Robinhood Expands Overseas, Rolling Out Crypto Transfers Across Europe

Hey FinTech Fanatic!

Robinhood is making waves in the European market with a major update: customers in the European Union can now transfer cryptocurrencies in and out of the platform.

Announced on Tuesday, this expansion allows users to deposit and withdraw over 20 digital assets, including Bitcoin, Ethereum, Solana, and USD Coin, marking a significant step forward in Robinhood's international growth strategy.

This move gives European users the power to “self-custody” their digital assets, enabling them to fully own their crypto in personal wallets. It’s a clear shift from merely trading on the platform to giving users true control—a feature Robinhood hadn’t yet offered since launching crypto services in the EU last December.

As the U.S. faces growing tension between regulators and crypto firms, Robinhood is strategically capitalizing on the EU's more crypto-friendly regulatory environment, especially with the new MiCA regulations set to unify rules across the bloc’s 27 member states.

With this expansion, Robinhood isn’t just growing its presence—it’s laying the groundwork for what could be a dominant position in Europe’s burgeoning crypto market. This is a clear sign that the company is not only adapting but thriving in a shifting regulatory landscape.

Keep reading more updates in the FinTech space, and I'll be back in your inbox tomorrow!

Cheers,

FEATURED NEWS

🇺🇸 Klarna has unveiled “𝗔𝗽𝗽𝗹𝗲 𝗳𝗿𝗼𝗺 𝗞𝗹𝗮𝗿𝗻𝗮”, a storefront in the Klarna app and Klarna website where customers can purchase Apple products using its flexible payment options. Now an official Apple reseller, Klarna also launches a brand new, bespoke payment option for Apple products: Upgrade Financing.

FINTECH NEWS

🇬🇧 A worrying dynamic holds back the UK stock market. Read this insightful letter from Pranav Sood, Executive General Manager at Airwallex, on the challenges facing the UK stock market and what needs to change for growth to return. Find the complete letter here

🇬🇧 HSBC says investment in former British FinTech star Monese is worthless. The banking group wrote off its $5.86 million minority stake in Monese in March and April, as the company underwent restructuring. Monese's BaaS platform, now rebranded as XYB, has become a standalone business. Find out more

🇯🇵 Mizuho to invest in Rakuten Card, Rakuten to cancel FinTech reorganization. The firms have agreed to consider a new strategic capital and business alliance between them. To accelerate the growth of Rakuten Card, Rakuten aims to strengthen its collaboration with Mizuho FG. This partnership will enable growth in both the consumer and expanding corporate sectors.

🇬🇧 UK-Wide Innovation Challenge launches, transforming customer outcomes and driving innovation. FinTech Scotland, SuperTech (West Midlands), and eight industry collaborators are launching a new innovation challenge to enhance consumer outcomes through technology and data. FinTech firms worldwide are invited to apply by October 25, 2024.

🇺🇸 Post Office ditches MoneyGram after cyber attack. MoneyGram services will no longer be available at thousands of Post Office branches following the cancellation of their contract renewal due to a major cyber security incident earlier this month. A new contract was set to start this week, but the Post Office has paused it while seeking further assurances from MoneyGram.

🇸🇬 ANZ joins MAS-led asset tokenisation project. The Australian bank, in partnership with Chainlink Labs and ADDX, will investigate interoperability between private blockchains to exchange tokenised real-world assets, such as commercial paper.

PAYMENTS NEWS

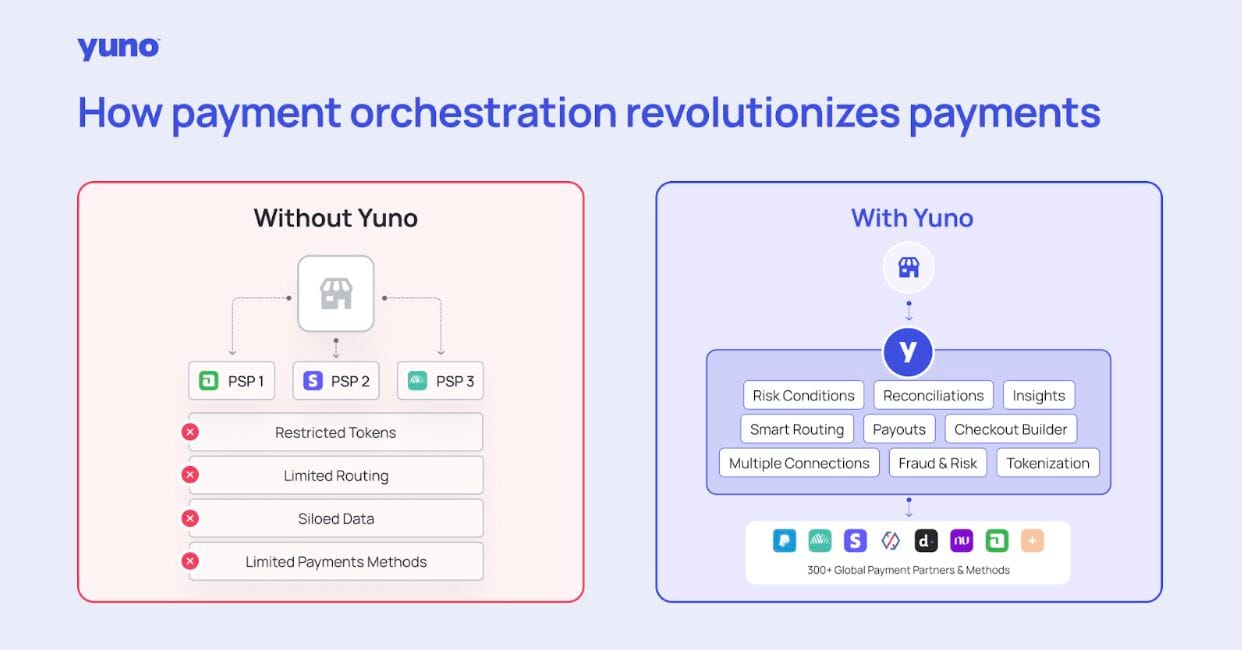

Here is a great example from Yuno:

🇦🇺 Airwallex explores building AI models as it drives towards IPO. Airwallex’s global head of product, Shannon Scott, said in an interview that while excitement over generative artificial intelligence can sometimes be exuberant, the technology holds potential for improving automation, compliance and other aspects of its payments platform.

🇬🇧 Ecommpay extends partnership with Token.io to optimize real-time open banking payments in more markets. Ecommpay has added Token.io’s virtual accounts in the Netherlands, Spain, France, and Ireland to its Open Banking Advanced, enhancing cash flow and customer experience for e-commerce businesses.

🇹🇭 SCB taps Thunes to offer instant global money transfers. This collaboration will allow SCB customers to send money instantly to 26 countries in 17 currencies, offering increased transparency and reliability while providing fast, dependable international transfers and reducing costs.

🇶🇦 QNB becomes first bank to launch updated version of Visa Click to Pay service. QNB, a long-time user of Visa’s Click to Pay, now benefits from upgrades, including the Visa Payment Passkey Service, which enhances the checkout process with biometric authentication (face or fingerprint), removing the need for passwords or one-time codes.

🇮🇹 Italy's Banco BPM has finalized a partnership with Gruppo BCC Iccrea and FSI to create Numia, the country’s second-largest e-payments provider, with a domestic market share exceeding 10%. Banco BPM and Iccrea will each hold a 28.6% stake in Numia, while FSI will own approximately 43%.

🇺🇸 American Express and Boost Payment Solutions bring optimized virtual card payments to suppliers. This collaboration will enable suppliers to streamline acceptance of American Express virtual Cards and minimize the challenges associated with manual processing of virtual Cards.

🇸🇪 Mastercard agrees to buy subscription management startup Minna. The payments giant has struck a deal to acquire Swedish subscription management specialist Minna Technologies. Financial terms were not disclosed. The deal is subject to regulatory approval.

DIGITAL BANKING NEWS

🇮🇹 Revolut is launching personal loans for it's 2 Million customers in Italy as part of its strategy to become the “primary bank account for customers,” according to Maurizio Talarico. The new offering allows customers to apply for a loan between €1,000 and €50,000 with a repayment plan spanning from six months to seven years.

🇬🇧 Sonali Bangladesh UK (SBUK) Limited selects Finastra to provide digital banking, including enhanced Shariah-compliant services. By implementing Finastra Essence, SBUK aims to offer its corporate and banking clients a wide range of digital products and services.

🇿🇦 TymeBank reaches 10m customers amid record deposits, less than six years since inception, as the digital-only bank’s small business finance service continues to grow. According to a statement, the bank has disbursed more than $600 million (R12 billion) in funding to over 80 000 small businesses in SA.

🇸🇪 Tink launches Merchant Information to give consumers full transaction visibility. The solution within Tink’s Consumer Engagement offering, displays banking app transactions with clear brand names, logos, locations, and details, reducing the need for consumers to contact their bank about unrecognized transactions.

🇬🇧 UK banks divided over charging scam victims £100 for reimbursement. The new fraud rules will see some lenders dock customers’ compensation while others waive charges. Banks will have to reimburse the majority of fraud victims within just five working days.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 OpenSea axed NFTs that behaved like securities for years before SEC scrutiny. The marketplace has delisted and disabled NFTs deemed to behave like financial instruments and has directed employees to avoid using market terms such as ‘trading’ and ‘broker.’

🇪🇺 Robinhood beefs up EU crypto offering with crypto transfers. The company is looking to ramp up its crypto offering across the EU by offering customers the opportunity to deposit and withdraw more than 20 cryptocurrencies, including Bitcoin.

🇺🇸 Digital assets firm Fireblocks teams up with tokenization interoperability Routers provider Ownera. The partnership will enable financial institutions to distribute and trade tokenized securities on the Fireblocks Network. Read the full piece

🇦🇪 Ripple becomes first blockchain business licensed by Dubai’s DFSA. Through this license, Ripple aims to expand its payments service from the Dubai International Financial Centre (DIFC) into other parts of the United Arab Emirates (UAE) while enhancing its operations in the Middle East.

PARTNERSHIPS

🇦🇪 Magnati and Wio Bank partner to support businesses with embedded finance solutions. This partnership enables Wio Bank to expand access to support business growth by providing fast access to financing using Magnati’s platform, simplifying cash flow management and credit access.

DONEDEAL FUNDING NEWS

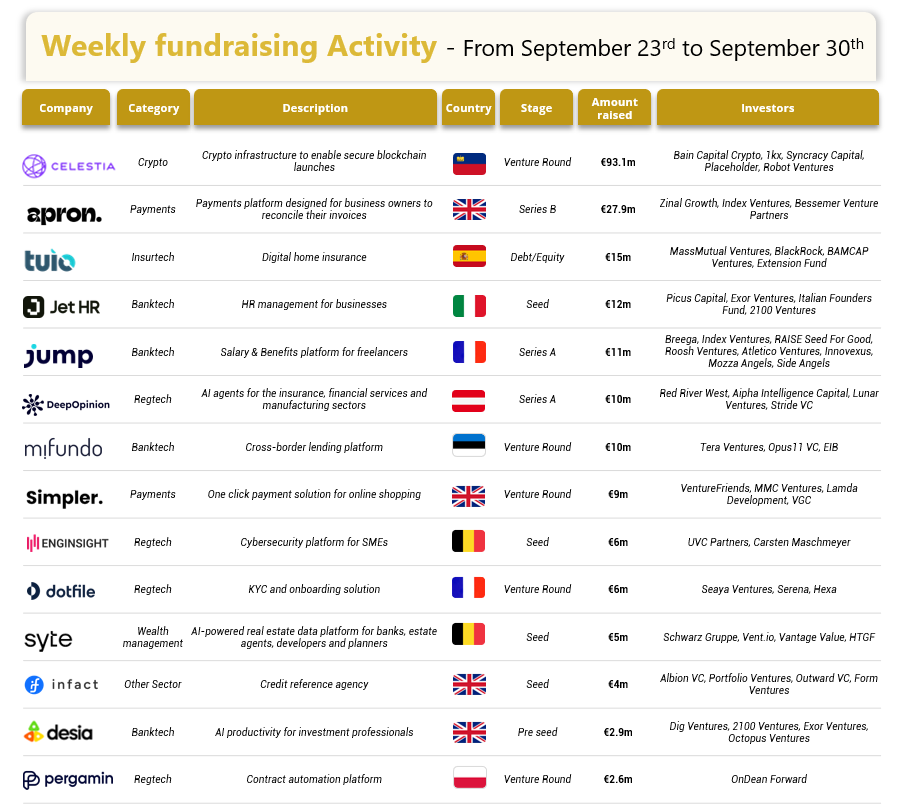

💰 Last week, we saw 14 official FinTech deals in Europe, raising a total of €216.3 million, with 4 deals in the UK, 2 deals in Germany, 2 deals in France, 1 deal in Italy, 1 deal in Spain, 1 deal in Liechtenstein, 1 deal in Estonia, 1 deal in Poland and 1 deal in Austria. Read the complete BlackFin Tech overview article

🇺🇸 Lightspeed Venture Partners is raising money for three new funds that could total around $𝟳 𝗯𝗶𝗹𝗹𝗶𝗼𝗻, according to a person who has discussed the fundraising with the firm’s partners. It’s the latest firm seeking to raise billions after a period when institutional investors pulled back from venture capital.

🇮🇩 Jakarta-based InsurTech Rey secures $3.5m funding round as it seeks to expand its AI-powered health insurance platform. The startup plans to use the $3.5m to enhance its AI tools for claims processing and underwriting. Read on

M&A

🇬🇧 Nationwide announced the complete acquisition of Virgin Money, with the move allowing the financial institution to augment its offering. By concluding this deal, Nationwide intends to provide increased value to its members, as well as to optimise customer satisfaction and deliver competitive savings and lending rates.

🇬🇧 London-based Robinhood rival Freetrade buys UK arm of Australian investing platform Stake. This move is expected to bolster Freetrade’s domestic operations, and comes as British retail investment platforms as a whole are facing heated competition from Robinhood.

🇺🇸 NCR Voyix has completed the sale of its digital banking unit to Veritas Capital for $2.45 billion in cash, along with the potential for additional contingent consideration of up to $100 million, the company said in a release. Rebranded as Candescent, the unit is now a privately held company, according to a Monday report from Yahoo.

MOVERS & SHAKERS

🇸🇬 Maybank Singapore names Datuk Yee Yang Chien as new Chairman. Datuk Yee’s expertise is expected to support Maybank Singapore’s growth, with a focus on sustainable development and innovation. More on that here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()