Sam Altman Plans Stablecoin Mini Bank Account with Visa

Hey FinTech Fanatic!

Sam Altman’s impact on AI is well known, but his ambitions extend beyond OpenAI. As a co-founder of Worldcoin, he has also been deeply involved in the intersection of crypto and digital identity.

Now, World Network—the blockchain ecosystem behind Worldcoin—is in talks with Visa to integrate on-chain card functionality into its self-custody crypto wallet. If the partnership moves forward, World Wallet could evolve into a “mini bank account” enabling stablecoin payments, fiat on/off ramps, and financial applications across Visa’s global merchant network.

Since its launch in 2021, Worldcoin has drawn significant attention—not just for its vision, but also for its challenges. Its iris-scanning verification system, designed to create a universal digital ID, has faced scrutiny from regulators worldwide.

Several countries have conducted investigations or ordered it to cease operations over concerns about data privacy and security. Yet, despite the regulatory headwinds, the project continues to expand, now looking to deepen its financial offerings.

This development comes as stablecoins gain traction in the U.S., with regulators exploring their role in the financial system, highlighting the evolving relationship between traditional finance and digital assets. Visa’s potential involvement could provide the infrastructure to connect crypto with mainstream payments, expanding World Wallet’s role in digital finance.

However, with regulatory challenges still unfolding, the project will have to balance its ambitions with the scrutiny that has followed it since launch.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

FEATURED NEWS

🇺🇸 OpenAI CEO Sam Altman in talks with Visa for a Crypto Stablecoin Wallet. The move aims to bring Visa card functionality to World Network wallets, delivering a range of FinTech and FX applications, as well as allowing stablecoin-based payments to thousands of merchants around the world that are part of the Visa network.

INSIGHTS

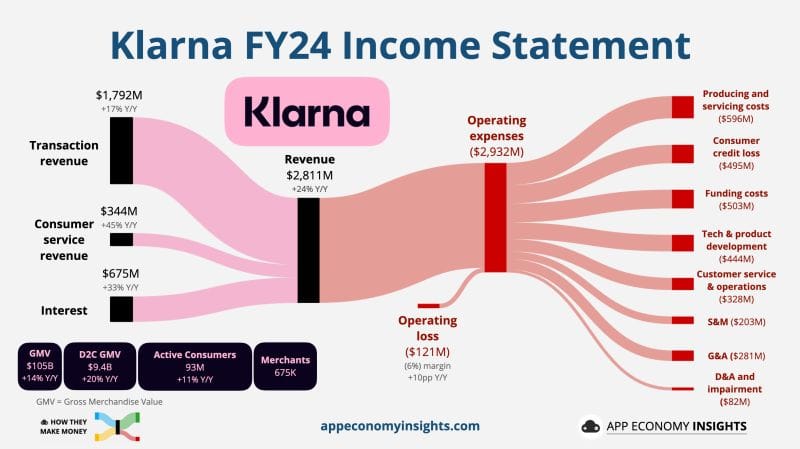

Klarna filed for a US 🇺🇸 IPO on the NYSE under the ticker $𝗞𝗟𝗔𝗥

Bertrand spent hours reviewing the F-1 so you don't have to👇

FINTECH NEWS

🇬🇧 Upvest kicks off UK market expansion and appoints former Investec & Starling Exec Symmie Swil to lead the charge. The company is focused on rapidly growing its presence across the UK, with Swil appointed to lead this scale-up effort and on track to go live with three UK clients before the end of the year.

🇪🇺 EU’s digital euro rollout to cost €432m. The costs are based on market research conducted during the procurement process, which is nearing completion. However, Piero Cipollone, a member of the board of the European Central Bank noted that the final costs are uncertain, as they depend on the completion of the legislative process.

🇬🇧 ClearScore says London is a natural home for flotation. The credit checking specialist’s scale and brand recognition in the UK made it the clearer choice for any initial public offering, co-founder Justin Basini said, making it a rare FinTech to explicitly state its preference for London.

🇦🇪 XTB opens new Dubai Office. “The UAE is a key market for us; this is why securing compliance with both the SCA and DFSA is crucial in allowing us to offer even greater security, transparency, and investment opportunities to our clients,” said Achraf Drid, Managing Director at XTB MENA.

PAYMENTS NEWS

🇬🇧 Visa announces new change to VAMP rules: Here’s what you need to know by Solidgate. Visa updated its VAMP rules: Starting April 1, 2025, TC40 fraud alerts resolved via RDR will count toward the VAMP ratio. Fraudulent chargebacks may impact metrics, making strong fraud prevention crucial.

🇬🇧 Ecommpay shortlisted in four Retail Systems Awards. The company has been named a finalist in four categories at the 20th annual awards: Innovative Payment Solution of the Year, Payments System of the Year, Payments Innovation Award, and Fraud Prevention Solution of the Year. The ceremony will bring together the industry’s best and brightest for the biggest evening in the retail technology calendar.

🇺🇸 ACI Worldwide CEO on critical importance of payment processing & company outlook. Tom Warsop says his platform can handle “trillions of dollars” reliably every single day. His company handles things like wire transfers, debit card charges worldwide, and other similar transactions. Watch the complete interview

🇸🇬 BC Payments secures In-Principle Approval for Major Payment Institution license from MAS. The MPI license enables the company to utilize Banking Circle’s global clearing network, providing seamless cross-border payment services and acting as a key regional hub in its global payments operations.

🇺🇸 Viamericas launches cash-to-cash money transfer service for quick and easy U.S. money transfers. This new service improves how customers send and receive money within the United States, with funds available for cash pickup at any participating Viamericas location.

🇿🇼 Mobile-Money platform Mukuru aims to grow its African business. The platform, which was awarded a deposit-taking microfinance license by the Reserve Bank of Zimbabwe in December, has permission to operate in 50 different territories. Keep reading

🇮🇳 Juspay open sources payment orchestrator amid FinTech industry shakeup. Juspay’s newly open-sourced orchestration technology will allow merchants to self-host the solution within their infrastructure, enabling them to integrate with a diverse range of payment providers while defining their own transaction rules.

🇺🇸 Klarna warns of internal reporting weaknesses. Klarna is preparing for a stock market listing in the U.S. In its preliminary prospectus, the firm warns about weaknesses in its internal financial reporting controls, which could potentially lead to significant errors in its financial reports.

🇺🇸 CLEAR partners with Stripe to power billing and payments for millions of customers. With Stripe, CLEAR is bringing a fast and easy experience to how its customers pay with Stripe’s ease of use, support for digital wallets and other payment methods, and higher conversion rates.

REGTECH NEWS

🇸🇦 Madfu secures Sharia certification for its BNPL solution. This certification reinforces Madfu’s commitment to providing Sharia-compliant BNPL solutions, in alignment with the Kingdom’s vision of fostering financial inclusivity through innovative FinTech services.

DIGITAL BANKING NEWS

🇨🇴 Daviplata has 18.5 million customers in Colombia, with 56% of them being women. The platform has shown positive trends in deposits, transactions, purchases, and revenues. Daviplata is working on improving financial inclusion, serving 4.5 million users who rely on it as their only financial product.

🇬🇧 Monzo Bank is rolling out a new Split Payments feature for customers to track, pay, and chase payments for shared expenses. Users can create splits, invite participants, add expenses from various accounts and cards, and send reminders to ensure everyone stays on track.

🇱🇺 Digital bank Advanzia boosts profit by over half in 2024. The digital bank reported a net profit of €151 million for 2024, marking a 54% increase from the €98 million recorded in 2023, according to its annual results. Keep reading

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Crypto VC giant Haun Ventures raising $1 billion for two new funds amid Trump-driven blockchain boom. Haun’s new funds are poised to be one of the largest hauls across the crypto venture space in the last two years and come after Paradigm announced an $850 million third fund in 2024.

🇦🇪 Dubai-based Hoxton Wealth expands app functionality with crypto account organization and enhanced asset management. These new updates offer users greater control and visibility over their assets and liabilities. Read more

🇺🇸 Crypto Exchange Kraken explores up to $1 billion debt package. The company is working with Goldman Sachs Group Inc. and JPMorgan Chase & Co. on the effort, which is at a preliminary stage. The two banks have begun conversations with additional banks and direct lenders.

🇬🇧 Users can now transfer their crypto to eToro to invest in other assets. Users in the UK and Europe can transfer cryptoassets held with other exchanges, brokers, or in other blockchain wallets to the eToro Crypto Wallet, where they can convert their holdings to cash, to trade and invest across multiple asset classes on eToro’s investment platform.

PARTNERSHIPS

🇺🇸 FinTech Cross River and Forward bring payouts as a service to software developers. The collaboration empowers SaaS providers, offering them a strategic advantage in an increasingly competitive landscape and leaving a lasting impact on the financial operations of the industry.

🇬🇧 ExpenseOnDemand chooses Moneyhub to power cutting-edge Expense Management Solution. This new collaboration will help transform the way businesses handle credit card expenses by integrating intelligent Open Banking technology with a high level of customer support.

🇨🇿 Liberis and Teya team up to deliver flexible SME funding in the Czech Republic and Slovakia. Through this partnership, Liberis and Teya want to support merchants in the Czech Republic and Slovakia by bringing fast and flexible funding options tailored to their needs and demands.

🇮🇪 TransferMate joins RTGS.global network. TransferMate will deliver seamless, real-time international payments for RTGS.global’s business customers, reducing reliance on traditional banking intermediaries and eliminating the risk associated with moving money cross-border.

🇫🇮 Tietoevry teams with Tapeeze on customizable payment cards. Through this partnership, they will enable banks, FinTechs, and branded organizations to create their own branded multi-function cards including flexible, secure payment functionality - without the need for complex infrastructure or regulatory approvals.

🇺🇸 IncredibleBank partners with Alloy to accelerate growth in account opening. By leveraging Alloy, IncredibleBank significantly improved the bank’s digital onboarding process and overall operational efficiency. Application review time was reduced by 88%, and manual reviews were reduced by 90%.

DONEDEAL FUNDING NEWS

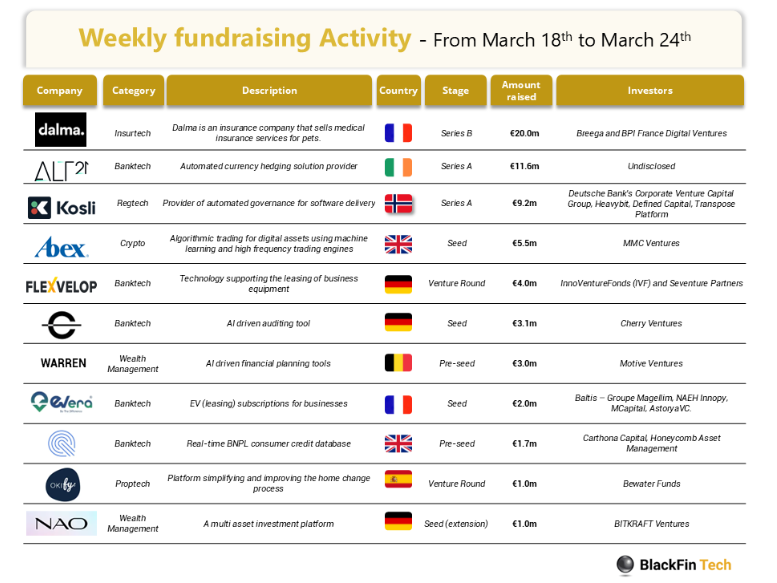

💰 Over the last week, there were 11 FinTech deals in Europe, raising a total of €62 million: 3 deals in Germany, 2 deals in the UK and France and 1 deal each in Ireland, Norway, Belgium and Spain.

💰 222x return for VC, and 1700 employees will become millionaires. The big winners of the Wiz deal are: Cyberstarts, Sequoia, Index, Insight Partners, and Greenoaks. Click here for further insights

🇸🇦 Saudi FinTech firm Nayla Finance raises $4m seed funding. The funds will be used to expand its product offerings and support micro-businesses throughout the Kingdom. The company plans to enhance its data-driven lending platform and scale its operations by forming partnerships in key sectors

🌍 Ex-Network International execs raise $6.75M for Enza, an African FinTech serving banks. The new capital will go toward expanding the team and rolling out new products for its banking clientele across Africa. Continue reading

🇺🇸 Lumber raises $15.5m to enhance workforce management platform with agentic AI. With the new funding, CEO Shreesha Ramdas revealed plans to expand early wage access, introduce workers’ compensation insurance, and more than triple the company’s headcount.

🇸🇦 Saudi FinTech Arabian Pay receives investment to expand BNPL offerings. The FinTech has raised an undisclosed investment as part of its Pre-Seed round from Al Bassami Holding Group. This investment will enable it to enhance its market presence, accelerate the development of its platform, and expand its partnerships.

🇫🇷 French FinTech RockFi secures €18M from Partech and others. The company plans to use the funds to support its growth and aims to achieve €1B in assets under management by the end of 2026. Keep reading

🇺🇸 Crypto card issuer Rain raises $24.5 million in a round led by Norwest Venture Partners. The company will use the money raised in this round to expand its team, develop new technologies, and apply for additional regulatory licenses. Continue reading

M&A

🇮🇳 Plus500 targets Indian 150B futures market growth with Mehta acquisition. The acquisition gives Plus500 immediate access to India's futures market, where over 150 billion contracts were traded in 2024, representing more than 75% of global transaction volume.

MOVERS AND SHAKERS

🇳🇱 Robert-Jan Lieben joins EBANX to drive European expansion. He will be based in Amsterdam, strengthening EBANX’s ties with European companies. This appointment follows other regional initiatives, including EBANX’s Payments Summit held in Barcelona, Spain, last September.

🇮🇳 Bank of America’s India Country Head said to leave position. Kaku Nakhate, is leaving her role after 15 years with the firm. Nakhate will stay with the firm to focus on developing senior client relationships in the Indian business. She will stay on as chief executive officer of BANA India.

🇦🇪 NymCard appoints Srikanth Achanta as Chief Technology Officer. He will focus on advancing the nCore platform with enhanced security, optimized API performance, and advanced data analytics. Achanta will use machine learning to enhance services, speed up integrations, and launch self-serve tools for faster embedded finance deployment.

🇺🇸 Nick Delikaris rejoins EquiLend as CPO. In the position, Delikaris will be responsible for EquiLend’s product roadmap and solutions suite, including data and analytics, trading, post-trade, regtech, Spire, and 1Source. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()