Schroders Ups Revolut’s Valuation to $48bn

Hey FinTech Fanatic!

Revolut’s valuation has jumped again. Schroders Capital Global Innovation Trust plc has updated its estimate for the FinTech to $48bn—an 85% increase from last year.

This puts Revolut’s implied value above the $45bn seen in last summer’s secondary share sale but below the $60bn some shareholders are reportedly targeting for a future sale. Schroders attributes the rise to customer growth, higher deposits, and the long-awaited UK banking licence approval.

The upgrade comes amid Revolut’s sustained growth, with Schroders citing customer expansion, higher deposits, and the long-awaited UK banking licence approval as key drivers.

However, the trust itself is now in wind-down mode after a shareholder vote last month, meaning it will gradually sell off assets, including its Revolut stake. Despite this, Schroders plans to align any sale with major corporate milestones, such as an IPO or trade sale, rather than rushing to offload shares in the open market.

Beyond valuations, Revolut is ramping up its crypto push. Last week the company reportedly said that to open Revolut X—previously for sophisticated investors—to retail traders and is hiring product marketing managers across the UK, Poland, Spain, and Portugal to support the expansion.

Meanwhile, Revolut keeps expanding its offerings. The new Chrome card is out, and Joint Savings Accounts have launched in Ireland, with Netherlands and the Spain next in line. Regarding Spain, Revolut is stepping up the game against traditional banks with a payroll account offering 2.25% interest. Meanwhile, Hungary could soon see Revolut-branded ATMs, and in Australia, customers now have access to local EUR accounts.

Across the Atlantic, the U.S. CFO reaffirmed plans to secure a banking licence, and in Czechia, Revolut just hit the 1 million user milestone. The company also held its first-ever Reddit AMA, led by its Global Head of Product, Dmitry Zlokazov, fostering direct engagement with customers.

With rising valuations, a strong push into crypto, and new product launches across multiple markets – what a week for Revolut! Exciting times lie ahead.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Dominate the Payments Space! Subscribe to my Daily PayTech Newsletter for daily updates and trends in the evolving world of payment technology. Revolutionize your payments expertise today!

INSIGHTS

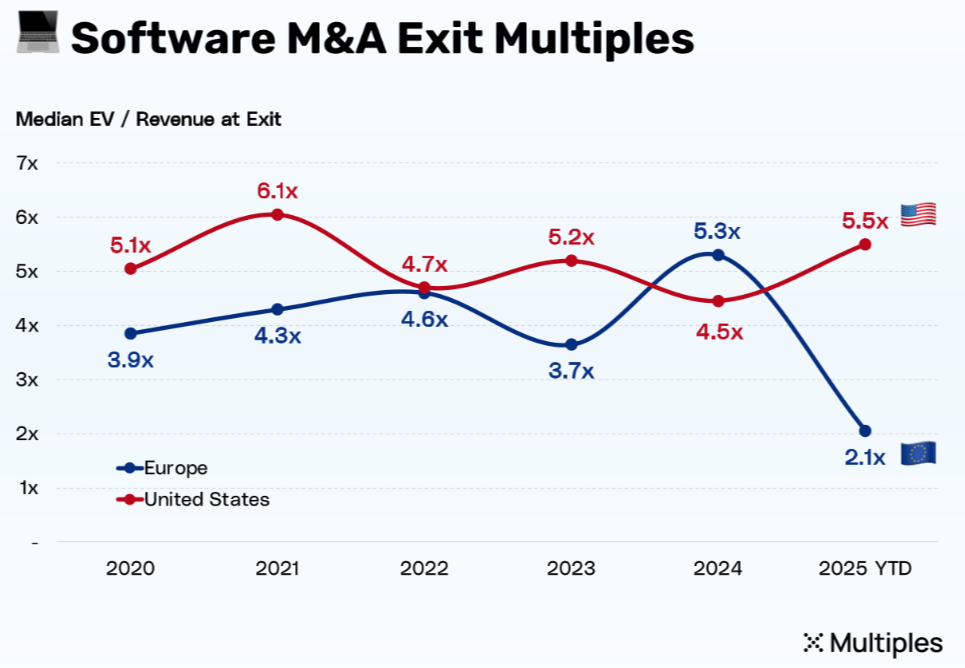

🇪🇺 (Fin-)Tech M&A Valuations: USA 🇺🇸 🆚 Europe.

FINTECH NEWS

🌎 Over $1bn raised across 16 FinTech deals last week. The majority of FinTech deals were completed in the US. Of the 16 deals, 11 of them were US-based companies. Other countries represented were the UK, with three deals, and Canada and Argentina, with one deal each.

🇺🇸 CFPB set to ditch BNPL rule. The rule would have required BNPL providers to grant consumers key legal protections and rights similar to those of conventional credit cards. These include the right to dispute charges and request a refund from the lender after returning a product purchased with a buy now, pay later loan.

🇭🇺 Revolut ATMs in Hungary? Foreign FinTechs called on to share ATM costs. If Revolut moves forward with launching ATMs in the country, it will face several key challenges. First, the company must secure regulatory approvals from the Hungarian National Bank (MNB), which oversees financial services and ATM operations.

🇺🇸 FinTech firm Biz2X plans to hire 200 professionals across roles in FY26. Biz2X is a turnkey global SaaS platform that enables financial institutions to provide a customised online lending experience for their small and mid-size business customers.

PAYMENTS NEWS

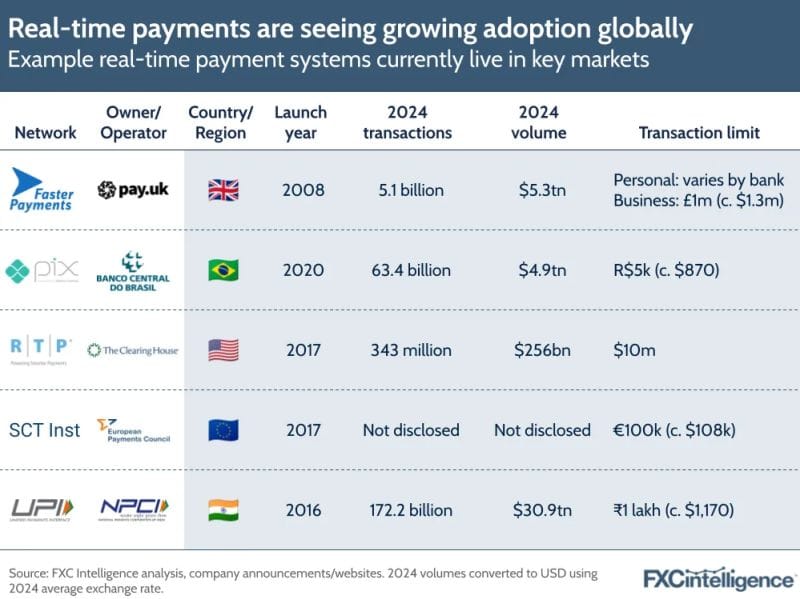

📈 Real-time Payments (𝗥𝗧𝗣) are seeing growing adoption globally.

Here's an overview of Key Markets👇

🇺🇸 NMI launches Tap To Pay on Google Play Store. NMI’s Tap to Pay solution gives its partners a simple way to help merchants and small businesses accept payments on the Android smartphones or tablets they already use, eliminating the expense and complexity of deploying traditional point-of-sale equipment.

🇨🇴 Transfiya, an instant payment system, has 99.99% availability in Colombia. The service, managed by ACH Colombia, handled 300 million transactions in 2024 and serves over 22 million users, providing fast, secure, and efficient money transfers across different financial institutions.

REGTECH NEWS

🇩🇪 MiCAR is allowing German banks to explore crypto assets. With MiCAR coming into full effect and BaFin now officially designated as the local regulator, banks can confidently begin exploring opportunities in digital assets. There is pent-up demand from institutional and retail customers.

DIGITAL BANKING NEWS

🇳🇬 Zenith Bank expands digital, physical infrastructure amid FinTech disruption. This expansion comes as the bank intensifies efforts to compete with fast-growing FinTech disruptors. The bank’s POS terminals grew 14.8% YoY to 475,524 in 2024, becoming a key revenue source for traditional banks.

🇦🇺 Revolut launches local EUR accounts for Australians. This new offering allows customers to establish local EUR accounts, facilitating swift payments and aiming to include more currencies in the future. The accounts enable them to operate across various markets. Meanwhile, Revolut has launched its first salary account in Spain, offering up to 2.27% annual return for users who deposit a minimum of €1,200 per month.

🇧🇷 Nubank launches ‘Caixinha Turbo’ with a yield of 110% of CDI, but has conditions. This is a type of bank deposit receipt that allows daily withdrawals. However, there are conditions to access the higher yield: clients must deposit R$900 monthly into their account, and they can invest up to R$5,000 in the product.

BLOCKCHAIN/CRYPTO NEWS

🇹🇭 Thai SEC files criminal complaint against OKX, nine others for unlicensed exchange. OKX allegedly operated without a license, violating Section 26 of the Decree and facing penalties under Section 66. The complaint begins a formal legal process involving investigation, prosecution, and potential court proceedings.

🇺🇸 Coinbase breaks new ground with MPC security technology. The company is open-sourcing its Multi-Party Computation (MPC) cryptography library. MPC functions like a safe that requires multiple combination codes, where each participant knows only their part of the code and never shares it with others.

🇺🇸 Crypto.com probe by the SEC has officially closed, says CEO Kris Marszalek. “We are pleased that the current SEC leadership has decided to close its investigation into Crypto.com,” said Crypto.com’s CLO, Nick Lundgren, in a statement, which accused the previous administration of abusing its authority to harm the crypto industry.

🇬🇧 UK Regulator intends to start authorizing crypto firms in 2026. The new regime marks a significant shift from the current anti-money laundering framework. Crypto exchanges will move from simply registering to comply with AML rules to needing authorization with specific rules for various services.

🇳🇬 Binance was used by terrorists and kidnappers in Nigeria, according to minister. Alhaji Mohammed Idris, the government's Minister of Information, said in an exclusive interview that authorities stumbled upon evidence linking the operations of Binance to criminal elements, including terrorists and similar groups.

🇫🇷 French state Bank Bpifrance plans $27M investment in Digital Assets. The plan is for the investments to support local blockchain projects in their early stages for the betterment of the broader blockchain industry in France. Keep Reading

🇰🇿 Kazakhstan proposes the creation of a crypto bank. The lack of crypto regulation is enabling illegal exchanges and tax evasion, according to lawmaker Azat Peruashev. The aim is to provide a legal exchange and custody platform for digital assets.

🇦🇪 UAE set to launch Digital Dirham CBDC this year. This will be accepted across all payment channels alongside physical currency and accessible through licensed financial institutions. It will feature high security, tokenization, and smart contract integration, enabling instant settlements and multi-party transactions.

PARTNERSHIPS

🇬🇧 Interflora achieves highest ever acceptance rate of 95.4% with Checkout.com ahead of Mother’s Day surge. Checkout.com enables Interflora’s customers to pay with ease using Apple Pay and Google Pay, which now account for 20% of mobile transactions. These mobile-friendly options are critical during high-pressure gifting occasions, where speed and convenience drive conversion.

🇬🇧 Tirana Bank partners with Backbase for digital banking upgrade. The agreement marks the bank’s most significant investment in technology to date, surpassing previous upgrades to its systems. The initiative is part of a wider effort to expand its digital offerings and strengthen its position in the region’s financial sector.

🇮🇳 Axis Bank launches 24/7 global USD clearing through Kinexys by J.P. Morgan. This collaboration will enable Axis' commercial clients to make cross-border payments anytime, streamlining payments and unlocking liquidity through blockchain technology, boosting the bank's position in the international banking sector.

🇬🇧 Zempler partners with Wise to roll out international payment service. The initial launch of the service will allow users to send payments in US dollars and euros and will be available for accounts in the Single Euro Payment Area (SEPA) region.

🇳🇴 Fana Sparebank enters five-year partnership with Tietoevry Banking. The partnership includes core banking systems, card and payment services, and advanced financial crime prevention tools. The new agreement will also significantly enhance the bank’s mobile and self-service offerings, including self-service loan management.

🌎 QorPay integrates with Visa’s Cybersource to support secure payments. By leveraging Visa’s technology, QorPay enables clients to simplify transactions, mitigate fraud risks, orchestrate data, and optimise expense management through a unified dashboard.

🇨🇴 FinTech firm Monet and Refácil launch solution for paying bills on credit in Colombia. This new service will allow users to pay household bills such as water, electricity, gas, phone, and television, without the need to have cash at the time of the transaction.

DONEDEAL FUNDING NEWS

🇬🇧 Revolut’s valuation has been upgraded by one of its best-known shareholders, implying a rise to $𝟰𝟴𝗯𝗻. The upgrade by Schroders Capital Global Innovation Trust plc, an investment trust managed by Schroders, is an 85% jump compared to the valuation it gave London fintech a year ago.

🇮🇳 Indian FinTech startup axiTrust nets $2.6m seed funding. The company plans to integrate its platform with MSME systems for real-time insights and automation, and will use the new funds for hiring, app development, and marketing.

🇮🇳 Indian investment tech startup Smallcase bags $50m series D. The Bengaluru-based company plans to use the funds to diversify its investment product offerings, including mutual funds and fixed income. It also aims to enhance partnerships with financial institutions for broader integration.

🇲🇽 YC alum Mendel, a ‘Ramp for LatAm enterprises,’ raises $35M Series B. Mendel’s mission is straightforward: to reinvent corporate spend management by automating most of the operations for an enterprise CFO that are currently done manually. Simply put, it aims to be the go-to for all B2B spending.

M&A

🇹🇷 Kazakh FinTech giant acquires Rabobank's Türkiye operations. The acquisition, which is subject to regulatory approval, involves the purchase of Rabobank A.Ş. However, the deal is considered non-material as Rabobank's Turkish operations do not have borrowing or deposit clients or a branch network.

MOVERS AND SHAKERS

🇩🇪 Deutsche Bank names new CFO Raja Akram in latest leadership shake-up. The bank has made the latest in many changes to its top leadership, announcing the departure of CFO James von Moltke and its CLO as the German lender starts to pull together its new strategy.

🇪🇪 LHV CEO and chairman Madis Toomsalu to step down. Toomsalu has worked for LHV since 2007 and has served in various positions across the group during this time, including head of credit analysis and head of credit risk. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()