Robinhood and Revolut Eye $170 Billion Stablecoin Market

Hey FinTech Fanatic!

Robinhood and Revolut are exploring the possibility of launching their own stablecoins, hoping to capitalize on tightening regulations that could weaken Tether’s dominance in the $170 billion digital-asset market.

While both FinTech giants are evaluating this move, they have not committed yet. A Robinhood spokesperson stated there are “no imminent plans,” while Revolut is focused on expanding its crypto offerings without confirming a stablecoin.

The financial potential is enticing; Tether reported a profit of $5.2 billion in the first half of 2024, driven by rising USDT circulation. This impressive model has sparked interest among other companies seeking to replicate it.

Stablecoins are evolving beyond mere transfer tools. In markets like Brazil and Nigeria, users are increasingly buying stablecoins to save money or pay for goods.

As competition grows, we could see a “hyper-fragmentation” of stablecoins, with various brands and neobanks issuing their own tokens. This shift comes as new EU regulations require stablecoin issuers to have electronic-money licenses and maintain reserves with independent banks.

The upcoming implementation of these regulations could force exchanges to delist non-compliant stablecoins, creating uncertainty for Tether, which currently holds a market share of over 66% with USDT. Meanwhile, Circle’s USDC has obtained the necessary EU license and is poised to capitalize on the regulatory landscape.

Tether’s CEO, Paolo Ardoino, is concerned about potential risks from mass redemptions under new EU rules, stating the company is developing a “technology-based solution” to navigate the evolving market.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

#FINTECHREPORT

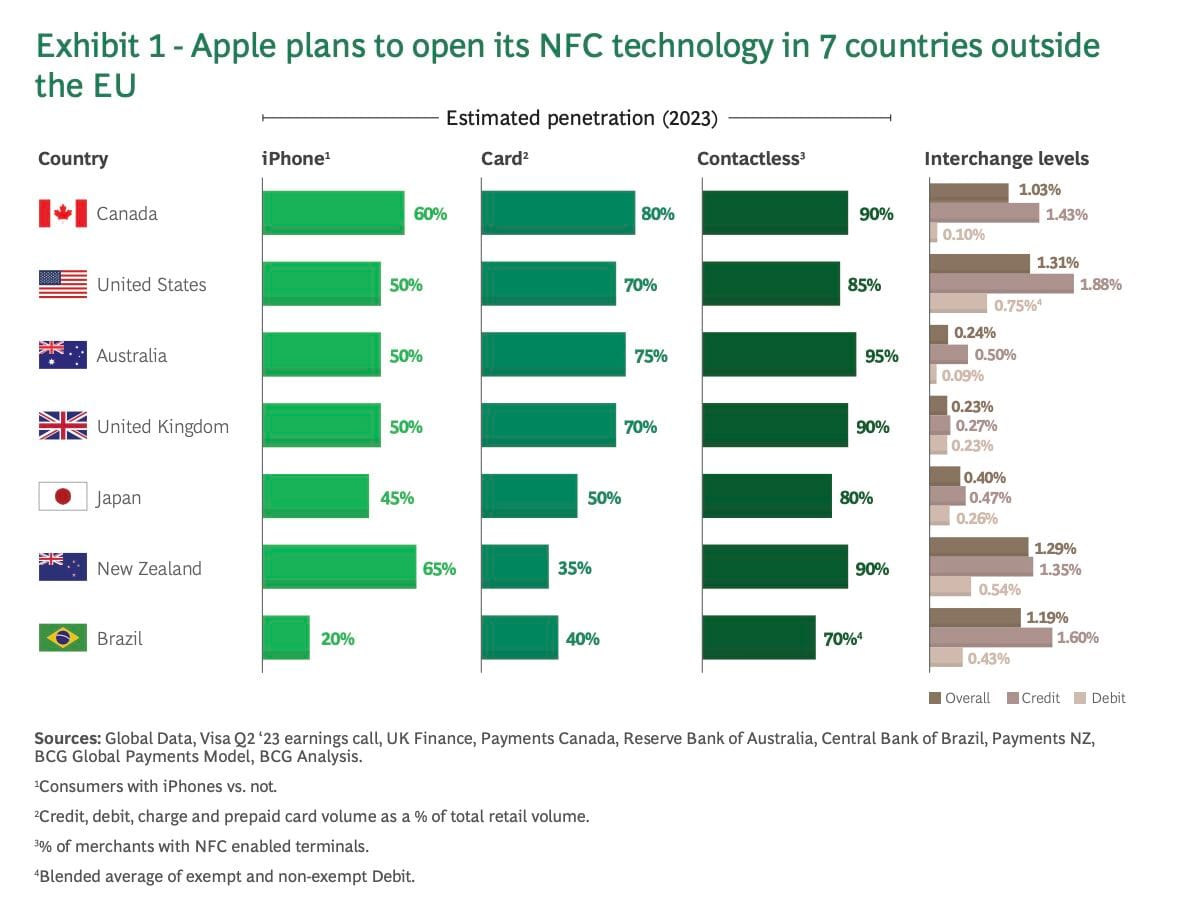

📊 Apple in Payments. Over the past few months, Apple has made three significant announcements that shed new light on its payments strategy. But they also raise questions for other payments players that they must speedily resolve.

FINTECH NEWS

🇺🇿 Mastercard and ZOOD partner to launch the first virtual Buy Now Pay Later card in Uzbekistan. As the first of its kind in the market, the ZOOD Card will enable consumers to convert their purchases into convenient installment plans for in-store, and local and global online shopping outlets.

🇬🇧 Sikoia achieves ISO 27001 certification. This marks a significant milestone in the company’s commitment to maintaining the highest standards of information security for its partners, clients, and stakeholders. Read the full piece

🇺🇸 Intuit (INTU) unveils new AI-driven expert platform experiences at Investor Day 2024. These innovations help consumers make smart money decisions year-round and fuel business growth on Intuit’s platform, supercharged with an AI-powered financial assistant in customers’ pockets.

🔄 Fincra launches its Multicurrency Account API. The company launched the new Banking-as-a-Service (BaaS) product in order to optimise the manner in which African and international businesses facilitate easy foreign currency transactions in USD and EUR, with more currencies being planned to follow.

🇺🇸 Visa sets aside $1.5 billion in a litigation escrow account. The global payments firm authorized the deposit of the money into a litigation escrow account that’s used for covered litigation, it said in a filing Thursday, without specifying any particular legal matters.

🇺🇸 Banking-as-a-Service is a “dirty word” with US investors, says European FinTech boss. Alex Mifsud, co-founder and CEO of European embedded finance provider Weavr, is critical of the current BaaS model, over issues around which of the BaaS partners is accountable for financial compliance. More on that here

🇺🇸 Former Brex COO who now heads unicorn FinTech Figure says GPT is already upending the mortgage industry. Figure, founded in 2018, specializes in helping consumers secure home equity lines of credit. The company touts that its all-online process condenses a normally 45-day process to five.

🇨🇦 Payfare withdraws financial guidance as DoorDash partnership winds down. The firms are establishing a transition plan to begin in the fourth quarter, and the core services agreement related to DoorDash’s DasherDirect card program will stop at the end of its current term in early 2025, Payfare said in a Thursday press release.

🇺🇸 Fiserv, Wells Fargo to end joint venture. The venture between the payments processor and the bank will expire on April 1 of next year, resulting in an unspecified cash payment for Fiserv. Spokespeople for the companies declined to comment on the amount of the payment.

🇺🇸 Fidelity slashes mobile deposit limits following fraud wave. Online check-fraud scheme shares some similarities with the fraud wave that hit JPMorgan Chase. Fidelity Investments put stricter guardrails on the deposits customers make through its mobile app, hitting back against a check-fraud scheme that targeted the investing giant earlier this month.

PAYMENTS NEWS

🇨🇦 Stripe opens new flagship office in Toronto. The expansion reflects Toronto’s growth as the fourth-largest market for tech talent in North America and reinforces Stripe’s commitment to Canada. Continue reading

🇬🇧 Stripe-backed TrueLayer losses mount even as revenue triples. TrueLayer saw pre-tax losses rise nearly 40% to £55.6m in 2023, despite tripling revenue year-on-year. The increased losses come as the company restructures to cut costs, including a 10% staff reduction in 2022.

🇪🇺 EU Banks launch Wero Payments to dislodge Visa, Mastercard. EU’s biggest banks have spent years quietly creating a new way to pay that could finally allow customers to ditch their Visa and Mastercard cards — the latest sign that the region is looking to dislodge two of the most valuable financial firms on the planet.

🇵🇦 Paymentology and ViaCarte join forces to expand card issuance across Latin America and the Caribbean. Together, Paymentology and ViaCarte will significantly increase card issuance in the LAC region, with ViaCarte acting as the BIN sponsoring institution.

🇹🇹 NPCI Intl. to develop UPI-like real-time payments platform in Trinidad and Tobago. The partnership aims to help Trinidad and Tobago build a reliable real-time payments platform for person-to-person (P2P) and person-to-merchant (P2M) transactions, boosting digital payments and financial inclusion.

🇺🇸 Airbase demonstrates the transformational power of AI with the launch of touchless accounts payable. Airbase’s AI-powered touchless AP system is built to handle every step of the accounts payable process with minimal human intervention.

🇺🇸 Paymentus to bring advanced billing and payments capabilities to Altera digital health solutions. Altera serve physician practices, hospitals, and health networks globally. Integrating Paymentus' billing platform will enhance revenue cycle management by optimizing billing and payments.

🇨🇳 WeChat Pay now available on Taobao. This integration comes after Taobao and its Tmall’s user feedback solicitation was announced in early September, reflecting the growing competition in China’s digital payments sector. Find out more

OPEN BANKING NEWS

🇬🇧 boshhh partners with Yapily. This collaboration has enabled boshhh to develop a fully automated system that can identify up to 16 different claim types for each customer in just 90 seconds, making it a game-changer in the field of financial reporting.

🇺🇸 Privacy Lock & Data Center Inc. (DCI) announced partnership. Through this partnership, the companies will deliver a comprehensive data privacy solution to DCI banks, streamlining consumer data protection and governance while ensuring compliance with open banking standards.

DIGITAL BANKING NEWS

🇲🇽 Due Network, a global FinTech for international payments, announces the start of operations in Mexico. Due Network enables businesses and individuals to transfer funds to and from over 60 countries, including Mexico, at a fraction of the cost and significantly faster than traditional bank transfers.

🇺🇸 Citi joins hands with Apollo for $25 bln private credit and direct lending program, illustrating a growing alliance between banks and non-banks looking for a slice of the lucrative $2 trillion market. Mubadala Investment Company and Apollo's annuity and retirement services unit, Athene, will also participate in the program, the companies said.

🇨🇦 Scotiabank partners with Nova Credit to improve digital credit access for newcomers to Canada. Through this collaboration, Scotiabank offers newcomers from specific countries the chance to obtain higher credit limits. This is achieved by allowing them to use their credit history from their home country when applying online for increased credit limits.

BLOCKCHAIN/CRYPTO NEWS

🔗 Robinhood, Revolut explore joining the $170 billion stablecoin market. The companies have both been kicking the tires on issuing their own stablecoins, but could still opt not to proceed, said people with knowledge of the matter. Read on

🇦🇪 First Abu Dhabi Bank completes programmable payments pilot with JPM coin through Onyx by J.P. Morgan. FAB states that this pilot opens up the possibility of a dynamic and automated funding and settlement solution to FAB and J.P. Morgan’s mutual clients, and will enable them to benefit from Onyx’s real-time programmable capabilities.

🇺🇸 Worldpay aims to boost blockchain infrastructure involvement by becoming a validator. The payments provider is in talks with blockchains about becoming a validator and verifying blockchain transactions. It has processed $1.3 billion worth of payments using stablecoin so far this year, up from less than $1 billion in 2023.

🪙 Binance launches pre-market spot trading service with 'actual tokens.' The exchange has launched a pre-market spot trading service, enabling users to take early positions before a token's spot market listing. Continue reading

PARTNERSHIPS

🇩🇰 Ebury partners with kompasbank. The new partnership facilitates international trade between Danish SMEs and their foreign customers and suppliers. It is the first of its kind in Scandinavia and will benefit Danish SMEs that want a full-fledged, digital, self-service platform for FX and international payments.

DONEDEAL FUNDING NEWS

🇪🇪 Mifundo lands €10M to revolutionise cross-border lending with AI. The funds will be used to develop a cross-border data platform for portable credit profiles across the EU. The company aims to create a unified EU credit market, reducing financial inequality and improving access to financial services for all European citizens.

🇮🇳 Healthcare NBFC Care.fi secures a total of INR 8 Cr in debt funding from Wint Wealth (INR 5Cr) and an impact investment of INR 3 Cr from Caspian Debt. The firm plans to utilise the funds to enhance its market presence and operations, all while focussing on providing financial support to the healthcare sector.

🇮🇳 Scope launches $50M VC fund for FinTech and gaming startups. The fund targets early-stage FinTech startups in India and gaming startups in the U.S., with deal sizes ranging from $500,000 to $2 million. Learn more

M&A

🇦🇺 Douugh to acquire Radical DBX in major push for embedded finance and B2B expansion. News of the proposal has seen Douugh shares move strongly higher in Friday trading on the Australian Securities Exchange. Douugh will acquire 100% of R-DBX via the issuance of 892,823,759 DOU shares at a price of $0.005 each.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()