Ripple Joins Forces with Revolut and Zero Hash to Expand RLUSD Reach

Hey FinTech Fanatic!

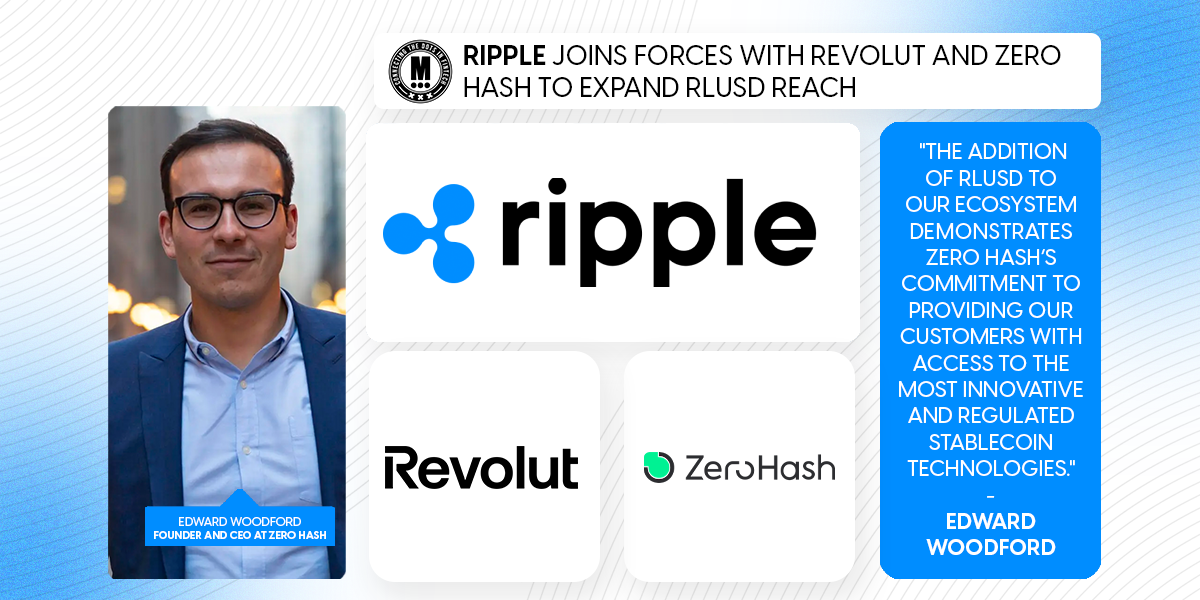

Ripple Labs is making waves with new partnerships with Revolut and Zero Hash, expanding the reach of its RLUSD stablecoin. This move is set to challenge the dominance of USDT and USDC in the stablecoin market. Ripple USD (RLUSD), pegged to the US dollar, is quickly gaining momentum, and this partnership marks a key step towards widespread adoption.

Edward Woodford, Founder and CEO at Zero Hash, shared: "The addition of RLUSD to our ecosystem demonstrates Zero Hash’s commitment to providing our customers with access to the most innovative and regulated stablecoin technologies." This integration means Revolut and Zero Hash users can now trade RLUSD seamlessly on both XRPL and Ethereum networks, opening up new possibilities for digital payments.

With Ripple USD quickly rising in valuation and trading volume, the stage is set for a fierce competition with traditional stablecoins. As Ripple expands its global footprint, this could mark the beginning of a new era in the world of stablecoins.

Read more global FinTech industry updates below 👇 and I'll be back on Monday!

Cheers,

Stay on top of FinTech trends. Subscribe to FOMO now and catch the week’s most important news and updates.

FINTECH NEWS

🇸🇪 How Klarna CEO spends his fortune taking big bets on fast-growing startups. Flat Capital, managing Sebastian Siemiatkowski's wealth, has been expanding its AI startup portfolio. Flat is shifting focus from later-stage growth companies, partly driven by Siemiatkowski's personal interest in AI. This AI-focused strategy marks a departure from the firm's previous investment approach.

🇺🇸 We now have ‘a whole generation’ of FinTechs preparing for IPOs, says QED Investors’ Nigel Morris in ‘Squawk Box’. He discussed the latest market trends, the IPO market, the state of the financial services sector, FinTech trends, the regulatory outlook in the new Trump administration, and more.

PAYMENTS NEWS

🇪🇺 Mollie quietly obtained an EMI License. This license allows companies to issue e-money, offer their own payment accounts with local IBANs, and expand their payment services portfolio. Read More

🇨🇴 Multi currency cards: Insights from Diego Quesada, Country Manager of Pomelo Colombia & Perú. "With around 6 million Colombians traveling abroad each year, the possibility of using a single card to make all types of payments in different currencies has increased. It is the issuers in the FinTech sector, retailers, and new brands that are joining traditional players in offering this service," Quesada said.

🇬🇧 FXellence launches multimarket cross-border payment solution. Available initially in the UK, the new platform caters to business clients, addressing common challenges faced when sending money abroad. Customers will be able to hold over 30 currencies in a single digital wallet, enabling payments to more than 100 countries.

REGTECH NEWS

🇺🇸 FDIC releases documents that probe banks’ crypto-business plans. The regulator released a trove of documents related to its supervision of US banks that were providing services to the cryptocurrency industry or considering doing so, providing a glimpse into some of the regulator’s oversight priorities.

🇺🇸 FICO announces plan to add BNPL. “Given the growing popularity of BNPL loans, understanding how to effectively capture the benefit that BNPL data can have on FICO Scores is crucial to all stakeholders in the credit ecosystem,” said Vice President of Scores and Predictive Analytics at FICO.

DIGITAL BANKING NEWS

🇷🇺 Sberbank plans joint AI research with China as DeepSeek leaps forward. "Sberbank has many scientists. Through them, we plan to conduct joint research projects with researchers from China," Sberbank First Deputy CEO said. Continue reading

🇬🇧 ECB hopes Trump's crypto plan will speed up digital euro. The European Commission proposed digital euro legislation in June 2023 but not much has happened since amid scepticism from some lawmakers and bankers. "The political world is becoming more alert to this, and it’s possible that we will see an acceleration in the process," ECB board member said.

🇬🇧 HSBC considers CEO pay overhaul as UK banks dump bonus caps. The bank could hand its new CEO Georges Elhedery a package worth as much as £15 million under a fresh plan that is being discussed, a person familiar with the matter said. Continue reading

🇺🇸 US banks raise equity to jumpstart deals and bolster balance sheets. The volume of banks' equity raises increased after the election, as investors became more optimistic that regulators will allow more mergers and acquisitions in the banking industry, said Morgan Stanley's global Co-Head of Financial Institutions.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase pushes US to pave way for bank-crypto partnerships. “It’s important for regulators to make clear that banks can work with third-party providers in providing trading and exchange services to their customers,” said Coinbase Chief Policy Officer.

🇺🇸 Ripple Partners with Revolut and Zero Hash. Through the strategic partnerships, Ripple Labs’ RLUSD will be listed for seamless trading in different markets. Both Revolut and Zero Hash customers can now access RLUSD on both XRPL and Ethereum (ETH) networks.

🇬🇧 Standard Chartered shares 5-year bitcoin forecast, Sees BTC at $500K by 2028. The head of digital asset research at Standard Chartered attributes this potential increase to improved access for investors and a reduction in volatility, factors he believes will support long-term growth.

🇺🇸 Galoy launches Lana to unlock digital asset collateralized lending for challenger and community banks. The platform is specifically tailored to meet the soaring demand for bitcoin-backed loans, specially designed for challenger and community banks.

PARTNERSHIPS

🇬🇧 ACI Worldwide extends FinTech partnership with Banfico. Through the partnership, ACI will support UK and European banks and payment service providers (PSP) to comply with mandates to offer Confirmation of Payee (CoP) and Verification of Payee (VOP) services.

🌍 Decta payments gateway opens the door to Klarna. DECTA clients can now offer customers frictionless, flexible payment options that enhance the shopping experience and drive higher conversion rates. Merchants can attract customers, increase average order values, and improve checkout conversion rates.

🇲🇽 Western Union and Penny Pinch launch international money transfer services. This enables customers in the country to send and receive money globally, based on their convenience and needs. They also have the flexibility to send funds to bank accounts and mobile wallets worldwide, as well as for cash pick-up at locations abroad.

🌍 XTransfer and Ecobank Group forge landmark partnership. Through this partnership, XTransfer will leverage Ecobank’s vast African banking network, enabling Chinese traders to collect funds in local African currencies allowing them to send payments in their local currencies without incurring high foreign exchange losses.

🇧🇭 LuLu Exchange partners with FinTech Galaxy. By enabling A2A transfers, LuLu has become a cross-border payments company to offer services using Open Banking infrastructure. Galaxy is licensed by the Central Bank of Bahrain to offer account information services and payment initiation services in the Kingdom.

🇪🇺 iPiD partners with iBanFirst. This integration aims to streamline the process of payee verification within cross-border payments, offering an advanced solution with iPiD Validate, which is intended to improve both payment security and customer experience.

🇨🇳 ZA Bank partners with TransUnion to offer the TransUnion Credit Alert Service. Users can access the service through the ZA Bank app for free. The service will notify them of changes to their credit report. This includes new credit report enquiries for loan and credit card applications, new credit accounts opened under their name, and changes to addresses or phone numbers.

🇧🇷 Bancard and PagBrasil partner to offer Pix roaming. This will offer banks in Paraguay the opportunity to integrate a QR code into their digital platforms. Also, this collaboration will be especially impactful as Brazil remains the top travel destination for Paraguayans.

🌎 Kuady partners with BridgerPay. The collaboration will make Kuady’s payment services available to all businesses and companies using BridgerPay’s platform, providing a frictionless, secure, and localised payment experience in Chile, Peru, Mexico, Ecuador, and Argentina.

DONEDEAL FUNDING NEWS

🇦🇷 Rho Labs secures $4 million in seed funding. It was led by CoinFund to accelerate growth of cryptonative rates exchange Rho protocol. Rho’s trading capabilities are also particularly suited to institutions, as well as ETF and stablecoin issuers.

🇵🇱 Wealthon secures €126 million. “The new funding will strengthen our market position and significantly expand Wealthon’s reach. This is great news for small and medium-sized enterprises, for whom we are building our innovative financial solutions ecosystem and whom we aim to support long-term in growing their businesses,” said Co-founder and Chairman of the Supervisory Board at Wealthon.

🇬🇷 JPMorgan Chase’s $𝟵𝟭𝟳 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 investment in a Greek FinTech company. JPMorgan bought Viva.com to boost an international expansion that aimed to create a tech hub in Greece but went so wrong that the bank last year offered to sell back half of its stake at a valuation of $𝟭𝟳𝟱 𝗺𝗶𝗹𝗹𝗶𝗼𝗻.

🇺🇸 Mercury in financing talks as investors warm to FinTechs. The startup, whose profile soared during the bank crisis, has discussed raising money after hitting $500 million in annualized revenue. Continue reading

🇮🇪 ZeroRisk raises $4 million. The firm will use the new financing to expand its operations globally, particularly in the US market, where it serves a number of Tier 1 acquiring banks. The company is hiring for 40 roles across a variety of functions, including data science, user experience, product, engineering, and marketing.

🇺🇸 Lynx closes $27 million oversubscribed series A. The platform aims to revolutionize healthcare payments and administration. It also plans to use the funding to scale operations and accelerate Lynx's growth in some strategic areas. Continue reading

🇺🇸 INXY Payments raises $3M. “This investment validates our vision to make crypto payments accessible and compliant for businesses, we’re excited to expand our global presence and continue driving innovation in the crypto economy,” said the CEO of INXY Payments.

M&A

🇨🇭 Temenos announces the sale of multifonds for about USD 400 million. It has signed an agreement to sell Multifonds, its fund administration software business, to Montagu Private Equity. The sale simplifies the product portfolio and aligns with Temenos’ new strategic and operational plan to drive above-market growth.

MOVERS AND SHAKERS

🇺🇸 Joseph Hurley is joining Aeropay's Advisory Board. Joe’s 30+ years in financial services have been spent pushing the envelope for action and innovation. He’s held leadership roles at Discover Financial Services, Crown Agents Bank, and Diners Club International.

🇺🇸 NCR Voyix appoints James G. Kelly as President and CEO. "He brings more than 25 years of executive leadership and has the right experience, judgment and urgency to steer NCR Voyix into its next phase of growth at this pivotal moment," said a Chairman of the Board.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()