Revolut's Big Decision: UK or US IPO Next?

Hey FinTech Fanatic!

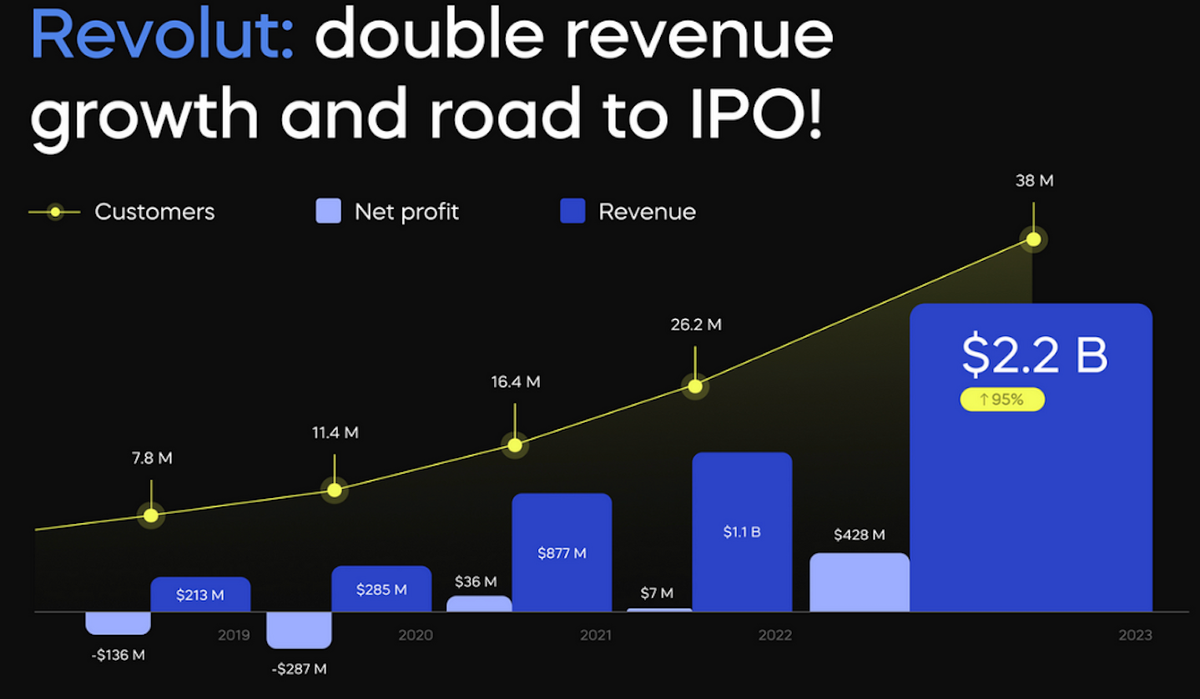

With its UK banking license secured, Revolut now must choose between an IPO in the UK or the US. Last week, Revolut achieved a significant milestone by obtaining a UK banking license from the Prudential Regulation Authority, in what is likely to be one of the biggest industry news stories this summer.

Revolut has been operating with a full EU banking license since 2021 and recently secured a license in Mexico earlier this year. However, acquiring a UK license, given that the UK is both its home base and largest single-country market, has been considered vital for its continued expansion.

Before this, Revolut faced limitations in the UK, being unable to offer some of its products and potentially being viewed less favorably by regulators in other countries where it is also seeking licenses, especially in the US.

With the UK license now in hand, Revolut is at a crossroads: it can either capitalize on its UK origins with a London-based IPO or set its sights on the US to drive more robust growth.

Where do you think Revolut will choose to IPO: the UK or the US? Let me know👇

Cheers,

POST OF THE DAY

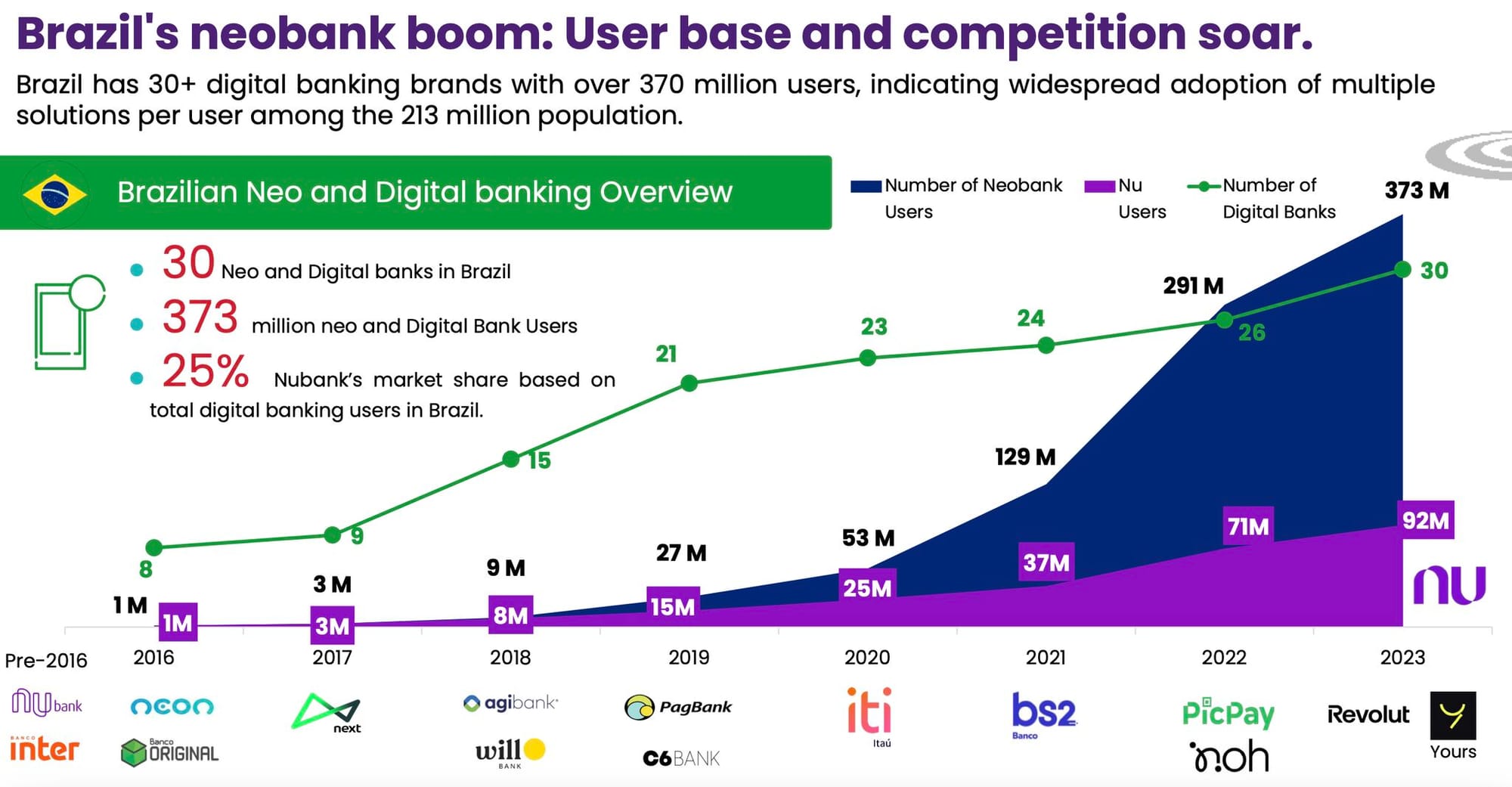

🇧🇷 Brazil has 30+ digital banking brands with over 370 million users, indicating widespread adoption of multiple solutions per user among the 213 million population 🤯

PODCAST

🎙 Podcast: Pipe's Pivot from Revenue Exchange to Digital Lending, with CEO Luke Voiles. In this conversation, Luke Voiles, CEO and Board Member of Pipe since February 2023, shares his background in distressed credit investing and how it led him to focus on lending money to other lenders. Dive deeper by listening to the full podcast episode

INSIGHTS

🇬🇧 UK markets watchdog plans to simplify rules to boost competitiveness. Britain's financial watchdog on Monday launched two reviews of retail conduct and insurance rules to cut costs and improve competitiveness, now that a strict new duty to put consumers first has had time to bed down.

FINTECH NEWS

🇳🇬 FinTech Lemfi now offers money transfer services to African diasporans in emerging markets like Pakistan, India, China, and its latest additions, Brazil and Mexico. The startup announced these new markets, allowing Africans in the Latin American markets to send and receive money.

🇸🇻 Inswitch and Nequi announced a strategic partnership. This collaboration aims to strengthen and address the financial needs of Salvadorans, particularly those who are unbanked. Read on

🇦🇺 iGoDirect Group has announced the release of its web push provisioning product, Web-to-Wallet. A first of its kind in APAC, Web-to-Wallet enables users to instantly add their digital Visa prepaid cards from a website directly to Apple and Google Wallet without the need to download a third-party app.

🇨🇦 Three canadian FinTech firms strike new partnerships: VoPay, Flinks, and Payfare have been tapped to power offerings for tech giants, Credit Union. Read the complete article

🇬🇧 SME lender Triver teams up with Elcom to launch new payment service. UK-based small businesses supplying the public sector will be able to get paid immediately, following the launch of a new instant invoice payment service by SME working capital provider Triver and procurement platform Elcom.

🇺🇸 HP announced new, comprehensive U.S. consumer financing options for HP products purchased on HP.com. By leveraging ChargeAfter’s technology and collaborating with three leading financial providers – Bread Financial™, Concora Credit and Koalafi – HP can now offer nearly every U.S. consumer a financing option when they shop for personal computers (PCs), printers or peripherals on HP.com. Finance options include promotional financing to qualified buyers , or lease-to-own options with no credit needed.

🇪🇸 Mintos announced the launch of its latest product in Spain: Mintos Smart Cash. This money market fund offering greatly adds to the loans, bonds, ETFs, and real estate already available on Mintos. The service provides investors with a secure and low-risk opportunity to place their money in the BlackRock ICS Euro Liquidity Fund.

🇺🇸 Brex CEO Pedro Franceschi says the company's monthly cash burn is "way below" $10 million. It's also looking outside SF/NY, and at mid-sized companies, for growth. The company is trying to prove it can be a standalone business able to weather the volatility of public markets.

PAYMENTS NEWS

🇬🇧 Surfboard Payments announces partnership with Cardstream Group to deliver innovative payment solutions. This collaboration introduces an embedded payment solution for the UK and other markets, offering a white-label multi-channel platform for ISVs, ISOs, PayFacs, and their merchants to handle in-person and remote transactions.

🇮🇪 Nexi, the European PayTech, signs an agreement with Payac Services CLG, a credit union owned payment services provider, to deliver SEPA Instant payments to all participating credit unions in the Republic of Ireland.

🇨🇱 Paytech Kushki has officially entered the in-person payment solutions business with the launch of its POS (Point of Sale) system in Chile. With this new product, the company aims to enhance its offerings and provide national businesses with the capability to process physical transactions.

🇬🇧 Worldfirst world account enables instant cross-border business payment function in over 200 markets. This function will benefit British and European SMEs that import from international markets. It allows these businesses to promptly pay their overseas suppliers free of charge, ensuring timely receipt of goods and cost savings to support their business growth.

🇮🇪 An Post signs with Safecypher to drive down card-not-present fraud. The Irish Post office will now embed the Safecypher security technology for CNP (Cardholder-Not-Present) payments into its popular An Post Payments app.

OPEN BANKING NEWS

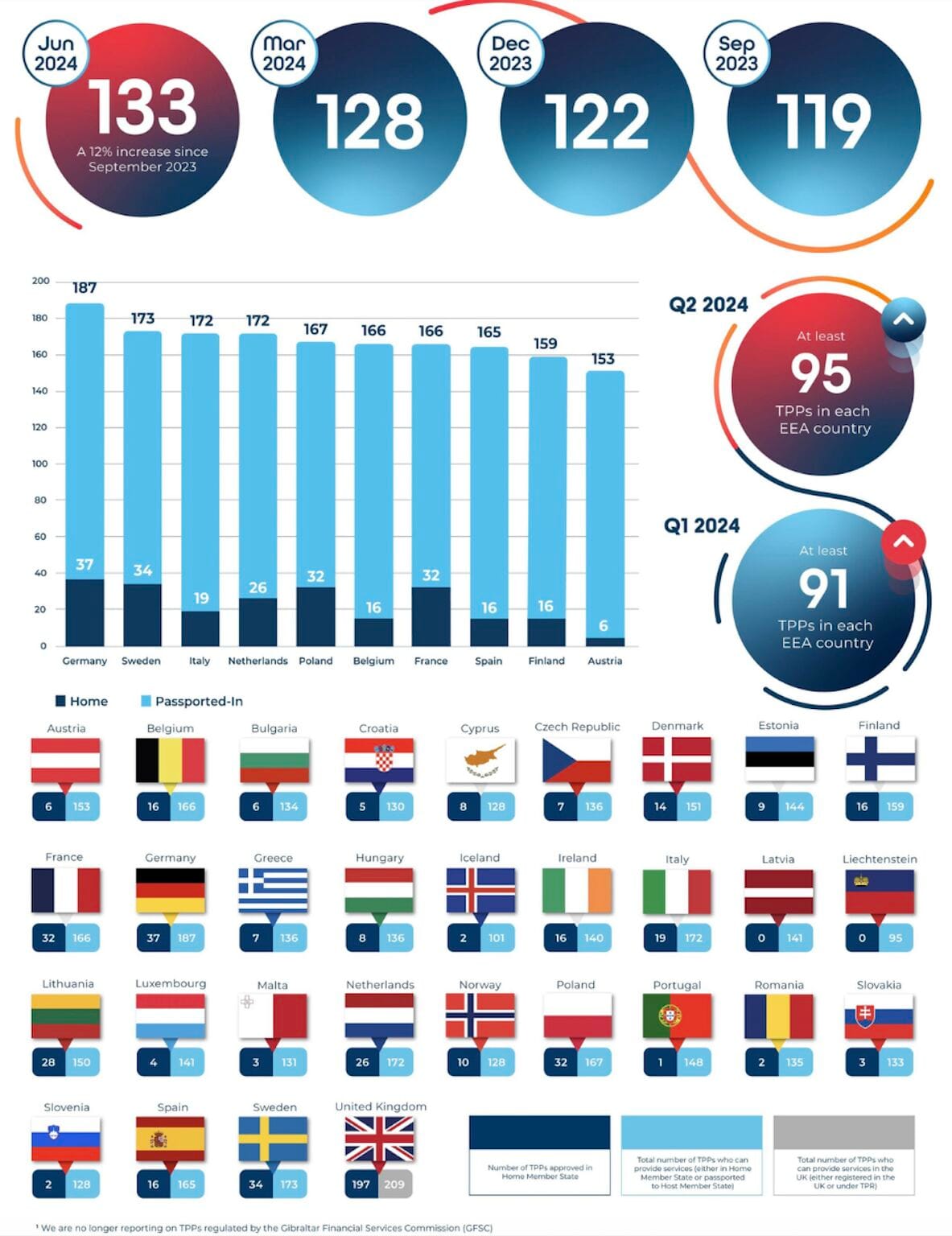

🏦 Q2 2024 Konsentus Third Party Provider Open Banking Tracker👇

🇳🇿 Westpac announced that its first third party Open Banking integration is now live with BlinkPay. BlinkPay is a Māori FinTech company that enables businesses to accept customer payments direct from a bank account. More on that here

🇮🇹 Shift4 and Fabrick partner to enhance payment acceptance solutions for merchants across Europe. This partnership will allow client companies to access the best tools to maximise secure payment conversion while simplifying treasury processes.

🇨🇦 Personal financial planning app Neontra recently launched a behavioural engineering feature that nudges users to stick to their financial goals. The app is designed to complement existing desktop financial planning tools by playing a more day-to-day role in a client’s finances.

🇱🇹 SDK.finance partners with Salt Edge to boost the delivery of Open Banking solutions. This collaboration will help FinTech companies and financial institutions of all sizes develop open banking-enabled financial services and applications or update their existing ones.

DIGITAL BANKING NEWS

🇬🇧 Global payments and financial platform Airwallex has selected GoCardless to provide direct debit to its customers across several markets. Airwallex has launched the service in the UK, with Europe expected to follow soon after this announcement.

🇦🇺 Australian bank Westpac is now offering debit cards to children as young as eight in a move it says will help them hone their financial skills. The move comes as a Westpac survey shows that three quarters of parents are already teaching their children some form of financial digital literacy.

🇬🇧 Monzo banks on Grow with SAP. This move will simplify Monzo’s finance IT estate, enabling it to fully embrace the benefits of the cloud, increasing innovation and meeting customer and market demands. Read on

🇲🇾 Singaporean neobank Fingular turns profit in Malaysia in just 9 months after launching under the Tambadana brand. Fingular's advanced processes enabled it to quickly pass a regulatory audit, marking a key milestone in the Malaysian FinTech market

🇬🇧 Bank of England calls for input on payments innovation. The central bank has published a Discussion Paper that sets out its response to rapid innovations in payments and their impact on monetary and financial stability.

🇮🇹 Banca d’Italia: Halt on new customer onboarding for Qonto in Italy. On July 25, Banca d’Italia issued a temporary ban on new customer onboarding for Qonto's Italian branch. Existing customers can continue to use all of Qonto's corporate banking services. However, the opening of additional sub-accounts and the issuance of new debit cards are restricted.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 The biggest takeaways from ETH ETFs’ opening week in the US: Link here

🇺🇸 SEC revises Binance lawsuit, excludes Solana as a security. The revision notably removes Solana (SOL) ‘s classification as a security. This legal adjustment is part of an action originally filed in June 2023.

DONEDEAL FUNDING NEWS

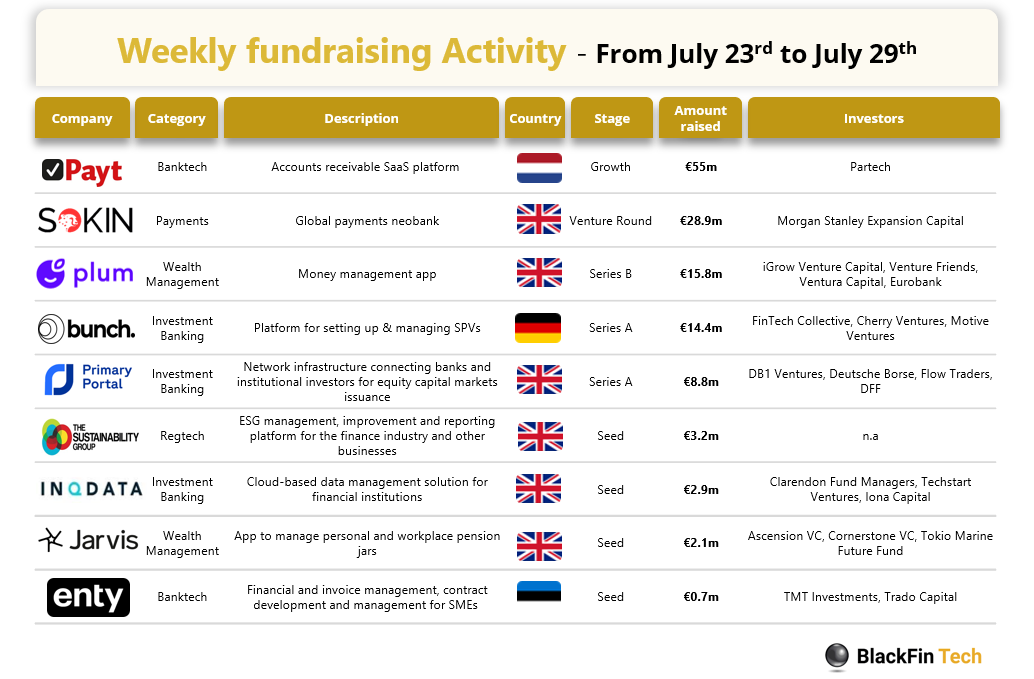

💰 Last week, we saw 9 official FinTech deals in Europe, raising a total of €137.9 million, with 6 deals in the UK, 1 in Estonia, 1 in Germany, and 1 in the Netherlands. Read the complete BlackFin Tech article here

🇨🇦 Propel announces an upsized $330 million syndicated credit facility. With the upsize, the total commitment for the credit facility is $330 million. The credit facility will further support Propel's growth strategy. Explore the full article

MOVERS & SHAKERS

🇸🇪 Swedish account-to-account (A2A) payments FinTech, Brite Payments appointed its first Chief Commercial Officer, Luke Trayfoot. Mr. Trayfoot, who previously built high-performing commercial teams at PayPal and Mangopay, has a deep understanding of the payments sector and internationalisation strategy.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()