Santander's Digital Bank Openbank Launches in Mexico

Hey FinTech Fanatic!

Openbank, Santander's digital banking just entered Mexico with an eye-catching 12.5% annual return on savings accounts. The fully digital bank is expanding its European playbook to tap into Mexico's digital banking potential.

The launch brings some impressive numbers to the table:

- Access to 10,000+ Santander ATMs across Mexico

- Zero minimum balance requirements

- 24/7 customer support

- Deposit insurance protection by the Institute for the Protection of Bank Savings

- Top-tier local ratings from Moody's and Fitch

Openbank is rolling out access gradually, promising a lightning-fast onboarding process through their newly launched app.

What makes this particularly interesting is Openbank's track record in Europe, where they've already doubled their customer base in five years and claimed the title of largest digital bank by deposit volume. This Mexican expansion follows their recent U.S. launch, showing aggressive growth in North America.

"We're bringing the best of both worlds - advanced digital banking with FinTech innovation, backed by Santander's security and solvency," says Matías Núñez, Openbank Mexico's CEO.

Looking ahead, the bank plans to expand its product lineup in the coming months, focusing on enhanced security features and customizable card controls based on location and transaction types.

What do you think about their chances of success with that attractive 12.5% savings rate? Let me know your thoughts in the comments and I'll be back with more news in your inbox tomorrow!

Cheers,

#FINTECHREPORT

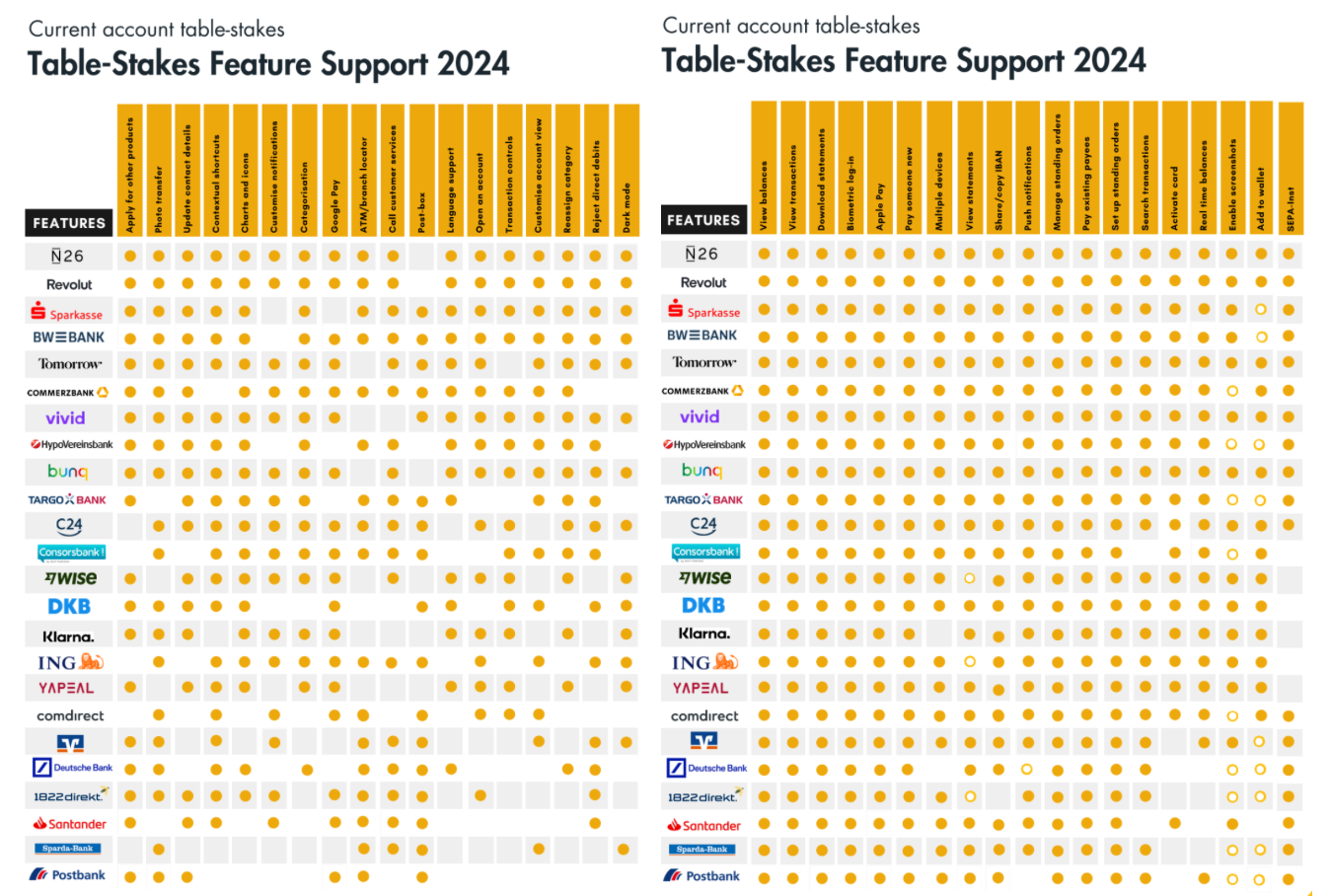

🇩🇪 The German Mobile Banking App Reviews by Optima Consultancy and Visa is out👇

PAYMENTS NEWS

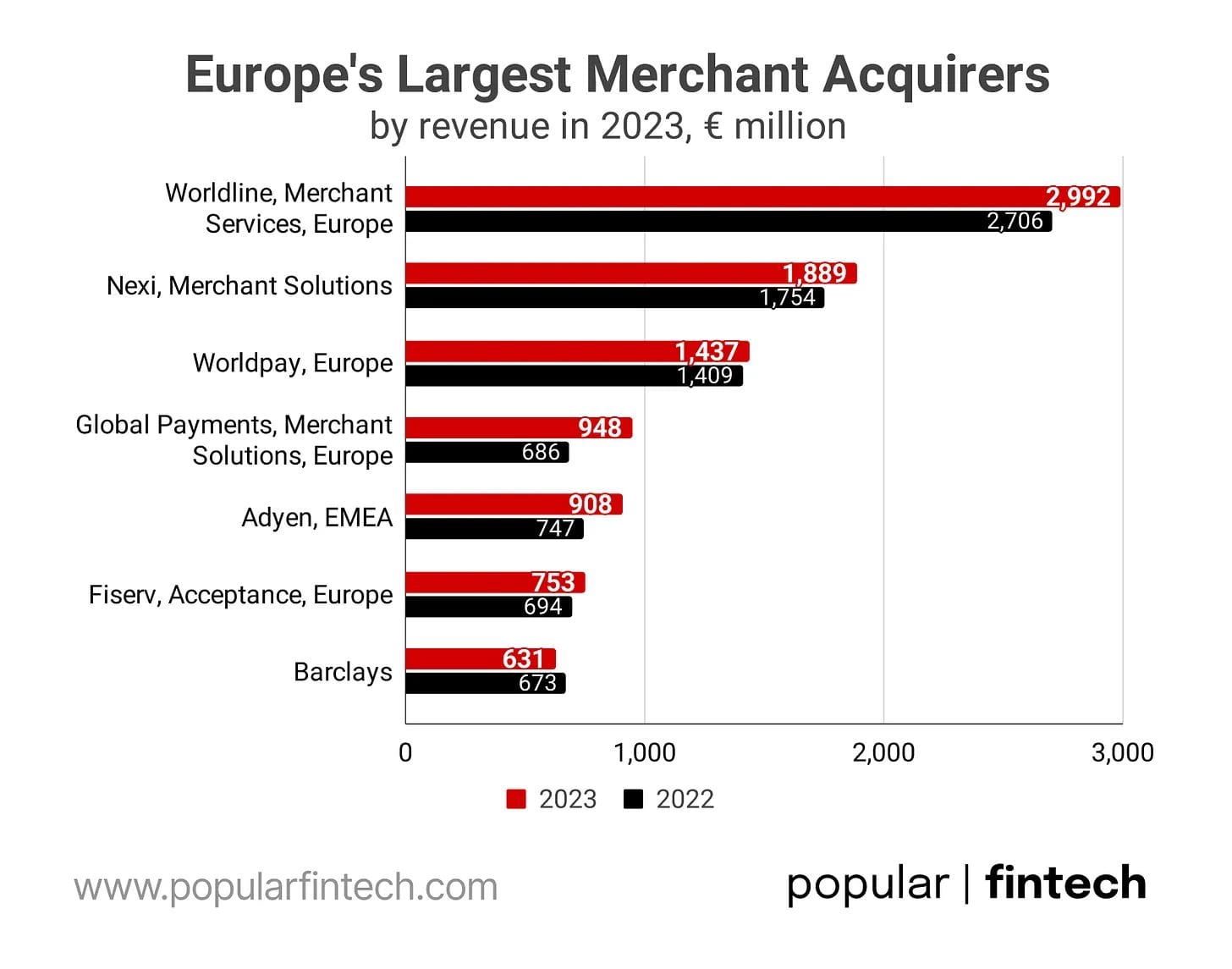

📈 Europe's Largest Merchant Acquirers by Revenue👇

The Key Takeways:

🇩🇪 Airwallex partners with Moss to enhance and streamline global payments. Airwallex’s solutions enable Moss customers to top up their wallets, transfer funds, and use currency conversion for better exchange rates. This enhanced functionality helps Moss support businesses across nine European markets.

🇿🇼 Zimswitch taps ACI Worldwide to protect Zimbabweans from payment fraud. Through this implementation, Zimswitch aims to enhance the security of Zimbabwe's digital payment infrastructure, providing stronger protection for both financial institutions and consumers.

🇬🇧 Solidgate AI Dispute Representment. The Solidgate AI Dispute Representment module connects to various acquiring banks and payment methods via its payment orchestration engine, streamlining the process. Click here to learn more

🇺🇸 Revolutionizing Global Workforce Management with the EOR Model, by PayQuicker. The Employer of Record (EOR) model has emerged as a game-changer, offering businesses a streamlined approach to global expansion and talent acquisition. Explore the full article for further insights.

🇺🇸 Visa, Mastercard warn of ‘Unintended Consequences’ from CCCA at senate hearing. The Senate Judiciary Committee discussed the Credit Card Competition Act (CCCA), which would require large banks to offer merchants alternatives to Visa and Mastercard. More on that here

🇸🇪 Sweden's Riksbank presents case for modernisation of retail payments infrastructure. The Riksbank’s view is that the future infrastructure will have to comply with European standards, be ready to accept retail payments instantly or on schedule, and facilitate the entry of new actors using new technologies.

REGTECH NEWS

🇵🇭 Philippines to boost FinTech oversight after top e-Wallet glitch. The Philippine central bank plans to tighten oversight of FinTech platforms as it investigates unauthorized deductions on GCash accounts.

🇨🇦 Collabria Financial Services taps Trulioo for Digital Identity Verification. Trulioo’s verification capabilities will fully automate Collabria’s KYB process, enhancing compliance and streamlining onboarding alongside its KYC workflows. The partnership will improve onboarding experiences for millions of credit union members.

DIGITAL BANKING NEWS

🇧🇷 Brazilian neobank Nubank considers domicile move to UK 🤯The Brazilian FinTech company Nu Holdings Ltd. is considering plans to shift its legal base to the UK, in a move that would mark a major win in Britain’s push to encourage more tech companies to move to the country.

🇬🇧 Wirex works with Banking Circle to revolutionize global financial operations. This strategic collaboration will elevate Wirex's global financial operations, empowering millions with advanced banking solutions. Banking Circle will deliver key services essential for Wirex's global expansion and the enhancement of its financial ecosystem.

🇧🇪 Wero launches in Belgium. The European Payment service Wero, through which some 16 European banks aim to compete with services such as PayPal, Mastercard and Visa, was officially launched in Belgium. Wero is now accessible through the applications of Belgium's four largest banks.

🇩🇪 N26 reports first profitable quarter after customer limit lifted. The German neobank reported its first profitable quarter in Q3 after a 2021 customer cap was lifted. It forecasts €440m in 2024 revenue, with 50% from interest income, surpassing competitors like Monzo.

🇬🇧 Revolut co-founder Nik Storonsky hints at a US banking license application. Nik Storonsky has hinted at making a fresh bid for a US banking license as part of the payment firm’s evolution from foreign exchange startup to global finance firm. Continue reading

🇲🇽 Openbank debuts in Mexico with fully digital proposition, no fees and competitive rates of return. The Santander Group’s digital bank launched operations in Mexico with its website and app, offering competitive debit and savings products and one of the world's most advanced technology platforms.

🇬🇧 HSBC relaunches 'Premier' brand in UK in pursuit of wealthy clients. It targets so-called mass affluent customers with £100,000–£2 million ($2.5 million) to invest through its fee-free Premier product. Jose Carvalho, head of wealth and personal banking, said the offering includes 24/7 service, financial tools, and other benefits.

🇸🇬 GXS Bank set to launch business banking offerings in early 2025, starting with Singapore, as part of its efforts to expand offerings and serve underserved segments across Southeast Asia. The services will initially target sole proprietorships and micro-businesses.

🇦🇺 Westpac to boost business banking. Westpac aims to recruit 200 additional business bankers over the next three years to enhance support for Australia’s rapidly growing SME sectors. The initiative could boost its business banker team by up to 40% by the end of 2027.

BLOCKCHAIN/CRYPTO NEWS

🇺🇾 Uruguay passes law regulating crypto, could set precedent for rest of Latin America. The new law, which was initially proposed over two years ago, recognizes cryptocurrency as virtual assets and gives the Uruguayan Central Bank the power to regulate the currency.

🇿🇦 Yellow Card secures crypto licence in South Africa. The company has secured a Crypto Asset Service Provider (CASP) licence, a significant step in its regional expansion. Yellow Card entered South Africa in 2020 and operates in 20 African countries.

PARTNERSHIPS

🇺🇸 Fiserv and ADP team up to empower small business success. Through this partnership, ADP and Fiserv will offer U.S.-based small businesses access to an integrated, all-in-one solution combining the full power of RUN Powered by ADP and the Clover small business management platform.

🇺🇸 Worldpay partners with Mastercard to introduce Virtual Card Programme for travel agents. Through the Mastercard Wholesale Programme, Worldpay provides virtual cards to travel agents, enhancing payment efficiency, flexibility, and benefits for agents and suppliers across the UK and Europe.

🇪🇬 FOO partners with eNovate to further digital transformation in Egypt. This collaboration offers FinTechs in Egypt a scalable platform, empowering them to focus on innovation and growth in the dynamic financial sector. The ongoing FOO-eNovate partnership includes key projects, starting with an end-to-end digital solution for universities.

🇬🇧 Guavapay partners with American Express to expand merchant payment acceptance options. MyGuava Business merchants can now accept AmEx via online gateways and POS terminals in the UK and Europe, expanding Guavapay’s reach and helping businesses access high-spending customers while improving payment experiences.

DONEDEAL FUNDING NEWS

🇲🇽 Mexican FinTech Fairplay receives $35 million loan from BBVA Spark. The new financing strengthens Fairplay’s position as a key partner for Mexican SME growth, with a focus on the retail sector, including wholesale, physical and digital channels, e-commerce, and marketplaces.

🇺🇸 Rise books $6.3M to be stablecoin-based ADP. Rise plans to broaden beyond contractor payments and into payroll starting next year — going up more directly against the like of ADP or Workday with products like taxes, healthcare benefits included into the platform.

🇨🇴 Colombia's Addi lands $100 million credit line to expand buy now, pay later service. The startup began turning a profit earlier this year and received regulatory approval to become a bank, it said in a statement. Read more

🇸🇦 EdfaPay Raises USD 5M to Power FinTech Expansion Across MENA. The funding underscores rising demand for FinTech solutions in the region’s SME and startup ecosystem, while EdfaPay’s growth fosters competition, boosts FinTech adoption, and supports economic transformation efforts.

🇸🇬 bolttech to fuel growth with US$50 Million venture debt facility from HSBC. The funding is intended to support bolttech’s market expansion, technology development, and operational flexibility. A partner since 2019, HSBC has supported Bolttech’s growth in over 14 countries, including ventures into embedded insurance.

🇮🇳 Payment solutions provider PeLocal secures $2m seed funding. The new funds aim to expand the platform and enhance strategies for large-scale projects. The company targets 10 million monthly transactions on WhatsApp within the next year.

M&A

🇫🇮 Paxos to Acquire Finnish E-Money Institution Membrane Finance. The platform announced it has agreed to acquire Membrane Finance (Membrane) in Finland. The acquisition is subject to regulatory approval. Upon completion of the acquisition, Paxos will be a fully licensed EMI in Finland and the EU.

MOVERS & SHAKERS

🇸🇬 Thunes fortifies Global Compliance with appointment of Peter Cohen as Chief Compliance Officer. Peter will play a key role in advancing Thunes’ commitment to world-class compliance standards, reporting to General Counsel Ruwan De Soyza as part of the Legal & Compliance Function.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()