SEC Clears Path for Ether ETFs Amidst Crypto Boom

Hey FinTech Fanatic!

The SEC has given the green light to a rule change on Thursday, setting the stage for ETFs that invest in ether, one of the largest cryptocurrencies globally.

This decision follows the Securities and Exchange Commission's approval of bitcoin ETFs less than six months ago. These bitcoin funds have been a major hit in the industry, with net inflows already exceeding $12 billion, according to FactSet.

Late May had been anticipated as a key decision point for the ether funds, coinciding with the SEC's deadline to rule on the VanEck Ethereum ETF.

Several firms that sponsor bitcoin ETFs, such as BlackRock, Bitwise, and Galaxy Digital, have begun the process of launching ether funds.

Have a great start to the week, but not before you check more FinTech updates I listed for you below 😉

Cheers,

#FINTECHREPORT

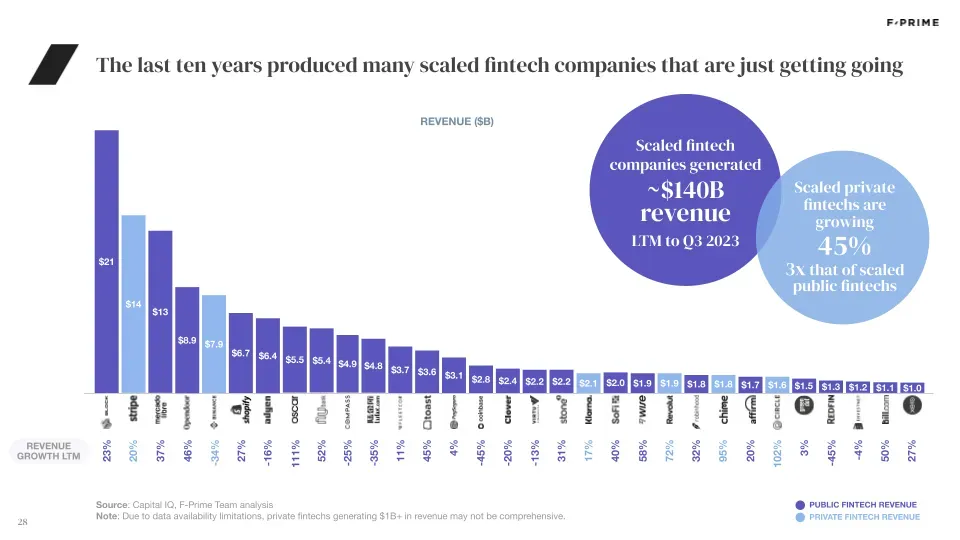

📊 In this recent State of FinTech report by F-Prime Capital, they took stock of the sector’s progress over the last decade, identifying the companies that have reached (or are about to reach) enterprise scale. Read the complete report for more interesting stats.

FINTECH NEWS

🇺🇸 Walmart, Capital One end credit-card deal in wake of lawsuit. Capital One Financial Group will no longer be the exclusive issuer of Walmart Inc. credit cards after retailer’s lawsuit. Read more

🇧🇷 Visa has announced partnerships with Brazilian FinTechs Dock and Muevy to enhance international remittance services through Visa Direct in Brazil. This technology enables financial institutions and exchange agents to swiftly execute international transfers to more than 190 countries.

🇮🇪 Ireland licenses FinTech firm Ramp Network as Virtual Asset Service Provider. Ramp Network’s Irish subsidiary will facilitate the exchange of fiat currencies for over 100 crypto assets. This capability will enable the company to facilitate onboarding users to Web 3 through an on- and-off-ramp service.

🇦🇺 Australian-owned wealthtech HeirWealth launches. The family wealth platform tackles challenges in the $3.5 trillion intergenerational wealth transfer, including administrative inefficiencies and managing diverse assets across fragmented tools.

PAYMENTS NEWS

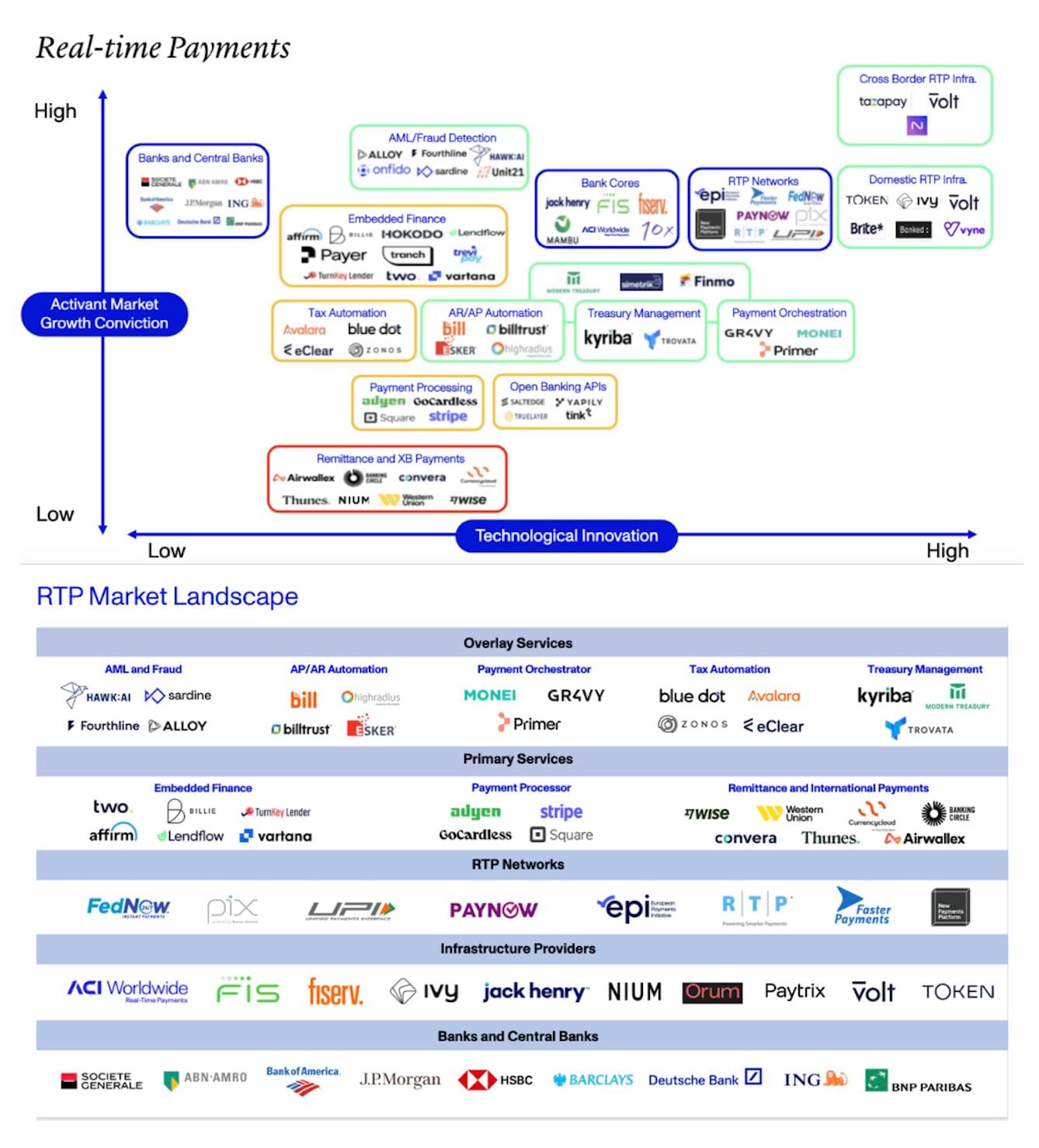

➡️ What is a Real-Time Payment (RTP)? And why is it so important?

🇨🇦 Moneris and Square introduce Tap to Pay on iPhone in Canada. Canadian businesses can now accept in-person payments seamlessly and securely from most major contactless debit and credit cards, Apple Pay via an iPhone or Apple Watch, or other digital wallets directly on an iPhone. Tap to Pay on iPhone lets sellers accept contactless payments directly from their iPhone with no additional hardware or payment terminal required and at no additional cost.

🇨🇴 FinTech Lyra has integrated Apple Pay for payments with Visa and Mastercard in collaboration with local operators Credibanco and Redeban, becoming the only gateway to offer it in this manner, adding additional value to its customers.

🇪🇺 Finastra partners with LGT to provide instant payment services in Austria and Liechtenstein. LGT will deploy Finastra’s payment hub using a model bank implementation approach to expedite its compliance with the EU instant payments regulatory timeline.

🇺🇸 Klarna labels CFPB BNPL rule 'baffling'. The US Consumer Financial Protection Bureau's new rule on buy now, pay later lenders has received a mixed reception from industry players, with Affirm welcoming the outcome but rival Klarna calling it "baffling".

🇺🇸 Affirm CEO Max Levchin on why he thinks CFPB regulation on BNPL is a 'good thing'. Watch video here

🇪🇺 Scalapay, a BNPL platform in Southern Europe, and Adyen announced the start of a strategic partnership that opens up new opportunities in the payments landscape. This collaboration will see Adyen processing installment payments made through Scalapay in Southern Europe and will allow its customers to access Scalapay's BNPL solution and benefit from all its features.

🇧🇷 Centrobill has announced its offering of fully licensed PIX payments in Brazil in a move aimed at influencing the Brazilian FinTech market by ensuring secure and cost-effective transactions. Read more

🇬🇧 Boodil has announced the launch of its new specialised payments platform developed for the travel industry, in collaboration with ‘The Advantage Travel Partnership’.

DIGITAL BANKING NEWS

🇺🇸 Chime partners with FairPlay to embed fairness into its algorithmic decisions. Chime will incorporate FairPlay's Fairness-as-a-Service solutions to further its mission of helping everyday Americans unlock financial progress.

🇺🇸 FinTech nightmare: ‘I have nearly $38,000 tied up’ after Synapse bankruptcy. A dispute between a FinTech startup and its banking partners has ensnared potentially millions of Americans, leaving them without access to their money for nearly two weeks, according to recent court documents.

🇺🇸 Cash App aims to add more features. Block’s Jack Dorsey wants to improve Cash App’s customer service experience in order to entice more users to make it their primary bank, he said last week. Read the full piece here

🇨🇦 Neo Financial enhances services to help Canadian newcomers establish credit profiles. Neo credit card products, including the Neo Secured Credit card, will now report to Equifax Canada as well as TransUnion®, providing Canadians with fuller credit profiles for broader lender acceptance.

🇺🇸 Google Wallet adds 25 new US banks to its support list. This brings the total to over than 140 new banks added in 2024 alone, allowing a wider range of US users to utilize the platform's convenience for contactless payments.

🇬🇧 Challenger bank Kroo bans crypto transactions, warning of "scams." Kroo stated that it would reject payments made to cryptocurrency asset providers and refrain from processing bank transfers from senders associated with cryptocurrency assets. Read more

🇬🇧 Bunq Bank looks to relaunch in Britain. The neobank, founded in 2012, previously had a presence in the UK but was ousted by Brexit regulation in 2020 along with a host of other European digital banks, including Berlin-based N26.

🇩🇪 N26 will soon lift its growth limit, imposed by Bafin due to rapid expansion and inadequate risk management. Since correcting most deficiencies, the Berlin-based FinTech can now accept unlimited new customers. Despite a recent 9.2 million euro fine for late money laundering reports, N26 has invested 80 million euros in improvements and aims for profitability later this year.

BLOCKCHAIN/CRYPTO NEWS

🪙 The dog that is the face of Dogecoin has died at 18.

🇺🇸 SEC approves rule change to allow creation of ether ETFs. The decision comes less than six months after the Securities and Exchange Commission approved bitcoin ETFs. Those funds have proven to be a big success for the industry, with net inflows already surpassing $12 billion, according to FactSet.

🇺🇸 FTX paid $25m to whistleblowers before bankruptcy. An independent, court-appointed lawyer released a 300-page report on the collapse of FTX. The examiner’s report is the latest to shed light on the breadth of fraud at the exchange.

DONEDEAL FUNDING NEWS

🇿🇦 Orca, a South African startup that works with banks and FinTechs in emerging markets to fight various types of fraud, has raised a $550,000 pre-seed round. The funds will be used to build simple, yet effective fraud prevention tools and iterate with customers in SA.

🇺🇸 CBi Group secures $15M series A funding to boost R&D. CBi Group, a rising U.S.-based commercial bank, has secured $15 million in Series A funding, led by Alpol Capital Family Office, known for its investments in new technologies.

🇨🇴 El Dorado, a platform that facilitates international payments and transfers using stable cryptocurrencies, has closed a seed investment round of $3 million. The Colombian paytech aims to grow its revenues by 900% in the region by 2024.

🇹🇷 Turkish FinTech Colendi secures $65M. Colendi has 17 million users in Turkey and aims to become a major digital banking entity in Europe, the Middle East, and Africa (EMEA), and the Gulf Cooperation Council (GCC).

🇬🇧 London-based FinTech Viable raises €2.8 million to improve finance outcomes for new breed of online and multi-channel merchants. The company is creating finance technology for online and multi-channel merchants to streamline operations and optimize working capital.

MOVERS & SHAKERS

🇺🇸 Papaya Global, the ultimate Workforce Payroll and Payments platform, announced new C-level promotions: Benny Vazana to Chief Business Officer and Avi Shauli to Chief Research and Development Officer. The promotions reflect the company’s continued expansion and positioning for future growth.

Binance, Coinbase lead crypto exchanges’ 1,200 job hiring spree. The news is a testament to the optimism of the industry, which expects Bitcoin to break its March record high, spot Ethereum exchange-traded funds to launch, and venture capital investments to gain momentum this year.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()