Waller highlighted the potential risks and practical challenges associated with interlinking fast payment systems, underscoring the Fed’s focus on strengthening its own FedNow network domestically.

DIGITAL BANKING NEWS

🇰🇼 Warba Bank announced the launch of Warba Advisor, the first personal banking advisor powered by AI as part of its strategic digital transformation. This initiative aims to improve customer service by using AI for personalized banking consultations. Warba Bank is the first in Kuwait to offer this service.

🇮🇪 Revolut has told potential business partners in Ireland that it will introduce its first home loans in the second quarter of 2025, marking a significant expansion of its offering. Learn more

🇬🇧 Atlantic Money provides low-cost alternative to Swift with app-less money transfers. Money movement firm Atlantic Money is to make it possible for users to forsake its app and instead send and receive currencies directly from within their own bank accounts.

🇬🇧 Waafi Bank selects The Bank of London as its UK services provider. Waafi Bank is dedicated to offering financial products that align with Islamic principles, ensuring that all financial dealings are Shariah-compliant, making this partnership crucial for its mission.

🇸🇦 NEO, a new mobile banking brand, is being launched in Saudi Arabia by SNB. Described as a “lifestyle digital banking and financial ecosystem”, the banking app comes with a multi-currency debit card (supporting up to 20 different currencies with fixed currency rates), a rewards programme, gift cards, and additional services.

🇪🇬 Egypt to launch first digital bank by Q4 2024 following CBE’s approval. This information was revealed in an IDSC report, which explains that digital banks are a type of FinTech institution offering many of the same services as traditional banks, with the key difference being that digital banks operate without physical branches.

BLOCKCHAIN/CRYPTO NEWS

🇮🇳 Customers of Indian crypto exchange WazirX unlikely to recover full funds. A director at restructuring firm Kroll working with WazirX, said that at least 43% of the money any customer had in WazirX is unlikely to be recovered. Last week, the firm asked a Singapore High Court for 6 months’ protection while it restructures its liabilities.

🇺🇸 Coinbase reports its first AI-to-AI crypto transaction. CEO Brian Armstrong made the announcement highlighting a new application of digital currency by artificial intelligence agents. Armstrong believes this advancement will enhance AI’s capacity to independently obtain resources and engage with humans and other AI systems.

DONEDEAL FUNDING NEWS

🇰🇪 Kenyan e-commerce startup Chpter raises $1.2 million in pre-seed round. The company plans to use the new funding to improve its technology stack and expand into Egypt and Nigeria. Read more

🇮🇩 Validus secures $50M debt financing to help enterprises in Indonesia. The Singapore-based digital lending platform will use the proceeds to support the financial inclusion of micro, small and medium enterprises (MSMEs) in Indonesia, addressing the challenges they face in accessing financial resources.

M&A

🇬🇧 GoCardless closes deal to acquire Nuapay. Bank payment company GoCardless has closed its acquisition of Nuapay in order to scale its indirect channel proposition and fast-track the launch of new capabilities. More on that here

🇿🇦 Sanlam buys 25% stake in unit that owns Motsepe’s TymeBank. Sanlam’s Life unit will acquire the stake in African Rainbow Capital Financial Services Holdings, which controls African Rainbow Capital Investments Ltd.’s holdings in TymeBank, AI Fund, CrossFin Holdings and Ooba, in a deal valued at 3.9 billion rand ($218 million), according a regulatory filing.

MOVERS & SHAKERS

🇳🇱 Mollie, a rapidly expanding Payment Services Provider in Europe, has appointed Dave Smallwood as the UK Managing Director. This strategic move aligns with Mollie’s plans to scale its UK operations, following impressive triple-digit year-on-year growth in the first quarter of 2024 🤯

🇬🇧 Coreless banking pioneer XYB bolsters lending team to accelerate growth. The newly onboarded team's deep market insights and advanced technological expertise will significantly elevate XYB’s current offerings and pave the way for exciting new developments. Click here to learn more about the recent changes

🇩🇪 Computop appoints Kenneth M. Overgaard-Nielsen as COO. His areas of responsibility include the Business Solutions department, which covers processes and internal systems, and the Merchant Services department, which supports Computop customers with connections and answers technical questions

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()